📌 Current situation (20.08.2025)

· Price $BTC BTC: $113,500–$113,700 (correction -1.45% in a day, testing support) .

· Selling pressure: Increased due to the fall of US stocks (Nasdaq -1.4%, S&P500 -0.7%) and outflow from ETFs .

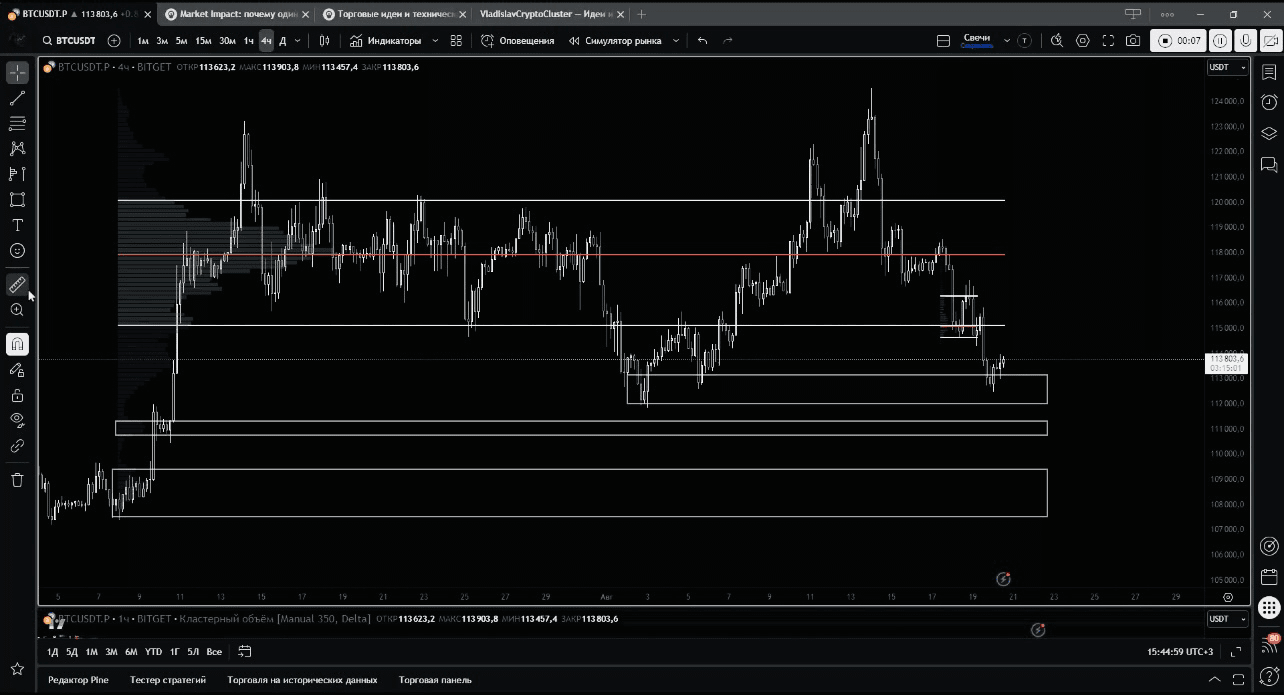

· Key levels:

· Support: $112,000 (buy orders in the order book), $110,053 (100-day SMA), $100,484 (200-day SMA) .

· Resistance: $116,033 (50-day SMA), $120,000 (psychological level) .

📉 Short-term scenario (“First a correction”)

1. Depth of correction:

· Base target: $112,000–$110,000 (liquidity accumulation zone) .

· Extreme scenario: $100,484 (200-day SMA) with negative macro data .

2. Reasons for the pullback:

· Outflow from ETFs: -$523.31 million on 19.08 (leaders: FBTC -$246.89 million, GBTC -$115.53 million) .

· Long liquidations: $116 million in an hour on 19.08 .

· Weak recovery: Low trading volumes and breaking the ascending trend line on the daily chart .

🚀 Long-term scenario (“We will go to $130,000”)

1. Conditions for growth:

· Maintaining support at $110,000 and recovery of price above $116,033 (50-day SMA) .

· Resumption of inflows into ETFs and positive macro data (inflation, Fed rates).

2. Target levels:

· $124,436 (historical maximum) → $130,000 (psychological barrier) .

· $169,886 by the end of 2025 (consensus forecast by Bitget) .

⚡ Trading strategy

Accumulation Buy on retracements $112,000 – $110,000

Stop-loss Upon breaking $110,000 $100,000

Take-profit Locking in profits $124,000 → $130,000

Risk management No more than 5% of capital in a trade —

🔍 Factors influencing the plan

1. Macroeconomics:

· Inflation data (CPI) and Fed decisions will determine risk appetite .

· Correlation with Nasdaq: recovery of tech stocks will support BTC .

2. Internal drivers:

· Great wealth transfer: Inflow of $200+ billion from millennials by 2030 .

· Halving 2024: Historically growth occurs 6–12 months after the event.

💡 Conclusion

· Short-term (1–2 weeks): A correction to $112,000–$110,000 is likely due to outflow from ETFs and weak volumes.

· Medium-term (September-October): Growth to $130,000 while maintaining support and resuming institutional demand.

· Main risk: Breaking $110,000 could intensify selling down to $100,000.

Recommendation: Accumulate in the zone of $112,000–$110,000 with a stop-loss below $100,000. Discipline and monitoring of ETF/macroeconomic news are critical!