The U.S. government shutdown has become a periodic phenomenon in American political life, but its impact on the economy, financial markets, and the emerging cryptocurrency sector varies each time. This article will systematically review the effects of previous government shutdowns on various financial assets from a historical perspective, deeply analyze the underlying reasons for the prolonged shutdown that began in October 2025, predict potential resolution timelines, and particularly focus on the unique impacts of this shutdown on the cryptocurrency market, such as Bitcoin, providing investors with a comprehensive framework to understand the current situation.

1 Comprehensive impact of past U.S. government shutdowns on financial markets

U.S. government shutdowns are not new; over the past 50 years, there have been more than 20 instances. Although the specific triggers and political backgrounds of each shutdown vary, there are some discernible patterns regarding their impact on financial markets. Historically, the duration of a shutdown is the key factor determining the depth of its impact. Short shutdowns (resolved within a few days) are often overlooked by the market, while prolonged shutdowns (lasting over 10 days) have a more significant impact on market sentiment and asset prices. Historical data shows that prolonged shutdowns have primarily occurred five times: in 2018 (35 days), 2013 (16 days), 1995 (21 days), 1978 (17 days), and 1977 (series of shutdowns, averaging 9 days each).

1.1 Impact on the stock market

•

Short-term volatility and long-term resilience: History shows that government shutdowns typically only cause short-term emotional impacts on the stock market without altering its long-term trajectory. Research from Fidelity Investments indicates that following a shutdown, there is an 80% probability that returns will exceed the average level within the next 12 months. This suggests that from an investment perspective, government shutdowns may actually present buying opportunities for investors.

•

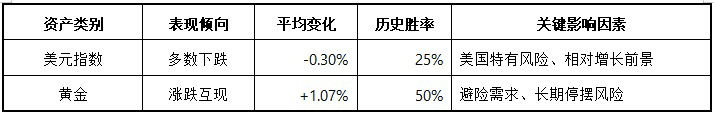

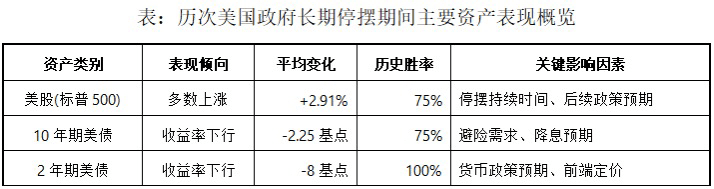

Specific performance analysis: According to Shenwan Hongyuan Securities' research, during past government shutdowns, the S&P 500 index mostly rose, with a win rate of 75% and an average increase of 2.91%. Performance varied across different shutdowns: during the 2018 shutdown, the increase reached 8%, while the 2013 shutdown saw an increase of 2.45%, and the 1995 shutdown had an increase of 1.2%. This indicates that the stock market has shown remarkable resilience in the face of political uncertainty, particularly at the onset of a shutdown, when the market often expects a quick resolution.

•

1.2 Reaction of the bond market

The impact of the U.S. government shutdown on the bond market is more consistent, primarily presenting the following characteristics:

•

Demand for safe-haven assets: The uncertainty triggered by the government shutdown typically drives investors toward safe-haven assets like U.S. Treasury bonds, thereby pushing up bond prices and lowering yields. Historical data shows that during government shutdowns, the 10-year U.S. Treasury yield has a win rate of 75%, with an average decline of 2.25 basis points; the performance of the 2-year U.S. Treasury is even more pronounced, with a 100% win rate and an average decline of 8 basis points.

•

Federal Reserve policy considerations: The shutdown may lead to delays in the release of key economic data (such as non-farm payroll reports and CPI data), complicating the Federal Reserve's policy decisions. During the 2013 shutdown, most economic data for October was delayed by several weeks, with the non-farm payroll report originally scheduled for October 4 delayed until October 22. This data vacuum may lead the Federal Reserve to adopt a more cautious monetary policy stance.

•

1.3 Performance of the dollar and gold

As a traditional safe-haven asset, the performance of the dollar and gold during government shutdowns shows an interesting divergence:

•

Dollar performance: Surprisingly, during past government shutdowns, the dollar index has only a 25% win rate, with an average decline of 0.30%. This indicates that government shutdowns, as a unique form of political uncertainty in the U.S., tend to suppress the dollar's performance, although declines are usually moderate.

•

Gold performance: Gold's performance during the shutdown has been unstable, with a win rate of only 50%, but an average increase of 1.07%. In long-term shutdown events (such as those in 1995 and 2018), gold's increase has been more pronounced. During the 2025 shutdown, gold prices even broke through $4000 per ounce, setting a new historical high, demonstrating gold's ultimate safe-haven property under extreme political uncertainty.

•

Table: Overview of major asset performances during various U.S. government long-term shutdowns

1.4 Insights from historical experience

Several important conclusions can be drawn from historical experience: First, short shutdowns (within a week) typically do not have a lasting impact on financial markets; second, prolonged shutdowns (lasting more than two weeks) lead to increased market volatility, but the extent of the impact depends on the breadth of the shutdown; finally, political polarization itself has long-term negative effects on the economy. Research by Richmond Fed economist Marina Azzimonti found that increased political polarization results in a significant reduction in corporate investment, and this reduction does not quickly reverse. Her research shows that 27% of the decline in U.S. corporate investment between 2007 and 2009 can be attributed to heightened partisan conflict.

2 Unique causes and time outlook of the 2025 U.S. government shutdown

The current U.S. federal government shutdown began on October 1, 2025, and has lasted two weeks as of October 15, with no signs of ending. House Speaker Mike Johnson even warned that this shutdown's duration may become "the longest in history." Understanding the uniqueness of this shutdown requires an in-depth analysis of the political dynamics, policy differences, and strategic considerations behind it.

2.1 Intensified political polarization and strategic shifts

The extreme polarization of the U.S. political landscape is the fundamental reason for the prolonged duration of this shutdown. Wang Youxin, director of the Bank of China Research Institute, pointed out that the ongoing deadlock between the two parties over temporary funding bills is essentially a "result of the resonance of value conflicts, power struggles, and institutional deficiencies." This polarization is reflected not only in policy disagreements but also in the strategic thinking of both sides regarding the shutdown.

•

Trump administration's unconventional strategy: Unlike past shutdowns, the Trump administration appears willing to endure a prolonged shutdown this time, even threatening to use the shutdown to identify "non-essential" workers and potentially terminate them permanently. Vice President Vance clearly stated that the longer the federal government shutdown lasts, the greater the layoffs of federal employees will be. This position breaks the past political consensus—that shutdowns are reversible temporary measures, and once the deadlock is resolved, government operations return to normal.

•

The Democrats' firm stance: The Democrats believe their efforts to retain healthcare subsidies are supported by the public. They had already compromised during the last budget showdown in March, which upset the leftist radicals, so many Democrats are eager to fight a bigger battle this time.

•

2.2 The core role of healthcare policy differences

The direct trigger for this shutdown is the sharp opposition between the two parties regarding healthcare subsidies. Specifically, the Democrats insist on extending the soon-to-expire Enhanced Premium Tax Credit under the Affordable Care Act, which is set to expire at the end of 2025. At the same time, they are also demanding the reversal of Trump's cuts to the Medicaid program. The Republicans accuse the Democrats of forcing a bundling of issues, believing that the Democrats should be held responsible for the government shutdown.

The difficulty in reconciling this divergence lies in its relation to the core ideologies and voter bases of both parties. The Democrats view healthcare subsidies as a key benefit for low- and middle-income families, while Republicans oppose further expansions of government healthcare spending. Trump publicly told Republicans to "not bother dealing with them (the Democrats)," indicating the White House's unwillingness to compromise on this issue.

2.3 The controversial use of budget negotiations and rescission authority

The Trump administration's use of rescission authority has also become a major obstacle in budget negotiations. In early 2025, Trump's Office of Management and Budget made significant cuts to federal funding, including reductions to foreign aid and public broadcasting. The Trump administration restored the rescission authority and submitted a rescission bill to Congress, which became law on July 24.

Senate Appropriations Committee senior member Patty Murray told The New York Times that this "partisan rescission bill" complicates the Democrats' and Republicans' efforts to collaborate on the next year's budget appropriations bill set to take effect in October. Democrats are concerned that any provisions they negotiate into the budget could be rescinded, making negotiations, already lacking in trust, even harder to advance.

2.4 End time predictions and potential turning points

Regarding when this shutdown will end, the general consensus is that the likelihood of resolution before the end of October is low. Prediction market platforms Polymarket and Kalshi show that the probability of the shutdown lasting until the end of October has risen to around 70%. This indicates the market generally expects the shutdown to last at least throughout October.

Possible resolution timeframes include:

•

Early November: If the shutdown continues until the end of October, both sides may face greater public pressure and economic uncertainty, which may prompt a compromise. However, given the strategic considerations of the Trump administration, the likelihood of a simple return to the status quo temporary agreement is low.

•

January next year: The Trump administration and several fiscal hawks advocate maintaining government funding until January next year. If their strategy is implemented, the shutdown could last an entire quarter, becoming the true "longest" government shutdown in history.

•

Pain points or buffers that can drive both sides to a solution are increasingly hard to find. The issue of military payroll has been resolved through administrative means—Trump claimed on the Truth Social platform that he would work to ensure active-duty military personnel receive their pay. Adjustments have also been made to the release of key economic data—the Bureau of Labor Statistics announced it would release the September CPI report on October 24. The elimination of these pain points has effectively reduced the urgency of the shutdown, creating conditions for a prolonged deadlock.

3 Unique impacts of this prolonged shutdown on the cryptocurrency market

Compared to traditional financial markets, the cryptocurrency market has different response mechanisms and performance characteristics during government shutdowns. The prolonged shutdown in 2025 has revealed some unprecedented new phenomena. These changes reflect not only the maturation of the cryptocurrency market but also the evolution of investor structures and their response mechanisms to macro policy.

3.1 Economic data vacuum and amplified volatility in the cryptocurrency market

One direct consequence of this prolonged shutdown is the chaos surrounding the release of key economic data. Similar to the situation during the 2013 shutdown, at the start of this shutdown, all annual appropriations bills were not in effect, leading to widespread effects across all government agencies and functions. This means that data collection and release efforts from statistical agencies such as the Bureau of Labor Statistics and the Bureau of Economic Analysis are severely disrupted.

•

Data delays and market uncertainty: If the shutdown extends into next week or even longer, the ability to collect October data will become questionable. In some extreme scenarios, the Bureau of Labor Statistics and the Bureau of Economic Analysis may be forced to skip the October data release and directly restart the November data disclosure process. This "data vacuum" has had a unique impact on the cryptocurrency market:

•

Diminished correlation of traditional assets: In the absence of official economic data, the correlation between cryptocurrency prices and traditional asset classes may weaken, being driven more by intrinsic factors and cryptocurrency-specific news.

o

Increased focus on alternative data: Traders may rely more on ADP employment reports, real-time forecasting models, and other alternative data to assess economic conditions, increasing the risk of excessive market reactions to single data points.

o

Impact of Federal Reserve policy expectations: Prior to the government shutdown, the market anticipated that the Federal Open Market Committee (FOMC) would cut interest rates by 25 basis points at the October meeting. The ongoing shutdown has led the market to be increasingly convinced that the likelihood of another 25 basis points cut in the coming weeks is rising. This interest rate cut expectation has complex effects on cryptocurrencies like Bitcoin—on one hand, the expectation improves liquidity conditions for risk assets; on the other hand, the uncertainty brought about by the government shutdown suppresses risk appetite.

•

3.2 Re-examination of Bitcoin's safe-haven properties and historical performance comparisons

Historically, Bitcoin's performance during government shutdowns has been inconsistent, largely dependent on its own market cycle phase:

•

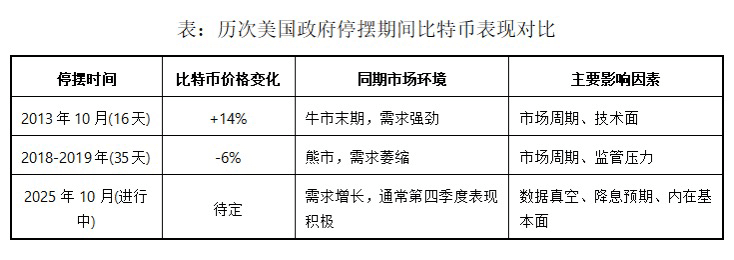

During the 2013 shutdown, Bitcoin's price rose by 14% from $132.04 to $151.34. At that time, Bitcoin was in the final stages of a bull market with strong demand growth.

•

During the 2018-2019 shutdown, Bitcoin's price dropped 6% from $3802.22 to $3575.85. By the time of the 2018 government shutdown, Bitcoin's demand was shrinking during a bear market.

•

Cryptoquant research director Julio Moreno noted that Bitcoin's situation today is more akin to 2013 than 2018. "As we enter the fourth quarter, demand for Bitcoin is increasing, which is typically a quarter with positive price performance." This historical performance difference indicates that Bitcoin's response to the government shutdown primarily depends on its own market cycle positioning rather than the shutdown itself.

3.3 New phenomena emerging during this shutdown

In the 2025 government shutdown, the cryptocurrency market exhibited some unprecedented characteristics:

•

Risk and safe-haven properties coexist: Traditionally, Bitcoin has been viewed as a safe-haven asset, akin to gold. However, during this shutdown, Bitcoin has simultaneously exhibited characteristics of both a risk asset and a safe-haven asset. On one hand, the government shutdown has exposed the fragility of the traditional financial system, increasing Bitcoin's appeal as an alternative store of value; on the other hand, the economic slowdown that may result from the shutdown has suppressed the overall performance of risk assets.

•

The dual impact of policy uncertainty: The unconventional response strategy of the Trump administration—including threats of permanent layoffs for federal employees and the use of rescission authority to cut budgets—has created unprecedented policy uncertainty. This uncertainty exposes cryptocurrency investors to two risks: one is the risk of stability in the traditional financial system, and the other is the risk of the regulatory outlook for cryptocurrencies. The latter is particularly important, as the government shutdown also affects the operations of regulatory agencies such as the U.S. Securities and Exchange Commission (SEC), potentially delaying the introduction of key regulatory policies for cryptocurrencies.

•

Dominance of technical and fundamental factors: Unlike previous shutdowns, the performance of the cryptocurrency market during this shutdown seems to be driven more by technical aspects and intrinsic fundamentals rather than a direct response to the political deadlock in Washington. Factors such as capital flows into Bitcoin ETFs, institutional adoption progress, and on-chain activity indicators may have a greater impact on prices than the shutdown itself.

•

Table: Comparison of Bitcoin performance during various U.S. government shutdowns

3.4 Long-term impact and changes in investor confidence

If this shutdown indeed becomes "the longest in history" as predicted by House Speaker Johnson, it could have some structural impacts on the cryptocurrency market:

•

The confidence in traditional finance is undermined: The longer the government shutdown lasts, the more it exposes the fragility of the traditional financial and political systems, which may lead more investors to seek alternative financial systems, including cryptocurrencies and decentralized finance (DeFi) protocols.

•

Generational differences in demand for safe-haven assets: Younger investors may not see gold as the only safe-haven asset like the older generation, but instead include cryptocurrencies like Bitcoin in their safe-haven portfolio. This generational difference may become more pronounced in situations where prolonged shutdowns increase uncertainty in traditional finance.

•

Delays in regulatory developments: Government shutdowns can slow down the operations of many federal departments, including financial regulatory agencies, potentially delaying the formulation and implementation of cryptocurrency-related regulatory policies, creating a "regulatory pause" that could both reduce regulatory pressure and increase policy uncertainty.

•

4 Summary and outlook

Historically, U.S. government shutdowns have had limited long-term impacts on financial markets, but they can cause short-term volatility and changes in investor sentiment. However, the 2025 shutdown exhibits many characteristics that differ from previous instances: unprecedented political polarization, fundamental shifts in strategic considerations from both sides, and a shutdown duration that may set records. These new characteristics render the impact of this shutdown on various assets, particularly the cryptocurrency market, exceptionally complex.

For investors, the following principles should be maintained during a government shutdown: keep a long-term investment perspective and avoid overreacting to short-term political events; enhance asset diversification by considering the inclusion of alternative assets like cryptocurrencies into investment portfolios; closely monitor policy developments, especially signals indicating potential softening of positions from both parties. Although the current deadlock seems difficult to break, historical experience shows that government shutdowns ultimately conclude with some form of compromise; it’s just that the timing and conditions of this compromise are harder to predict than in the past.

For cryptocurrency investors, this shutdown presents a unique opportunity to observe the performance of digital assets under extreme political pressure. It not only tests the safe-haven properties of cryptocurrencies like Bitcoin but also reveals the increasingly complex interplay between them and the traditional financial system. Regardless of when this shutdown ends, it may become a significant milestone for cryptocurrencies to further integrate into mainstream financial perspectives.

\u003cc-281/\u003e