Means rate cuts are coming with 100% chance but will there be 1 or 2?

I researched all the historic data and found out what will happen

Here is whether we'll have two rate cuts and how it will affect crypto

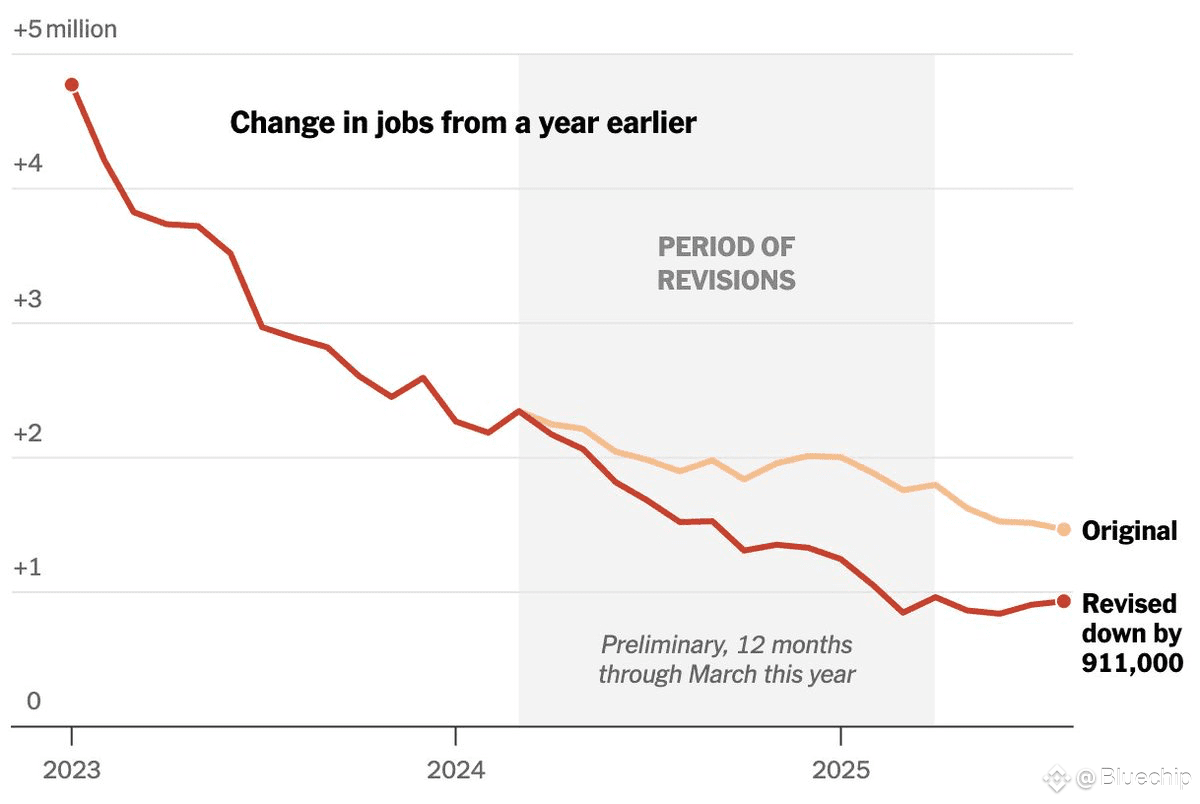

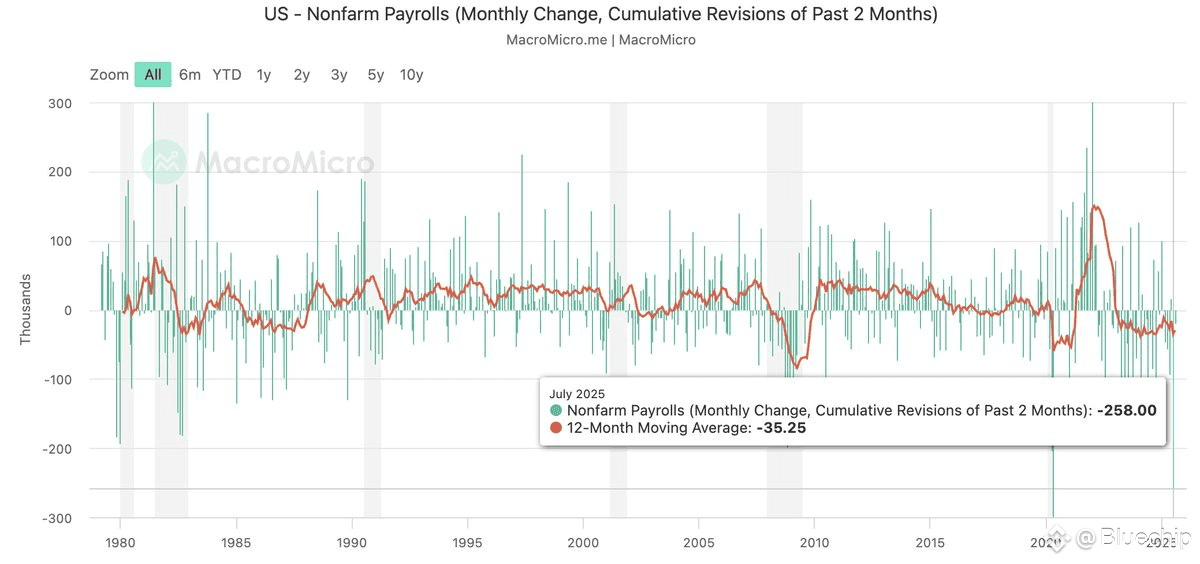

1/ The latest revisions just shattered the “strong labor market” narrative

The US quietly erased nearly a million jobs from the past year, showing the economy isn’t as resilient as advertised

That’s why cuts are now inevitable

Let's break down

2/ The Labor Department revised –911k jobs over the last 12 months

That’s the largest revision in history – bigger than the 2009 crisis

On average, job growth was overstated by ~76k per month

What looked like steady hiring was actually a much weaker trend

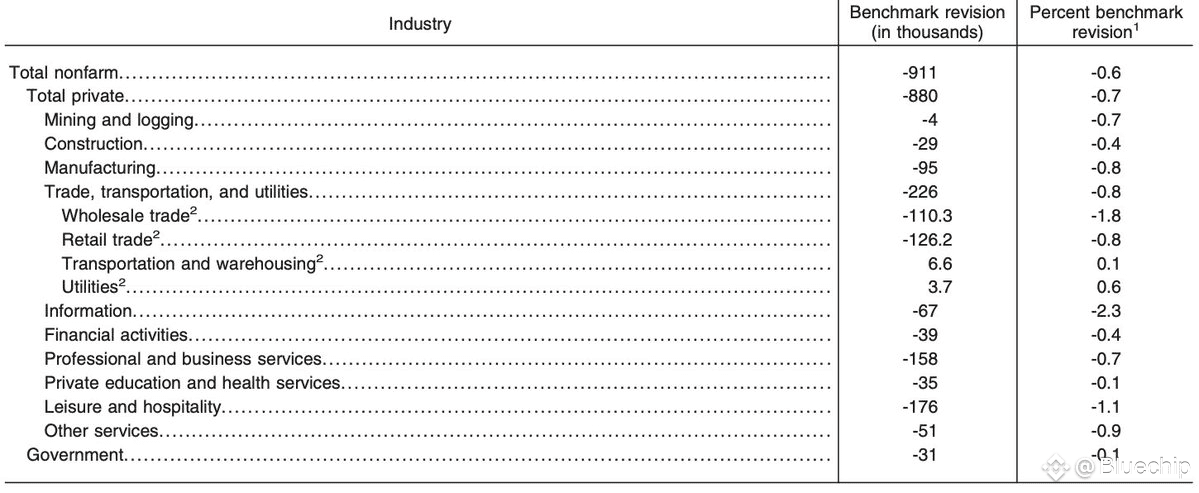

3/ The losses hit consumer-facing sectors hardest

- Leisure & hospitality shed –176k

- Trade/transport/utilities –226k

- Professional and business services –158k

These are the industries that drive everyday demand, and they were overstated the most

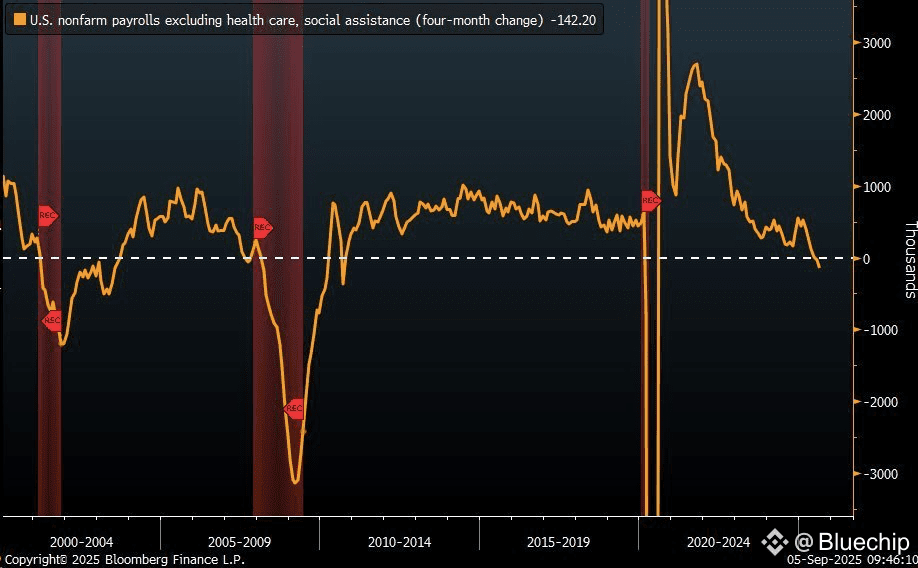

4/ Healthcare masked the weakness

Strip it out, and the US economy actually lost –142k jobs in the past four months

The labor market is being propped up almost entirely by health care

While most other sectors are already bleeding jobs

5/ For context, the 2009 revision was –802k jobs – today it’s –911k

That means the current adjustment is officially larger than the post-Lehman crisis

It’s a record-breaking downgrade that signals a far weaker job market than anyone thought

6/ Even recent months weren’t safe

May and June were revised down by –285k combined

This is the largest 2-month negative revision outside of the COVID crash

The idea of “strong, consistent” job gains was simply statistical noise

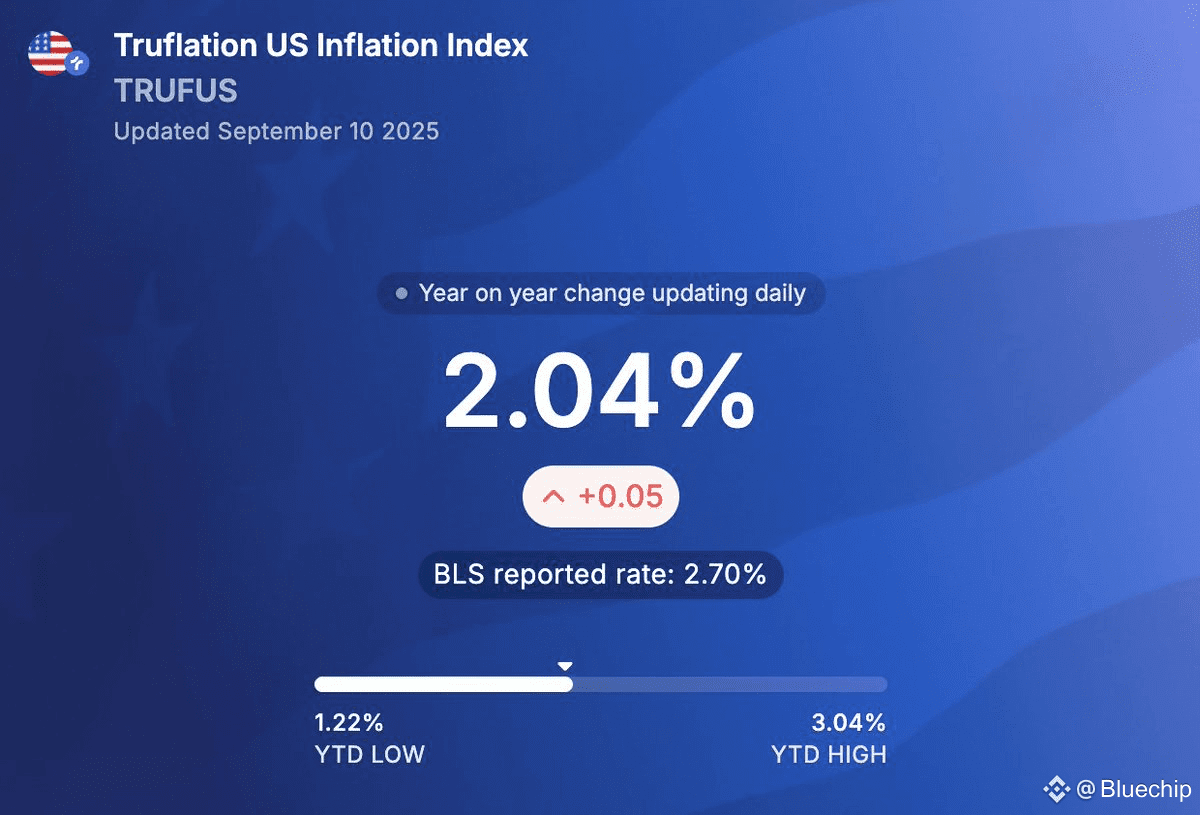

7/ These numbers leave the Fed with no choice

Its dual mandate is inflation and employment

Since 2021 the focus was almost entirely on inflation

Now employment is flashing red, forcing the Fed to pivot even while inflation remains above 2%

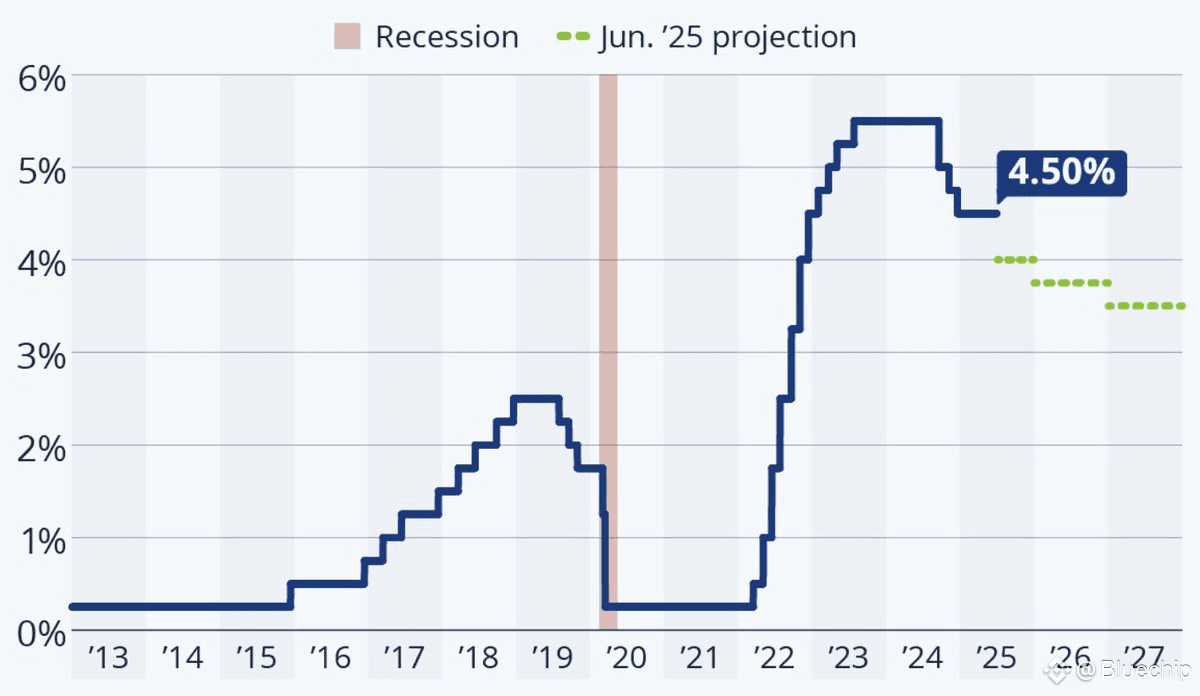

8/ Markets expect a 25 bps cut in September

This will be the first rate cut in 30+ years with CPI above 2% and GDP growth around 3%

That’s unprecedented , it shows how serious the labor market weakness is despite the inflation backdrop

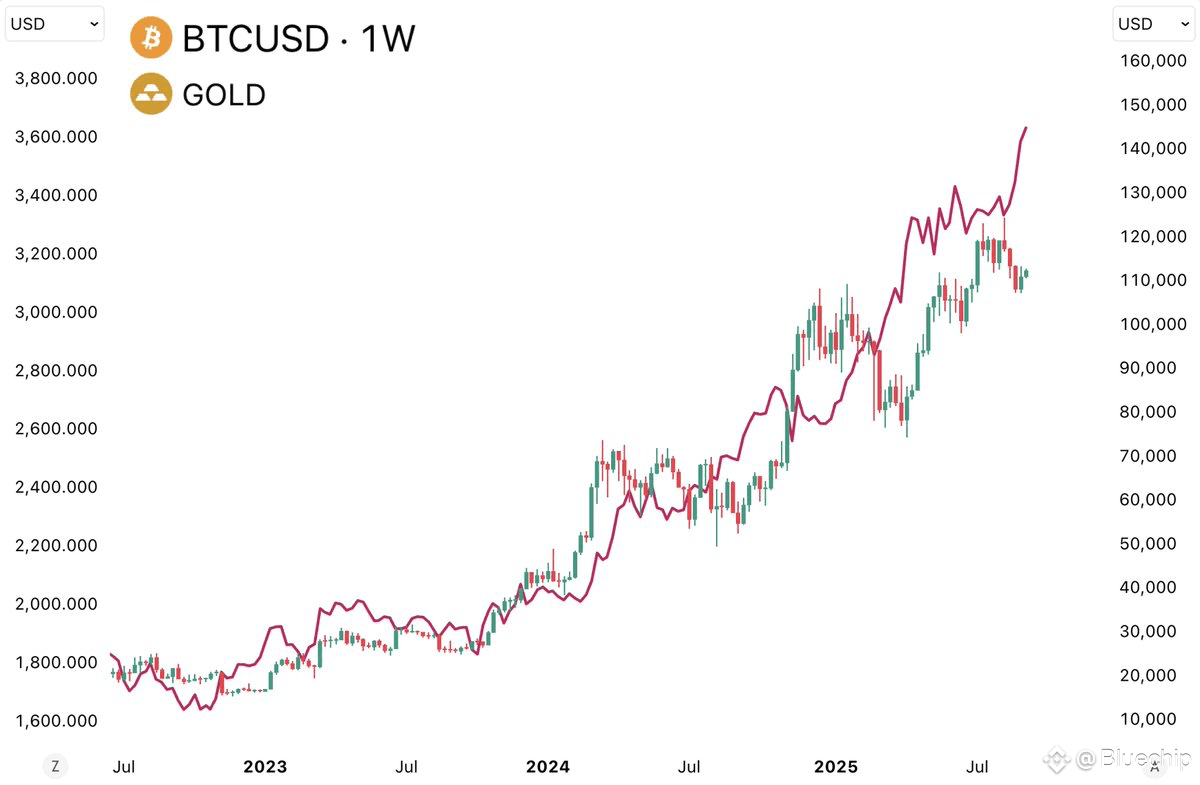

9/ Both gold and equities front-ran the move

Gold is up +40% this year, miners nearly doubled, while the S&P 500 hit record highs

Investors have been positioning for Fed cuts

But the –911k job revision breaks the illusion of labor strength and raises volatility risks

10/ For crypto, this setup is bullish

Lower rates mean cheaper liquidity, more appetite for risk, and stronger flows into volatile assets

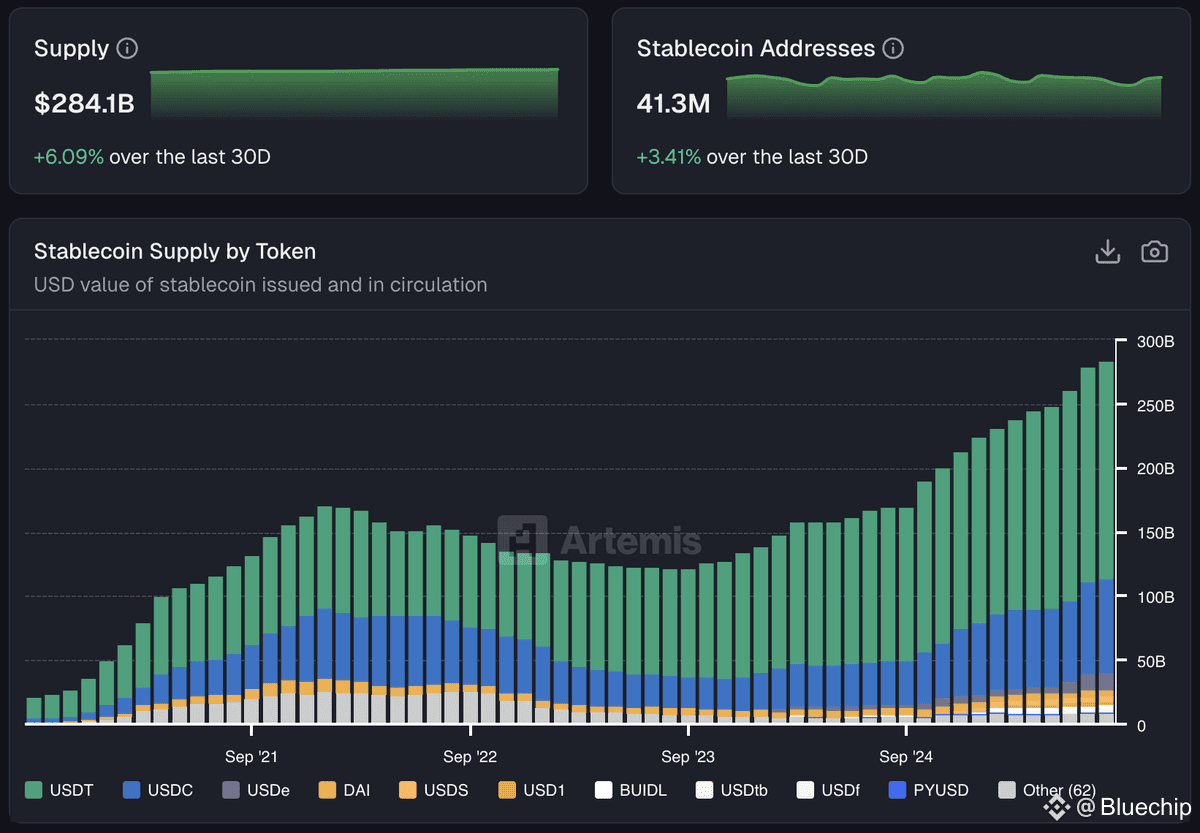

Stablecoin supply has been expanding, historically a lead indicator for Bitcoin rallies

11/ The coming weeks are critical

If the Fed cuts, it could ignite a Q4 rally across risk assets and kickstart the long-awaited altseason

But if job losses deepen, recession risks rise – and that could flip the narrative fast

Always DYOR and size accordingly. NFA!

📌 Follow @Bluechip for unfiltered crypto intelligence, feel free to bookmark & share.

#BNBBreaksATH #BinanceHODLerHOLO #AITokensRally #BinanceAlphaAlert $BNB #bnb