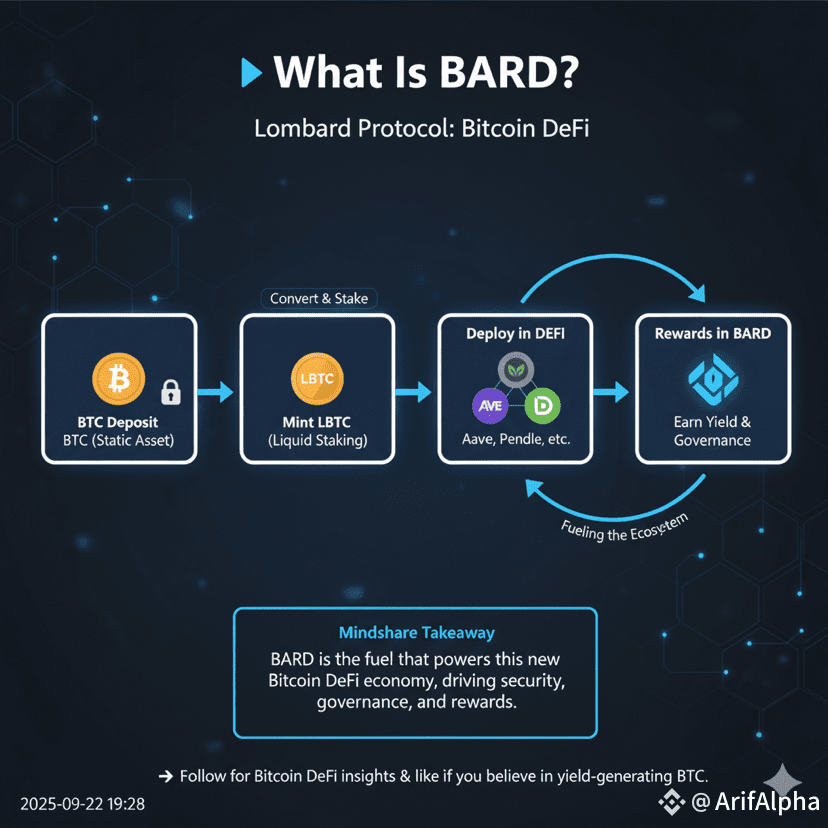

🔹 What Is BARD?

BARD is the utility and governance token of the Lombard protocol, a Bitcoin DeFi platform designed to transform BTC from a static store of value into a yield-generating asset.

Through liquid staking, Lombard converts Bitcoin into LBTC, a yield-bearing token that remains usable across DeFi ecosystems like Aave and Pendle.

👉 In short, BARD is the fuel that powers this new Bitcoin DeFi economy, driving security, governance, and rewards.

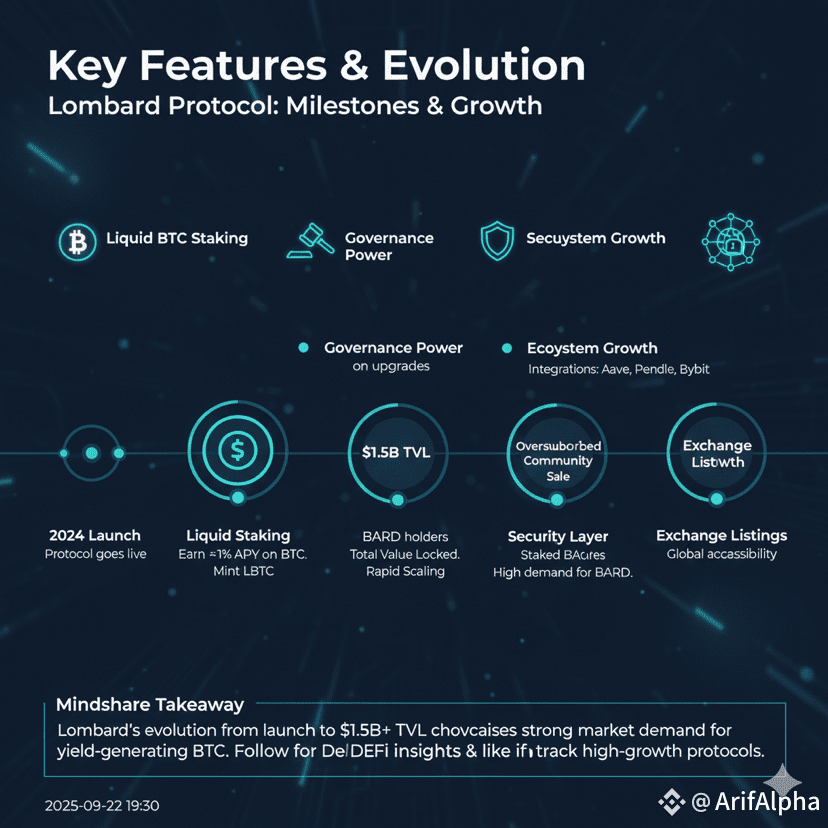

🔹 Key Features & Evolution

Lombard launched in 2024 and quickly scaled to over $1.5B TVL with LBTC.

Its evolution has been marked by:

▪️ Liquid BTC Staking – Earn ~1% APY while keeping BTC liquid.

▪️ Governance Power – BARD holders vote on protocol upgrades & grants.

▪️ Security Layer – Staking BARD secures cross-chain bridges and earns fees.

▪️ Ecosystem Growth – Integrations with Aave, Pendle, Bybit, and beyond.

🔹 Key Features & Evolution

Lombard launched in 2024 and quickly scaled to over $1.5B TVL with LBTC.

Its evolution has been marked by:

▪️ Liquid BTC Staking – Earn ~1% APY while keeping BTC liquid.

▪️ Governance Power – BARD holders vote on protocol upgrades & grants.

▪️ Security Layer – Staking BARD secures cross-chain bridges and earns fees.

▪️ Ecosystem Growth – Integrations with Aave, Pendle, Bybit, and beyond.

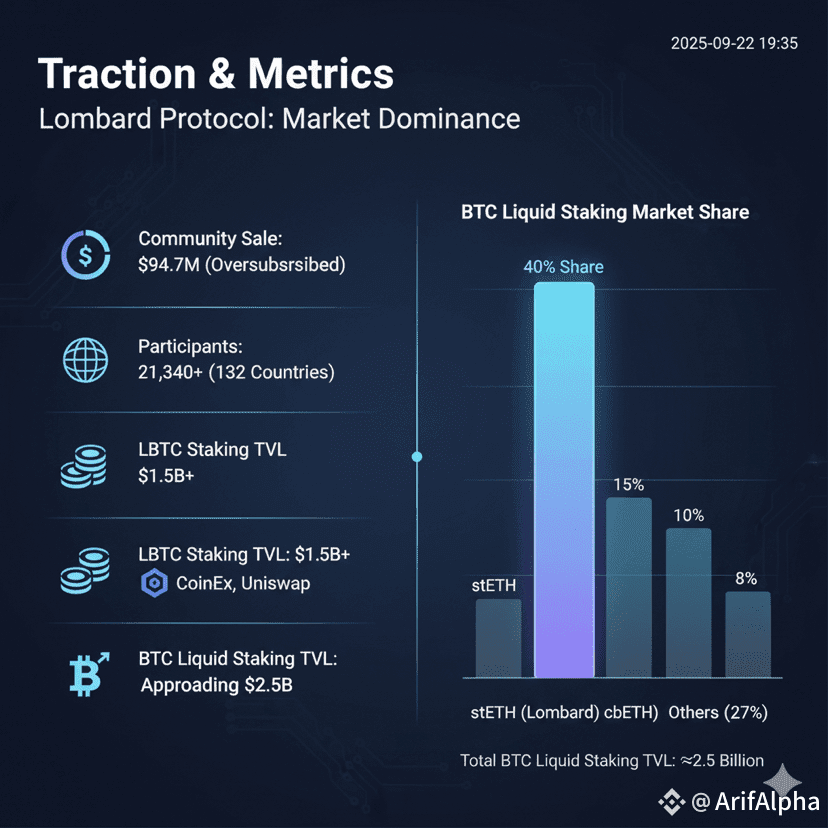

🔹 Traction & Metrics

The project has gained serious momentum:

▪️ $94.7M raised in a community sale, oversubscribed by 1,400%

▪️ 21,340+ participants from 132 countries

▪️ $1.5B+ TVL in LBTC staking

▪️ Listings on CoinEx & Uniswap

▪️ BTC Liquid Staking TVL approaching $2.5B, with LBTC at 40% share

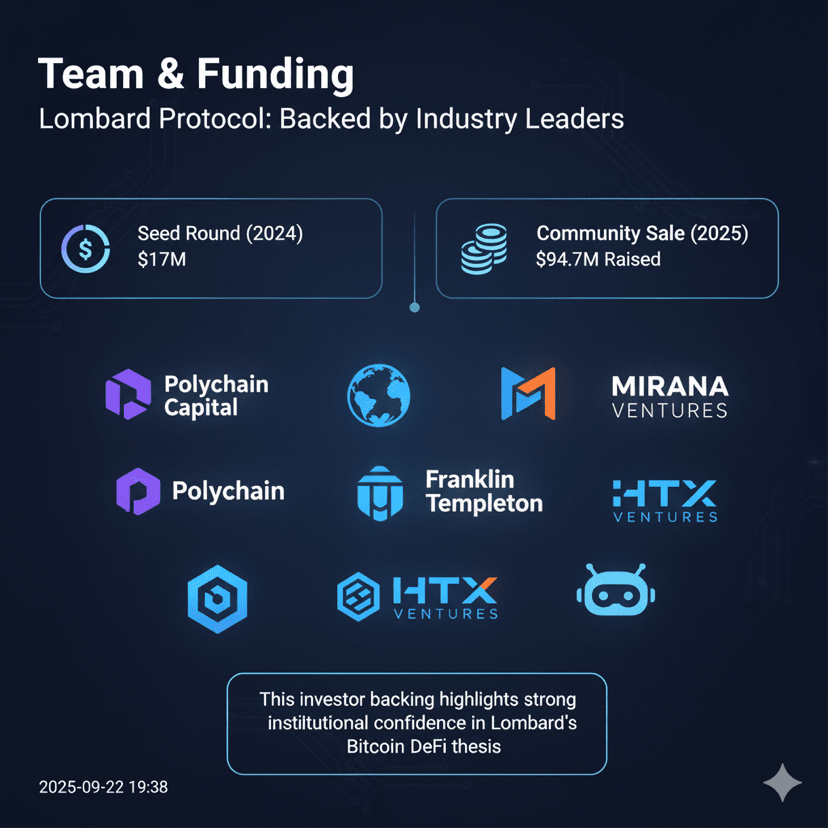

🔹 Team & Funding

Backed by Polychain Capital, Franklin Templeton, Mirana Ventures, HTX Ventures, Robot Ventures, and more.

▪️ Seed round (2024): $17M

▪️ Community sale (2025): $94.7M raised

This investor backing highlights strong institutional confidence in Lombard’s Bitcoin DeFi thesis.

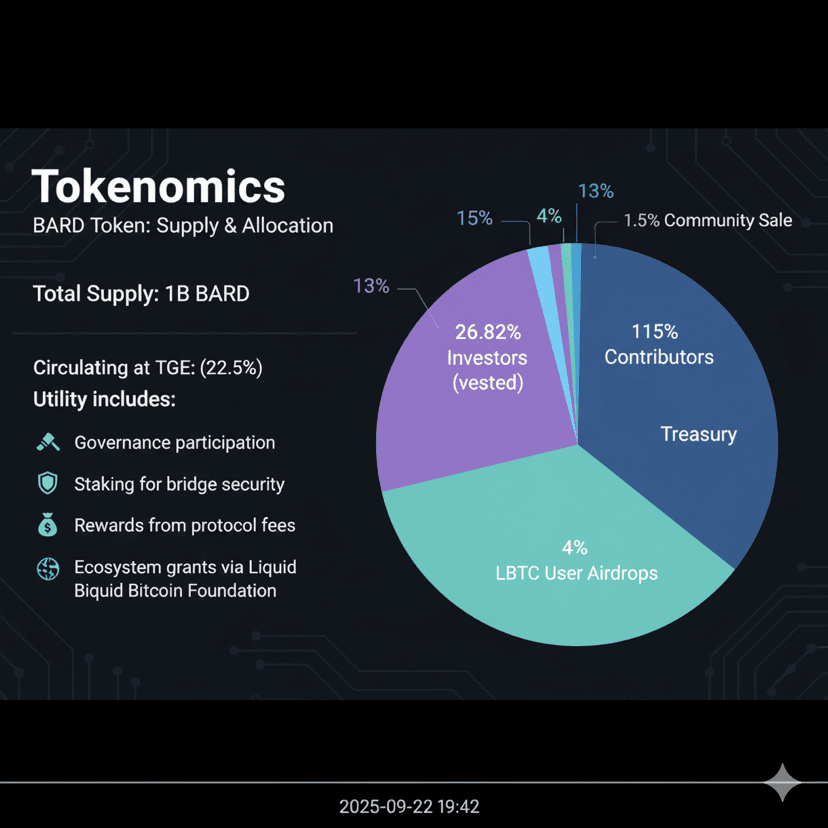

🔹 Tokenomics

Total Supply: 1B BARD

Circulating at TGE: 225M (22.5%)

Allocations:

▪️ 26.82% Investors (vested)

▪️ 15% Contributors

▪️ 13% Treasury

▪️ 4% LBTC user airdrops

▪️ 1.5% Community Sale

Utility includes:

▪️ Governance participation

▪️ Staking for bridge security

▪️ Rewards from protocol fees

▪️ Ecosystem grants via the Liquid Bitcoin Foundation

🔹 Real-World Use Cases

BTC Yield Farming: Earn while holding BTC in Aave/Pendle.

Cross-Chain Deployments: Use LBTC across ecosystems with lower fees.

Governance & Grants: Shape Lombard’s roadmap and fund new DeFi apps.

Foundation Support: Drive Bitcoin’s onchain adoption through education & innovation.

🔹 Why BARD Stands Out

In a market dominated by Bitcoin’s store-of-value narrative, Lombard unlocks BTC’s productivity by merging it with DeFi’s composability.

With $1.5B TVL, tier-one investors, and oversubscribed funding, BARD is more than a meme it’s a strategic bet on Bitcoin DeFi adoption.

⚡ Bottom Line: BARD positions Bitcoin not just as an asset to HODL but as a productive layer in global finance.

🔹 Hashtags & CTA

#Bitcoin #DeFi #BARD #Lombard #LiquidStaking

👉 Do you see BARD becoming the key bridge between Bitcoin and DeFi, or will BTC remain a passive store of value?