3/

$DOLO Price Analysis

1. Recent Trend Review

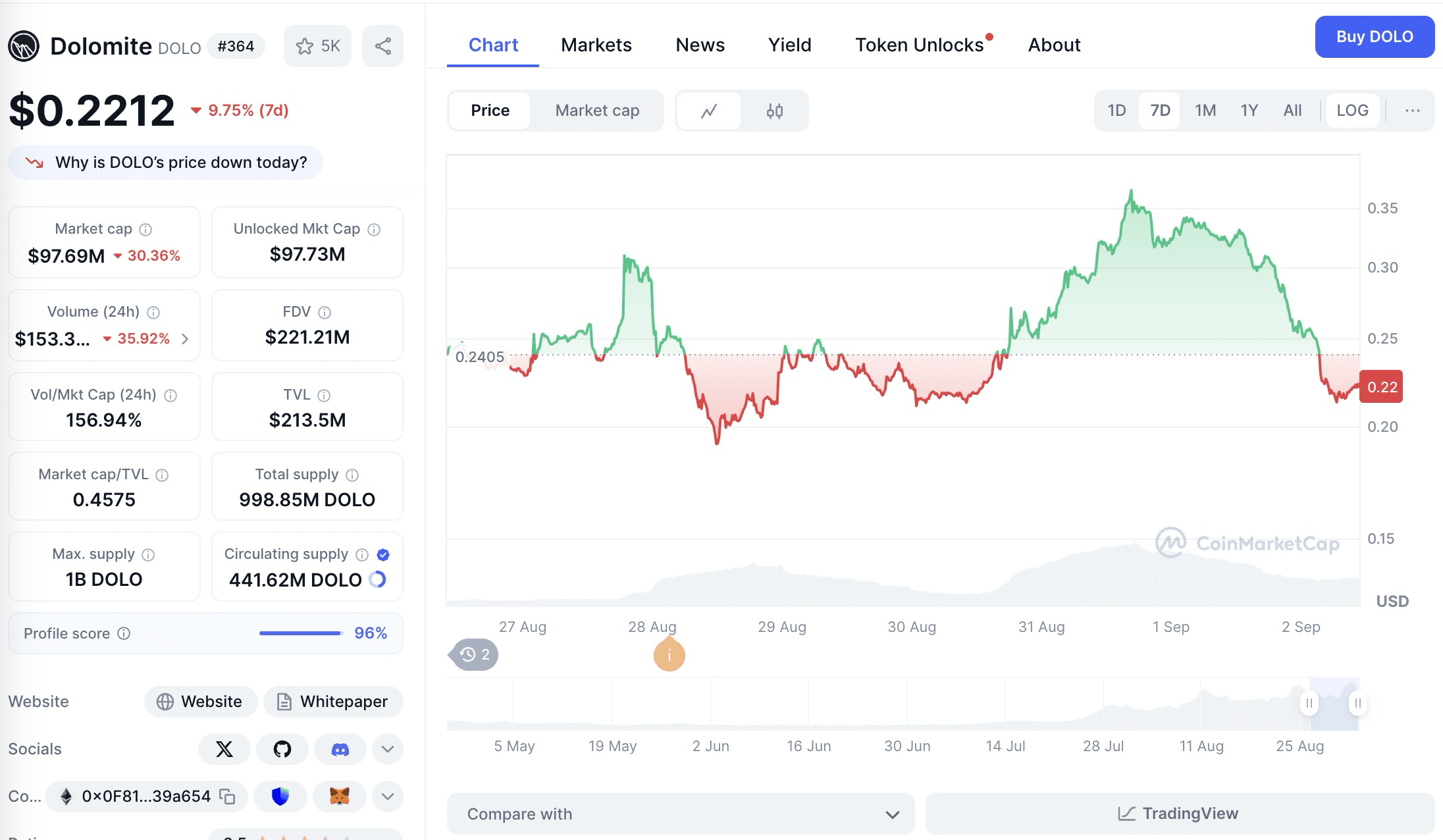

In the past 7 days, the price has dropped from the 0.24–0.25 USD range, currently at 0.2212 USD, with a weekly decline of about -9.75%.

The high point occurred around August 31 – September 1, once hitting near 0.35 USD, then quickly retracing.

Current price has retraced about 35% from the high, nearing the volatility range seen at the initial listing.

2. Fundamentals and Data Indicators

Market cap: Approximately 97.69 million USD, down over 30% from the previous week.

FDV: Approximately 221 million USD, indicating a circulation ratio of about 44%, unlock pressure still needs to be monitored.

24h trading volume: Approximately 153 million USD, with a trading/market cap ratio of 156.9%, indicating that market turnover remains high and speculation is strong.

TVL: Currently 213 million USD, close to 2.2 times the market cap, indicating a high degree of fund accumulation and utilization within the protocol.

Market Cap/TVL ratio (MCap/TVL): Only 0.4575, which is still undervalued compared to other lending protocols (Aave, Compound usually range from 1-2 times), indicating room for valuation correction.

3. Technical Position Observation

Support level: 0.20 USD is an important psychological barrier, also close to the average price during the initial listing on Binance, which may provide strong support in the short term.

Resistance level: The 0.28–0.30 USD range is a previous resistance point; if it can effectively break through with increased volume, a new round of upward movement may begin.

Formation: Currently, the price is consolidating in the 0.22–0.25 USD range; if the trading volume continues to shrink, it may form a consolidation bottoming pattern.

4. Market Interpretation and Outlook

In the short term, the 'hype' around DOLO's listing is gradually cooling down, and the retracement is a normal digestion process. Combined with the high growth of TVL and the relatively low market cap/TVL, the fundamentals still support its valuation center as a core protocol in the Berachain ecosystem.

Opportunity point: If the price further retraces to the 0.20 USD support level, it could be a buying window;

Risk point: If it falls below 0.20 USD with increased trading volume, it may continue to drop to 0.18 USD.

Mid to long-term logic: With PoL v2 incentives, WLFI stablecoin USD1 integration expectations, and external attention brought by Binance listing, DOLO is expected to maintain a core position in the Berachain ecosystem narrative.

It is recommended to start preliminary positions after falling below 0.2, within the range of 0.15-0.2

Keep an eye on it, USD1 may surge.$DOLO Rise