Every time a liquidation occurs, no retail investor can be considered innocent. All the embarrassing defeats are the result of your own luck causing trouble and greed spreading, step by step dragging yourself into an irretrievable quagmire.

Always stumbling in the chaos of chasing highs and selling lows, always collapsing and crying in the deep night of losses breaking defenses, always holding onto the gambler's obsession of going all in with a full position, yet never willing to stop and reflect on the foolishness and absurdity of the past. Once you chase, you get trapped; once you get trapped, you become numb. From the initial frantic, reckless operations to later numbness and indifference, to finally absurdly thinking that there is no difference between taking proactive losses and being passively liquidated, completely giving up resistance and allowing the market to crush the hard-earned principal into dust.

The more you lose, the more agitated you become, and the more agitated you are, the more you lose your rationality. You always feel that making small profits with light positions is trivial and cannot fill the holes from previous losses, so you completely lose the last bit of clarity, treating the trading arena like a gambling table, clinging to the foolish notion of 'going all-in for a shot, win to turn around, lose to go back to zero,' diving headfirst into an abyss. You can't even comprehend the core principle of profits and losses being intertwined; behind the huge profits always lies a corresponding risk that can lead to your financial ruin. From the moment your rationality is swallowed by a gambler's mentality, this game has long been destined for complete failure, but you refuse to acknowledge it.

Isn't it true that many people are cursing under their breath? Recently, there has been a clear downward trend, so why are we still losing money even when shorting? Don't blame external factors; the answer lies in your impulsive decisions made in the heat of the moment.

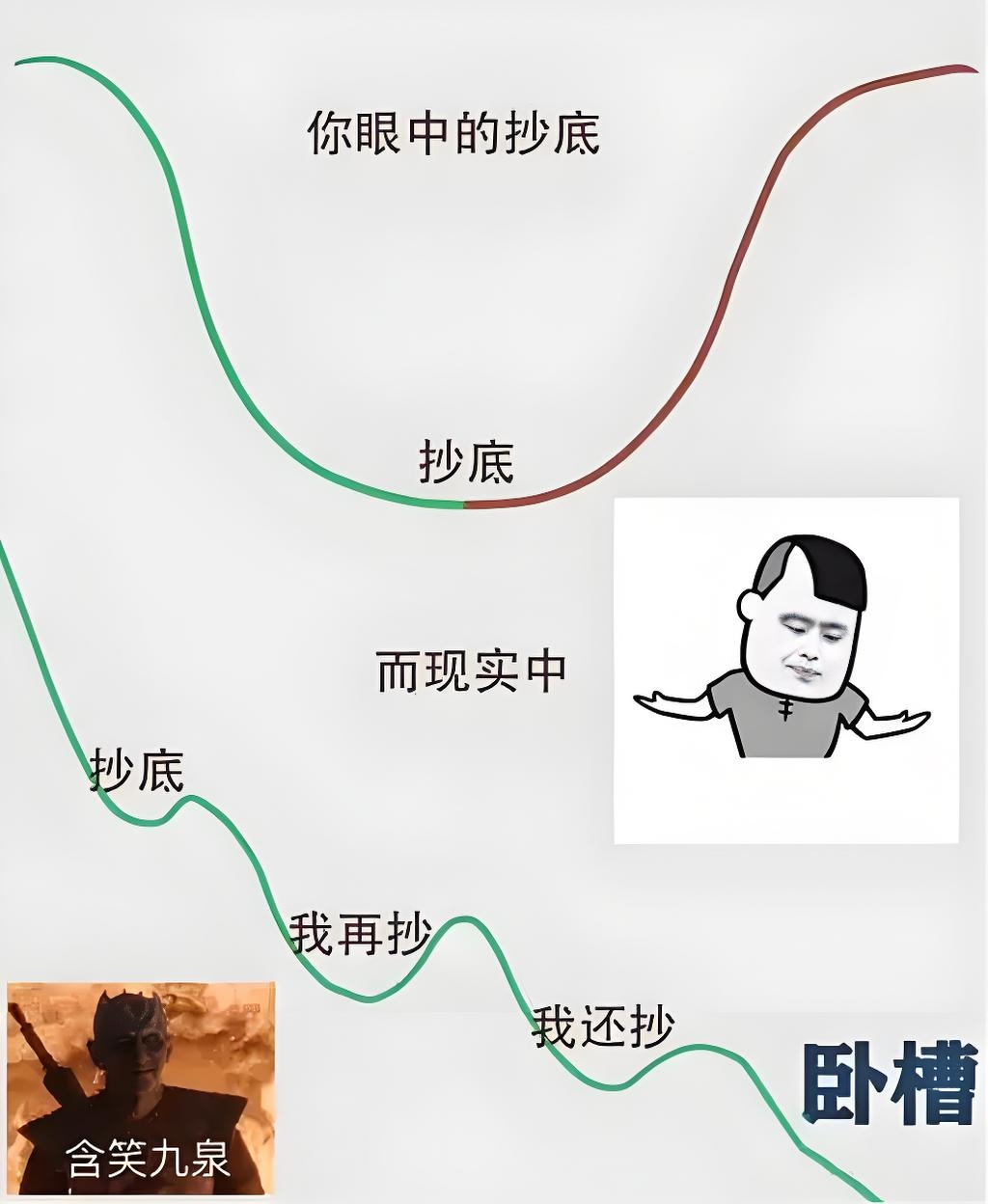

In the early stages of a decline, watching the market weaken under pressure, you slap your thigh in regret, thinking, 'Why didn’t I get in earlier?' As the losses continue to expand, greed and anxiety cloud your judgment, fearing that you might miss out on this so-called 'money-making opportunity,' you rush to short the market. But destiny has a way of playing tricks on the greedy; often, as soon as you enter, you land precisely on a support level, and the market instantly rebounds, rubbing your face in the dirt. After being trapped, you are unwilling to accept your losses, impulsively adding to your shorts against the trend, piling on more positions until they become heavy. In the end, you can only watch as your margin is depleted, forced to liquidate by the system, returning to square one overnight, without even a chance to turn things around.

There are even more foolish individuals who short the market with their entire position, as if not betting all their capital would be an insult to the downward trend. However, the recent market has been fluctuating, with constant tug-of-war between bulls and bears, daily rebounds occurring, providing ample opportunities for short positions. Shorting too early is not really terrifying; as long as your position is reasonable and your mindset is stable, you can either wait for the right moment to add to your position to lower your average price or endure short-term losses while waiting for the trend to continue. There will always be a chance to exit profitably, but you insist on clinging to the belief of going all-in, and what happens? Your mindset collapses completely, the liquidation line is within reach, and even a slight rebound forces you to stop-loss, causing you to suffer significant losses; but after you grit your teeth and cut your losses, the market declines again, and you start slapping your thigh in regret, thinking, 'If only I had held on in the beginning.'

Thus, you repeatedly engage in internal conflict between regret and impulse, losing more and becoming increasingly anxious, becoming more incorrect and losing even more, trapped in an unsolvable cycle. Watching your capital gradually being eaten away, from initial anticipation to complete despair, you can do nothing but silently cry and curse under your breath. Don't blame the market for being harsh, don't blame the market for being unfair; we must learn to abandon greed, change our lucky mindset, learn to reflect, control risks, and align knowledge with action. It is better to do nothing than to make mistakes.