Ondo Finance has expanded its Ondo Global Markets platform to BNB Chain, enabling non-US investors to access tokenized US equities around the clock using blockchain-based settlement and custody. The move follows the project’s strong debut on Ethereum in September, where it quickly amassed $350 million in total value and processed over $669 million in on-chain trading volume.

Launched as a bridge between traditional markets and decentralized finance, Ondo Global Markets currently offers over 100 tokenized US stocks and ETFs directly on-chain.

“BNB Chain is home to one of the largest and most engaged global user bases in Web3. Expanding Ondo Global Markets to BNB Chain allows us to bring tokenized US stocks and ETFs to millions of users across Asia, Latin America, and other geographies in an environment that is fast, cost-efficient, and highly interoperable,” said Nathan Allman, CEO of Ondo Finance.

Ondo finance price declines 1.74% to $0.74 on Wednesday, Oct. 29 | Source: Coinmarketcap

The ONDO token ONDO $0.74 24h volatility: 3.2% Market cap: $2.35 B Vol. 24h: $120.34 M , which serves as the governance and utility token for the ecosystem, trades at $0.74, down 1.7% intraday, pinned down by broader market caution ahead of the US Federal Reserve’s rate decision on Wednesday.

Ondo Finance Strengthens RWA Ecosystem With Institutional Partnerships

Ondo finance collaboration with BNB Chain follows a string of major institutional partnerships and acquisitions in 2025. Earlier this year, Ondo partnered with Trump-backed World Liberty Financial (WLFI) to advance the adoption of tokenized RWAs, exploring the use of Ondo’s tokenized assets as treasury reserves within the WLFI network.

In July, Ondo also acquired the US-regulated broker Oasis Pro and blockchain developer Strangelove, respectively, to boost compliance and infrastructure capabilities.

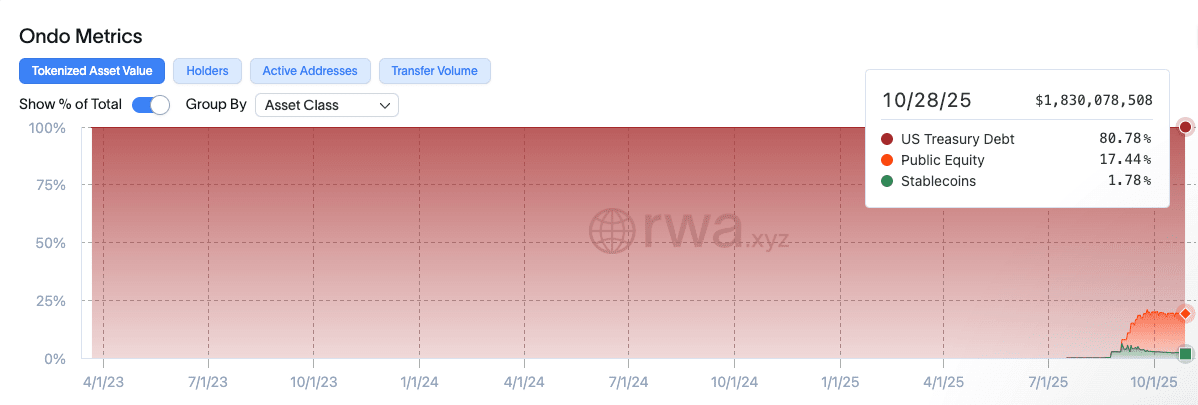

Ondo Finance Total tokenized asset hits $1.83 billion, Oct. 29, 2025 | RWA.XYZ

According to RWA.xyz, Ondo Finance’s total tokenized assets have now reached $1.83 billion, up 4% in the last 30 days. US Treasuries dominate the portfolio with 80.78%, followed by public equities (17.44%) and stablecoins (1.78%).

With a $2.3 billion market capitalization, Ondo’s network value remains closely tied to its rapidly growing tokenization ecosystem. The BNB Chain integration is expected to further enhance liquidity and visibility.

next

The post Ondo Finance Expands $1.8B Tokenization Market to BNB Chain appeared first on Coinspeaker.