The market environment is full of mixed information, and I really don’t know where to start. First of all, cryptocurrency, BTC price plummeted to $78,000 last week. According to Coinglass, more than $3 billion of futures longs were liquidated. BTC is about to usher in its worst single-month performance since June 2022. At the same time, ETFs also saw the largest single-month fund outflow in history ($2.5 billion outflow last week alone).

As prices plummeted, market sentiment deteriorated significantly, with Alternative’s “Fear & Greed” index falling to an extreme low last Friday. The Trump administration then intervened with two pieces of good news, announcing that a “Cryptocurrency Summit” would be held at the White House this week and proposing the inclusion of five tokens in a new strategic reserve (BTC, ETH, SOL, XRP, ADA).

Encouraged by this, the price of the currency rebounded sharply, and the price of BTC rose sharply, but it was blocked around 92,000 to 93,000, which corresponds to the resistance position of the long-term trend line. If the government is learning how the Federal Reserve “manipulates” asset markets — or rather, “verbally guides” market trends — then so far, their timing and technical control have been perfect. Does this mean we are witnessing the formation of a “Trump Put” in the cryptocurrency market?

However, the news of the “strategic reserve” has not been recognized by all market participants. Long-term supporters and opinion leaders of decentralization (such as Naval Ravikant) do not support it. It is expected that discussions and disputes about the composition of reserve assets will likely continue to ferment for some time to come. It would be quite ironic if the Democratic Party finally chose to embrace BTC and become BTC extremists in order to oppose the Trump administration.

Our intuition is that this rally may just be a corrective rebound within the trend, as the structural forces of the recent top are still in place (memecoin FUD sentiment, the impact of trading account losses, excessive market position leverage, risk aversion in the overall asset market, etc.), not to mention that the legislative process for establishing a strategic reserve of cryptocurrencies is still long and full of variables.

It should be emphasized that the US President does not have the power (or funds) to directly purchase cryptocurrency assets. Relevant measures still need to be approved by Congress and follow legislative procedures. Before any substantive action is taken, funds must be obtained through the issuance of debt by the Treasury Department.

While we are positive about the long-term direction of the market narrative, we must also remind the market not to have overly optimistic expectations for short-term progress, and that cryptocurrency prices will remain closely tied to the risk appetite/risk aversion sentiment of the macro market for the foreseeable future.

Back to the macro market, despite a rebound in stocks at the close on Friday, the stocks most exposed to Trump’s policies are down about 80% from their election highs, and his uncertain stance on tariffs and DOGE spending cuts is starting to negatively affect sentiment.

Although the US stock market rebounded from oversold conditions last Friday (+1%), slightly converging the trend in February, the overall macro market sentiment has become significantly more negative, and most economic surprise indexes have turned negative.

Most notably, the Atlanta Fed’s first-quarter GDP growth forecast took a record fall last week, from +2.2% to -1.3%, driven by sharp weakness in exports (from -$29 billion to -$250 billion) and consumer spending (from +2.2% to +1.3%).

Further fueling expectations of weak economic growth, consumer credit and housing data continued to fall sharply, with new home sales hitting a record low and housing starts falling after a post-pandemic boom.

Meanwhile, Treasury Secretary Bessent appears to be unfazed by the current economic slowdown, blaming economic pressures on "Bidenflation" and the policies of the previous administration. What’s more interesting is that he explicitly stated that the real “Trump economy” will only come “6–12 months from now.” It sounds like the government is in no hurry to deal with the current economic downturn, which also means that the “Trump put option” in the stock market may not start to take effect until a year from now.

If the Trump put in crypto is currently just rhetoric, and the Trump put in equities isn’t going into effect until next year, where exactly is the real Trump put? We believe the macro (and crypto) community is missing the point, and the real Trump put has been playing out in fixed income markets.

Here are some observations from the past month:

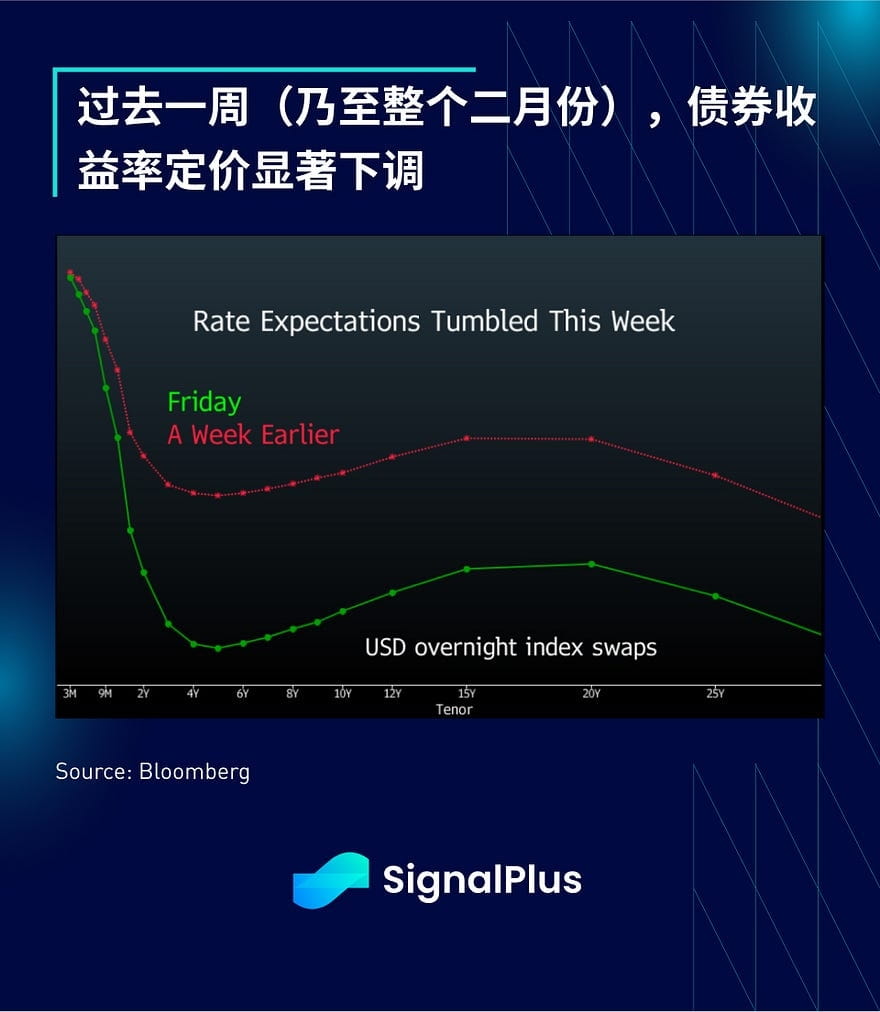

Bond yields have fallen significantly, and expectations for the first rate cut of the year have been brought forward from the end of the year to early summer.

Super core PCE has quietly moved lower, having fallen to its lowest level since March 2021 (3.096%).

Elon Musk made it clear that the bond market should thank the government for DOGE’s spending cuts.

In a January X conference call, Elon Musk said:

“If you’re short bonds, I think you’re on the wrong side.”

In a public interview with Bloomberg TV, Treasury Secretary Bessent said:

“We are not concerned about whether the Fed cuts interest rates… After the Fed made a large-scale rate cut, the 10-year bond yield rose, and the market reaction raised questions about whether monetary policy can effectively affect the overall economy.”

Bessent further emphasized:

“The president wants to see lower interest rates…In our conversations, we’re primarily focused on the 10-year bond yield.”

"The president has not asked the Fed to cut rates. He believes that if we deregulate the economy, push through the tax bill, lower energy costs, and so on, then interest rates and the dollar will adjust themselves."

It is clear that the Trump administration has a deep understanding of the workings of financial markets and recognizes how falling long-term interest rates can benefit the economy. In fact, focusing on long-term interest rates rather than overnight interest rates is exactly the same logic as the Fed's QE (quantitative easing) or Operation Twist, but it is expressed differently.

In other words, the Trump administration’s current strategy is to lower long-term interest rates, allowing the benefits of lower funding costs to naturally spill over to the U.S. dollar, stock market, and cryptocurrency markets. Therefore, we believe that the real “Trump put option” in the market is in the bond market, not the stock market, and investors can adjust their investment strategies accordingly. (Disclaimer: Please do your own research, not investment advice)

Market focus this week will be on whether the United States will impose 25% tariffs on Mexico and Canada as planned, followed by the European Central Bank meeting and Friday's non-farm payrolls report. After experiencing last week's violent fluctuations, risky assets may take a breather and may maintain a volatile consolidation pattern in the near term, while the upside may be limited.

I wish you all a smooth transaction!