The price of bitcoin recently suffered a decline from its all-time high, signaling a possible change in market conditions. This decline, although it appears typical, may indicate underlying concerns about future volatility.

Historical indications suggest that an explosion of volatility may be on the horizon, leading major investors to adopt a neutral stance.

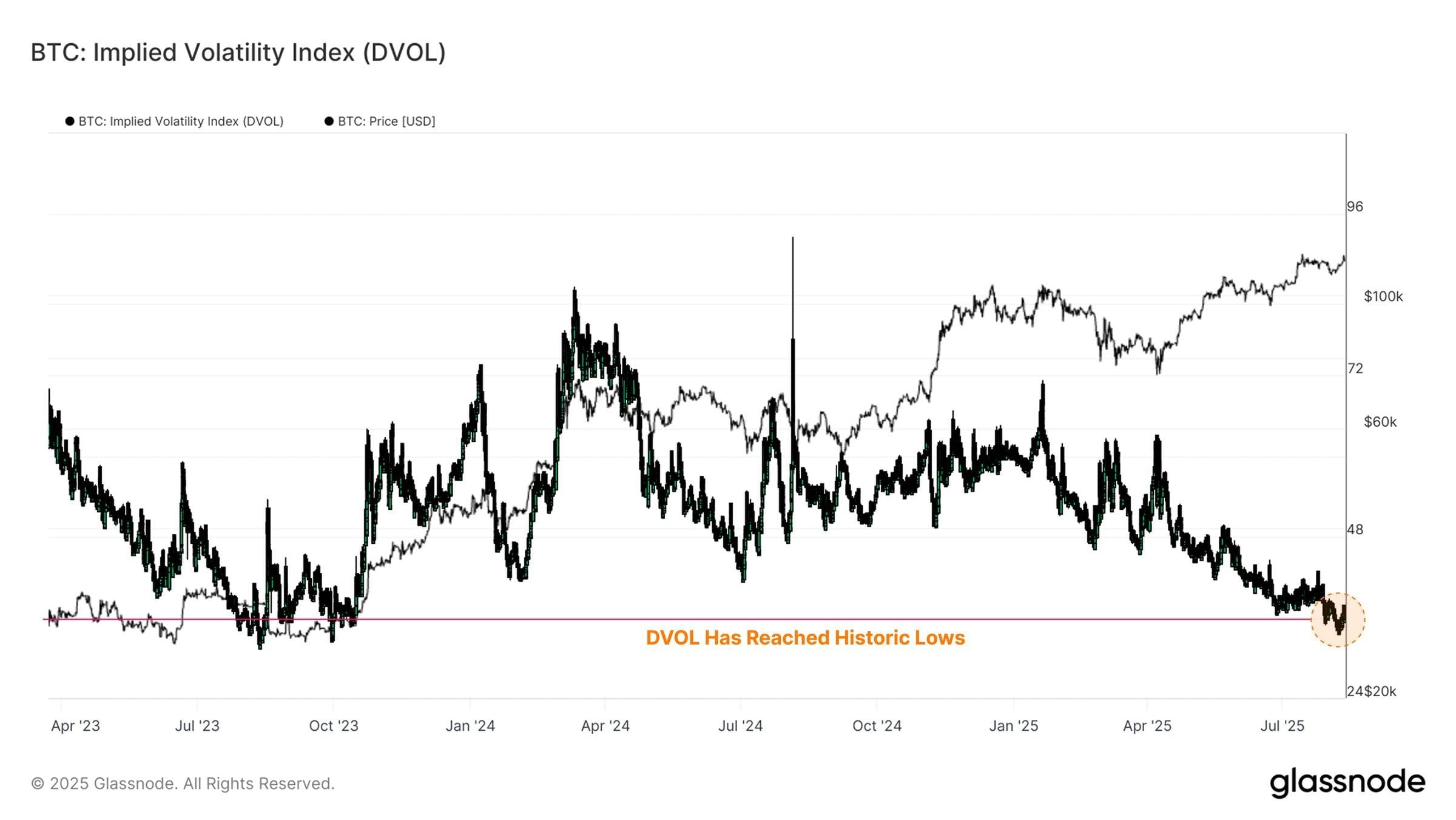

The bitcoin DVOL index, which tracks the asset's volatility, is at historically low levels. Only 2.6% of days have recorded lower values, indicating extreme complacency in the market. This suggests that investors are not hedging against possible declines, which could lead to significant price movements if unforeseen events trigger volatility.

The DVOL measures expected price fluctuations for the next month, and the current low levels indicate a relaxed outlook from traders. However, this calm may be temporary, as volatility shocks often follow periods of complacency. If an unexpected market event occurs, Bitcoin may experience rapid price swings, potentially catching investors off guard.

Bitcoin faces the calm before the storm

Bitcoin DVOL Index. Source: Glassnode

Bitcoin DVOL Index. Source: Glassnode

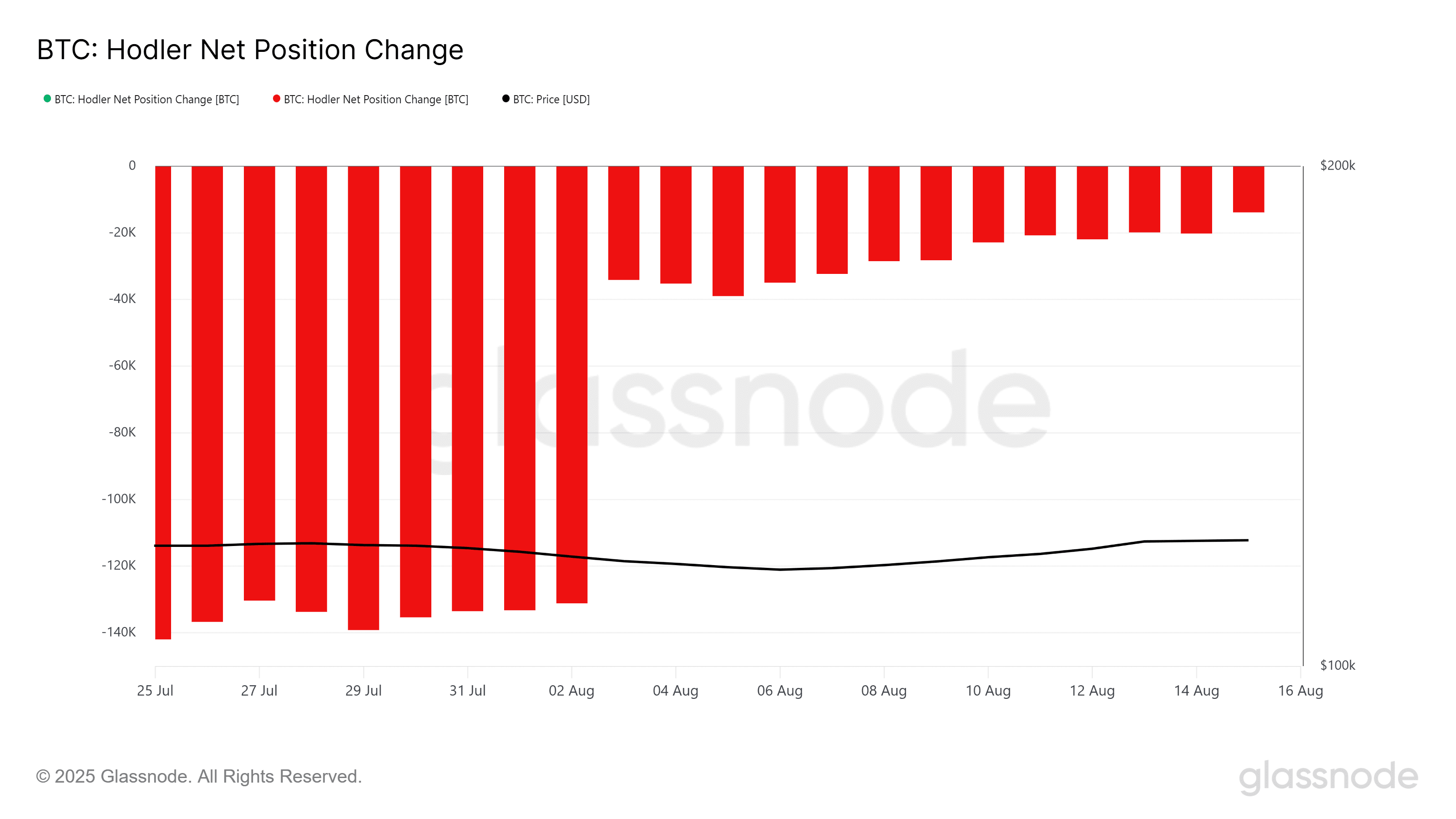

The overall macro momentum of bitcoin shows a significant change in investor behavior. The net position change of HODLers has slowed down, signaling reduced activity from long-term holders (LTHs). Although LTHs began accumulating at the beginning of the month, this buying trend was interrupted, likely due to prevailing market uncertainty.

Despite the lack of new buying activity, the absence of sales suggests a degree of optimism among these investors. They seem to be waiting for a clearer market direction before making their next decisions. This suggests that LTHs are cautious but expect that any spike in volatility could eventually lead to a price increase, keeping their positions intact for now.

Net Position Change of Bitcoin HODLers. Source: Glassnode

Net Position Change of Bitcoin HODLers. Source: Glassnode

BTC price may hold its support

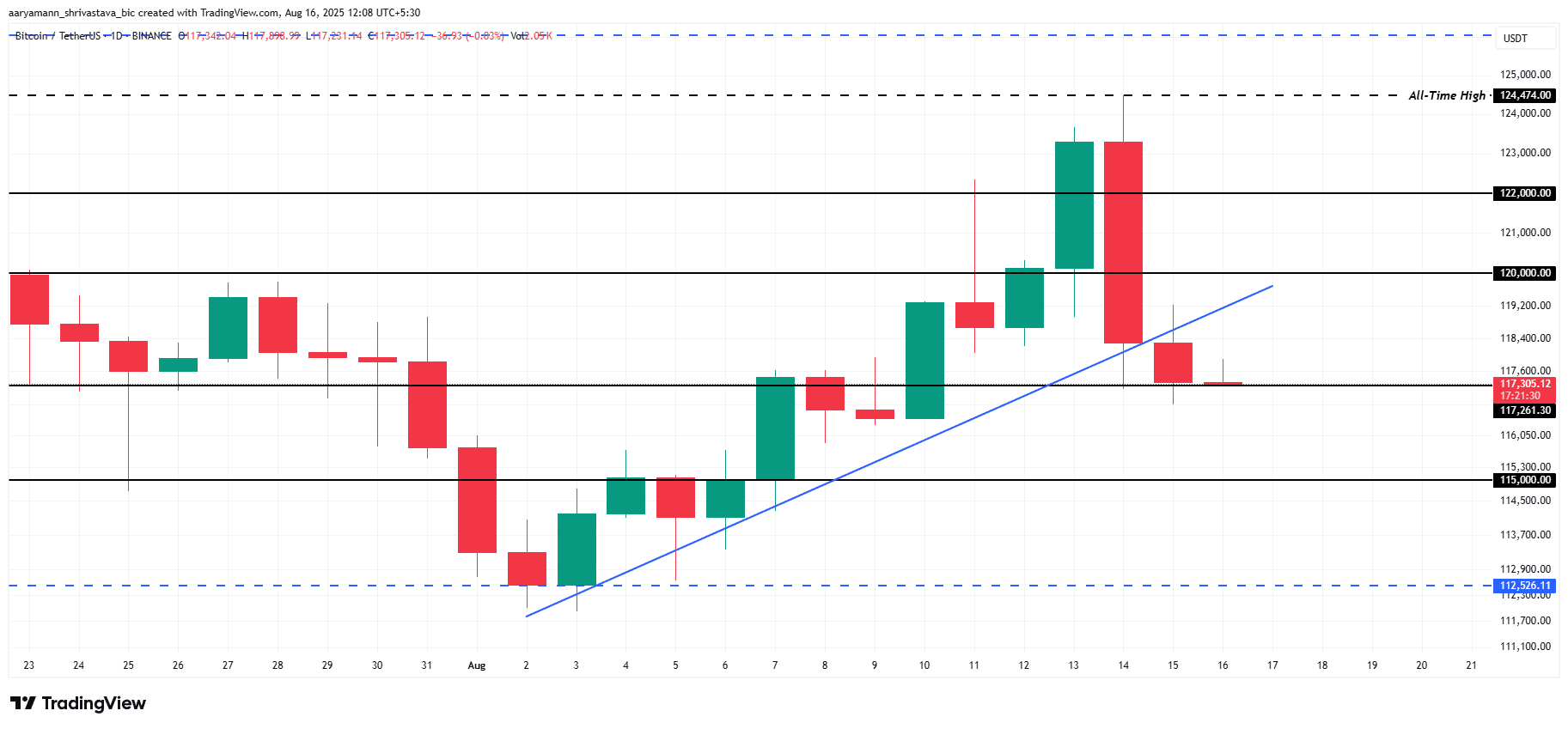

The price of bitcoin showed an upward trend throughout the month, but this momentum weakened in the last 24 hours, with BTC falling to $117,305. This drop occurred when the price fell below the established upward trend line, signaling a change in market sentiment.

If investors hold their positions during the expected increase in volatility, bitcoin may stabilize above $117,000. This would pave the way for a possible advance toward $120,000, turning it into support and allowing for further upward movement.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

However, if investor sentiment turns pessimistic and sales increase in response to volatility, bitcoin may face a significant drop. In that case, the price could fall below the support level of $115,000, potentially reaching as low as $112,526. This would eliminate the gains observed in August, invalidating the optimistic outlook.

The article Bitcoin Analysis: historical indicator suggests high volatility was first seen on BeInCrypto Brazil.