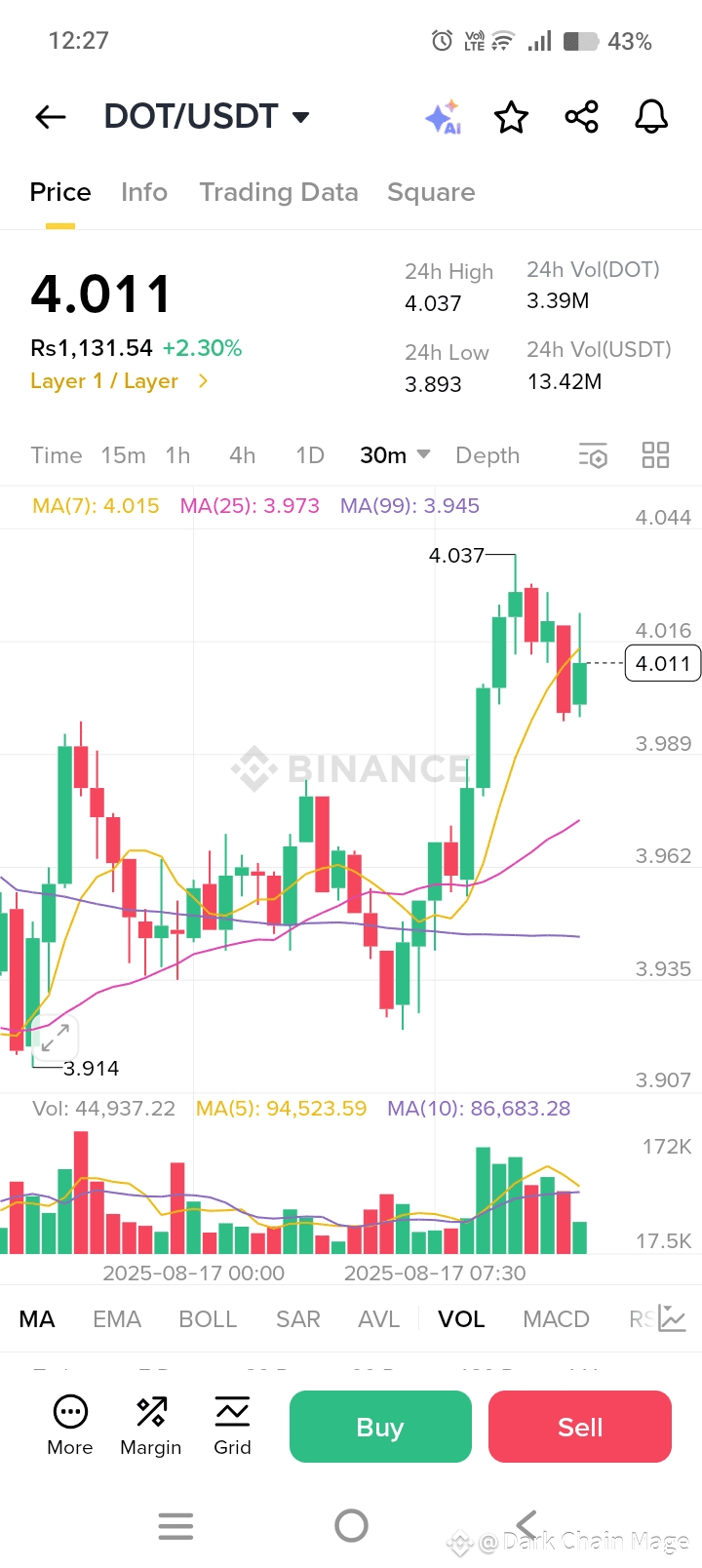

Polkadot ($DOT ) has shown fresh strength, crossing the $4 psychological level with a +2.30% intraday gain. The 30-minute chart reflects growing momentum as DOT bounced from a low of $3.893 and tested a local high at $4.037.

🔑 Key Observations from the Chart:

1. Short-Term Strength:

DOT is trading at $4.011, slightly above its 25 MA ($3.973) and 99 MA ($3.945).

This shows a bullish crossover, suggesting buyers are regaining control.

2. Volume Confirmation:

The recent breakout was backed by increased trading volume, giving strength to the uptrend.

3. Support & Resistance Levels:

Support: $3.95 – $3.89 zone (buyers defended this range earlier).

Resistance: Immediate hurdle lies near $4.05 – $4.10. A clean breakout could push DOT towards $4.20 – $4.30.

4. Trend Outlook:

If DOT maintains above the 7-day MA ($4.015), bullish momentum may extend.

A failure to hold $4.00 could trigger a retest of $3.95 support.

⚡ Market Sentiment:

Polkadot’s recovery above $4 signals renewed confidence among traders. With Layer 1 projects gaining fresh attention in the crypto space, DOT could be setting up for a short-term rally—especially if Bitcoin maintains stability.

👉 Traders should watch $4.05 resistance closely. A breakout could unlock the next leg higher, while rejection may bring consolidation back toward $3.95.