$BTC As of August 20, 2025, Bitcoin is trading between $113,524 and $113,882 per coin in the last hour, with an intraday price range over 24 hours from $112,647 to $115,789.

The leading cryptocurrency has a market capitalization of $2.26 trillion and a trading volume of $45.41 billion over the past day, as the price consolidates at a critical support level amid technical and macroeconomic factors.

===========

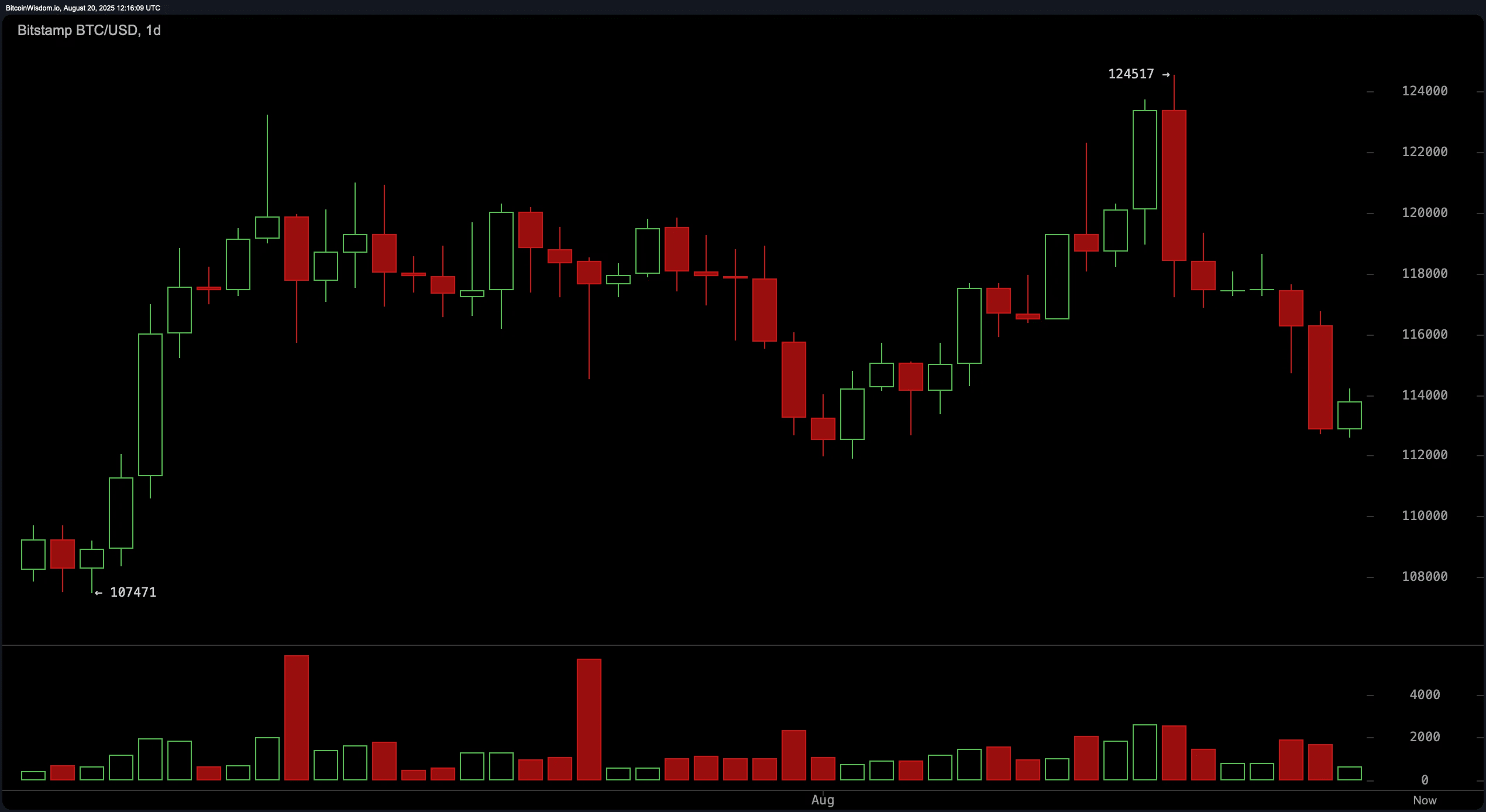

The price dynamics of Bitcoin on the daily chart indicate a clear downward trend following a sharp deviation at the $124,517 level.

This level marked the peak of a double top, which has since triggered a series of lower highs and declining closes.

A significant spike in volume at the local high confirms distribution, while recent candles show indecision in the support zone of $112,000–$113,000.

This level also coincides with previous demand and a short-term bounce, making it key for potential reversal attempts. Failure to hold this support may open the way for a deeper retreat to the psychological level below $110,000.

==========

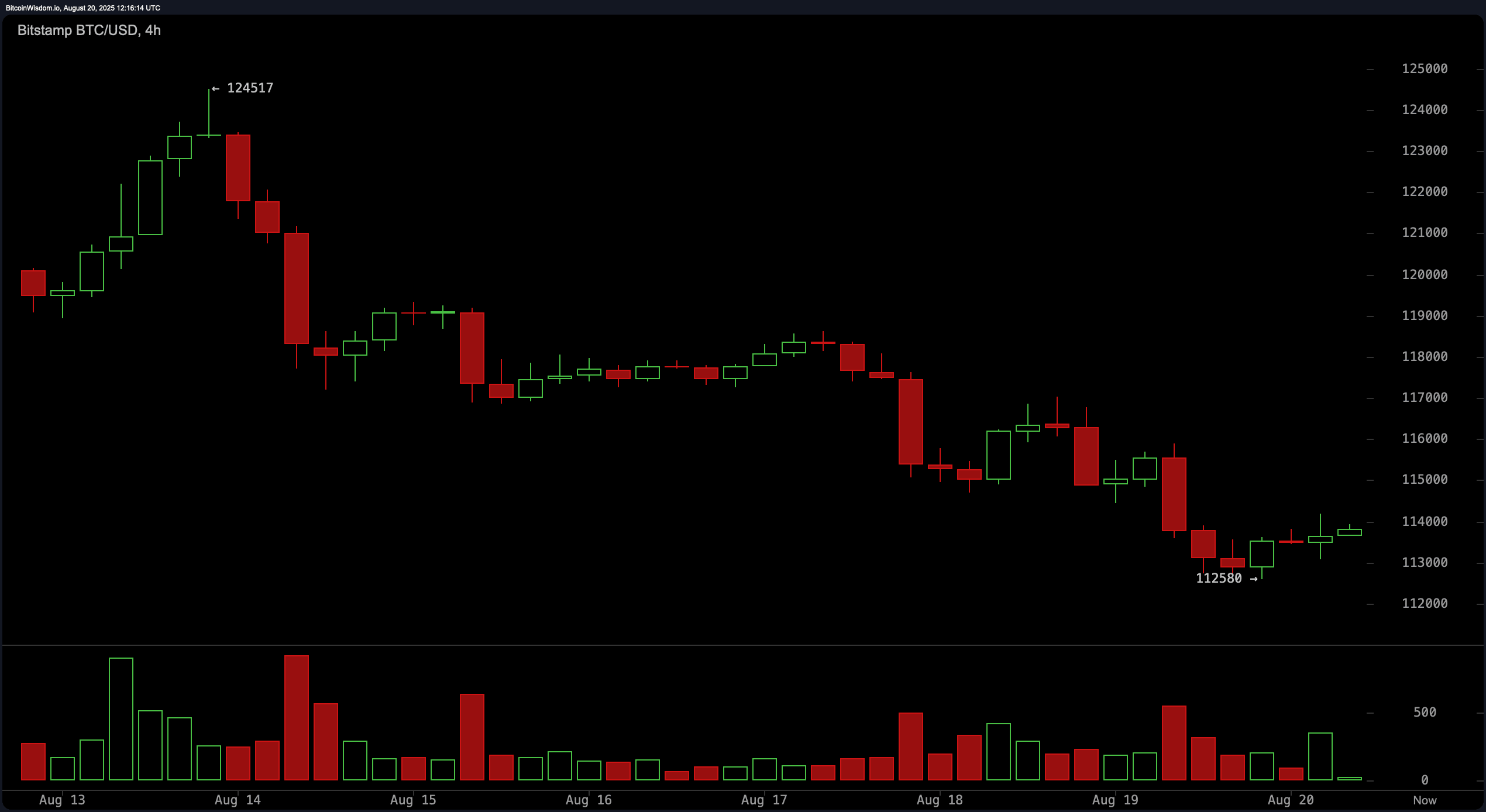

Medium-range signals from the 4-hour Bitcoin chart continue to reflect a controlled downward channel that started on August 13.

A modest bounce from $112,580 has emerged, but it remains unconvincing without a breakthrough above the resistance zone of $115,500–$116,000.

Clusters of volume around recent lows indicate possible capitulation, but the lack of bullish momentum raises caution.

A sustained close above $116,000 will be the first sign of a trend change, while a rejection from this zone may trigger a resumption of selling pressure.

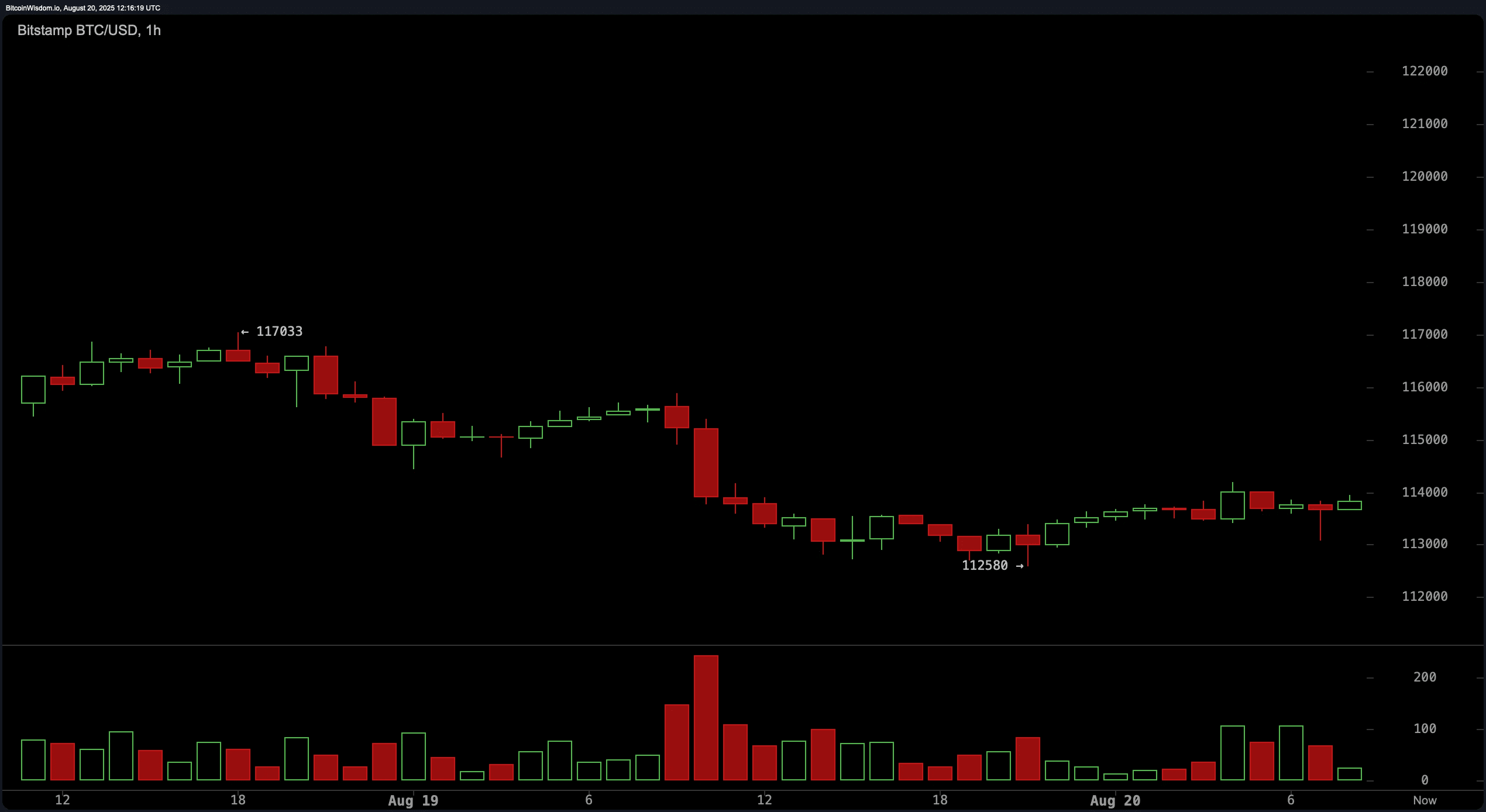

As we approach the 1-hour chart, Bitcoin seems to be forming a potential bottom, with recent candles showing higher lows and slightly higher highs.

The price is supported around $113,000, with noticeable indecision reflected in declining volume.

For short-term traders, range-based strategies may provide opportunities, especially for scalping long positions at support and exiting near the ceiling of $114,500–$115,000.

However, if this upper boundary is rejected with strong volume, short positions may regain dominance.

==========≈

Bulls' Verdict:

If Bitcoin holds support above $112,500 and decisively breaks above $116,000 with increasing volume, the recent downward trend may give way to a medium-term recovery.

A sustained close above this resistance will confirm accumulation patterns and potentially initiate a retest of the $118,000–$120,000 zone.

===========

Bears' Verdict:

Failure to hold the support range of $112,000–$112,500, especially amid increasing ETF outflows and bearish momentum, may accelerate the decline to $110,000 or below.

Without a clear signal of a bullish reversal, Bitcoin remains vulnerable to continued selling pressure and broader market risk sentiment.