Nirvana.

Daily News

1. Jupiter team member: The Jupiter team did not participate in the release of LIBRA and had no prior knowledge of LIBRA's launch

2. BNB Chain's gas fees have surged nearly 400% in the past 7 days, approaching $15 million, more than twice that of Ethereum

3. The on-chain total holding of the U.S. spot Bitcoin ETF has exceeded 1.2 million BTC

4. More than 30 states in the U.S. have introduced policies supporting Bitcoin and digital assets

5. WeChat is conducting a grayscale test for the DeepSeek-R1 full-version model

6. Grok 3 will be released on Monday, praised by Musk as 'the smartest AI on Earth'

7. Sidekick Protocol, which raised millions of dollars, established a strategic partnership with Trovo.live

8. Insider: ai16z founder X account hacked, hacker posted scam link

9. Immutable co-founder: JPMorgan buys $100 million of MSTR, increasing its Bitcoin exposure to $300 million

Market Observation

Daily level:

Continuously oscillating at high positions, overall volume is currently relatively abundant

Has the opportunity to become the next wave of the main rising trend's continuation structure

Last month experienced a weekly volatility of 8%, short-term volatility remains high

There is strong demand in the range of 87000-90000 under the current oscillation structure (medium-term trend reversal zone)

If there is an opportunity to come down and test again, it is still a medium-term entry point

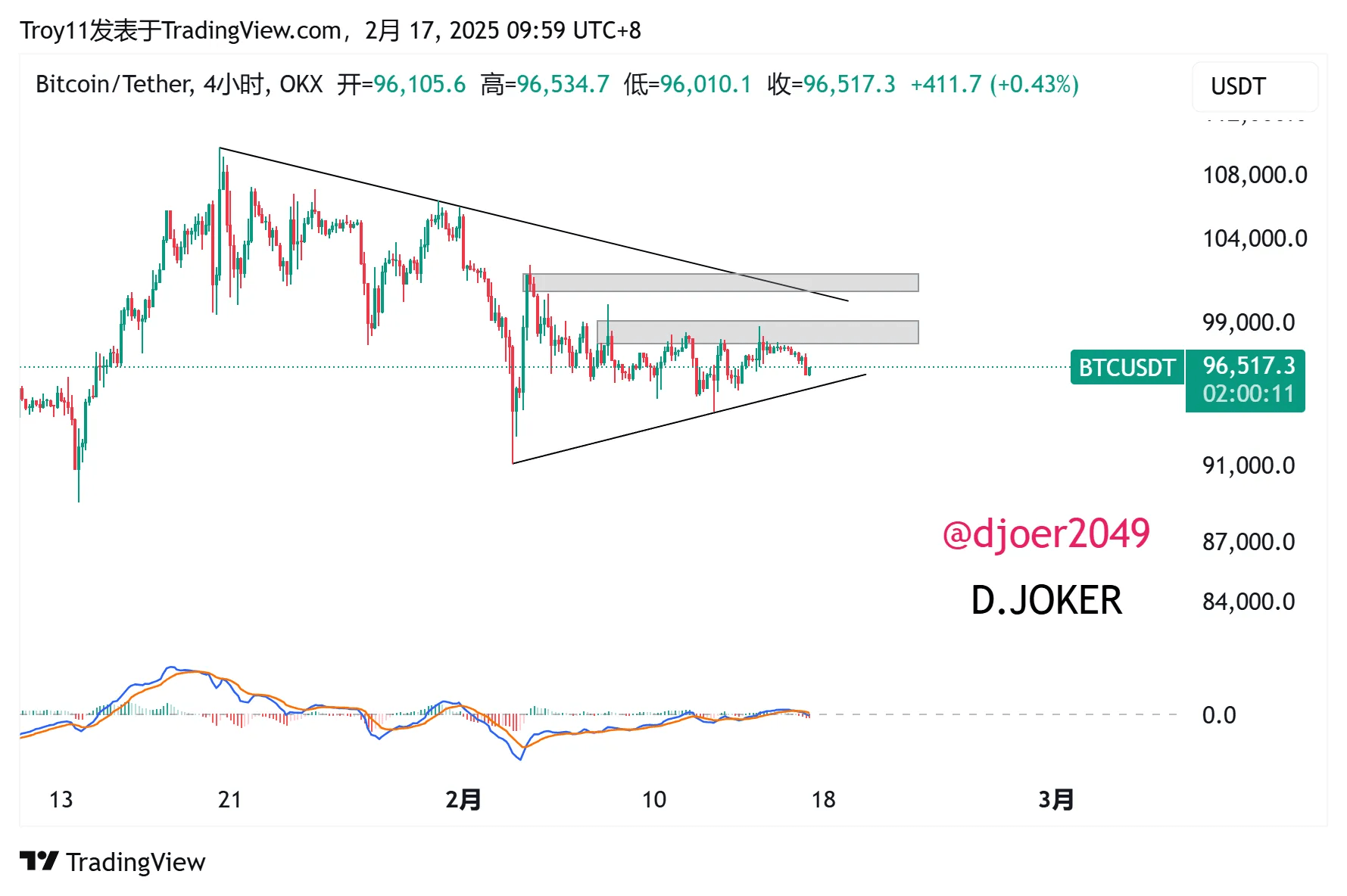

4H level:

Triangular consolidation structure nearing the end, likely to change direction in the coming days

Currently, the trading win rate of short cycle order flow strategy is relatively high in the market phase

Resistance range above: 98000-99500; 101000-102000

Support range below: 95500-96000

Operation Suggestion:

The resistance range above has been tested multiple times, not recommended to go short

Can observe if there is an opportunity to break through

Support range below can wait for entry

Breakdown turns bearish

Daily level:

The beginning of February saw a spike to last August's low point

This position has become the extreme point of liquidity plunder

Currently testing the chip cost position before the last wave of market movement started

The incapable A Dou currently cannot be expected too much in the medium to long term

Support range below is around 2350-2500

Medium-term can patiently wait for a downward test to re-enter

4H level:

Potential Wyckoff accumulation structure

Resistance range above: 2800-2900

Support range below: 2520-2800

Operation Strategy:

Can go long in the lower range

Can go short in the upper range

Breaking through 2900 has the opportunity to reverse the market

Weekly level:

The structure that needs the most attention

This is also a key point that SOL is about to face recently

Current support range is between 175-185

Once it breaks down, medium-term holders can appropriately reduce positions

The bullish trend of SOL may reverse to a bearish trend

4H level:

Short-term upward resistance is relatively large

Resistance range above is around 198-205

Operation Suggestion:

Short-term rebound resistance range can find opportunities to go short

Opportunity Hotspot

#Short-term

Experienced a wave of high positions with an 80% washout after going online

Currently, FDV is still around 18 billion

Recently, the two waves of chip costs were 17.5 and 18.5 respectively

Short-term can build positions between 17.5-18.5

Stop loss around 10%

The extreme rebound position is between 25-28

Profit and loss ratio can be

$TST

Has been in a downward trend since going online

The trading methods of the two waves of declines are almost identical

Also means the short-term turning point is approaching

Token 21 will be burned

Can see if there is an opportunity to catch a rebound

BN #alphalist still has many opportunities,

Currently can continue to pay attention to $SWARM $AI16Z $COOKIE

#Medium to long term

$SUI

The beginning of the month saw a spike back to the high point that started last year's main rising wave

Currently testing the key turning point of the medium-term trend in the second exploration

Odds are higher at prices above 3.1, stop loss below 3

$LTC

ETF expectations, also a relatively strong mainstream coin recently

The washout is quite severe and control is obvious, short-term volatility is often large

Currently in a high position oscillation from the bear market bottom

Resistance range above is around 140-150

Once it breaks through, there is an opportunity to go to around 180-200

Can continue to ambush opportunities on the right side