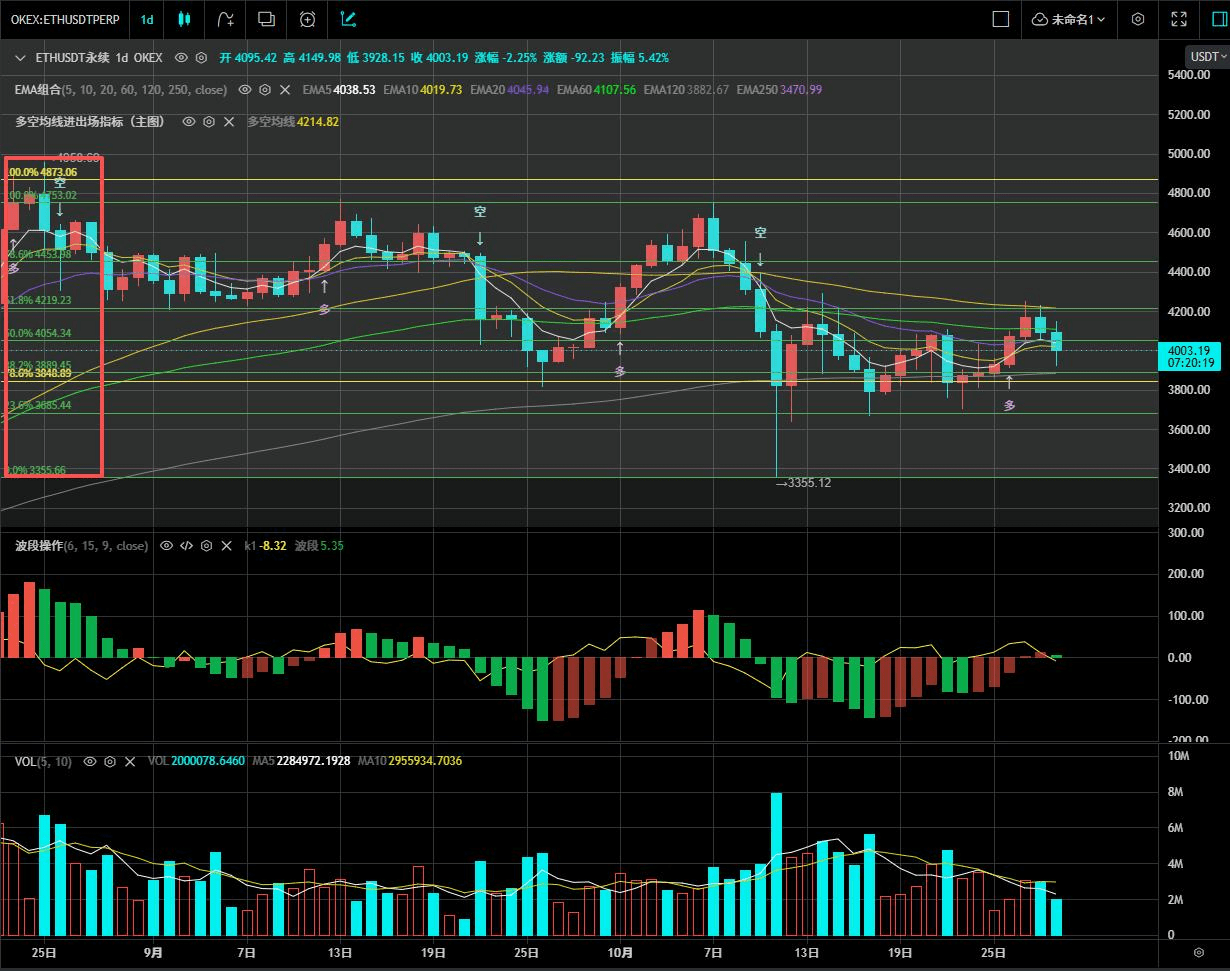

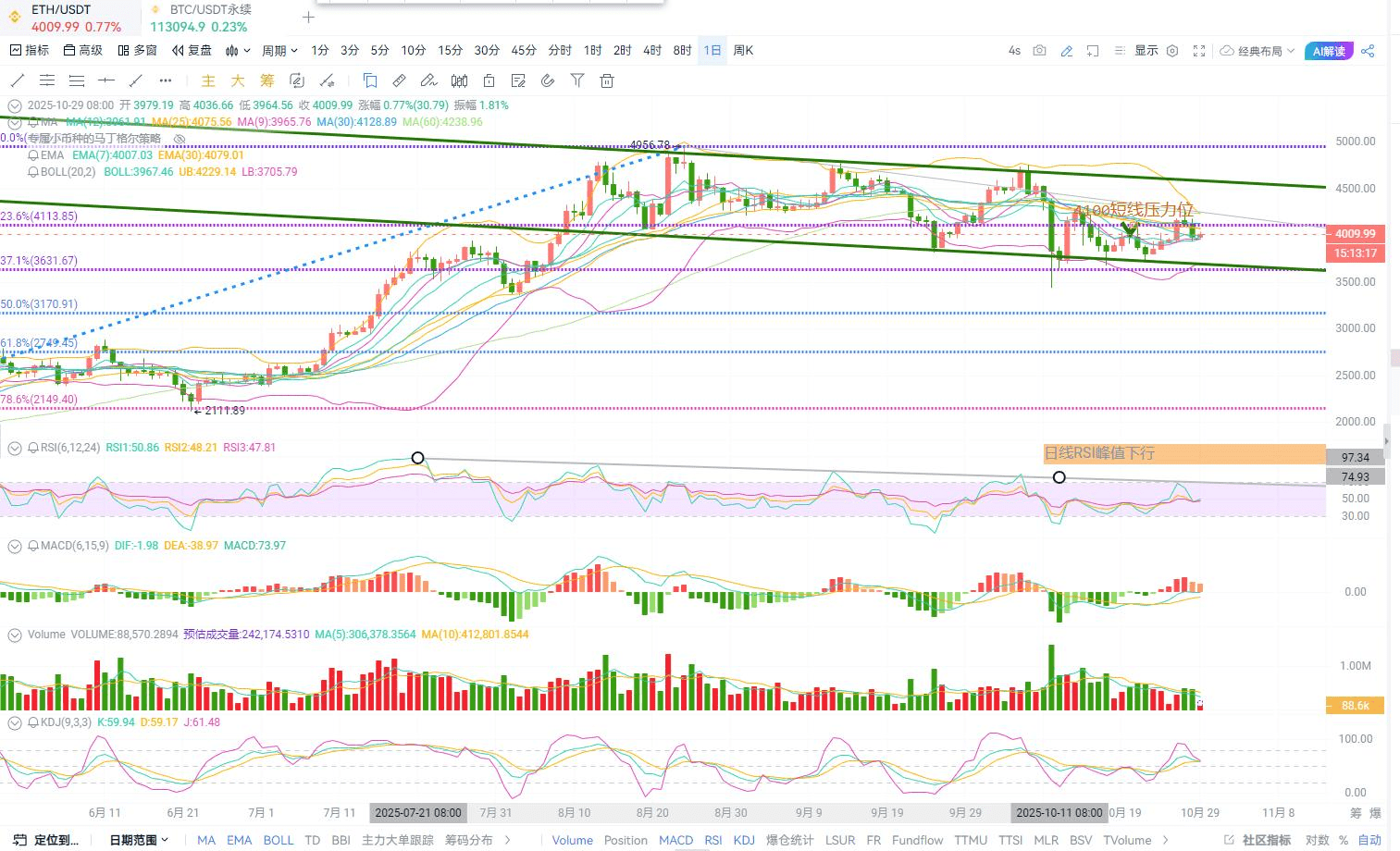

$ETH #加密市场回调 #美联储降息预期 #巨鲸动向 #以太坊ETF #币安 The daily ETH price is within a downward green channel. Recently, a bearish engulfing pattern has appeared, with the price approaching a strong resistance level of 4056.79, facing a risk of correction in the short term. The MACD moving average system shows a tangled state, and both short-term and long-term moving averages are flattening. Market sentiment and volatility indicators (BOLL and RSI) show balanced sentiment and normal volatility, but trading volume is insufficient.

Implement a high short strategy near the resistance level, bearish in the 4030 range, targeting the 3700 position, which is a reasonable choice in line with the consolidation pattern. Scenario for strategy failure: If the price breaks through 4100 and continues upward, it indicates that the resistance level has failed, and timely loss-cutting is necessary.

Implement a high short strategy near the resistance level, bearish in the 4030 range, targeting the 3700 position, which is a reasonable choice in line with the consolidation pattern. Scenario for strategy failure: If the price breaks through 4100 and continues upward, it indicates that the resistance level has failed, and timely loss-cutting is necessary.

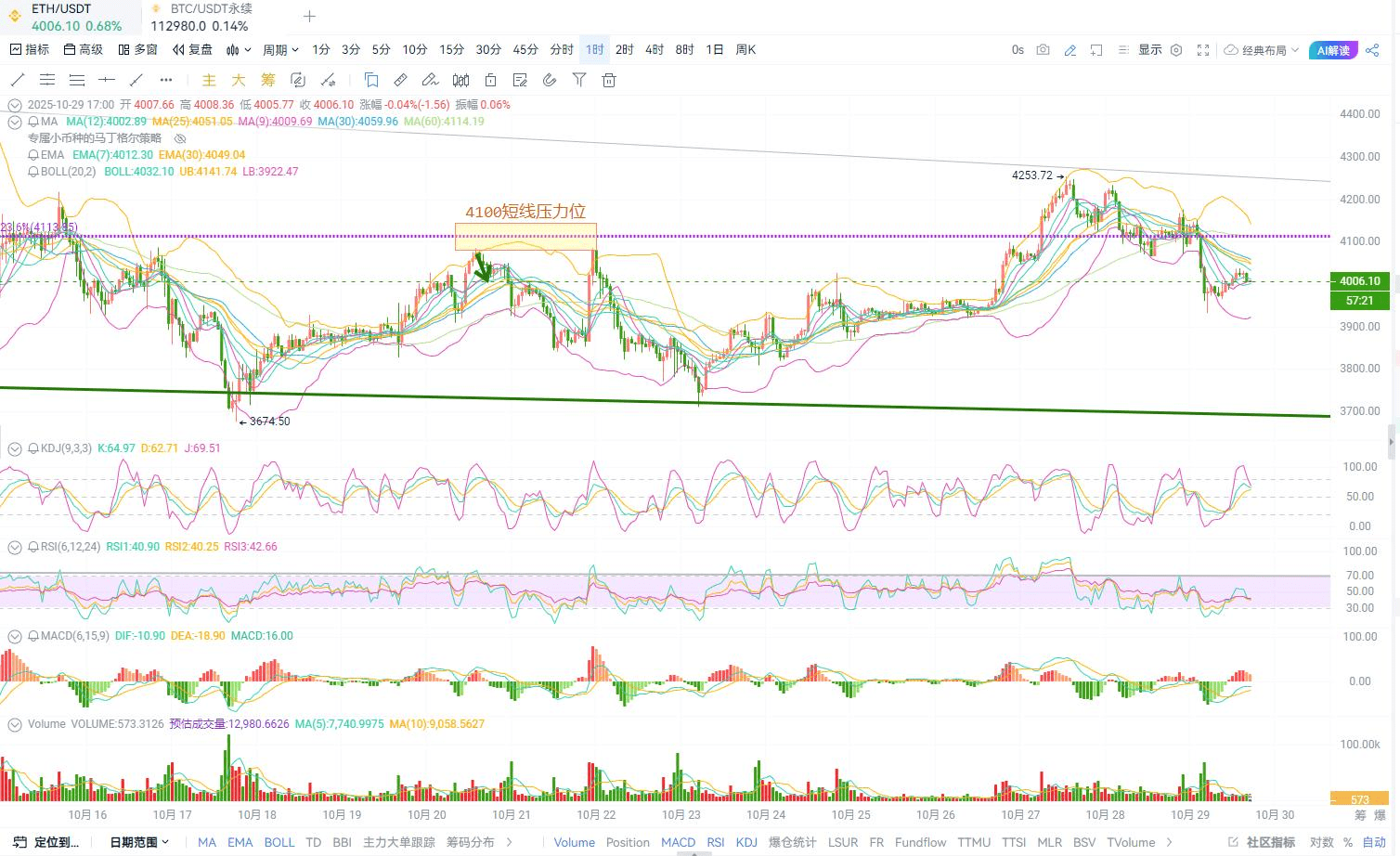

The hourly candlestick is approaching the strong resistance level of 4100, and has formed a bullish engulfing pattern, but the momentum and trading volume are insufficient. The market is still in a consolidation phase, with the moving average system entangled and the slope gentle. There is a lack of momentum, and trading volume and VWAP data are missing. It is advisable to remain in cash and observe, with a bearish outlook as a supplement; it is not suitable to be overly optimistic about bottom fishing too early.

The hourly candlestick is approaching the strong resistance level of 4100, and has formed a bullish engulfing pattern, but the momentum and trading volume are insufficient. The market is still in a consolidation phase, with the moving average system entangled and the slope gentle. There is a lack of momentum, and trading volume and VWAP data are missing. It is advisable to remain in cash and observe, with a bearish outlook as a supplement; it is not suitable to be overly optimistic about bottom fishing too early.