ETHUSD – 1H Timeframe Analysis | Liquidity Grab & Bearish Continuation Scenario

ETHUSD – 1H Timeframe Analysis | Liquidity Grab & Bearish Continuation Scenario

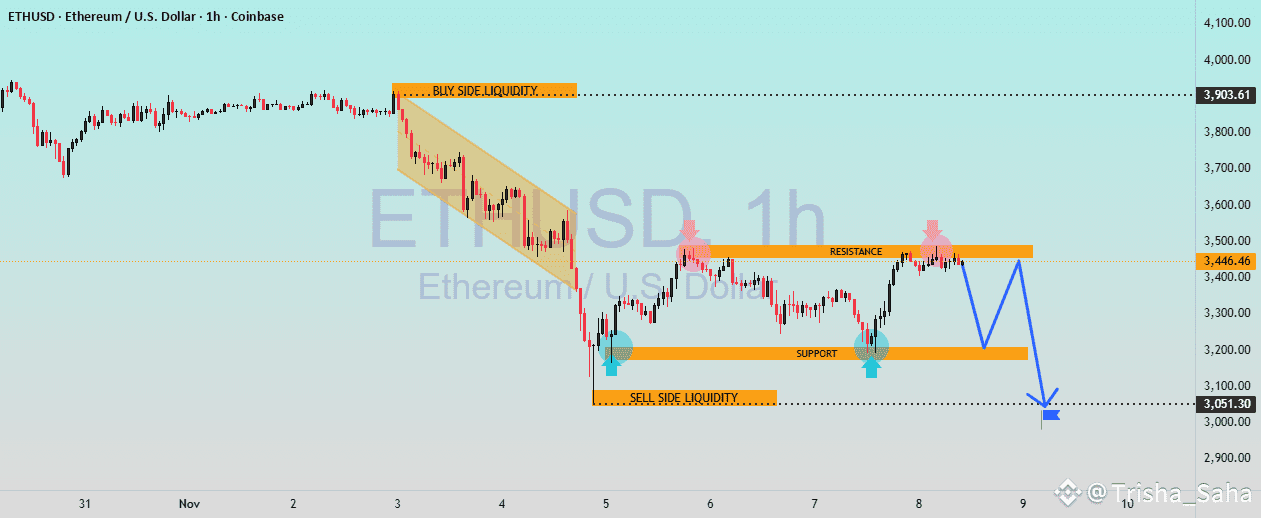

In this chart, Ethereum (ETHUSD) is currently trading near the $3,440 level after tapping into a strong resistance zone where buy-side liquidity has been collected. Price previously swept the highs, indicating potential exhaustion in bullish momentum.

🔍 Key Technical Observations

✅ Buy-Side Liquidity Sweep

Price moved into the upper liquidity zone and quickly rejected.

Indicates institutions may have gathered liquidity for a downside move.

✅ Resistance Zone – Strong Supply Area

Multiple rejections from the orange resistance block.

Sellers are defending this area aggressively.

✅ Support Zone – Demand Area

Around $3,250 – $3,200, price previously reacted with bullish wicks.

Blue arrows show buyers stepping in temporarily.

✅ Sell-Side Liquidity Below

A clean downside target remains near $3,050.

Liquidity pools below indicate unfinished business.

📉 Market Structure Outlook

The projected movement suggests:

Short-term bearish rejection from resistance.

Possible retest of support near $3,250.

If support breaks ➝ downside continuation towards $3,050 liquidity zone.

This aligns with a lower-high formation and a continuation of the existing downtrend.

🎯 Bearish Scenario

Entry: On bearish confirmation below support zone

Target: $3,050

Invalidation: Sustained breakout above $3,500 resistance