Daily sharing

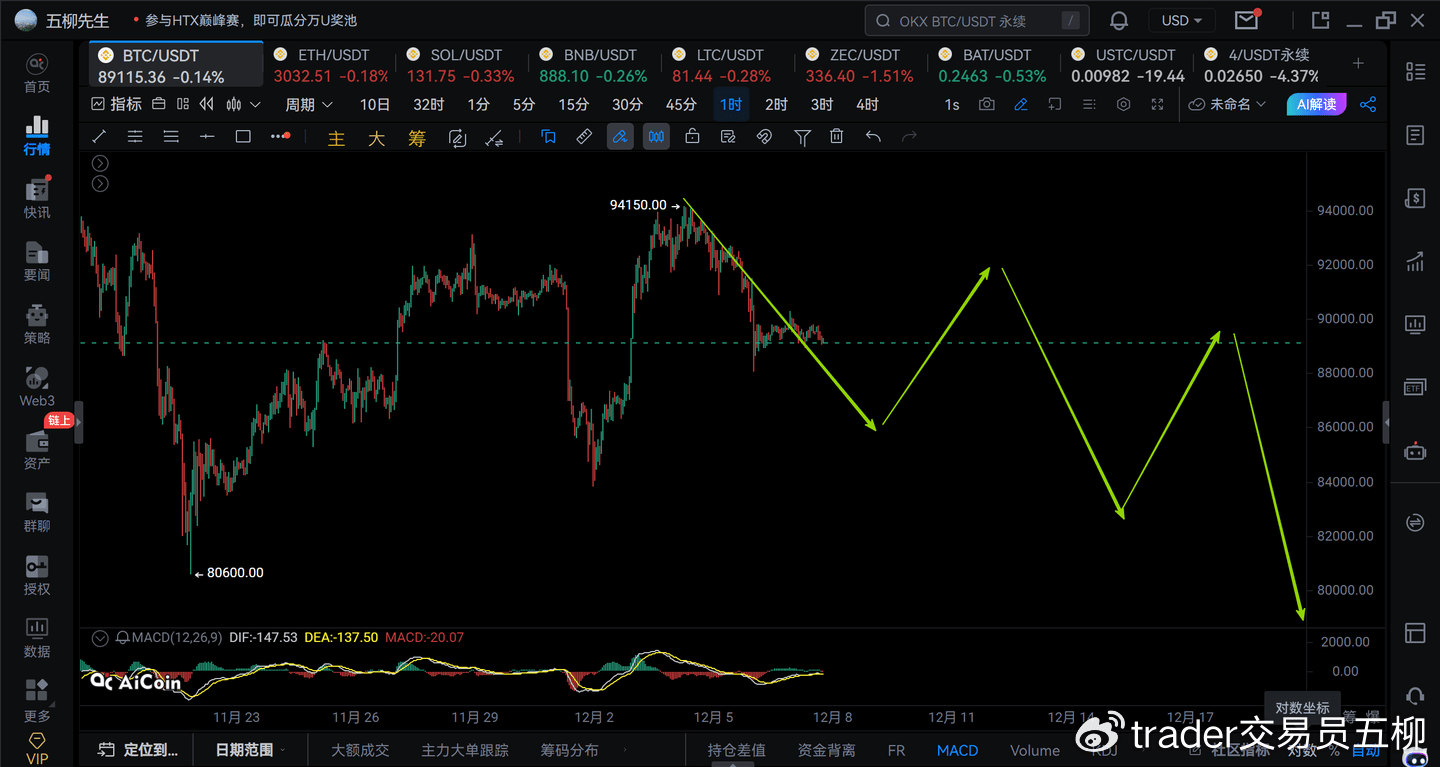

In Thursday's market analysis, we pointed out that the short-term rebound strength has weakened, and a 1-hour level pullback will occur soon. Currently, Bitcoin has dropped from 94150 to around 88000, a decrease of 6000, which is the result of the 1-hour level pullback. However, it is important to note that this 1-hour level pullback has not yet ended, and we can continue to observe whether it evolves into a 4-hour level pullback.

Since the rebound from Bitcoin 80600, there has not been a clear bottom signal on the daily chart, and there is currently no major driving force appearing in the short term, so this rebound is merely a rebound, and there is still a high probability of falling below 80600 again. It might be worth being patient and waiting for the next 4-hour level drop to see if there is a suitable buying opportunity.

BTC short-term

Due to the rapid changes in the market, the article can only make predictions based on the market changes at the time of publication. Short-term players should pay attention to the latest changes in the market, and this should only serve as a reference.

1H:

1-hour level, currently the decline at this 1-hour level seems to extend downwards for a while. First observe. If it breaks below 88000 again in the short term, then 94150 is likely the top of the 4-hour level rebound. The subsequent movement may oscillate downwards in a 4-hour level decline.

Of course, even if a 4-hour level decline begins here, it is very likely not to immediately reach around 80000 or below, because the Federal Reserve's interest rate cut is approaching in December, and the market may be influenced by news, pulling up and down several times. Therefore, there is still a probability of coming back to around 91500~92000 in the next 1-hour level rebound. Overall, the tendency to consolidate in a 1-hour level central area is relatively large, and then start declining to 80000 or below.

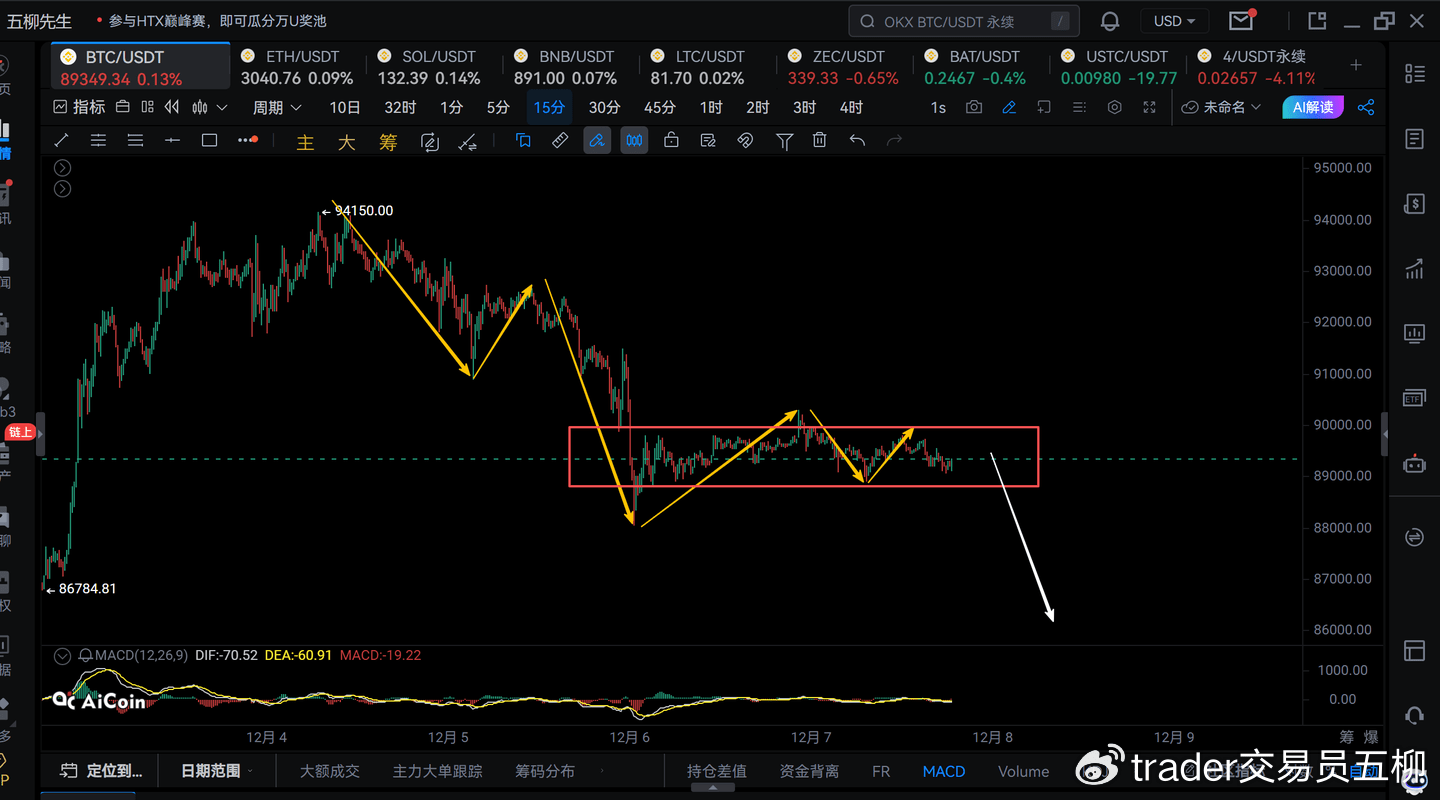

15M:

15-minute level, currently oscillating and consolidating in a 15-minute central area. It is temporarily uncertain whether it can fall again to break 88000 and go to around 86000. If it breaks 90286 again, then it is considered that a 1-hour level rebound has been completed in advance. This has a probability of going above 94000 or not breaking 94000, leading to a second sell.

So, the short-term movement here is still quite tangled. Continue to observe whether it breaks down again or pushes up in the evening. Moreover, no matter how it is tossed around here, the overall 4-hour level rebound is already in a phase that has ended or is about to end. Therefore, my personal suggestion is to buy on the rise and wait about a week before getting back in at a lower position.

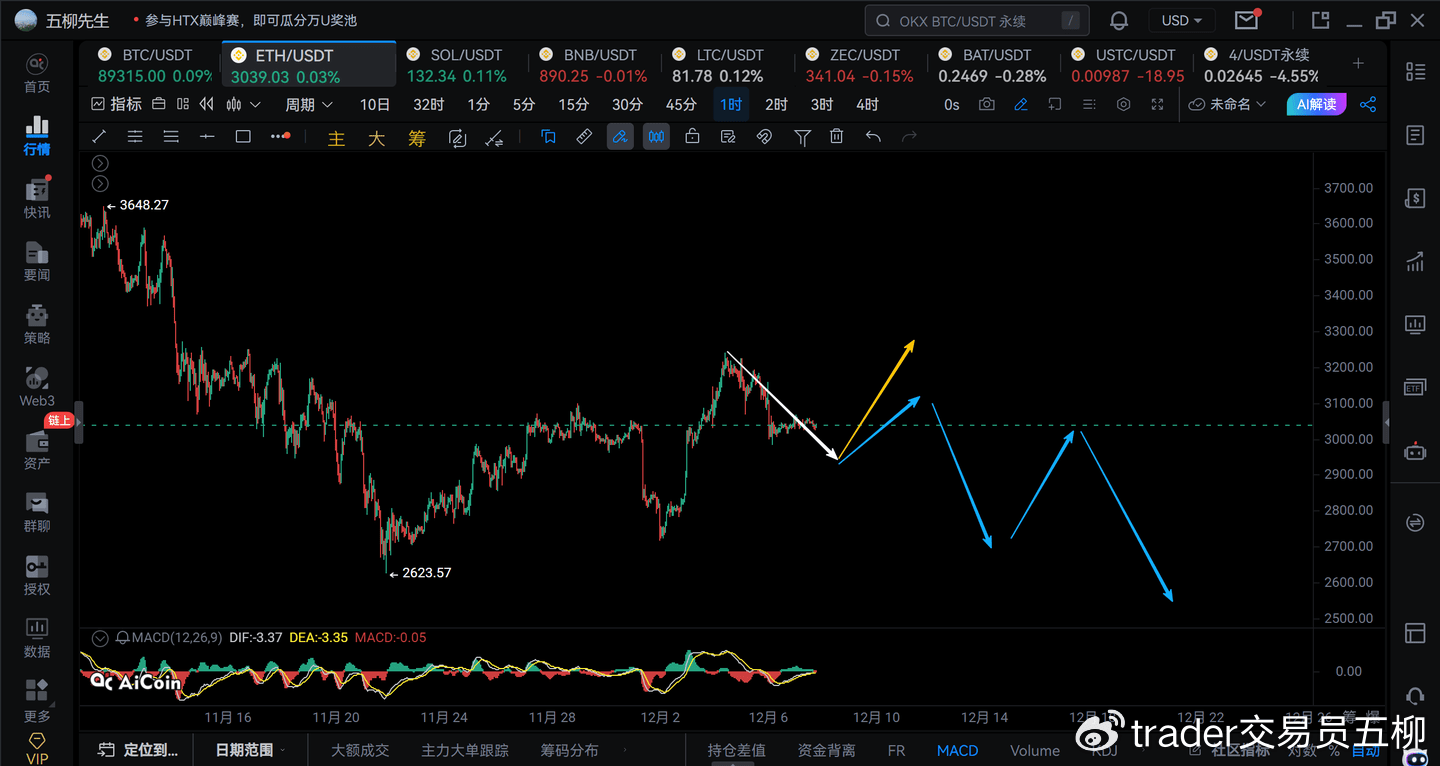

ETH

Ethereum here also needs observation. Watch if it falls again in the short term to break 2983. If it does not break by tomorrow morning and instead breaks upward above 3075, then there is a high probability that a 1-hour level rebound is already in progress, and there is a certain probability that it will push up above 3250. Then it will end the 4-hour level rebound.

If it can break below 2983 in the short term, then it is very likely that a 4-hour level decline is beginning here. However, it should be noted that there will still be a 1-hour level rebound going to around 3100 or above. In this case, the possible trend is as indicated by the blue arrow in the above image.

Of course, Ethereum overall is also in a state where the 4-hour level rebound is about to end or has already ended. It is still recommended to wait for the next wave of decline below 2600 before buying in.

Trend direction

Weekly level: direction downward, it is highly probable that a weekly level decline has already begun.

Daily level: direction downward, the daily level decline has not ended yet, and it is expected that 71000 will most likely not break.

4-hour level: direction downward, the 4-hour level rebound is in a state of about to end or has already ended.

1-hour level: direction downward, it is temporarily uncertain whether this 1-hour level decline has ended; further observation of the short-term structure is needed.

15-minute level: oscillating consolidation, observe whether the short term breaks down or pushes up.