Bitcoin (BTC) has pulled back sharply from its recent high of $124,000, now trading near $113,000, while Ethereum (ETH) is holding around $4,100. This move raises questions: is the market entering a deeper correction, or is it simply a healthy pullback?

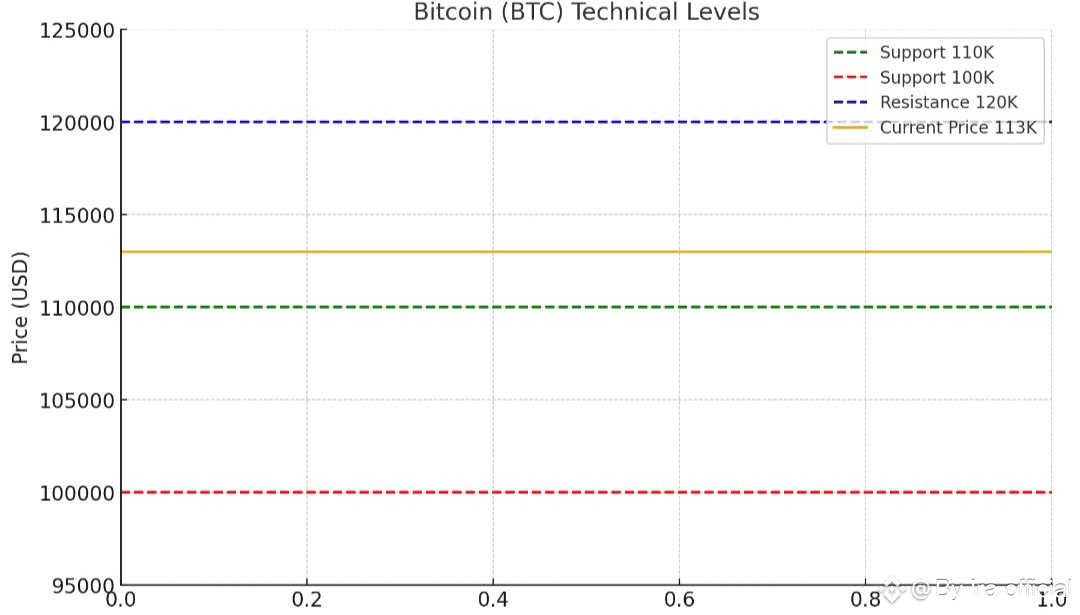

🔑 Bitcoin (BTC) Analysis:

Key Support: First major support sits at $110,000. A break below could open the door for a test of the psychological $100K zone.

Resistance: The $120K level has now turned into strong resistance, and reclaiming it is essential for bulls to regain momentum.

Indicators:

RSI has exited overbought territory, signaling potential for continued correction.

Higher selling volume during the drop suggests short-term bearish pressure.

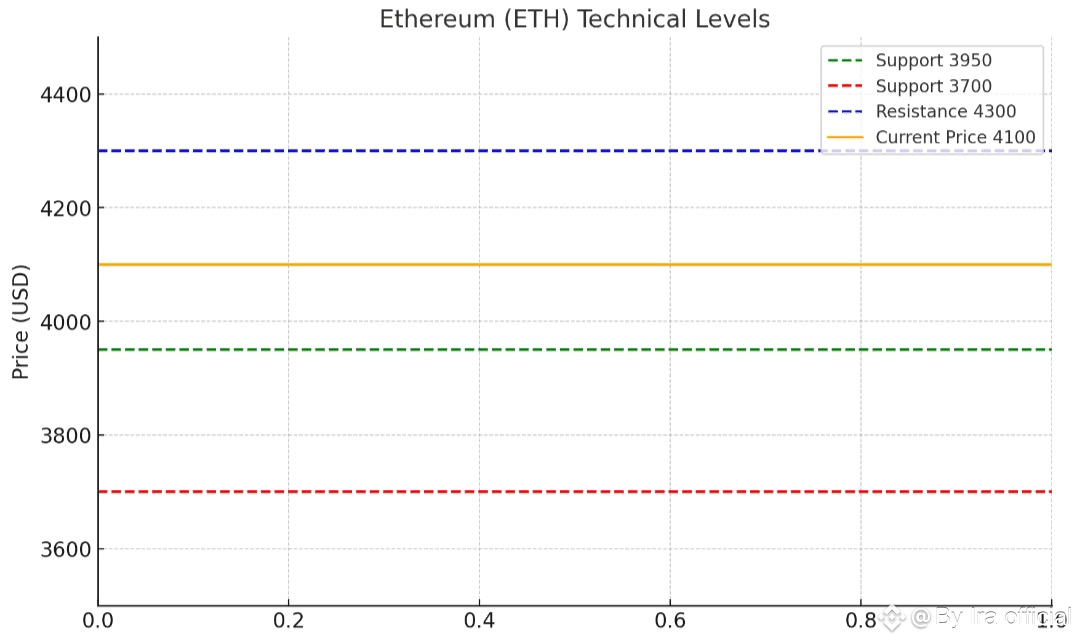

🔑 Ethereum (ETH) Analysis:

Support: Strong support at $3,950 – $4,000, with further downside risk toward $3,700 if broken.

Resistance: Bulls need to push ETH above $4,300 to reestablish strength.

Indicators:

ETH still maintains a higher-low structure, keeping the overall trend positive.

Trading volume is relatively weaker than BTC, showing ETH is largely following Bitcoin’s lead.

🚀 Possible Scenarios:

1. Bullish Case: A breakout above 120K (BTC) with strong volume could reignite bullish momentum, targeting 125K–130K.

2. Bearish Case: A drop below 110K could trigger a deeper correction toward 100K, dragging the wider market lower.

📌 Technical Takeaway:

The market is at a critical point: holding support zones will be key for sustaining the bullish trend. Losing them could invite a broader correction before any new attempt at higher highs.

Like and follow please 🔔👍🙏

#bitcoin #Ethereum #CryptoNews #TechnicalAnalysis #BinanceSquare