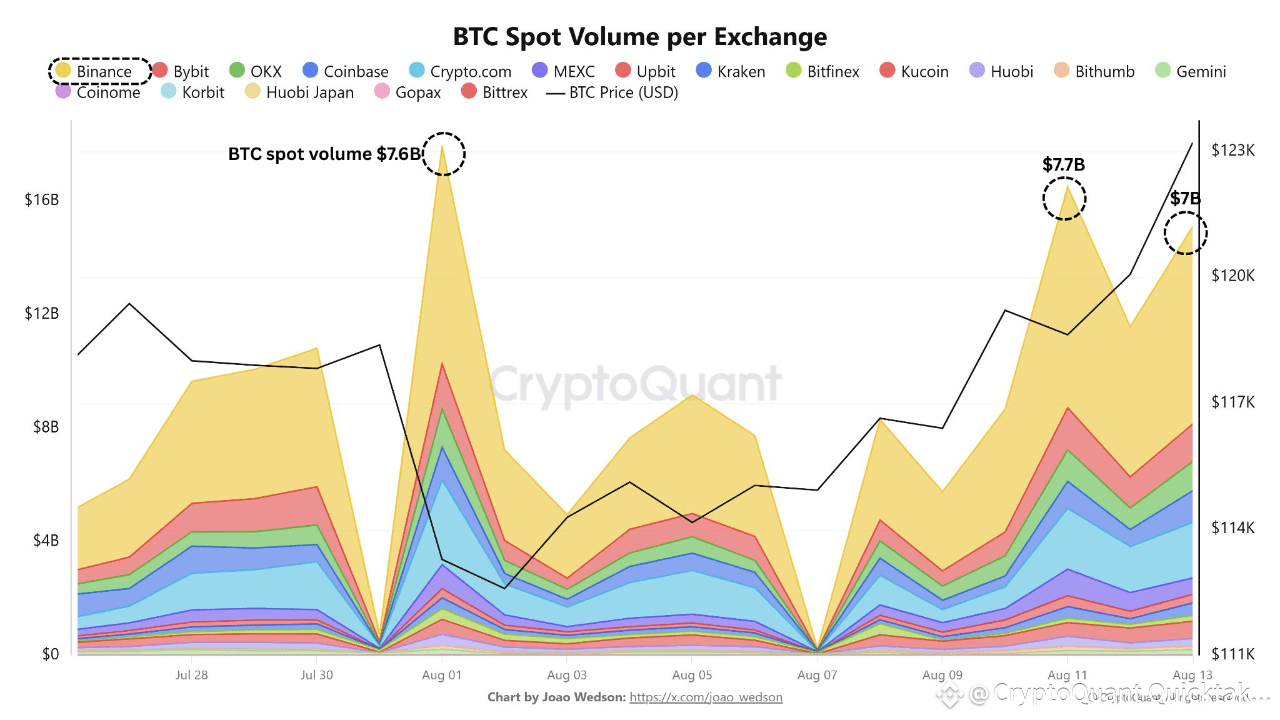

🚀Binance BTC Spot Volume Reaches $7B in a Single Day:

* Yesterday, Binance’s BTC spot volume surged to $7 billion within 24 hours, signaling an unusual wave of market activity.

* Such spikes often point to a sudden shift in trader sentiment, potentially driven by institutional positioning, large-scale whale accumulation, or the reaction to macroeconomic catalysts such as liquidity injections or market policy updates.

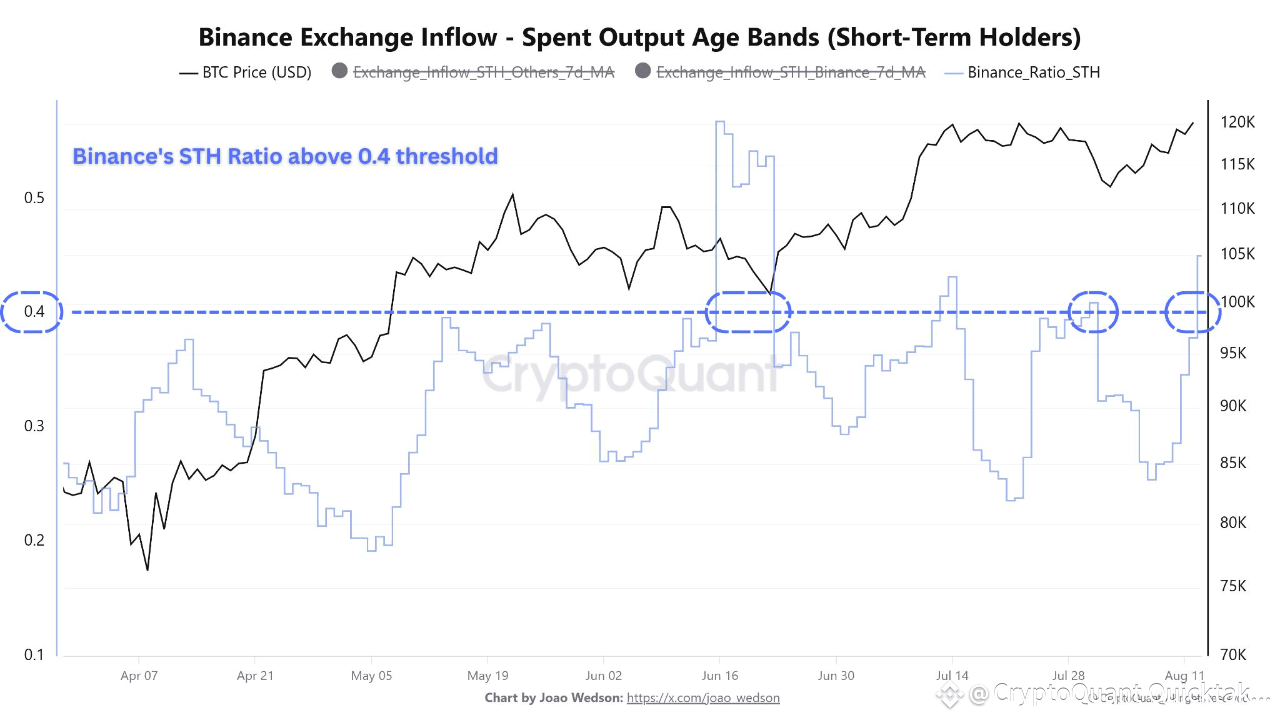

🦧Retail Selling Intensifies on Binance as Short-Term Holder Activity Surges:

* The chart Binance Exchange Inflow - Spent Output Age Bands highlights a sharp rise in the Binance Exchange Inflow Ratio for Short-Term Holders (STH), which has recently crossed the critical 0.4 threshold.

* This level, previously associated with retail-driven sell activity, often coincides with local bottoms or transitional phases in the market.

* The latest spike above 0.4 suggests that retail participants may have started depositing their Bitcoin holdings en masse to Binance, likely in an attempt to secure profits following a strong upward price trend.

* Historically, retail investors have shown a tendency to sell into strength, often exiting their positions prematurely during bull markets.

* The current data supports this pattern, as retail inflows into Binance rise just as prices strengthen, potentially offering liquidity to more sophisticated players

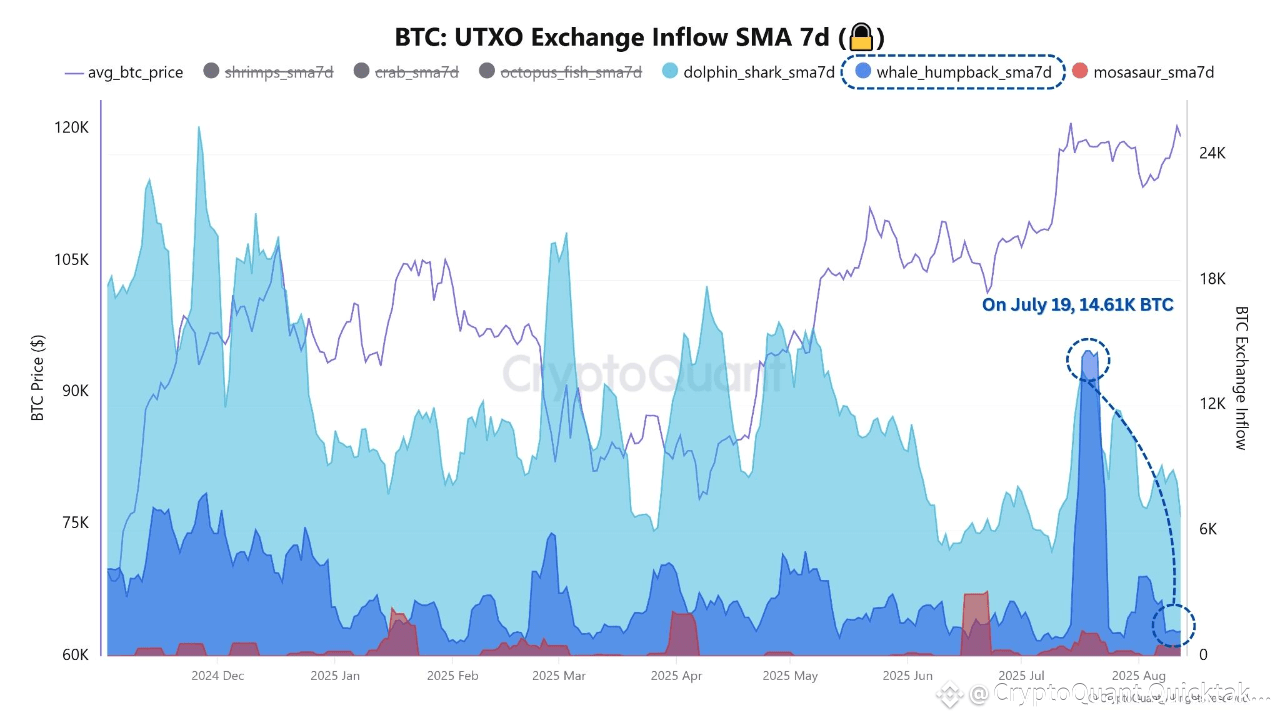

🐋 Whale/Humpback Exchange Inflow Trend

* The current Whale/Humpback inflow (1K–10K BTC) is 1.17K BTC, significantly lower than the 14.61K BTC recorded on July 19.

* That July spike indicated massive selling pressure from large holders, which contributed to a sharp drop in Bitcoin's price shortly after.

* In contrast, the current low inflow suggests that whales are not actively offloading BTC, meaning the same bearish conditions are not present now.

* This could imply reduced downside risk and a more bullish environment, depending on other market factors.

Written by Amr Taha