Global financial markets remain cautious as macroeconomic factors continue to shape risk sentiment. Recent *US employment data showed cooling, increasing expectations of future rate cuts, which is supportive in the medium term but still creates short-term uncertainty.

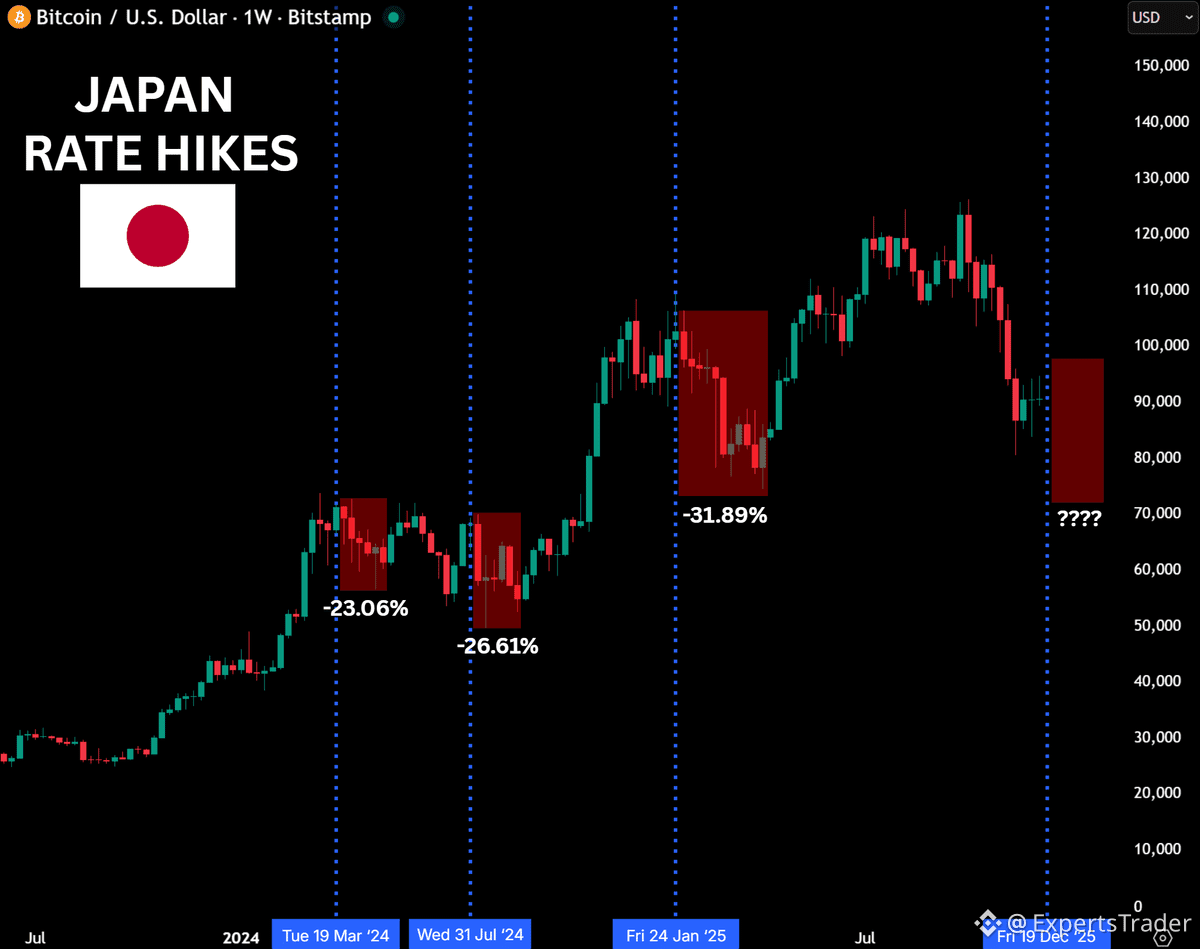

Meanwhile, focus remains on Japan’s Bank of Japan (BOJ) meeting on 19 December, where a potential rate hike is expected. Any surprise from the BOJ could add volatility across global markets, including cryptocurrencies.

Bitcoin (BTC) – Price Update & Outlook:

Bitcoin is currently trading in a **consolidation phase**, reflecting macro-driven indecision.

Short-term trend: Neutral to bearish due to macro uncertainty and resistance pressure.

Key support zone: $80,000 – $75,000

Holding above this range keeps the broader bullish structure intact.

Key resistance: $89,000 – $92,000

A strong reclaim and acceptance above this zone would signal renewed upside momentum.

Higher-timeframe outlook: Bitcoin remains bullish on higher timeframes, with expectations of a new all-time high in the coming weeks, provided key supports are defended.

Ethereum (ETH) – Price Update & Outlook:

Ethereum is currently trading around $2,850, showing clear relative weakness compared to Bitcoin.

Current price action: ETH remains under pressure and is lagging BTC, reflecting continued dominance expansion in Bitcoin.

Key support zone: $2,700 – $2,500

Holding this area is crucial to maintain Ethereum’s broader bullish structure.

Key resistance: $3,100 – $3,300

A reclaim above this zone is required for ETH to regain momentum and signal strength.

ETH/BTC outlook: Ethereum dominance remains weak, which explains the slower recovery and lack of upside follow-through.

Despite short-term weakness, Ethereum’s Long-term outlook remains bullish, and strength is expected once market rotation from Bitcoin begins.

Altcoins Market Update 🪙:

Several major altcoins have recently printed new all-time lows.

Retail participants continue selling, driven by fear and exhaustion.

From a cycle perspective, this aligns with a BTC-dominant phase, which historically precedes stronger altcoin recoveries later in the bull market.

Overall Market Outlook:

Short-term volatility remains likely due to macroeconomic uncertainty.Bitcoin and Ethereum remain bullish on higher timeframes despite near-term weakness. Patience, discipline, and proper risk management remain essential during this phase.

📢 Stay tuned for Quick Signal's 🚦 and real-time market updates. ✅