This Friday, the last day of October, closes the month. Once this month line appears, does it feel a bit cold at a high place, with a chilling sensation all over?

There are only two months left in 25 years, and the probability of 126,200 forming the top of this bull market is getting higher. Assuming that 126,200 is the top of this bull market, then Bitcoin will enter a bear market for a period of time.

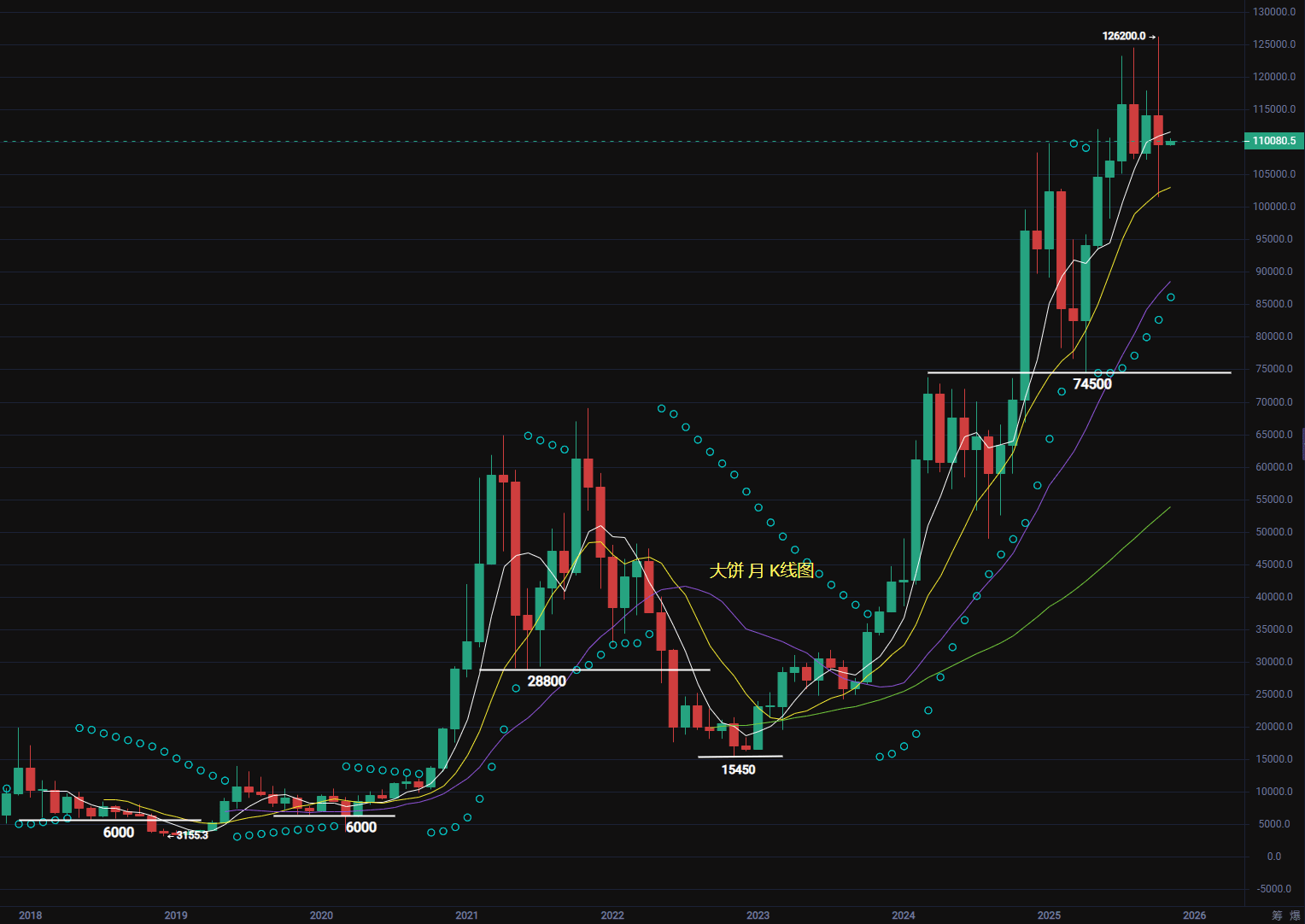

We observe the regularity from the trend of the Bitcoin monthly K-line. First, from the perspective of the time cycle, after the peak of Bitcoin in December 2017, Bitcoin maintained a bear market for 13 months before hitting the bottom, and the market did not start to explore the bottom until February 19. In the first half of 2019, a small bull market emerged and peaked in June of the same year, after which the market entered a 9-month bear market until it bottomed out on March 12-13, 2020. The small bull market cycle of Bitcoin in 2019 lasted only 5 months, and it did not create a new high, which can only be seen as the market's second impact on the high point of the 2017 bull market being blocked, and overall it still belongs to the prelude of the big bull market from 2020 to 2021.

During the 2020-2021 phase, the Bitcoin bull market peaked in November 2021 and entered a bear market, bottoming out in November 2022. After the peak in 2021, Bitcoin experienced a 12-month bear market before hitting the bottom. Following this pattern, the bear market after the big bull market could last up to a year.

Looking again at the month when Bitcoin reached its peak in the big bull market, it is quite regular (assuming 126,200 in October is the peak of this bull market). The bull market in 2017 peaked in December, 2021 peaked in November, and 2025 peaked in October. The time cycle between peaks is 3 years and 11 months. If this pattern holds, the next peak in the Bitcoin bull market will likely be around September 2029.

If 126,200 in October 2025 is the peak of this bull market, then from a timing perspective, the bottom of this bear market will be around November 2026 +/- 1 month.

Looking again at the price ranges where the last two Bitcoin bear markets bottomed out is also quite interesting; both occurred after breaking long-term key support levels, with prices dropping almost by half to find a bottom. At the end of 2018, Bitcoin fell below the 9-month platform of 6,000 and nearly halved to find a bottom. In 2022, it fell below the one-year support level of 28,800 and nearly halved to find a bottom. Following this pattern, the next Bitcoin bear market bottom should be below 74,500, dropping nearly by half to find a bottom. With institutional participation in this bull market, perhaps the market bear will not drop nearly by half to the 38,000--40,000 range like the previous two bear markets after breaking long-term support levels. But at least it should wait until the long-term support level of 74,500 is broken before entering to buy the dip.

Looking again at the bottoms of the bear markets in 2018 and 2022, they occurred two to three months after breaking long-term key support levels, with the market already approaching long-term relative bottom price ranges.

In summary, the next long-term bottoming time for Bitcoin in the upcoming bull market is around October 2026, or two to three months after breaking the long-term support level of 74,500. Bitcoin will have already entered a relative bottom range in the bear market. At this time, the cost-effectiveness of long-term buying Bitcoin will be very high. For long-term traders who only hold long positions, starting from now, returning to the market in a year can yield relatively cheap chips while waiting for the next bull market to rise.