Based on the latest technical data for **DOGE/USDT** (up to August 16, 2025 - 21:18), here is the comprehensive analysis:

---

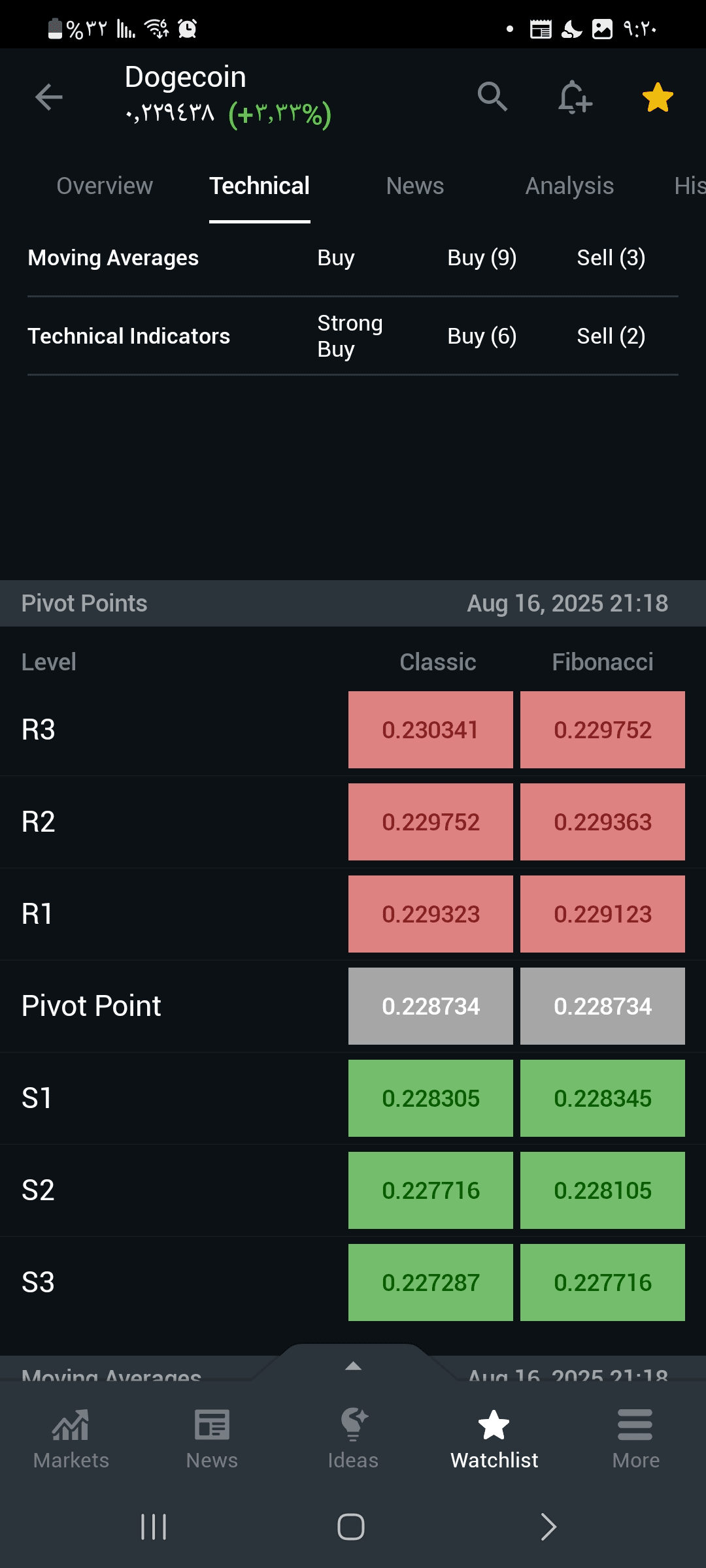

### 📊 Price Expectations and Pivot Levels

| **Level** | **Value (Classic)** | **Expectations** |

|---------------|----------------------|---------------------|

| **Resistance R3** | 0.230341 | Breaking it opens the way for 0.232+ |

| **Resistance R2** | 0.229752 | Potential test with selling pressure |

| **Resistance R1** | 0.229323 | Major immediate resistance |

| **Pivot Point** | 0.228734 | Balance point |

| **Support S1** | 0.228305 | Potential buying area |

| **Support S2** | 0.227716 | Breaking it strengthens the decline |

- **Current price**: Assumed to be close to **0.2290-0.2300** (based on indicators).

---

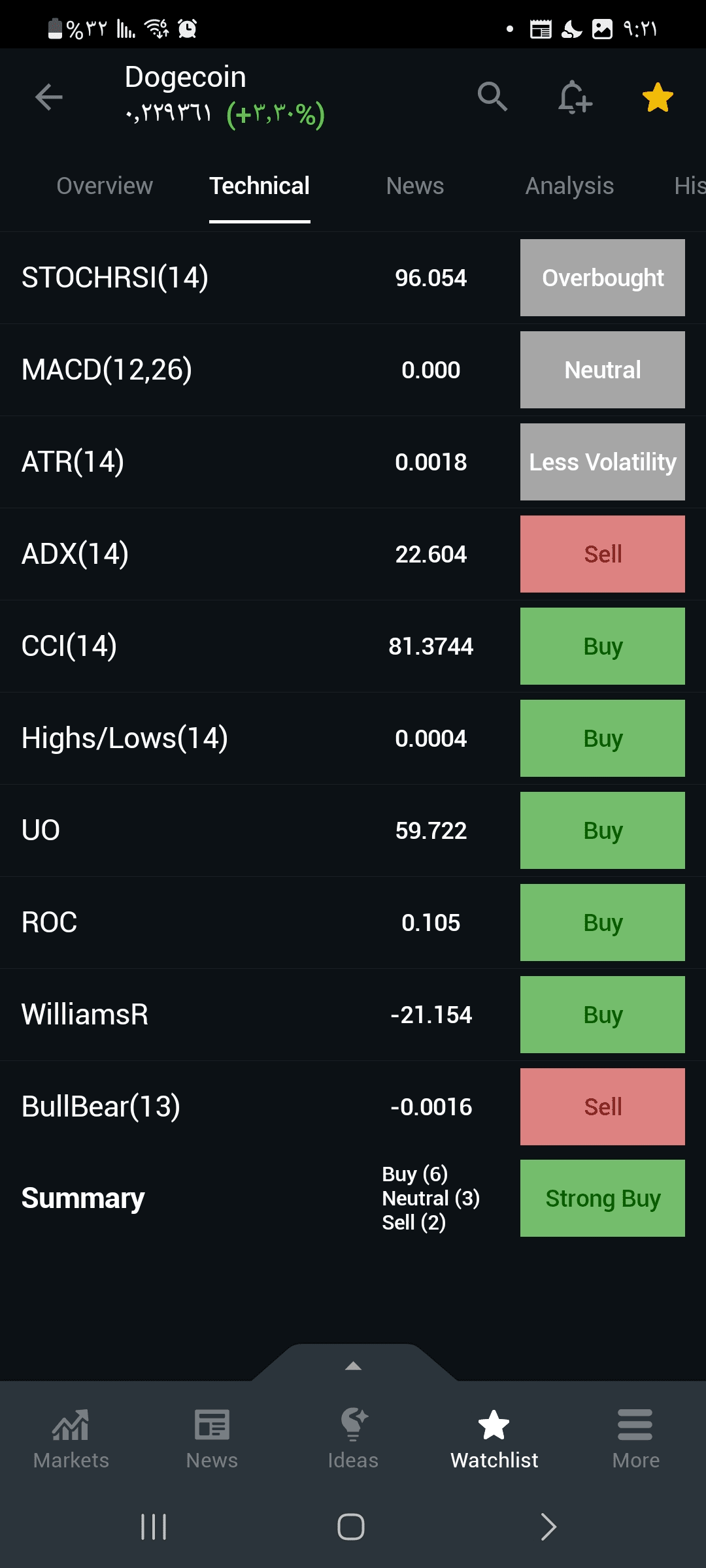

### 📈 Momentum Analysis: **Bullish but overbought**

1. **Positive signals**:

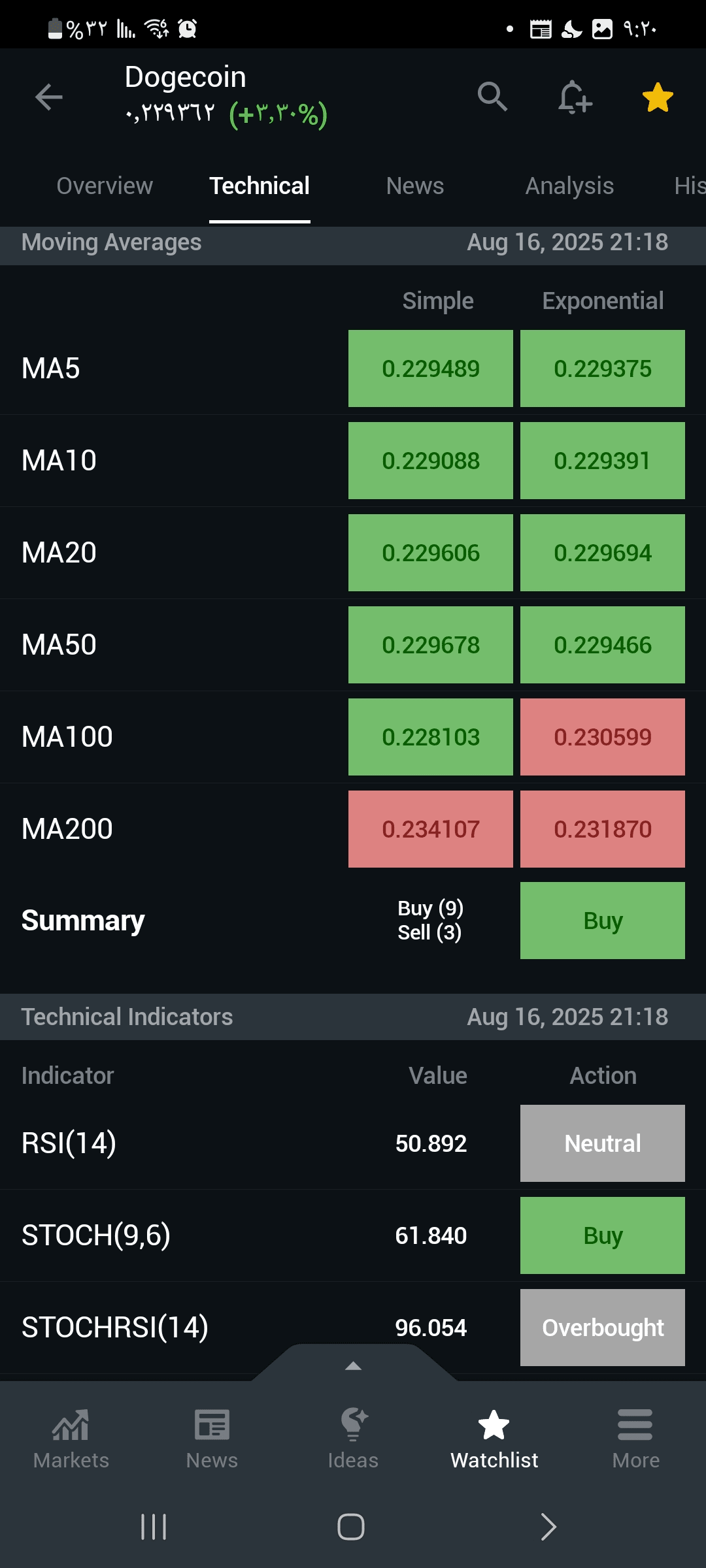

- **Moving Averages**: **9 buy signals** vs 3 sell → Strong bullish trend.

- **Momentum indicators**:

- STOCH(9,6): **61.84** (buy signal).

- CCI(14): **81.37** (buy - bullish strength).

- ROC: **+0.105%** (positive momentum).

- **Buying volume**: Most sub-indicators (UO, Highs/Lows) support the rise.

2. **Main risks**:

- **STOCHRSI(14): 96.054** → **Severe overbought** (highest level since previous analyses).

- **ADX(14): 22.604** → **Weak trend** (below 25) despite bullish signals.

- **Oscillators**:

- MACD: 0.000 (neutral) - absence of strong support.

- Williams %R: -21.154 (buy) but close to the overbought area.

---

### ✅ Answering the questions:

1. **Is there bullish momentum?**

- **Yes**, but it's in the **last overbought phase** (STOCHRSI 96 > 80).

- Evidence:

- Dominance of buy signals (9/12 in moving averages, 6/11 in indicators).

- RSI(14) improved to 50.892 (neutral but upward trend).

2. **Is it time to buy or sell?**

- **🔴 Avoid direct buying now** (due to strong overbought).

- **🟢 Gradual strategy**:

- **Buy at support**: **S1 (0.228305)** or **S2 (0.227716)** with a stop loss below **S3 (0.227287)**.

- **Sell at resistance**: **R1 (0.229323)** or **R2 (0.229752)** for quick profits.

- **Ideal scenario**:

- Wait for **correction to 0.2283** then enter a buy.

- If **R2 (0.229752)** is broken: enter a buy targeting **R3 (0.230341)**.

---

### 📌 Trading Recommendation:

| **Action** | **Level** | **Target** | **Stop Loss** |

|-------------------|-----------------|-----------------|------------------|

| **Buy (Buy Limit)** | 0.2283 - 0.2285 | R1: 0.2293 → R2: 0.2297 | 0.2276 (below S2) |

| **Sell (Take Profit)** | 0.2297 - 0.2300 | R3: 0.2303 | Above 0.2305 |

| **Avoid short selling** | - | - | - |

---

### ⚠️ Critical Notes:

1. **Risk management**:

- Reduced volatility (ATR: 0.0018) → Limited price movements.

- Reward/Risk ratio **1:2+** when buying from support.

2. **Bullish catalysts**:

- Breaking **R2 (0.229752)** with high trading volume.

- STOCHRSI drop below 80 (reducing overbought).

3. **Warning**:

> Any failure to break R1 (0.229323) may cause a correction to **0.2277 (S2)**.

---

### Summary:

- **Short-term trend**: Bullish with **risk of technical correction** due to overbought (STOCHRSI 96).

- **Expectations**:

- Base scenario: **Correction to 0.2283** then bounce towards 0.2303.

- Alternative scenario: Breaking R2 drives the price to 0.231+.

- **Recommendation**:

- **Wait to buy at support** (0.2283) or **sell at resistance** (0.2297).

- Avoid long positions above 0.2295 until overbought calms down.

> 📉 **Current risk**: Medium (3/5) - entry needs precise timing.