In 3 years, I turned an initial capital of 80,000 into 28.1 million, relying solely on memorizing all the practical insights I summarized today!

As a retail investor, you must understand the true meaning of the coexistence of risk and opportunity. Besides controlling your own destiny, no one can take over the responsibility for you. Retail investors who place their hopes on others are destined to be failures.

Learning is the foundation of success. Mastering techniques and analyzing public information is crucial for long-term survival in the cryptocurrency market.

The key is to master the inherent meaning of one or two technical indicators and interpret the inherent laws of the cryptocurrency market from them.

It organically combines with operational strategies and serves as a tool for speculation in the cryptocurrency market.

In today's article, I want to expose the trading and chart errors that most traders make—these seemingly insignificant errors can directly ruin your trading career and keep you trapped in losses for a long time. Without further ado, let’s get straight to the point!

01 The most fatal chart error is entering randomly at any price level.

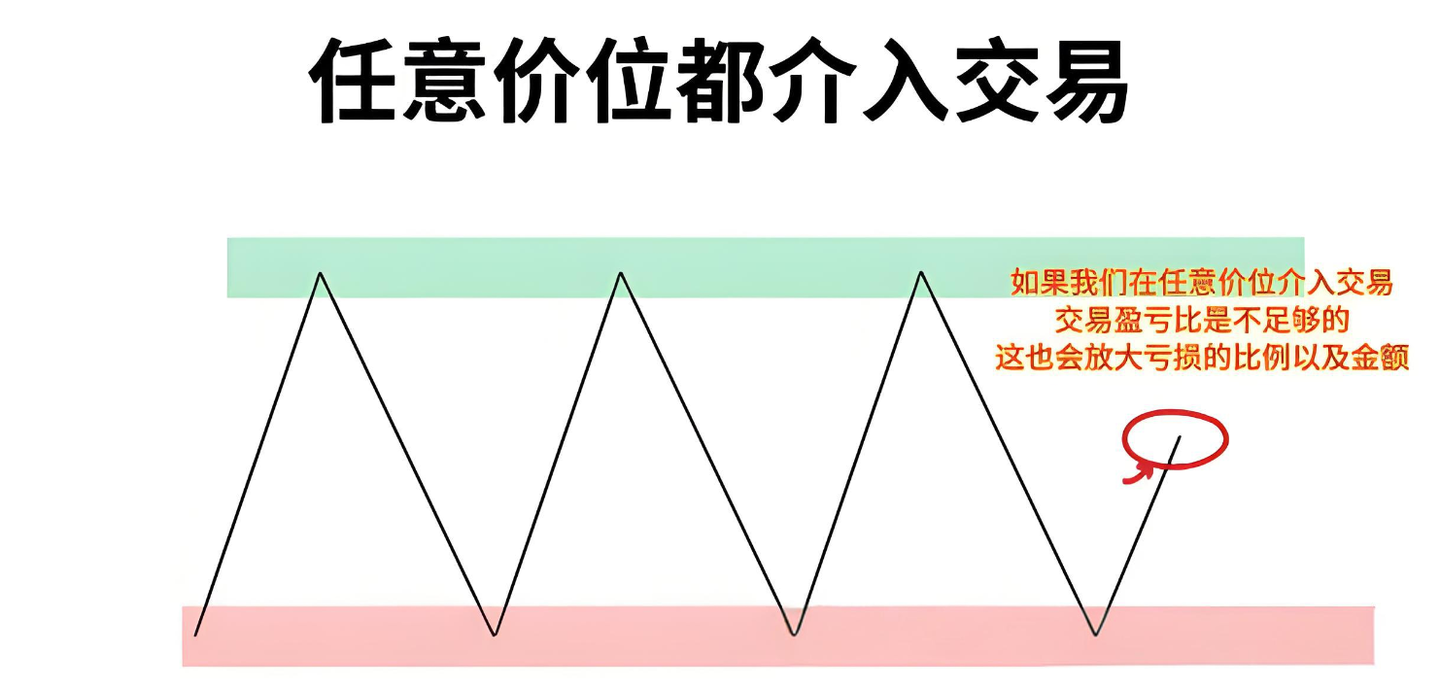

Many traders have a bad habit: when they see a candlestick pattern they recognize, they rush in without considering whether the price level is reasonable. Let me give you an example: the price is currently in a sideways consolidation range, and we can clearly draw support and resistance levels, while the current price is in the middle of the range, and a bullish engulfing pattern has appeared.

Many people see this bullish engulfing pattern and think the opportunity has come, immediately entering long. But I must tell you, that is wrong! Entering at such an 'arbitrary price level' has the biggest problem of an unbalanced risk-reward ratio, which will directly amplify your loss ratio and amount.

Let’s refine this example further:

The price at this middle level is particularly awkward, as it is neither close to the upper resistance level nor the lower support level. At this time, entering means you can't even set reasonable stop-loss and take-profit levels. Let’s illustrate this specifically:

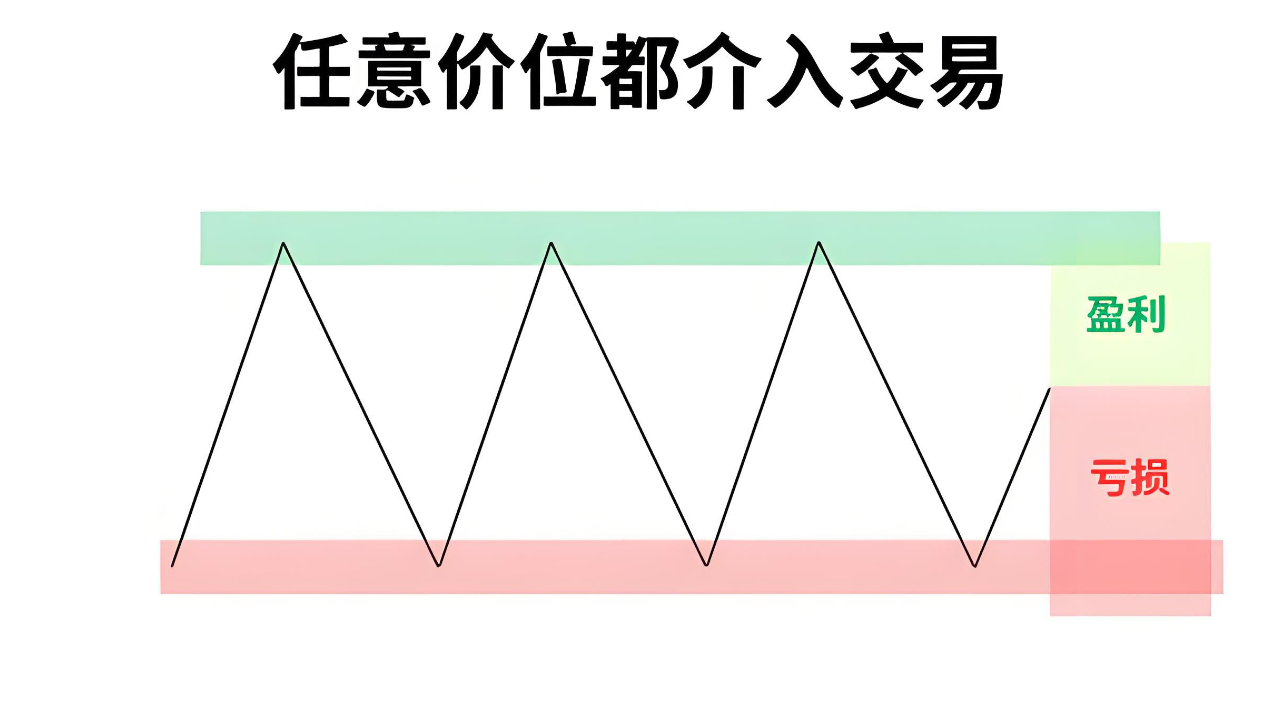

In a sideways range, support and resistance levels are very clear. If you enter in the middle, the stop-loss must be set below the support level, and the take-profit should be set above the resistance level. From the risk-reward perspective, the loss risk you have to take (red part) is much greater than the profit you can achieve (green part).

Doing this long-term means that even if you occasionally make a profit, one loss can take back all your previous gains, leading to a continuous loss situation. Therefore, I repeatedly emphasize: before entering, you must first examine whether the price level is reasonable, whether it is a key price level, plan your stop-loss and take-profit beforehand, and calculate the risk-reward ratio. If it’s unreasonable, you must resolutely avoid it.

Let me show you an example of a downtrend:

If you randomly find a position to short in the middle of a trend, the risk-reward ratio is definitely unreasonable; but if you wait for the price to correct to the 20 moving average key price level before entering, the stop-loss distance will be greatly shortened, while the profit space will increase. This kind of risk-reward ratio where 'profit is greater than loss' is the trade we should be doing.

Ultimately, the problem lies in 'avoiding entry at key price levels.' Let’s take a look at this example of an uptrend:

When the price is above the 50 moving average, it is a healthy uptrend. We should wait for the price to correct to the key price level of 'moving average + support level' before going long. If we enter now, we are too far from the key price level, resulting in a long stop-loss distance, a huge loss ratio, and the risk-reward ratio collapsing.

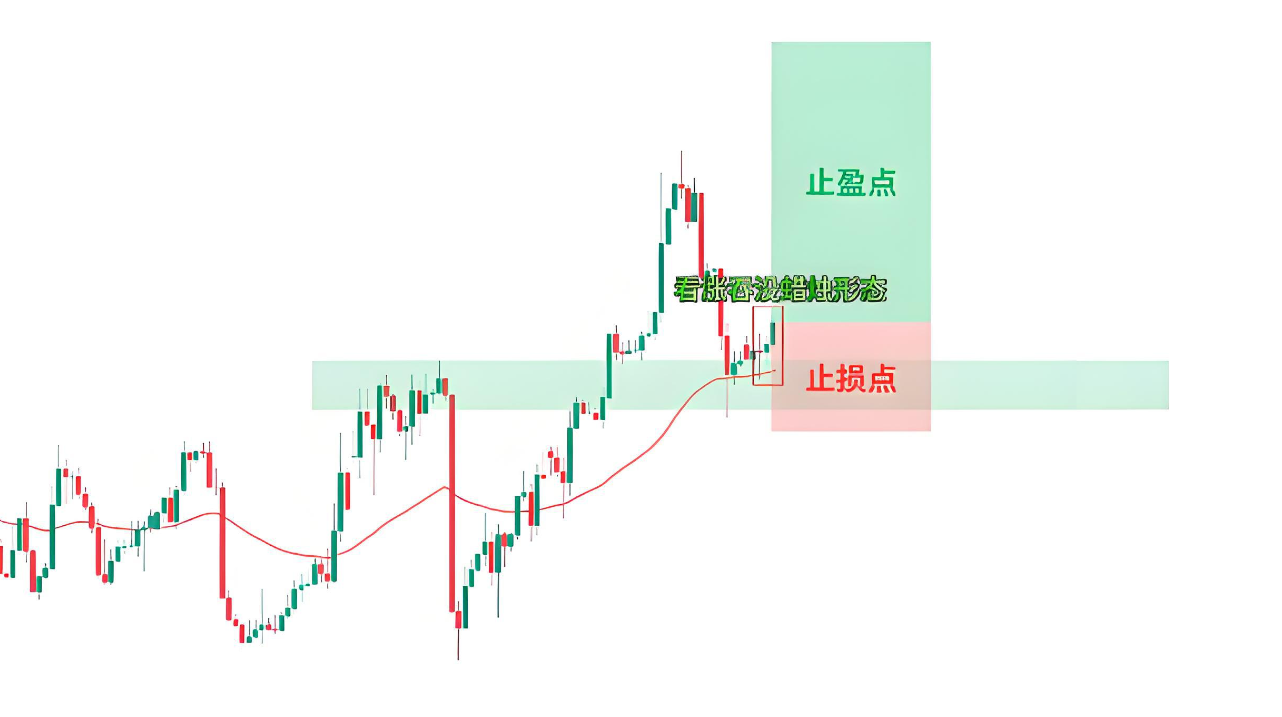

Rather than endure unreasonable risk-reward ratios at mid-price levels and suffer from floating losses due to price corrections, it is better to be patient and wait for the price to reach the key level and show a bullish signal before entering.

In this way, the entry point is very close to the stop-loss point, and the profit space is enlarged; moreover, the confirmation signal at the key price level can prove that the price is likely to bounce back, eliminating unnecessary floating losses.

02 Remember the two core trading principles to greatly enhance your win rate.

From the above examples, I have summarized two core concepts to help everyone establish the correct trading strategies and plans:

One is to trade with the trend, and the other is to trade at key price levels. As long as you can strictly implement these two points, combined with subsequent trade management, your trading performance will definitely improve significantly over the long term.

The benefits of these two principles are particularly practical, let’s discuss them separately:

1. Trade with the trend: It can significantly enhance the risk-reward ratio. For example, when the price is in an uptrend, we trade long with the trend, as the probability and magnitude of price increases in an uptrend are greater, naturally leading to higher win rates and risk-reward ratios;

2. Trade at key price levels: It can avoid unnecessary loss risks while also improving the risk-reward ratio, helping us to 'minimize losses and maximize profits.'

03 How to correctly implement the 'trend-following + key price level' strategy in practice.

Many traders open charts, and the first thing they do is look for entry signals at the current price, completely blinded by short-term fluctuations. The correct approach is to establish strict trading rules to ensure consistency in entry actions. Specifically, it can be divided into two steps:

Step one: First determine the overall trend and set the trading direction. We use trend structures to judge; for example, in this case: the price has formed a 'higher high, higher low' uptrend structure, clearly indicating that the current trend is up, so we only go long and do not short, which can ensure win rates and risk-reward ratios.

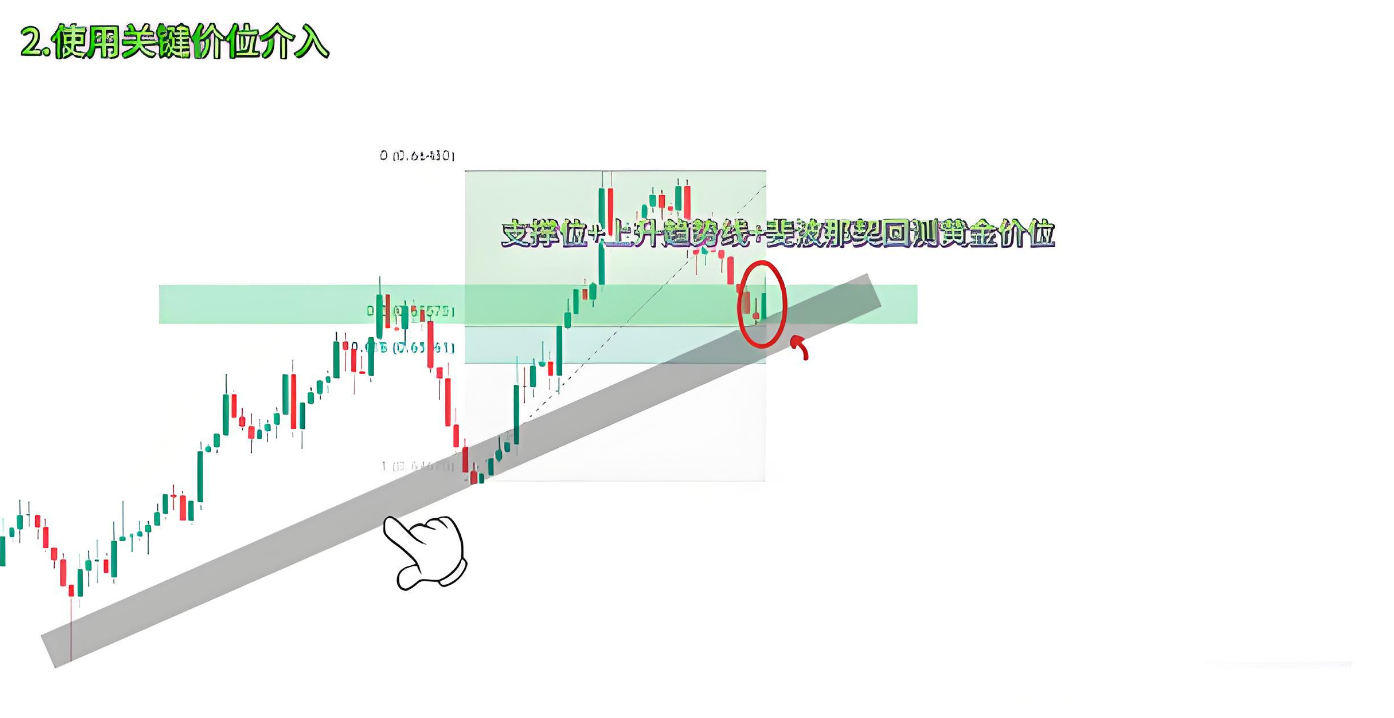

Step two: Find the key price level and wait for the confirmation signal to enter. Even if you determine it is an uptrend, you cannot enter arbitrarily; otherwise, you will bear unnecessary floating losses and receive low-quality trades. The correct approach is to find the key price level of 'multiple technical tools resonating'—for example, in this case, the price corrects to the resonance area of 'previous high breakout turning support + uptrend line + Fibonacci retracement golden level'. The validity of this key price level is extremely high, and the probability of a price rebound here is very large.

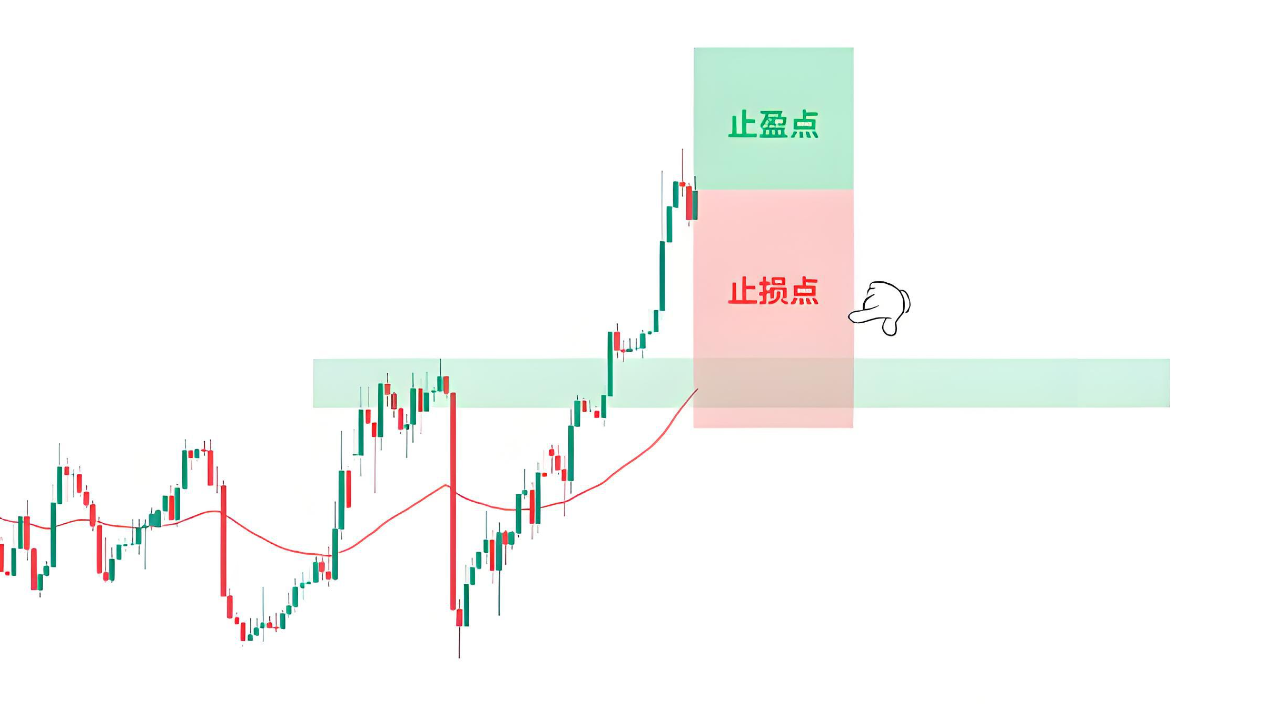

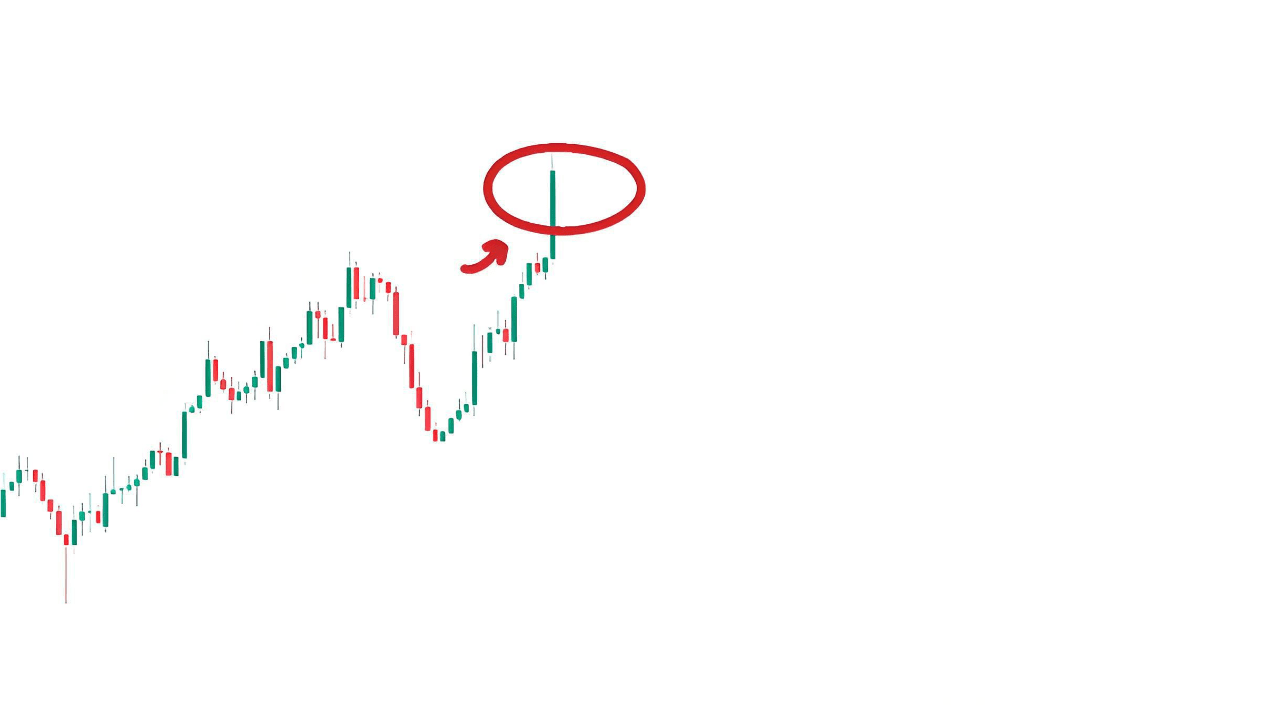

Next, wait for the entry signal, which must confirm the validity of the key price level. What I often use is candlestick patterns; for example, in this case: the price formed a bullish engulfing pattern at the key price level, with the bullish candlestick completely covering the previous bearish candlestick, indicating strong bullish momentum. It is very prudent to enter long at this time.

04 Can these two principles ensure stable profits? Just look at the stop-loss and take-profit levels to know.

Using the 'trend-following + key price level' strategy for entry will significantly enhance both win rates and risk-reward ratios. The core reason lies in the settings of stop-loss and take-profit:

1. Stop-loss setting: We enter based on key price levels, so the stop-loss is set below the key price level.

Because the entry point is very close to the key price level, the stop-loss distance is very short, and the loss ratio is minimized. In contrast, entering at any price level has a much longer stop-loss distance, which directly lowers the risk-reward ratio.

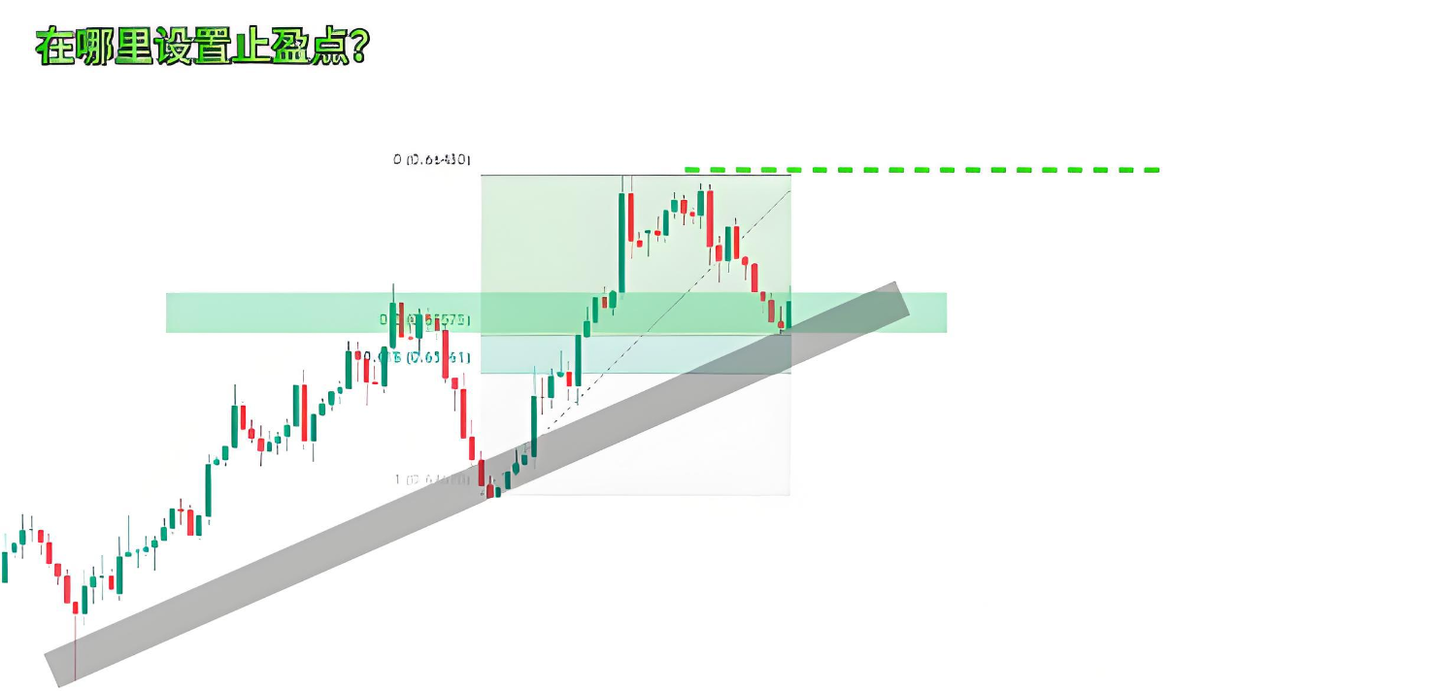

2. Take-profit setting: If it is a countertrend trade, the take-profit can only be set near previous highs/lows, and it must be a quick take-profit to avoid being stopped out by trend reversals;

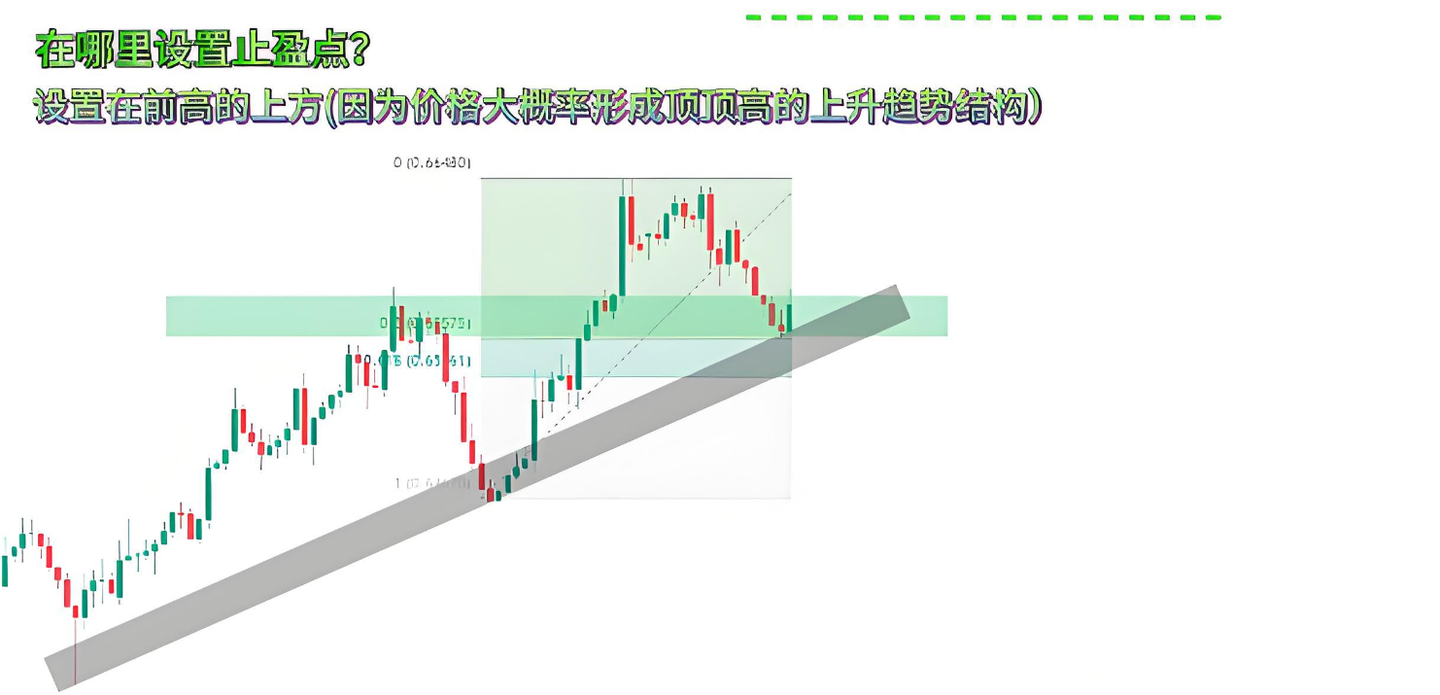

However, trading with the trend is different. For example, in an uptrend, we know that the price will form a 'higher high' structure, and the take-profit can be set above the previous high resistance level. Even if the take-profit point is set high, the win rate is still very high because the trend will push the price in the direction of profit.

You see, these two principles actually help us achieve 'loss less, win more'—minimizing losses and maximizing profits, establishing a considerable risk-reward ratio, and by persisting over the long term, you will naturally become a stable profitable trader.

Final summary

Be sure to avoid entering at random or arbitrary price levels, and keep away from key price levels to avoid low-quality trades. When establishing trading strategies and plans, two core principles must be followed:

1. Always trade with the trend;

2. Always enter trades near key price levels.

Remember these two points, and your trading win rate and risk-reward ratio will directly improve, bidding farewell to the vicious cycle of continuous losses.

This is the trading experience shared by Yan An today. Many times, you lose many profitable opportunities due to your doubts. If you do not dare to try boldly, to engage, to understand, how can you know the pros and cons? You only know how to take the next step after you have taken the first step. A cup of warm tea, a word of advice, I am both a teacher and a friend who loves to chat.

Meeting is fate, knowing is separation. I firmly believe that those destined to meet will eventually know each other, and those who miss each other are destined by heaven. The journey of investment is long, and the gains and losses of the moment are just the tip of the iceberg. One must know that even the wisest will have losses, and even the foolish will have gains; regardless of emotions, time will not stand still for you. Pick up your worries and stand up to move forward again.

The martial arts secrets have been given to you; whether you can become famous in the world depends on yourself.

These methods must be saved by everyone. If you find them useful, feel free to share them with more people around you who are trading cryptocurrencies. Follow me for more valuable insights into the cryptocurrency market. After being through the rain, I am willing to be an umbrella for you! Follow me, and let's walk the path of cryptocurrency together!