Cryptocurrencies are often presented as a banner of decentralization…

But what happened in the October crash revealed a different reality. A massive liquidation wave caused billions of dollars to evaporate in a short time, making it clear that a coordinated exit by the whales was the biggest factor behind the crash 🎯.

This scene highlighted the true focus of liquidity within the market, and yet 'buying the fear' remains a classic signal that usually precedes price reversals. As November comes to a close, it seems that the whales are moving again according to this scenario.

❖ Fourth Quarter Shifts: Macroeconomic Pressure on Whale Movement 📉🏛️

To analyze the current situation, it is helpful to review what happened over the past few weeks.

After a series of shocks in October and November, the market value of cryptocurrencies declined by about 20.7% to around $3.06 trillion—marking the worst quarter since Q2 2022.

Bitcoin (BTC) has declined by about 27% from its pre-crash level of $122,000, recording a negative return close to 20%—the worst quarterly performance since 2018.

These declines were not solely due to macroeconomic factors, although trade tensions, financial uncertainty, and tight policies played a significant role in reducing risk appetite.

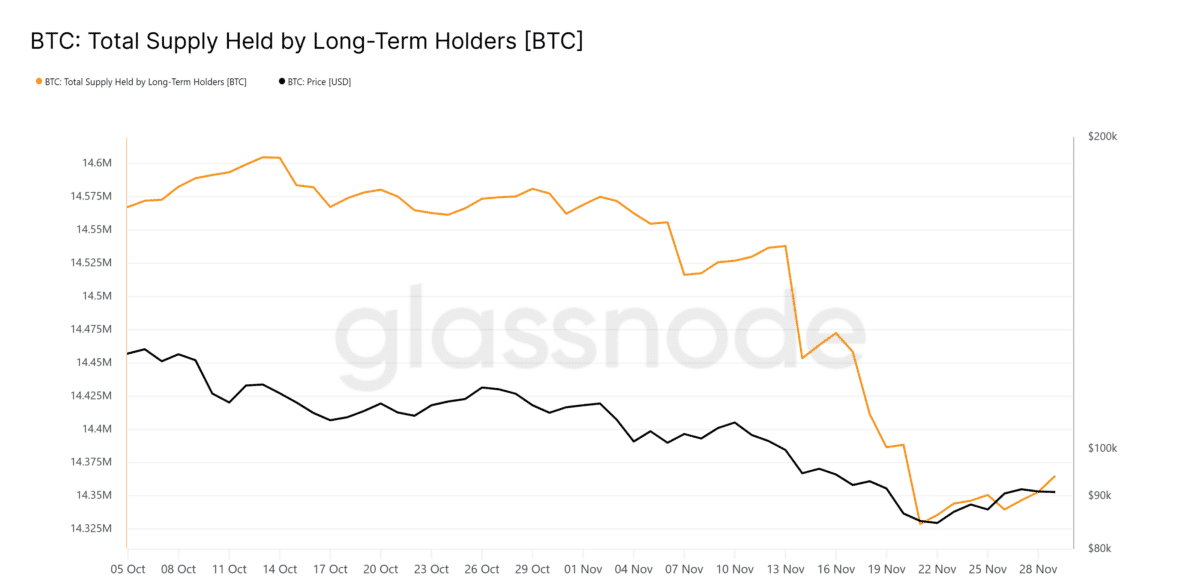

But interestingly, both old and new whales are participating in the selling, which has reduced the holdings of long-term holders by approximately 180,000 BTC—in a movement resembling a 'massive whale exit' from the market 🐋➜📉.

❖ Futures: The preferred arena for whales to exploit fear ⚖️🔥

Historically, when individual traders panic, whales appear on the opposite side.

In the 2022 cycle, as BTC dropped from $66,000 to $42,000, wallets holding between 100 to 10,000 BTC accumulated approximately 67,000 BTC—this is a direct application of the 'buying fear' strategy.

But what happened recently was different;

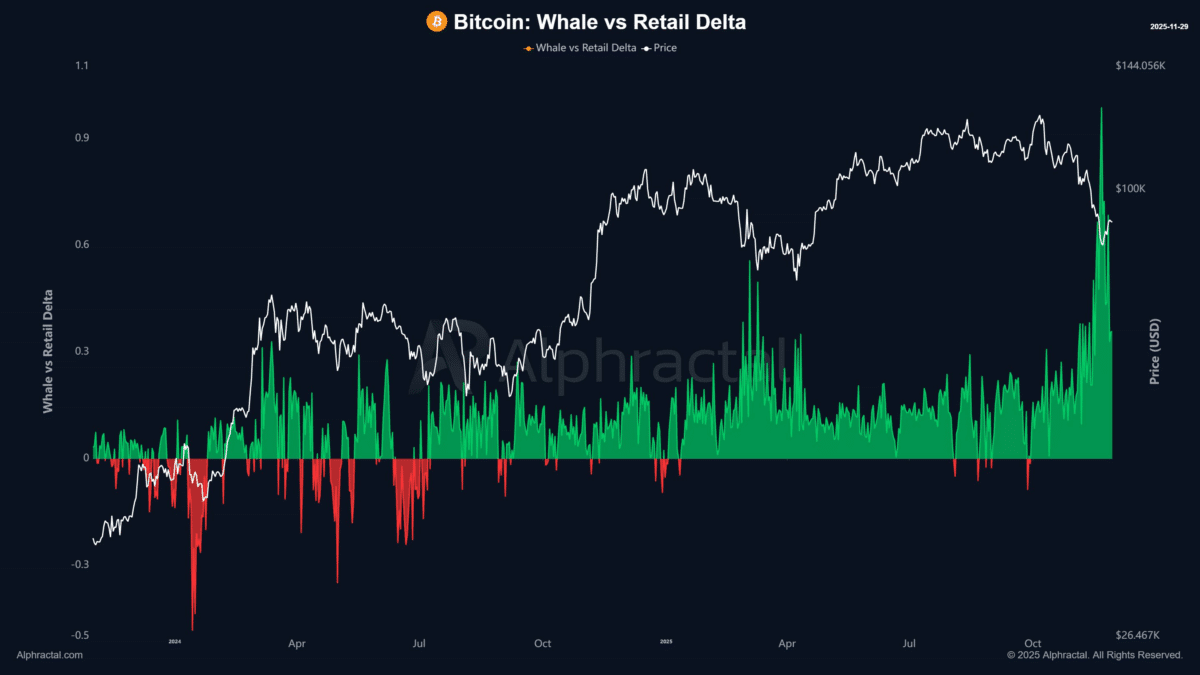

Instead of buying the dip immediately, some whales turned to futures to profit from the downward wave.

One notable example is that a major investor opened a short position worth $235 million just 10 days after the crash.

Data shows a clear increase in whale positions compared to retail, indicating increases in short positions or a reduction in long positions.

And here the question arises:

❓ Is the bottom still far away?

❖ December: The new starting point? ⛄📈

December enters the market at a very sensitive point.

During the second half of 2025, BTC achieved three consecutive peaks, but the difference between them did not exceed 5%—indicating weak buying momentum at higher levels.

Thus, short selling by whales becomes a logical behavior.

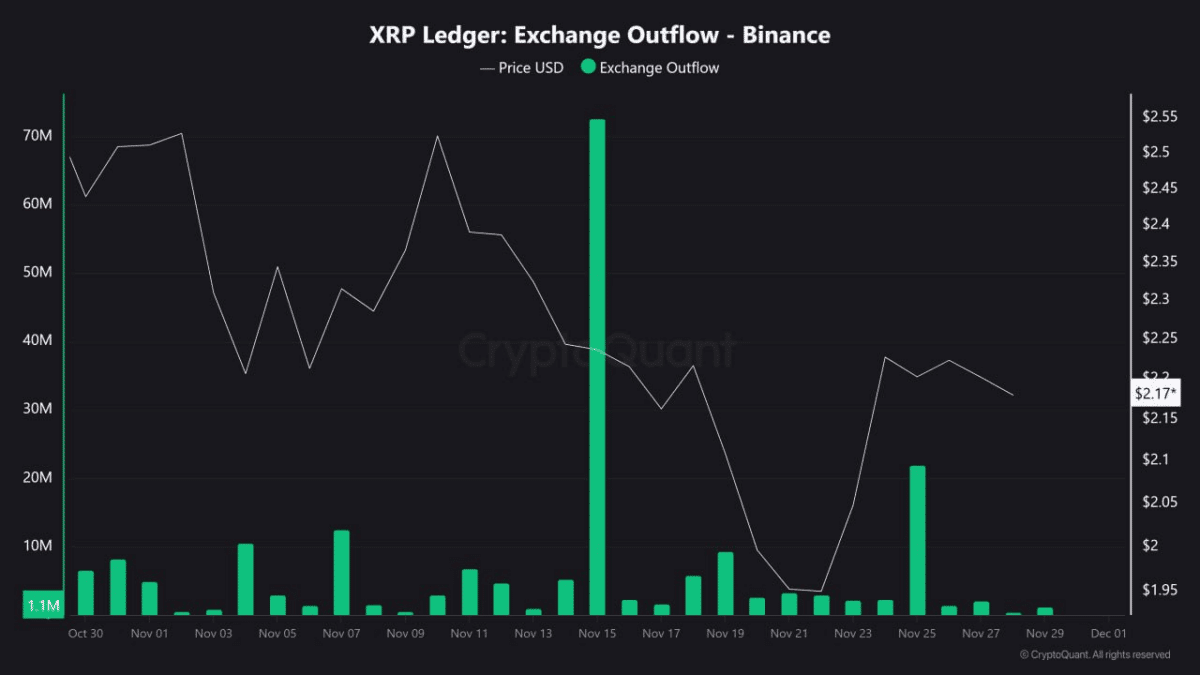

However, data from the network for both BTC and XRP reveal a strong increase in outbound whale flows:

▪ Outbound XRP flows reached about 116 million XRP by the end of November.

▪ The number of wallets holding more than 1,000 BTC has clearly risen.

These indicators—from tactical selling to leverage and new accumulation signals—suggest that the market is entering a healthy reset, which the whales may exploit to target the $85,000 to $90,000 area as an ideal entry point 🎯.

As economic fears ease and the monetary policy meeting approaches in 10 days, December may witness a new upward momentum driven by heavy portfolios.

✦ Summary ✦

Whale movements appear to be a calculated return to risk, as the market prepares for a phase that may redraw its trends before the end of the year. With economic fog calming, December could shift from a month of concern... to a month of advanced opportunities.