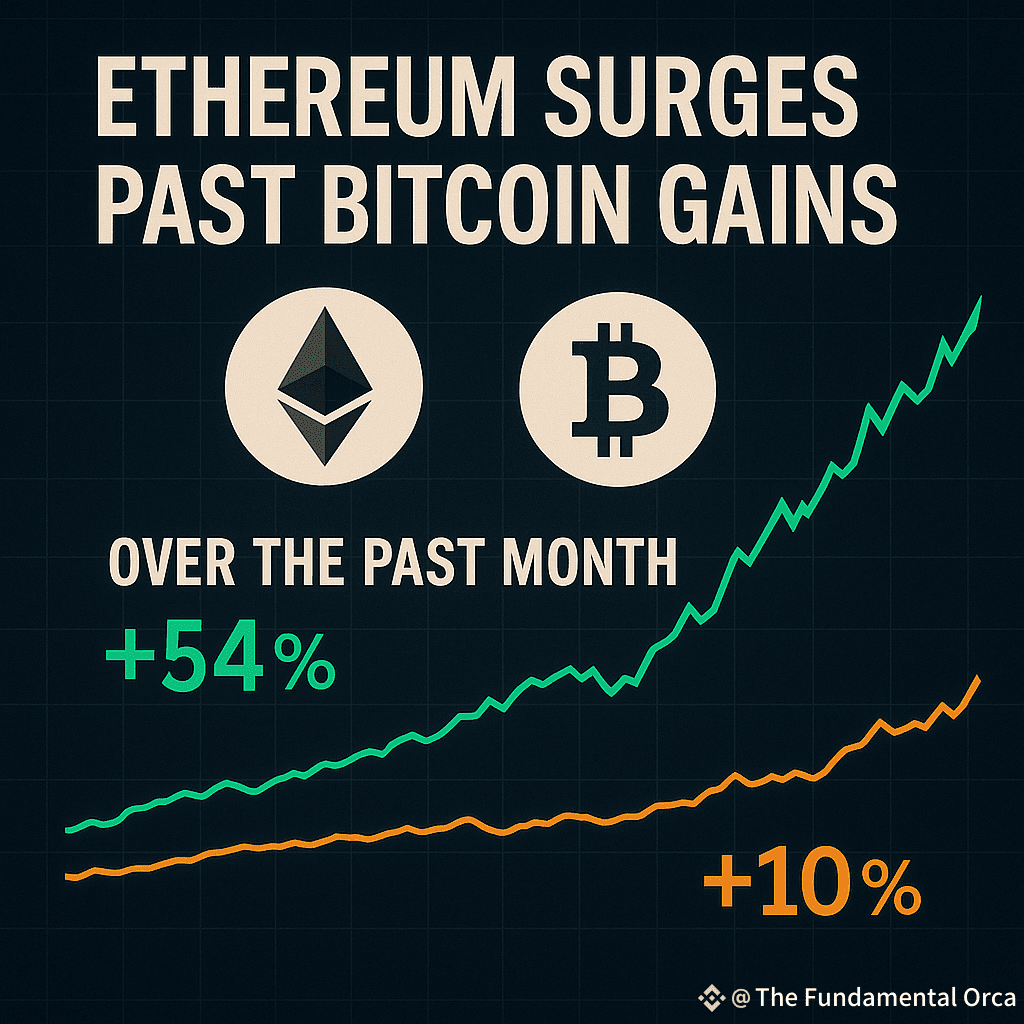

Over the past month, Ethereum has dramatically outperformed

Bitcoin—climbing approximately 54%, while Bitcoin managed a more modest 10%

rise. This divergence in performance has caught the attention of both retail

and institutional investors.

Several key drivers are behind Ethereum's explosive

momentum:

The GENIUS Act was signed into U.S. law in July 2025, bringing sweeping

regulatory clarity to digital assets. It particularly supports

decentralized infrastructure projects like Ethereum, allowing for wider

use of its blockchain in public and private sectors.Regulatory green lights for spot Ethereum ETFs further accelerated the rally.

Financial giants like BlackRock, Fidelity, Franklin

Templeton, and Grayscale have launched ETH-based ETFs with

significant inflows, marking a major shift in institutional participation.Analysts note that Ethereum’s integration into corporate infrastructure is

expanding rapidly. According to Cointelegraph, several Fortune 500

companies have begun testing Ethereum-based rollups and smart contracts to

automate internal processes and improve transparency.Adding fuel to the fire, ETH surpassed $4,800 in late July, briefly

testing its previous all-time high, while on-chain metrics such as

staking deposits and daily active addresses hit multi-month highs. This

reinforces investor confidence in ETH's long-term value and utility.Meanwhile, Ethereum Layer 2 solutions like Arbitrum and Base are gaining

massive traction. Coinbase recently reported that Base is seeing higher

transaction volumes than Ethereum Mainnet on some days—an indication of

scalability and growing adoption beyond just price speculation.

In contrast, Bitcoin's gains, while positive, have been more

muted—mostly driven by macroeconomic factors and continued interest

in BTC spot ETFs, but lacking the same level of developer activity or

institutional innovation.

With Ethereum’s role expanding beyond just a cryptocurrency

into a full-scale infrastructure for financial and enterprise systems, its

recent outperformance may be more than just a short-term price movement—it

could signal a fundamental market shift.

$BTC $ETH #bitcoinnews #Ethereum #GENIUSact #fundamentals #August2025