Quick Recap:

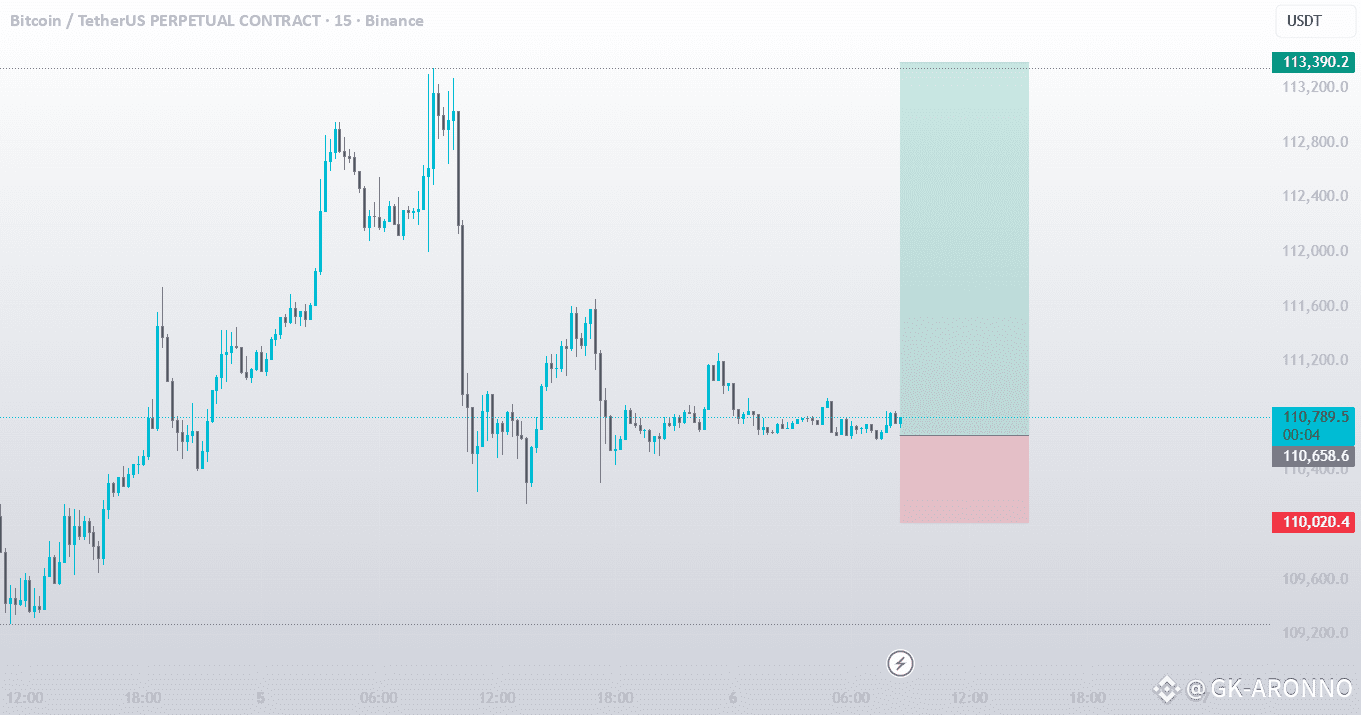

Bitcoin is coiling in a tight consolidation near the $110,700 level, effectively flat on the day. This is a healthy pause after the recent move, allowing the market to build energy for its next directional impulse. My bias remains bullish above key support.

Key Technical Observations:

Successful Retest in Progress: The price is currently retesting the ~$110,600 - $110,700 zone, which previously acted as resistance. This is classic bullish market behavior—old resistance becomes new support. The defense of this level so far is technically constructive.

Bullish Structure Intact: The higher low structure from the $109,600 swing low remains unchallenged. As long as we hold above this key support confluence, the path of least resistance remains upward toward $111,200 and beyond.

Low Volume Consolidation: The low volume (151.69K BTC) during this pullback suggests a lack of aggressive selling. This looks more like order accumulation and profit-taking, not a distribution top.

What I'm Watching:

My Bullish Scenario (Preferred): I am looking for signs of buyer absorption here at support. A strong bullish rejection candle (hammer, bullish engulfing) on this 15m chart, followed by a break back above $110,900, would signal the consolidation is over and the next leg up to $111,200+ has begun. This would be my signal to add to/add long positions.

Invalidation Scenario: The bullish thesis is invalidated on a decisive break and close below $110,600 with momentum. This would likely trigger a deeper flush toward $109,600. While not my base case, I have my stop-losses defined just below this support zone to manage risk.

Conclusion:

The dip is being bought, and the structure favors the bulls. This tight range is a spring coiling. I'm long-biased and looking for a confirmed bounce from this support zone to target the next resistance level. Risk management, as always, is key.