Based on the technical data in the three new images dated today 19/82025, here’s the detailed analysis:

---

### **Key Technical Indicators**:

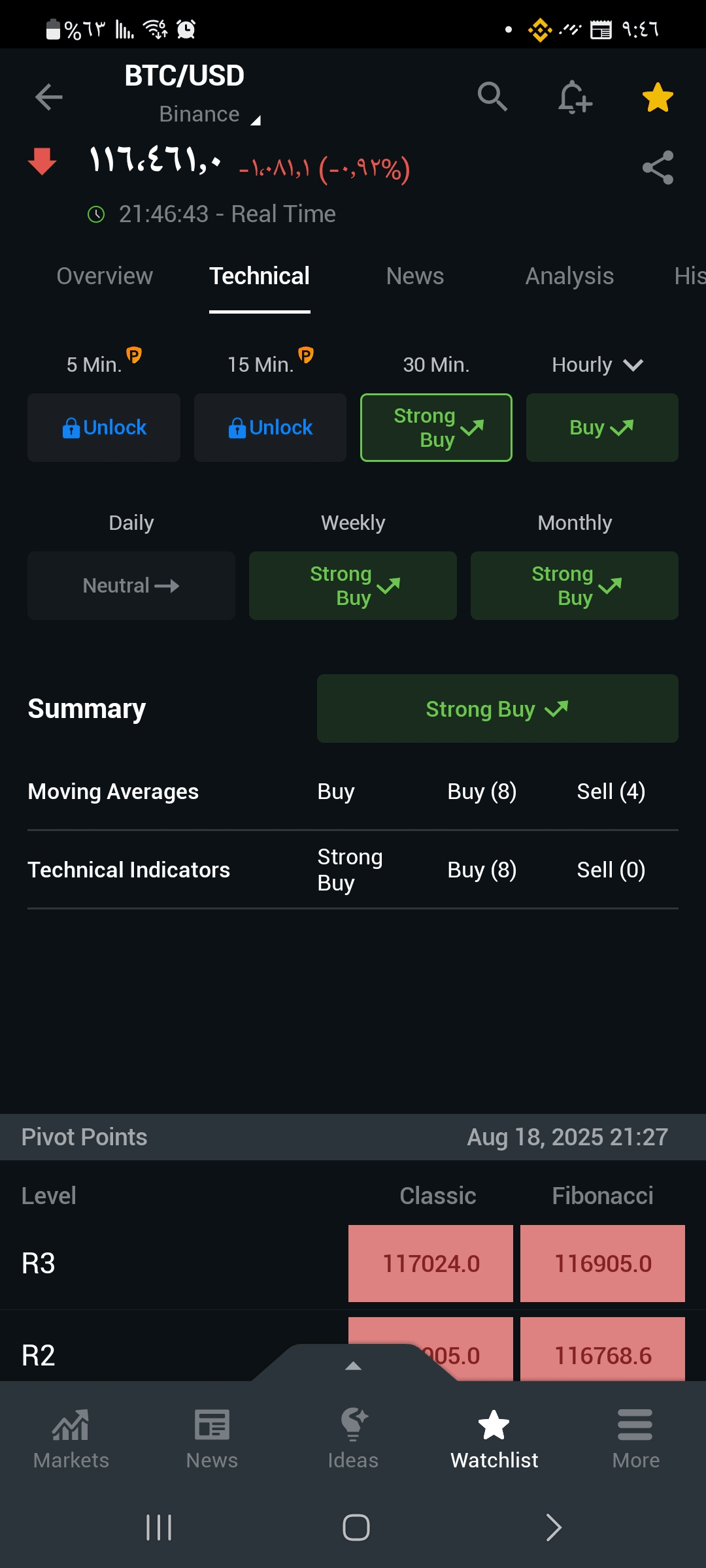

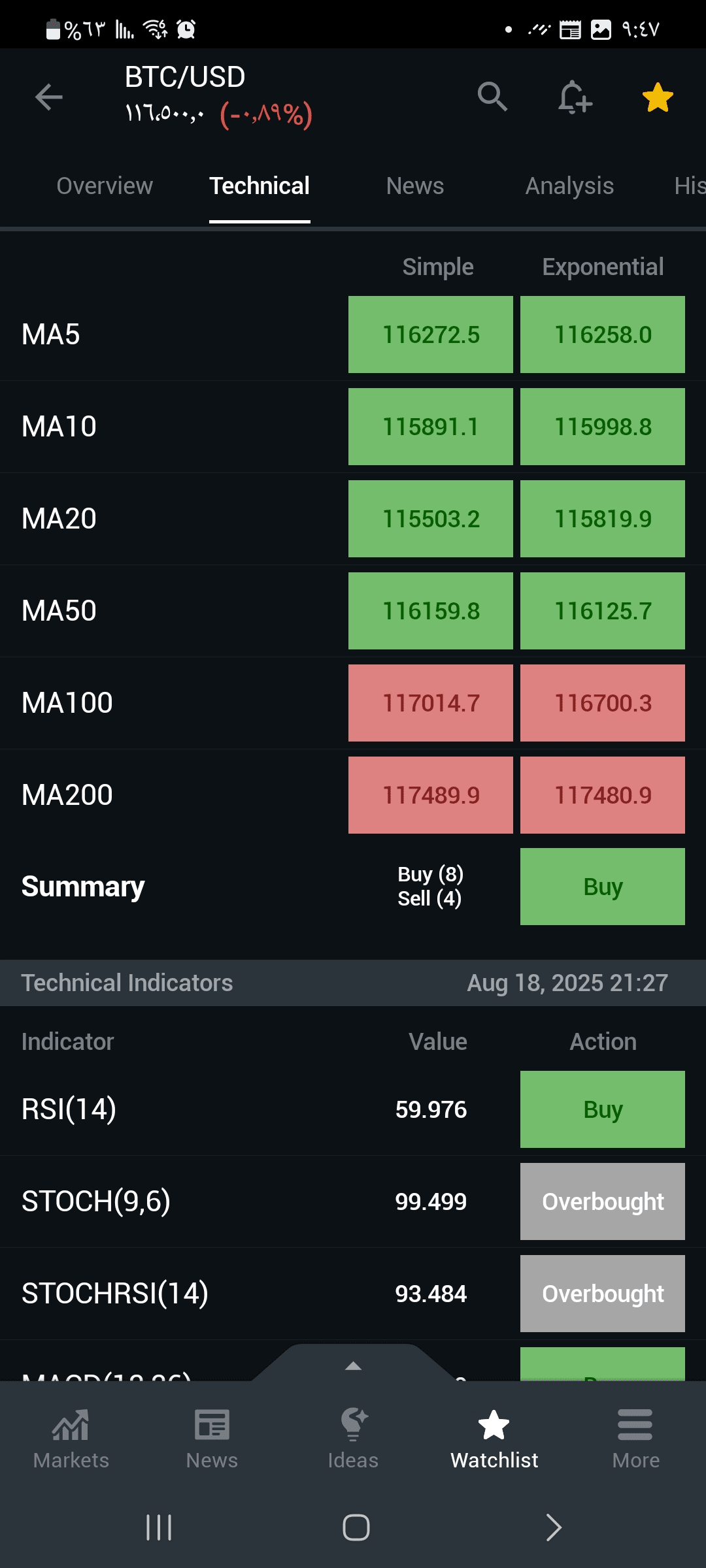

1. **Moving Averages Trend**:

- **8 buy signals** against 4 sells in simple moving averages.

- Current price (~116,272) **above MA10 (115,891) and MA20 (115,503)** → bullish signal.

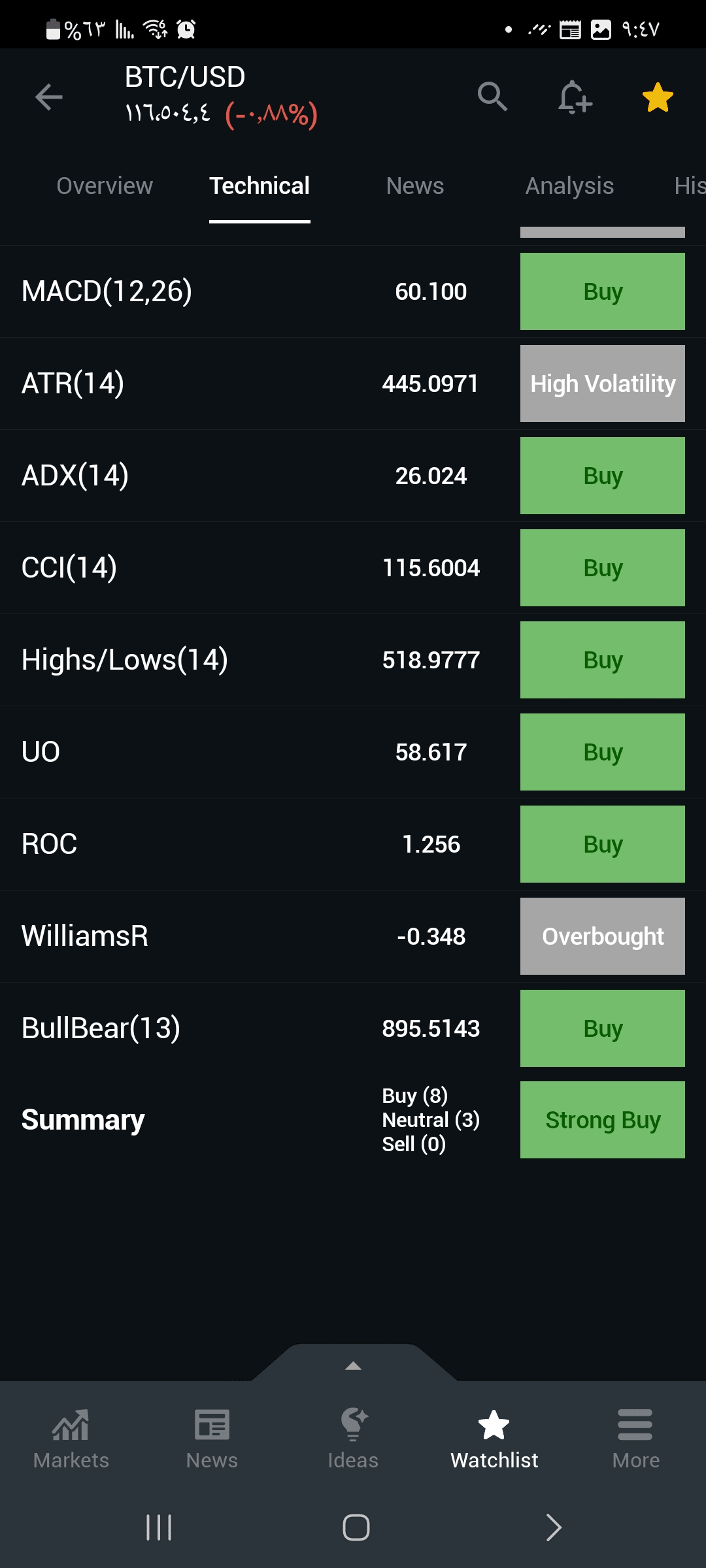

2. **Main Momentum Indicators**:

- **MACD(12,26): 60.100** (Strong **buy signal**).

- **ADX(14): 26.024** (Bullish trend has started gaining strength above level 25).

- **CCI(14): 115.6004** (Above 100 → bullish momentum).

3. **Overbought Indicators**:

- **STOCH(9,6): 99.499** (Severely Overbought).

- **Williams %R: -0.348** (Overbought).

- **STOCHRSI(14): 93.484** (Overbought) → Warning of a potential short-term correction.

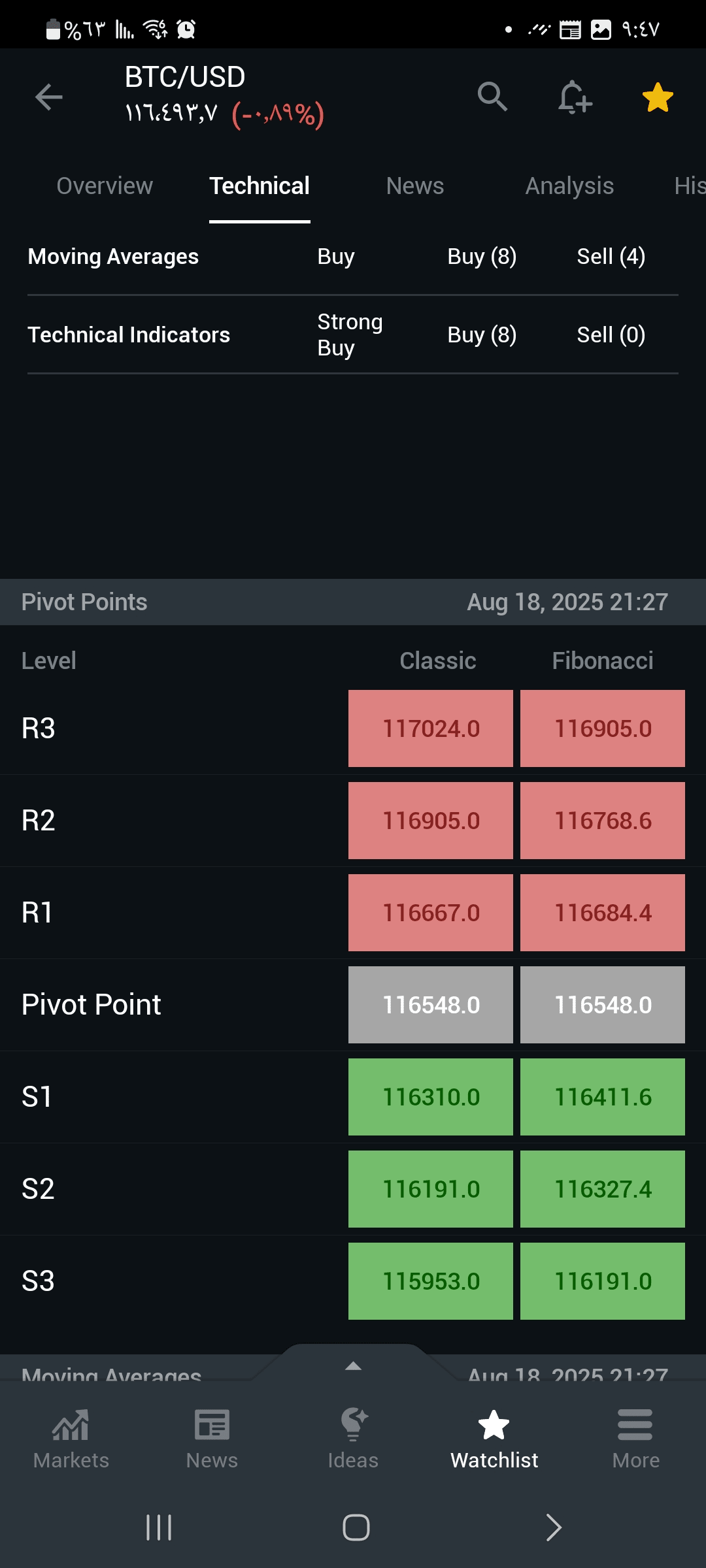

4. **Volatility and Support/Resistance**:

- **ATR(14): 445.0971** (High volatility → opportunities for strong movements).

- Pivot Points:

- Support: **116,310 (S1)** then **116,191 (S2)**.

- Resistance: **116,667 (R1)** then **116,905 (R2)**.

---

### **Price and Momentum Forecast**:

- **General Trend**: **Bullish (↑)** with:

- **80% of indicators indicate buy** (8 buy signals versus 0 sells in the last image).

- Support from short-term averages and momentum indicators (MACD, ADX, CCI).

- **Risks**:

- Overbought indicators (STOCH, Williams %R) indicate a potential **short-term correction** towards **116,310 - 116,191** before resuming the upward trend.

- Breaking below **116,191 (S2)** may change the trend.

- **Target Levels**:

- **Short Target**: 116,667 (R1) → breaking it opens the way for 116,905 (R2).

- **Medium Target**: 117,024 (R3) if momentum continues.

---

### **Strategic Recommendation**:

| Action | Details |

|----------------|--------------------------------------------------------------------------|

| **Buy** | - **Optimal level**: when correcting near **116,310 (S1)** or **116,191 (S2)**. - **Stop Loss**: below **116,000** to protect capital. - **Target**: 116,667 then 116,905. |

| **Avoid Selling** | - No strong sell signals (0 sell signals in indicators). - Only sell if the price breaks **116,000** with confirmation of high trading volume. |

| **Risk Management** | - Risk/Reward Ratio: 1:3 (Acceptable). - Reduce size due to high volatility (ATR > 445). |

> **Summary**:

> **Momentum is bullish with a good buying opportunity**, but wait for a slight correction (5-10 minutes) for a better entry. Avoid large positions due to overbought signals.