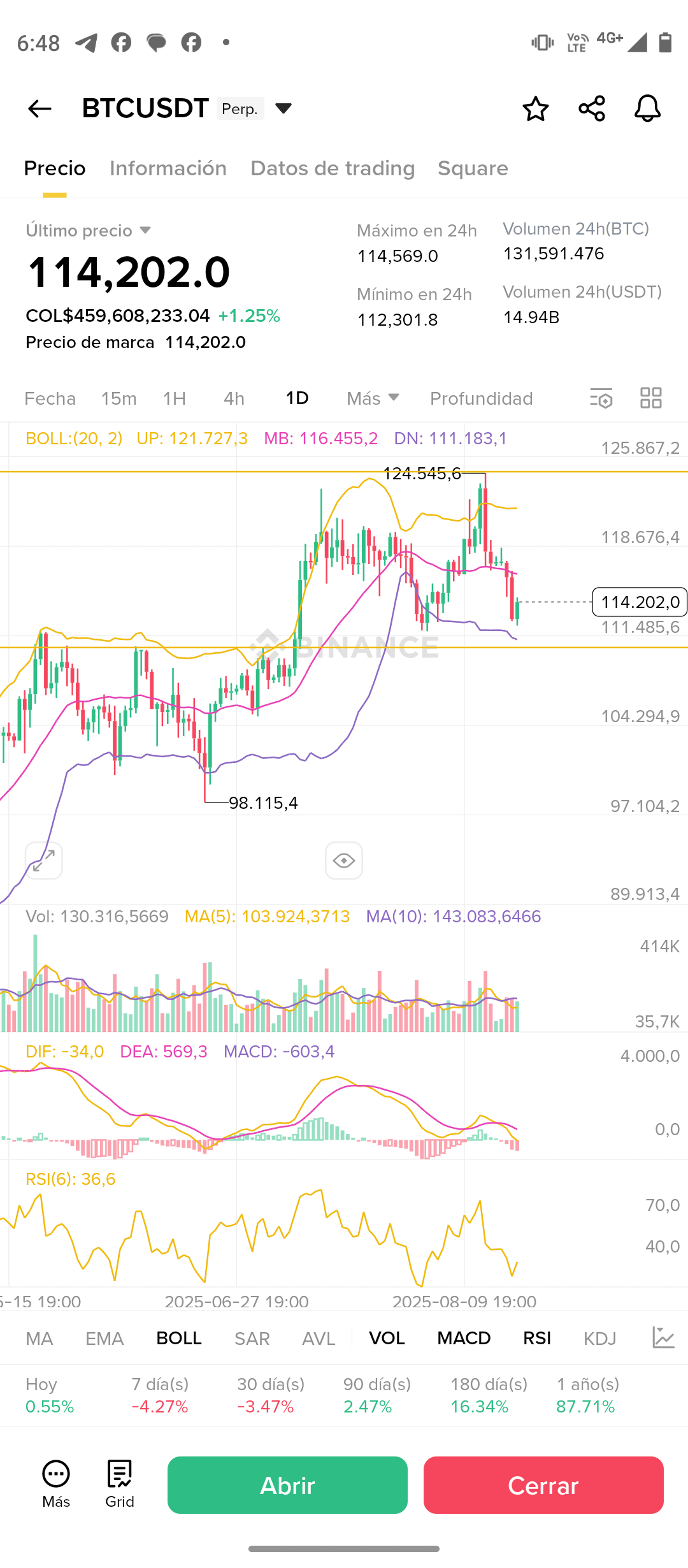

📌 Last price: 114,202 USDT (+1.25%)

24h high: 114,569

24h low: 112,301

24h volume: 131,591 BTC

Visible indicators on the chart:

1. Bollinger Bands (BOLL 20,2):

Current price (114,202) is located near the low-medium (116,455 ≈ central average), indicating recent bearish pressure.

The lower band is at 111,183, which acts as immediate key support.

2. Moving Averages:

MA(5): 103,924 — quite below, showing that the previous rise was rapid.

MA(10): 143,083 — very high, indicating a strong correction in recent days.

3. MACD:

DIF: -34.0, DEA: 569.3, MACD: -603.4.

Confirmed bearish crossover, with negative momentum, reflecting weakness in the short-term trend.

4. RSI (6): 36.6

RSI is approaching the oversold zone (<30), showing seller exhaustion and possible technical rebound.

Important technical levels:

Immediate support: 111,183 (lower Bollinger).

Major support: 98,115 (relevant low on the chart).

Immediate resistance: 116,455 (Bollinger average).

Strong resistance: 121,727 (upper band).

📈 Projection for tomorrow (short term):

If BTC respects the support of 111,183, there is a probability of a rebound towards 116,000 – 118,000.

In case of losing 111,000, the drop could extend towards the 108,000 – 105,000 zone.

Bearish pressure continues, but indicators show exhaustion in selling, which allows room for a short-term technical rebound.

✨ Conclusion:

The market is in a correction phase within a larger bullish trend. The key is for the bulls to defend the 111,000 USDT zone. Otherwise, BTC could seek lower levels.

👉 If you want more daily analysis, strategies, and a clear market view, follow me so you don't miss the next big opportunity in the crypto world. 🚀