In trading, every step tells a story—sometimes of patience, sometimes of risk, and often of reward. The recent trade we executed reflects not only numbers on the screen but also the discipline, strategy, and trust that go into making consistent progress. Let’s break it down and reflect on what really happened in this position and what lessons we can take from it.

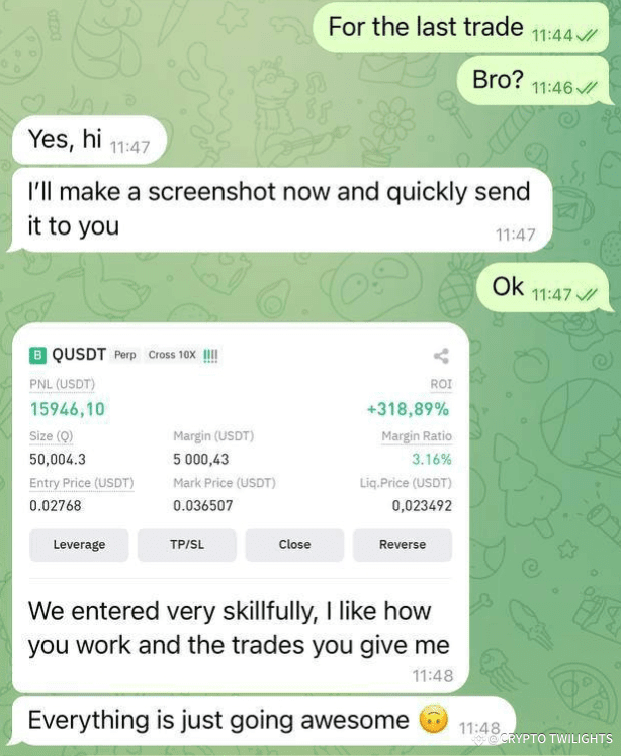

The screenshot speaks volumes: a profit of 15,946.10 USDT on a leveraged position with a return on investment of more than 318%. To some, this may look like just another lucky entry, but in reality, it is the result of careful planning and a calculated move. The entry price of 0.02768 and the current mark price of 0.036507 clearly show that the market was moving in our favor because of strong momentum, and we captured that wave at the right time.

One of the most critical parts of this trade was not just about “getting in” but about the timing of it. Entering too early in such setups often results in frustration as the market may consolidate or even drop before resuming its trend. Entering too late means you only catch the tail end of the move with limited profit potential. The entry here was precise—positioned where the probability of reversal was extremely low and the chance of continuation was high. That’s what made the difference.

Another highlight of this trade is the use of leverage (10x). Leverage is often misunderstood or misused by traders. Many see it as a shortcut to quick profits, but the same tool can wipe out accounts if not handled with discipline. What happened here was an example of leverage being applied carefully. The margin was set in such a way that the liquidation price remained at a safe distance from our entry, reducing unnecessary risk exposure. This shows that when leverage is managed correctly, it becomes a powerful tool to multiply gains without falling into reckless gambling.

But profits don’t only come from numbers—they come from psychology. The calmness to wait for the right setup, the courage to enter, and the patience to let the trade develop all play an essential role. Too often, traders panic when they see small pullbacks or when price doesn’t move immediately. In this case, patience paid off. The mark price rising from the entry confirmed the setup, and the ability to hold onto the trade allowed the profit to expand to impressive levels.

The chat exchange alongside the screenshot highlights another important element: trust and teamwork. Trading can feel like a lonely journey, but when there’s coordination, communication, and shared analysis, it becomes more structured. The message—“We entered very skillfully, I like how you work and the trades you give me”—is a reminder that trading is not just about personal gain but also about building confidence and reliability between traders. When strategies are shared transparently and signals are backed by real analysis, it creates a bond of trust that’s stronger than any number on the screen.

Now, let’s think deeper: what’s the real lesson behind such a successful trade?

Discipline matters more than excitement. Chasing random entries out of impatience rarely works. A disciplined trader waits, plans, and strikes only when the odds are clearly favorable.

Risk management is the silent hero. The liquidation price was kept at a safe margin, and the position size was carefully chosen. No matter how good the analysis, without proper risk control, the results would have been completely different.

Mindset drives outcomes. Entering with confidence, holding with patience, and exiting with clarity—this mindset separates winners from those who constantly struggle.

Trading is a journey of learning. Every win is not just about the money earned but about the experience gained. This trade reinforces that success is repeatable when strategies are applied consistently.

Looking at the final words—“Everything is just going awesome 😊”—we can sense the satisfaction that goes beyond the profit figure. It’s about the feeling of growth, the sense of moving forward, and the reassurance that the strategy works. These moments, when captured, become milestones in a trader’s journey.

But it’s equally important to remember that the market is dynamic. Today’s profit doesn’t guarantee tomorrow’s win. The same discipline, risk management, and patience must be applied again and again. Many traders fall into the trap of overconfidence after big wins, only to give back their profits in reckless trades. The challenge is not just to achieve success but to sustain it over the long run.

As we move forward, trades like this serve as both motivation and a reminder. Motivation, because they show what’s possible when we align with the market; and a reminder, because they highlight the responsibility we carry to maintain the same discipline in future trades.

The journey of trading is filled with ups and downs, but when every move is backed by strategy, skill, and patience, the results can be as rewarding as what we just witnessed. Profit is sweet, but the true reward lies in mastering the process and knowing that each decision is building a stronger foundation for the future.

In the end, trading is not just about numbers—it’s about growth, mindset, and discipline. And this trade is living proof that when all three align, the outcome can truly be “awesome.”