Let’s be real, no one loves KYC.

But in 2025, verifying your crypto identity isn’t just smart, it’s essential.

Especially in the EU, where regulations are tightening and platforms like Binance are leading the charge on compliance.

What is KYC?

KYC (Know Your Customer), is basically Binance’s identity check system.

It’s not just some bureaucratic hoop, they need to verify who’s behind every account, plain and simple. This isn’t just Binance being picky; it’s a core part of anti-money laundering (AML) regulations. Without it, crypto exchanges would be sitting ducks for money launderers and fraudsters, not to mention all sorts of illegal activities.

Why You Should Verify Your Binance Account

Completing KYC isn’t just about jumping through hoops. Here’s what it actually unlocks:

🔓 Full access to Binance services

💶 Higher withdrawal and deposit limits

🤝 Secure P2P transactions

🛡 Better protection from fraud and identity theft

📈 Eligibility for advanced features like Launchpad & Earn

In Spain, complying with AML/CFT laws is also key to keeping your account safe and future-proof.

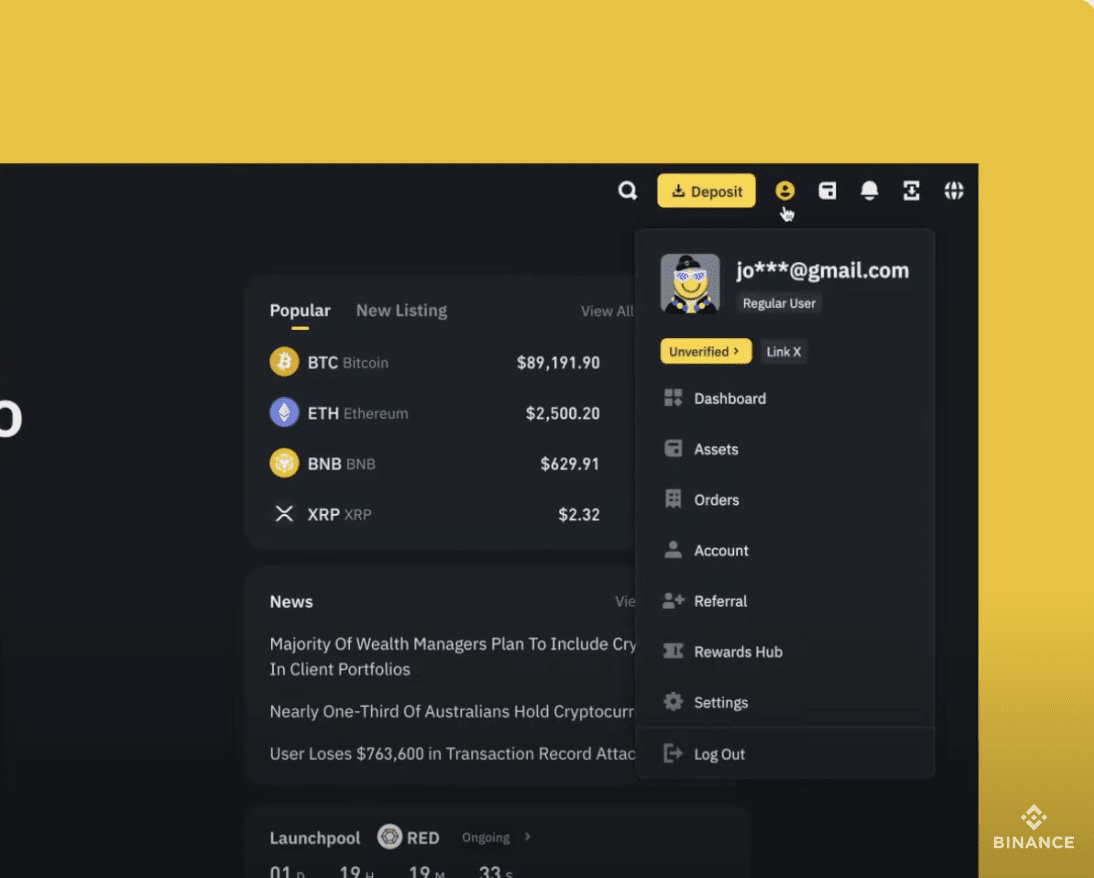

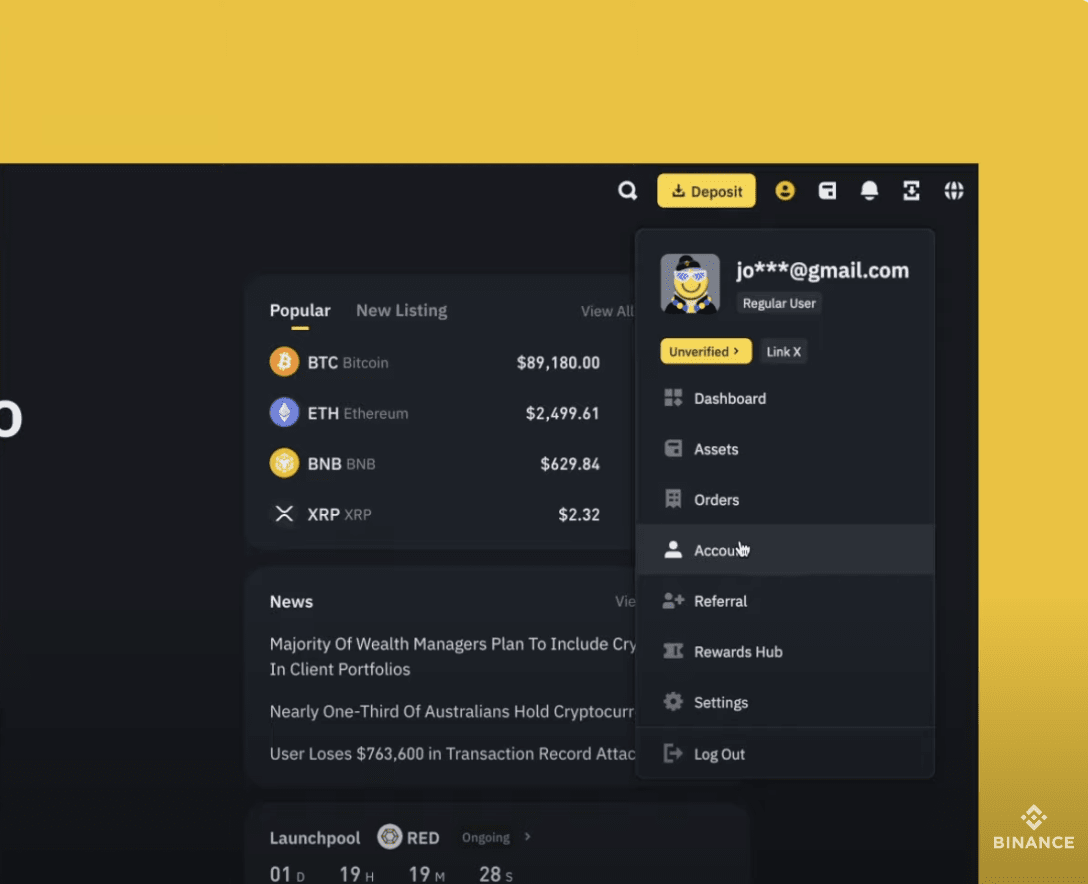

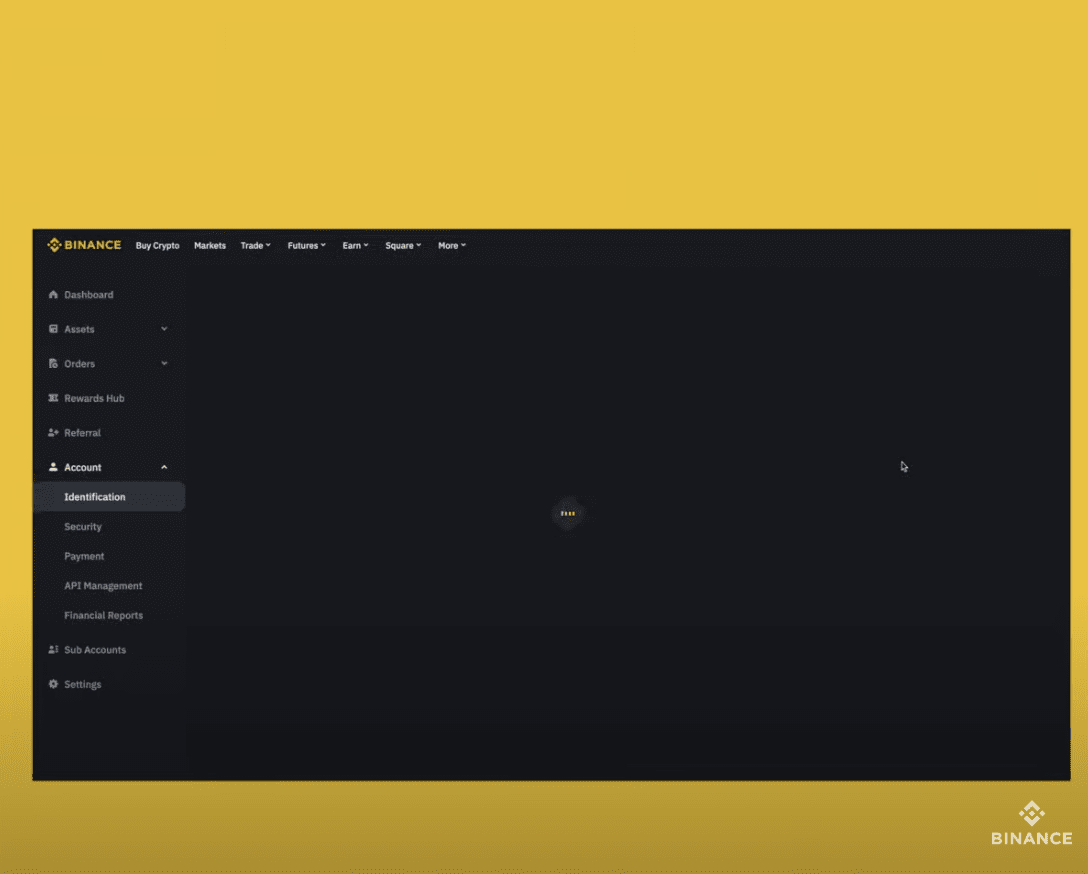

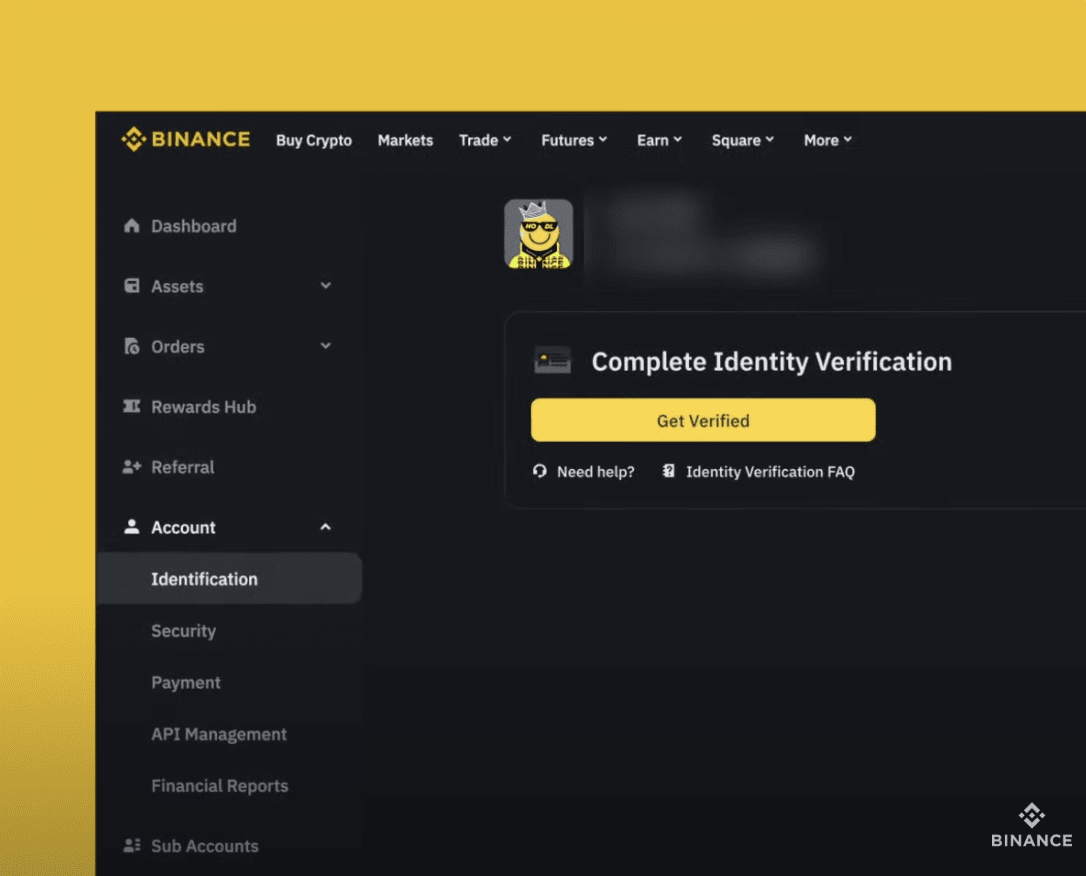

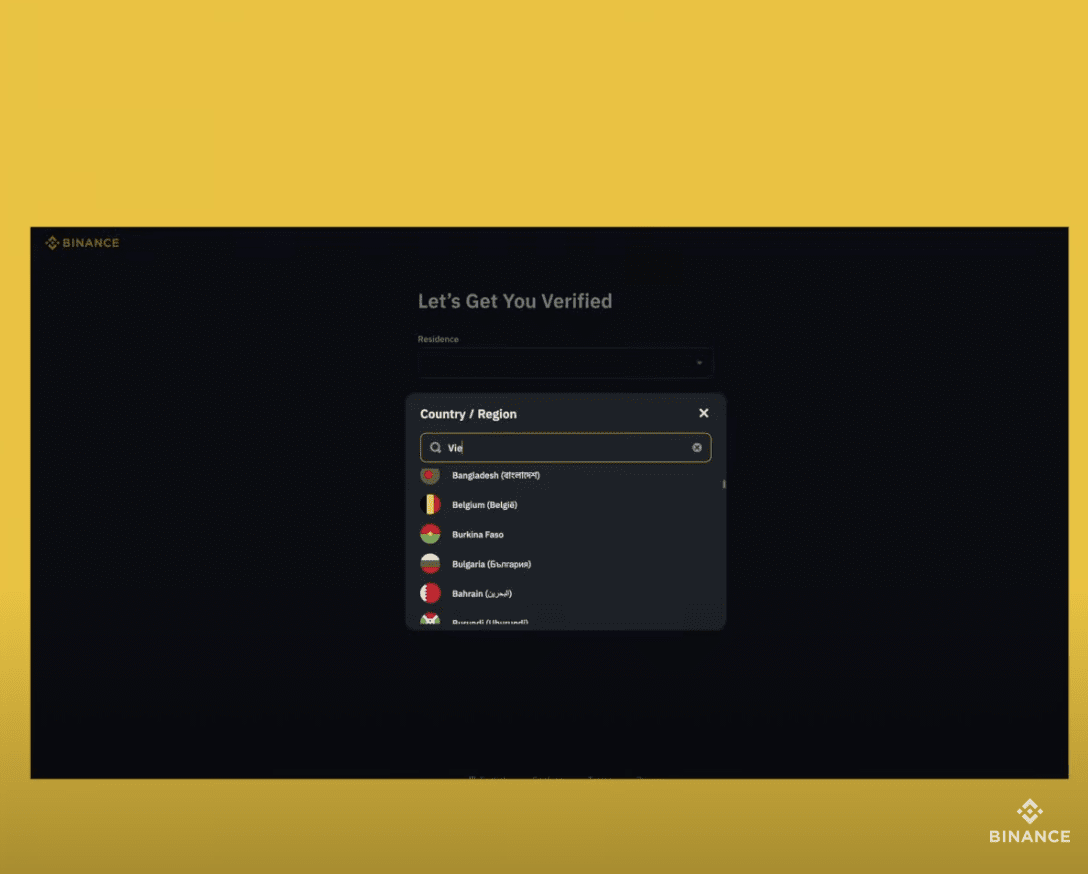

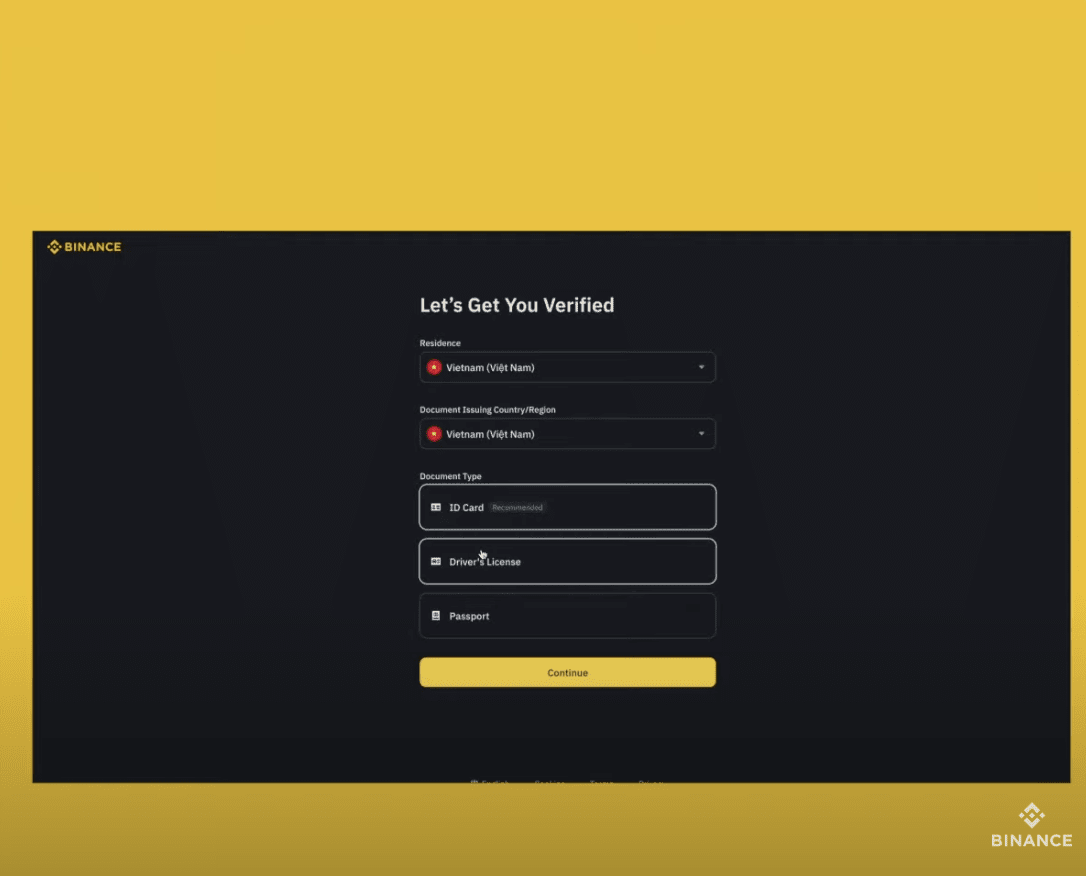

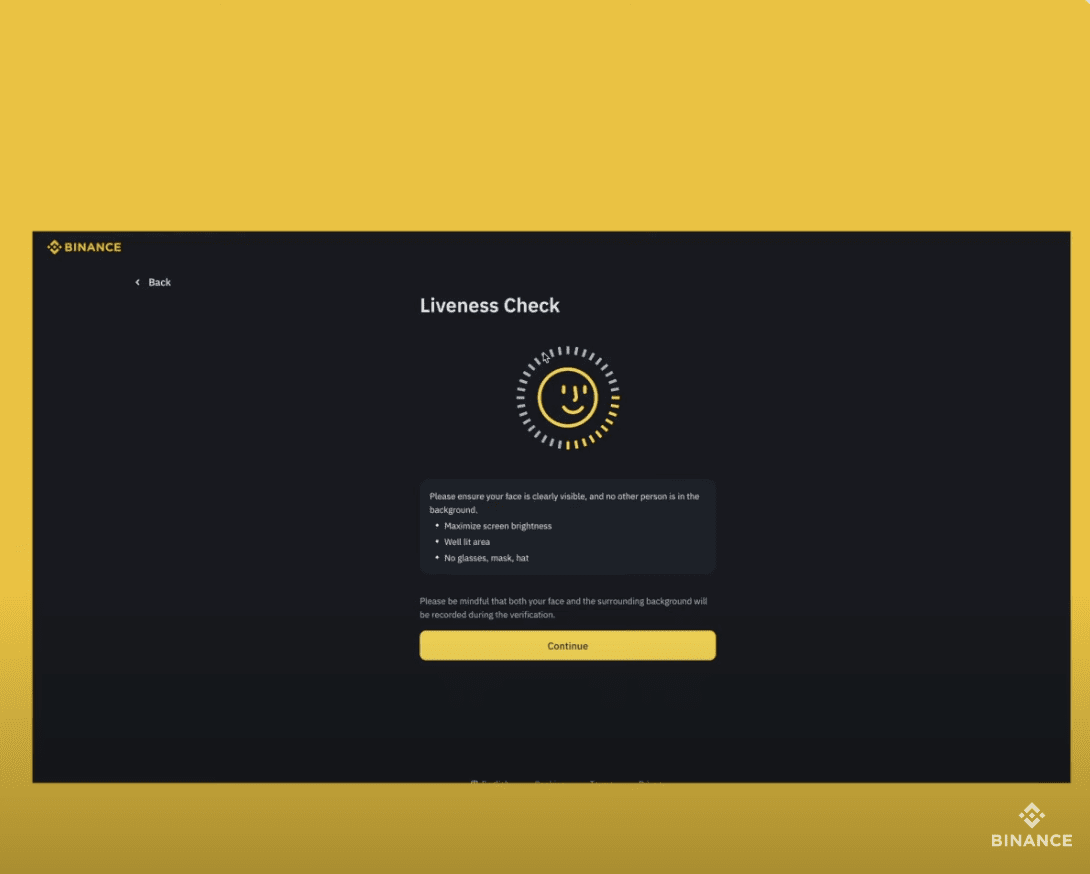

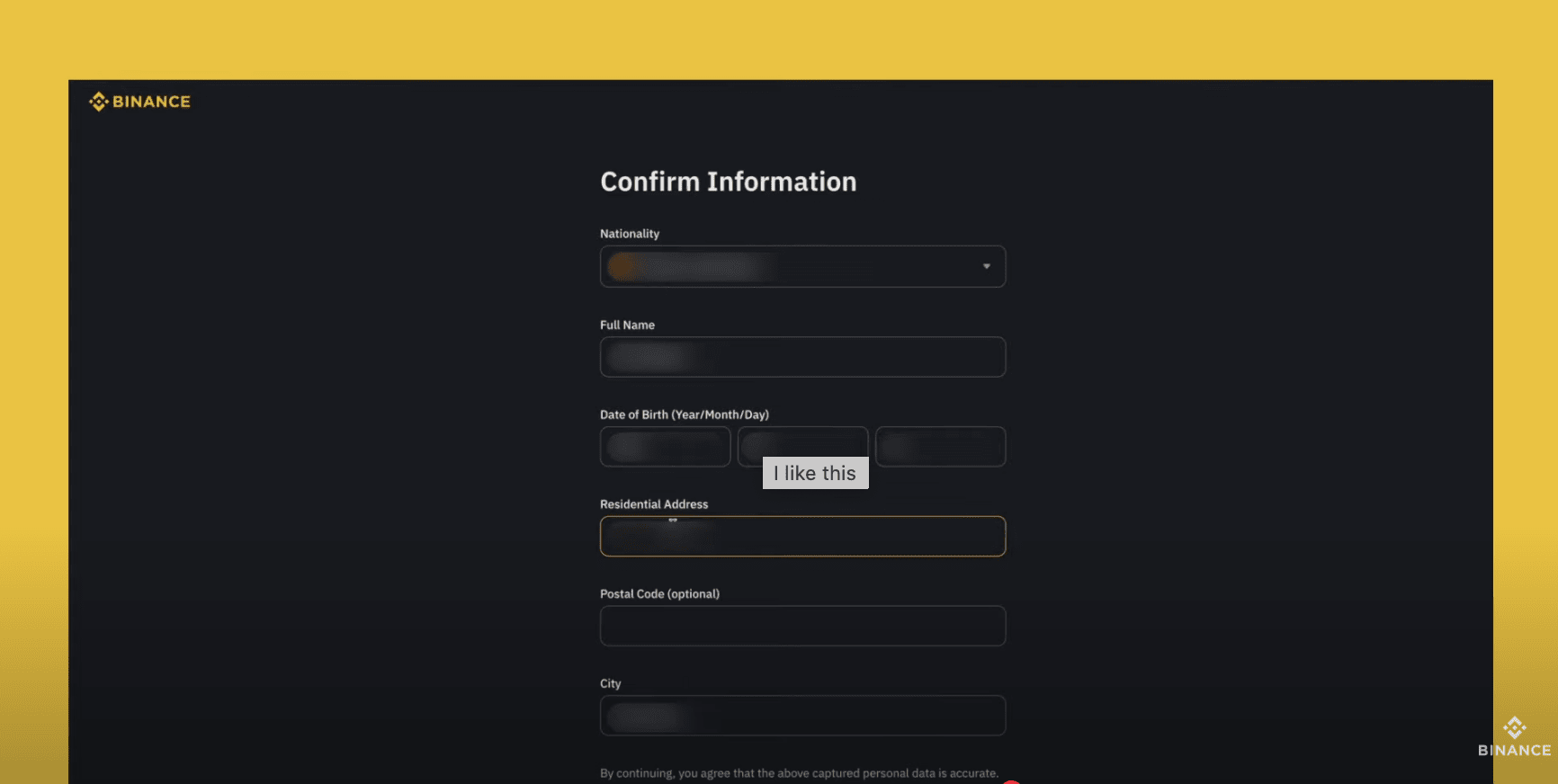

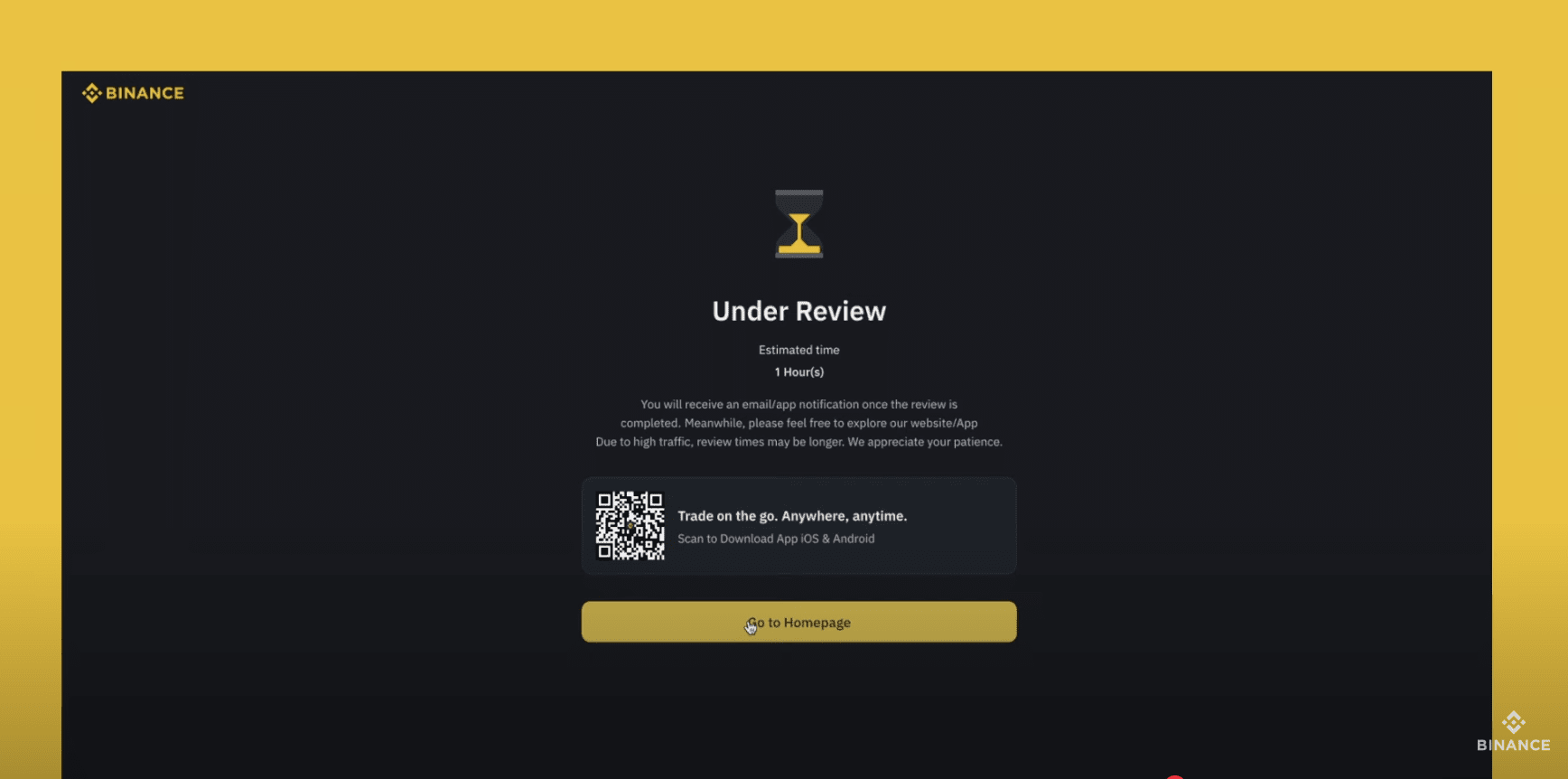

Step-by-Step: How to Complete Binance KYC in Spain

After that you have full access to Binance Features like higher withdrawal limits, fiat deposits and more. If you have any issues, Binance support is available 24/7 and the Binance support team is always available to help.