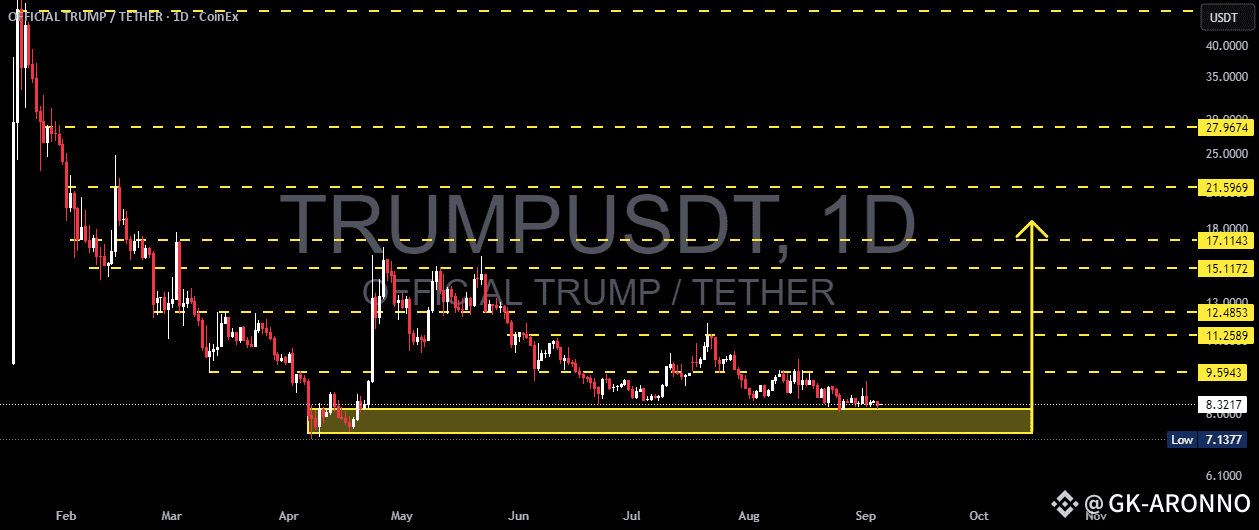

Currently, TRUMPUSDT is trading within the critical support range of $8.33 – $7.13, which has repeatedly acted as a strong demand zone since May. After a prolonged downtrend from its peak earlier this year, the market is now moving sideways, signaling a potential accumulation phase or preparation for the next major move.

---

🔎 Chart Structure & Pattern

Main trend: Long-term bearish since the peak.

Current phase: Sideways consolidation near a strong support zone.

Key support: $8.33 → $7.13 (demand zone).

Layered resistance levels: $9.59 → $11.25 → $12.48 → $15.11 → $17.11.

Major psychological targets: $21.59 and $27.96 if a strong reversal takes place.

---

✅ Bullish Scenario

1. If the price holds above $7.13 and forms a bullish reversal candle (pinbar, engulfing, or volume spike), a rebound is likely.

2. Short-term upside targets: $9.59 – $11.25.

3. A breakout above $12.48 with strong volume may push price toward $15.11 – $17.11.

4. A decisive breakout above $21.59 would confirm a long-term trend reversal with potential to reach $27.96+.

---

❌ Bearish Scenario

1. If the $7.13 support fails, selling pressure could intensify.

2. Next bearish target would be around $6.10 as a psychological support.

3. A breakdown below this zone may create a new lower low, extending the bearish trend.

---

📝 Conclusion

TRUMPUSDT is currently at a make-or-break zone.

As long as $7.13 holds, the possibility of a rebound toward key resistance levels remains strong.

However, a breakdown below this support would likely extend the bearish continuation.

📌 The best approach now is to wait for confirmation from price action at this crucial support level before positioning.

---