When the most powerful and low-key community venture capital in Asia—Onebit Ventures—suddenly announces their entry into CodexField, what does this mean? Those who understand, understand—this could be the next big opportunity coming. 🎯 Who is Onebit? Why are they worth paying attention to? Let's put it this way, in the circle, Onebit doesn't hold press conferences like some institutions, but when they take action, it often heralds the next market trend. Their investment logic is extremely sharp: ✅ Only invest in projects that can truly grow ✅ Must have community pull ✅ Early nodes must have 10–20 times explosive potential. Let's look at their previous track record:

- QORPO WORLD: GameFi cycle crazily achieving 16 times growth, directly landing on the track's windfall after investment.

- SuiGlobal: Early layout before L1 ecological explosion, steadily achieving 5-10 times returns.

- Elixir: Heavily invested in the seed round, subsequently attracting top global venture capital to follow up, continuously releasing potential.

🚀 Why is Onebit always under scrutiny? Three core points are enough to be fatal.

1. Exceptional Vision: Not chasing trends but digging for fundamentals, specifically selecting long-term projects with technology that can be implemented and withstand market fluctuations, avoiding short-term speculation traps.

2. Community resource dominance: Holding the core traffic network of Web3 in Asia + the Middle East, linking top ecosystems like Sui and TON, and relying on a matrix of over 100 KOLs to push projects from 0 to 100,000 users.

3. Post-investment full-chain support: Not just providing funds, but also handling token listings, global marketing, ecological connections, directly assisting projects in launching exponential expansion.

✨ Core signals for entering CodexField (those who understand layout early)

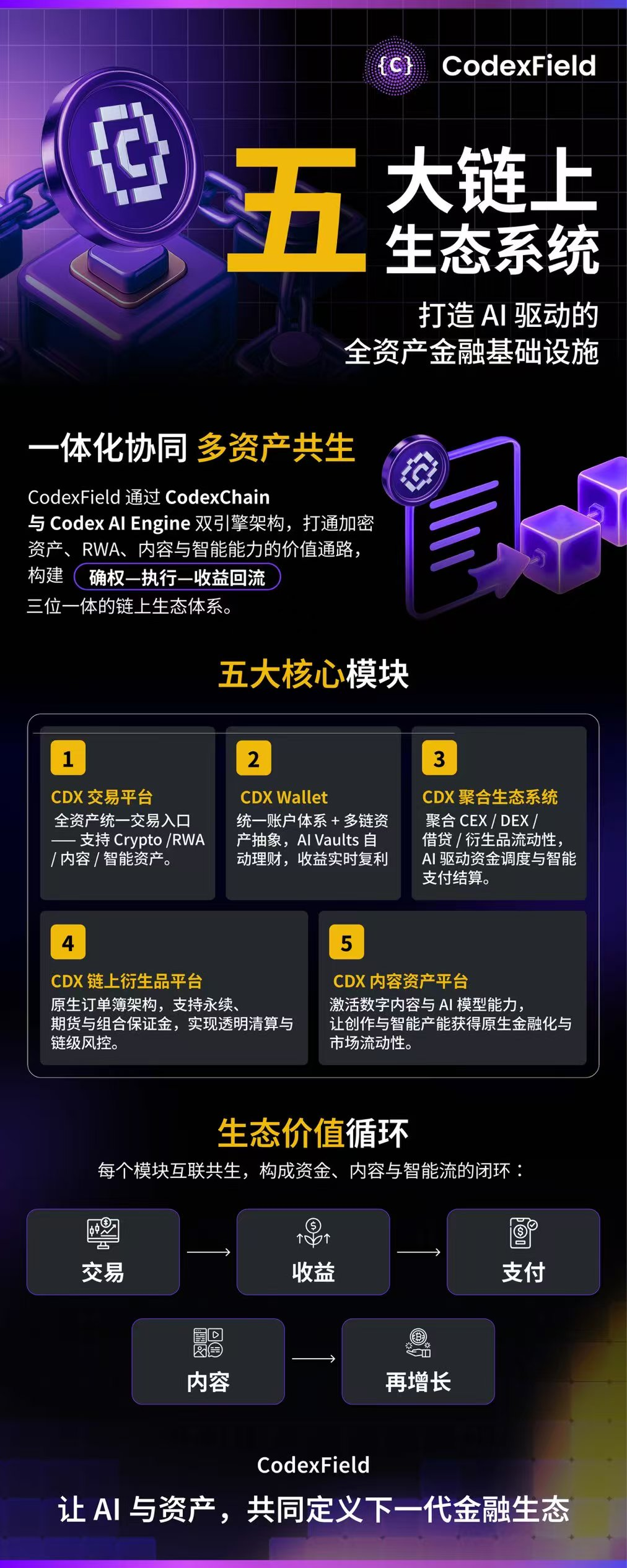

Essentially, institutions are using real capital to set the tone: CodexField is hitting the new cycle of AI + multi-chain finance, serving as a full-stack on-chain infrastructure, possessing early-stage characteristics and compound growth potential, likely to be the next explosive point in the infrastructure track, worth closely monitoring for both ecological value and investment opportunities.