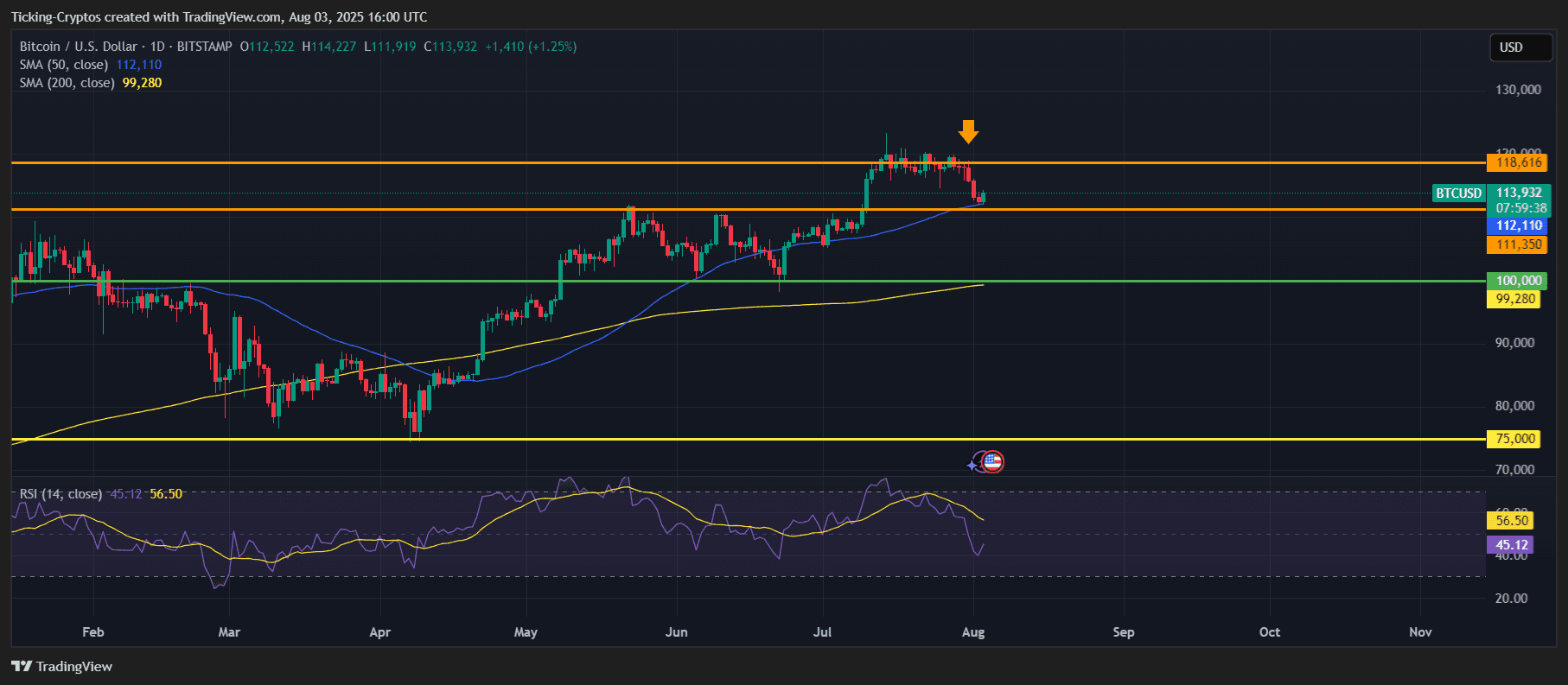

Bitcoin has dropped sharply in recent days, falling from $118,000 to $113,000, breaking below the important support zone of $115,000–$116,000. However, despite the short-term weakness, BTC is still trading above the 200-day SMA and has seen significant gains year-to-date. Let’s analyze the chart and why this could be a healthy correction rather than a bearish reversal.

Key Technical Levels and Indicators

Support just broken: BTC has broken below ~$116K (orange line), the previous support level has turned into resistance.

Current Price: ~$113,932

50-Day SMA: ~$112,110 (maintained as immediate support level)

Next major support: ~$111,350 (horizontal structure)

200-Day SMA: ~$99,280

RSI (14): Recovering from 45.12, indicating a neutral zone — not oversold yet.

This downward move is notable, but BTC remains significantly higher than the 200-day SMA, helping to maintain a long-term bullish trend. The RSI indicator is also recovering from a local low, suggesting that sellers may be losing momentum.

Bitcoin Analysis: Suggested Buy Zone

For those looking to buy the dip or scale at:

$112,000 – $111,000 Zone

This is a key support crossover point: the 50 SMA line and recent structure. As long as BTC maintains above this level, this could be a low-risk buying zone.

$100,000 – $99,280 Zone:

Strong psychological and structural support, backed by the 200 SMA line. If BTC drops to this level, strong accumulation is expected.

$75,000 (Extreme Scenario)

This figure corresponds to a 35% decrease from the recent peak — ideal for long-term investment goals if macro conditions worsen.

Bitcoin Price Prediction: Monitor These Zones to Exit or Manage Risk

$116,000 – $118,000

just lost support. If BTC pushes back to this area but fails to hold, it could become a bullish trap. Exercise caution.

Breaking below $111,000

If BTC closes below this level with significant volume, expect the price to drop to $100,000 or lower.

Final Thoughts: Will Bitcoin Recover?

Bitcoin is in a healthy correction phase — and although short-term sentiment has shifted to cautious, the long-term structure remains intact. Unless BTC drops below $100,000, this dip could be one of the last significant buying zones before a rally back up. Whales, institutions, and long-term investors are likely to closely monitor the $111,000 and $100,000 levels. And you should too.