Daily share

In Monday's article, we hinted that the rebound of Bitcoin at the 1h level has begun, and we are watching to see if it will push towards 94,000 again. Furthermore, we indicated that the 4h level rebound is nearing its end or may have already ended. In the articles for members from yesterday and the day before, we repeatedly suggested that everyone could try going long around 90,000, aiming for another upward push. Then, last night's member article also mentioned to watch whether the 4h level rebound will end after the interest rate cut is implemented.

Today, Bitcoin has started to decline, and we cannot yet be 100% sure that the 4h level correction has begun because without a second sell signal, we can never rule out the possibility of another extension. However, the rebound that started from 80,000 has already been in turmoil for 19 days, and theoretically, the 4h level rebound could end here. Let's be patient.

If there is a 4H level decline next, where will it drop to? Will it break below 80,000?

Although from the perspective of the Chan theory, the three sells in the current 4H level center of the big coin have not been excluded, the risk of making new lows is still very high, so we should still prepare psychologically for another drop below 80,600. Of course, where it can finally go also needs to be observed as it moves.

BTC short-term

Due to the rapid changes in the market, the article can only predict the changes at the moment of publication; short-term players should pay attention to the latest market changes, which are merely for reference.

1H:

At the 1H level, the structure is currently very clear; overall, from 80,600 to around 94,500, it is following an aAb structure, having a consolidation type movement. The segment from 80,600 to 93,000 is the central entry segment a, then consolidated a 1H level center A in the range of 97,700 to 93,000, and from 87,700 began a central exit segment b, reaching near 94,500. The central exit segment is currently in a clear divergence state, and the price has returned to the inner part of the 1H level center, so the probability of starting a new 4H level decline here is still quite high.

Of course, returning to the inner part of the center does not completely confirm a 4H level correction, as it may continue to extend the center. Therefore, if the next 1H level rebound does not make a new high, then it can be determined one hundred percent. Of course, for the sake of quickly following the market, we can also further judge based on the current strength of the 1H level correction. If the short-term 1H level decline can break below 87,000, then this is likely to indicate a 4H level decline.

And the current decline at the 1H level should not be over; at least another wave down is needed.

15M:

At the 15-minute level, the starting point of this 1H level decline can be either the left high of 94,588 or the right high of last night's spike. Here, for the sake of understanding that the 1H level decline has not ended, I took the right high as the starting point. Today, a 15-minute level rebound occurred during the day; the rebound is temporarily uncertain whether it can go up further, but it should be almost over, and there will be a third 15-minute level decline. Let’s see if the third 15-minute level decline can successfully break below 87,000.

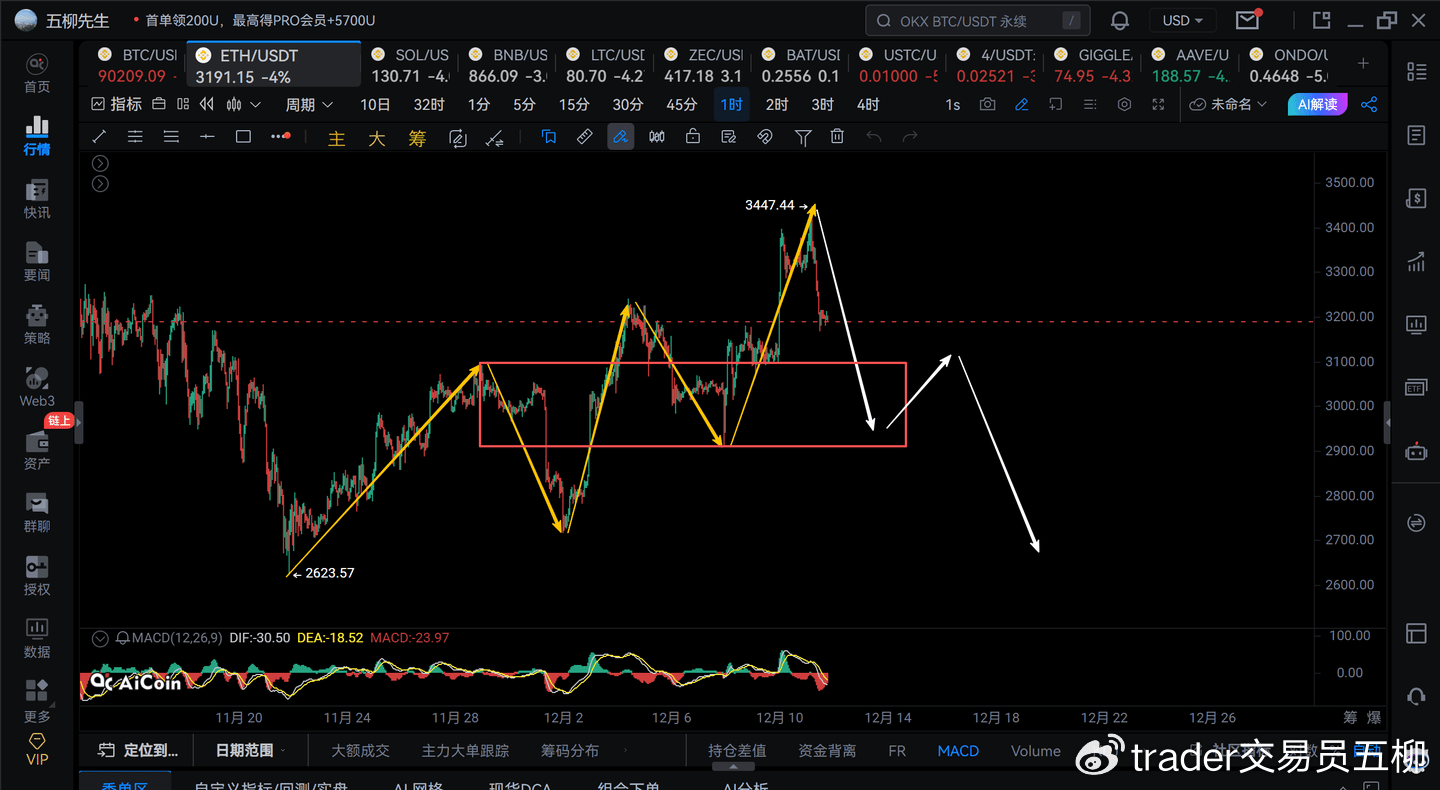

ETH

The overall 4H level rebound of ETH reaching a height of 3,447 is indeed slightly beyond my expectations. If the big coin near 94,500 is within my expectations, then ETH reaching a height of 3,447 is somewhat beyond expectations. Since ETH has broken through the observation point of 3,435, the probability that ETH will not drop below 2,623 has increased, but ultimately it still needs to be observed.

Currently, a 1H level correction is underway; this 1H correction starting from 3,447 has not yet ended. The focus is on 3,100; if it can break below 3,100, then the three buys in the 1H center of ETH will disappear, and the probability of a subsequent 4H level decline will be quite high. Therefore, 3,100 is an important observation point. It should be noted that the observation point is a distinguishing point of structural movement but not necessarily a support.

Currently at the 15-minute level, at least one more 15-minute level decline is needed, focusing on the strength of the next 15-minute level down.

Trend direction

Weekly level: direction down, there is a high probability that the weekly level decline has already begun.

Daily level: direction down, the daily level decline has not ended, and it is expected that 71,000 will likely not be broken.

4-hour level: direction down, the 4H level decline may end, but further observation is still needed.

1-hour level: direction down, observe the current strength of the 1H level decline.

15-minute level: direction down, at least one more 15-minute level movement is needed.