BitMine Immersion Technologies (BMNR) has consolidated its position as the world’s largest Ethereum ETH $4 289 24h volatility: 4.1% Market cap: $519.71 B Vol. 24h: $41.95 B treasury after announcing crypto holdings of $6.612 billion in an official press release on August 18. The disclosure marks a significant milestone in institutional crypto adoption, positioning BitMine as a major force in the digital asset landscape.

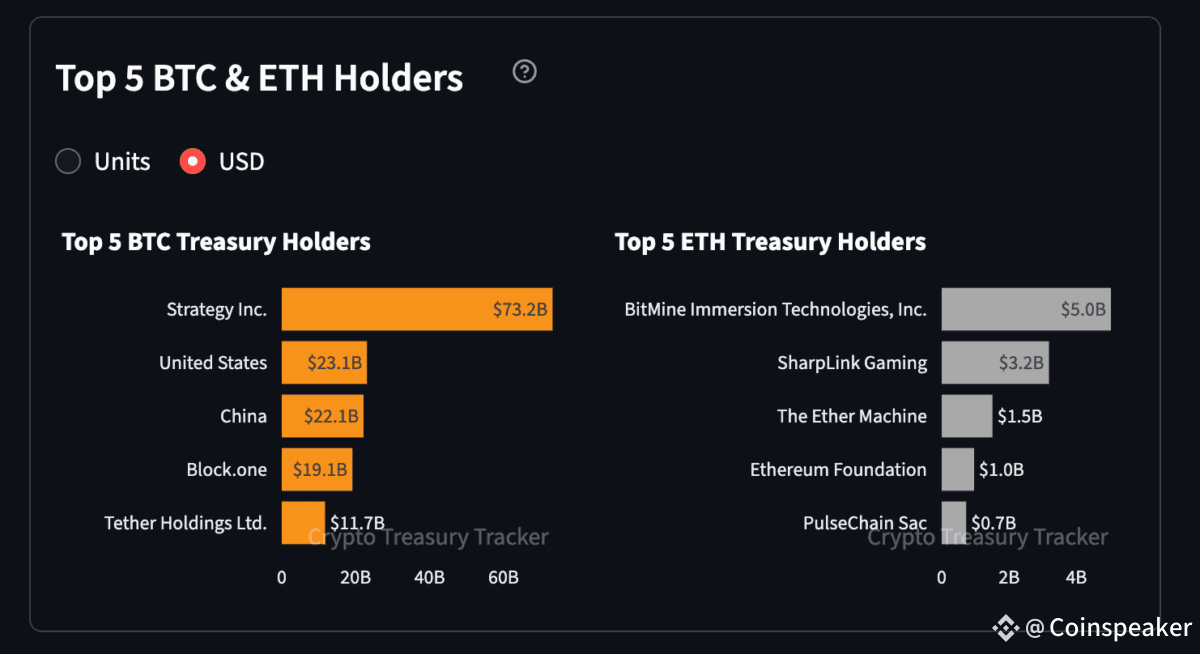

In its announcement, BitMine disclosed holdings of 1.52 million ETH and 192 BTC, representing a $1.7 billion increase from the previous week. This massive accumulation places BitMine as the world’s largest Ethereum treasury and the second-largest global crypto treasury, trailing only Strategy’s $73 billion Bitcoin BTC $116 041 24h volatility: 1.2% Market cap: $2.31 T Vol. 24h: $47.35 B holdings at press time, according to Sentora Research dashboards.

Top 5 Bitcoin and Ethereum Treasury Holders | Source: Sentora Research, August 2025

Investors received the news positively, with BitMine’s (BMNR) stock surging in trading activity, averaging $6.4 billion in daily turnover over the last week, making it the 10th most liquid US-listed stock by dollar volume.

“As we continue to say, we are leading crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock,” said Thomas Lee of Fundstrat, Chairman of BitMine.

Institutional firms including ARK’s Cathie Wood, Founders Fund, Pantera, Galaxy Digital, and Kraken are among top backers of the BitMine stock, as the company targets ownership of 5% of Ethereum’s circulating supply.

Ethereum Price Analysis: ETH Tests $4,250 Support

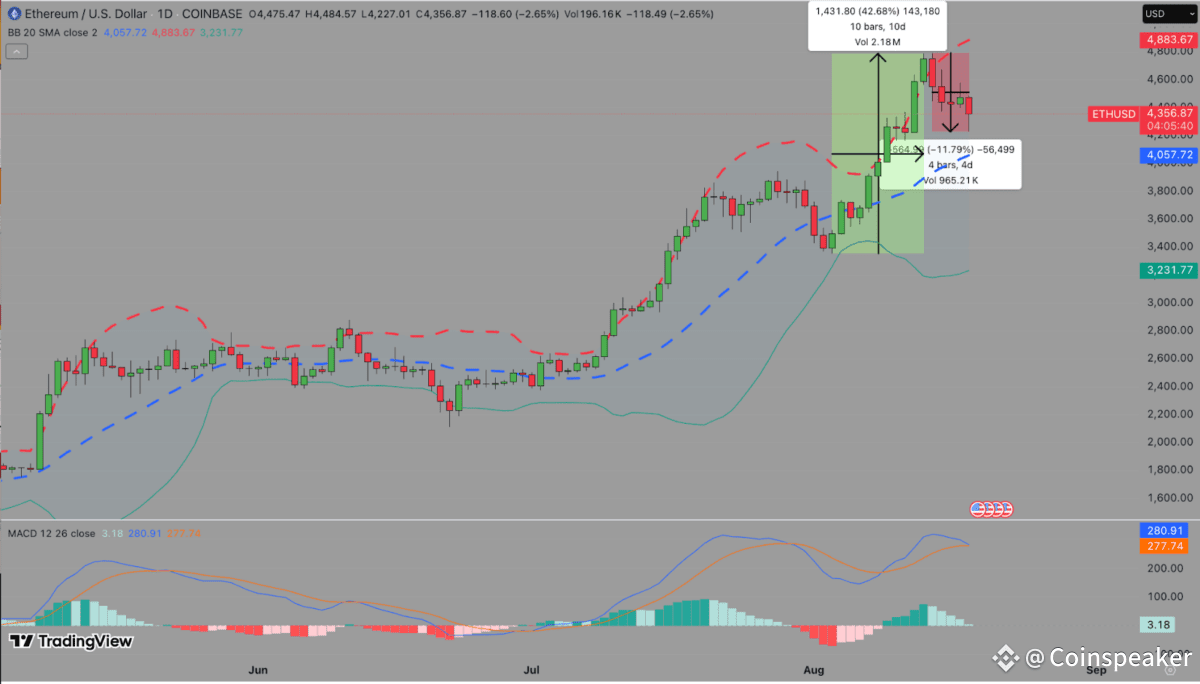

Amid BitMine’s announcement, Ethereum dipped below $4,250 on Monday, August 18, extending its pullback with a 2.18% intraday loss. The decline follows a sharp 42% rally between August 3 and August 14, where ETH climbed from $3,356 to $4,831.

Since reaching that local peak, buyer fatigue and market-wide profit taking has driven an 11% retracement over four days, with ETH trading as low as $4,232 on Monday. Weak weekend momentum carried into US morning trading, placing Ethereum on course for its fourth red session in the last five days.

Technical indicators currently show mixed signals for the short-term outlook. The ETHUSD 24-hour chart reveals trading momentum remains marginally positive, with the MACD line holding above the signal line, while narrowing bars indicate weak demand. Moreover, widening Bollinger Bands reflect increased volatility, with ETH trading near the upper band but facing resistance at $4,886.

Ethereum Price Forecast

The key level to watch is $4,250, which serves as a critical support threshold. A break below could send ETH toward the 20-day simple moving average at $4,058, while a successful hold above this level and subsequent break of $4,886 resistance could propel ETH into price discovery above $5,000.

Despite recent profit-taking, persistent institutional inflows led by BitMine could trigger expectations of an imminent rebound as the week unfolds.

Ethereum Rally Boosts Interest in Best Wallet’s $14M Presale

Ethereum’s renewed market activity this week has also driven attention toward secure multi-chain wallets such as Best Wallet (BEST).

Best Wallet Presale

The project has already raised over $14 million in its presale, offering investors low transaction costs, attractive staking rewards, and early access to decentralized applications.

Best Wallet’s presale momentum signals strong demand from Ethereum users seeking both safety and yield. Investors can still join at discounted tiers through the official Best Wallet site before the next price increase.

next

The post BitMine Consolidates as World’s Largest Ethereum Treasury with $6.6B Holdings appeared first on Coinspeaker.