📊 Price Action:

$BTC retraced after hot US PPI data reduced odds of a September rate cut.

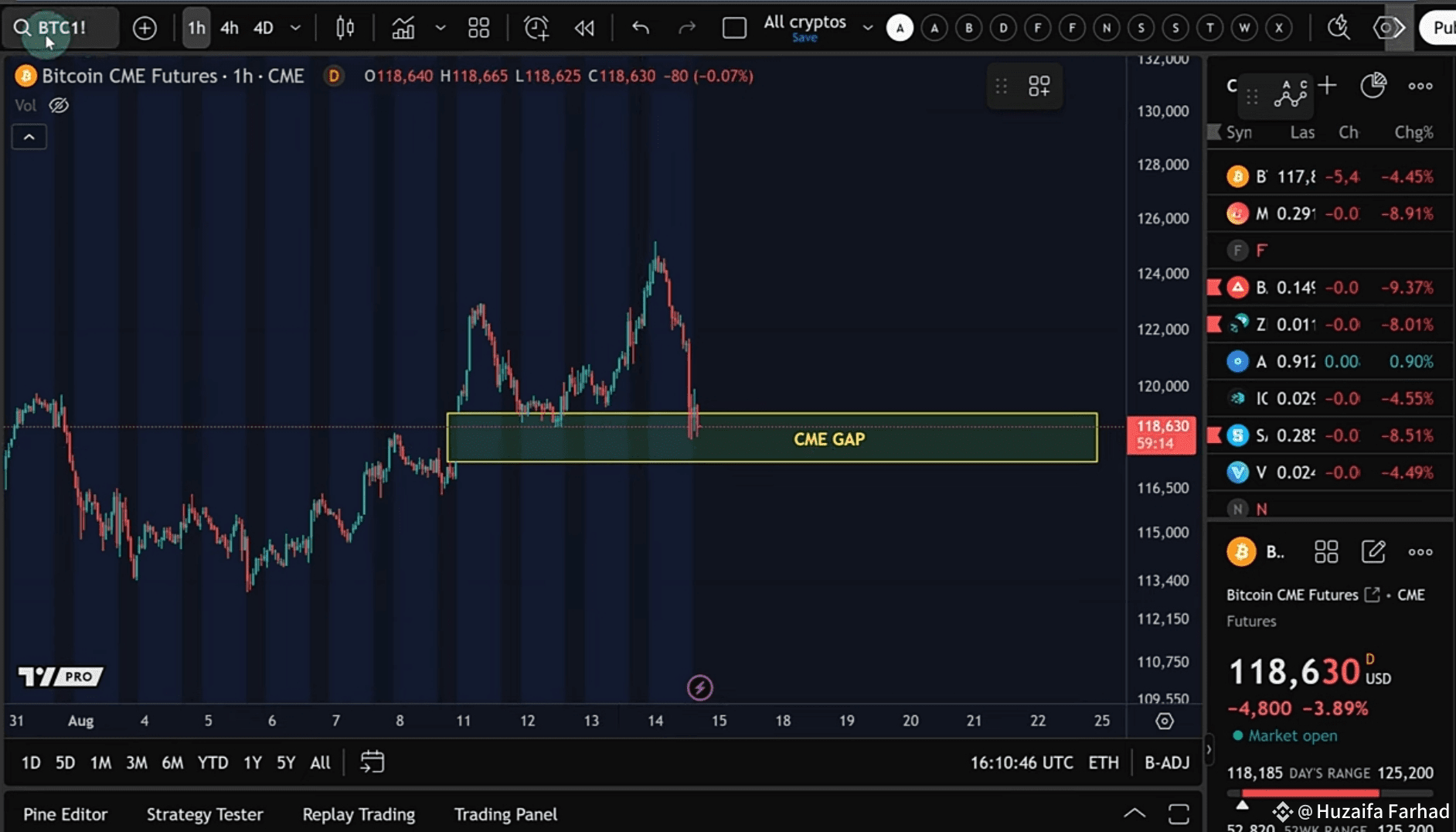

Current focus remains on CME futures gap: $117,400 – $119,000.

Structure still holding within bullish support zones.

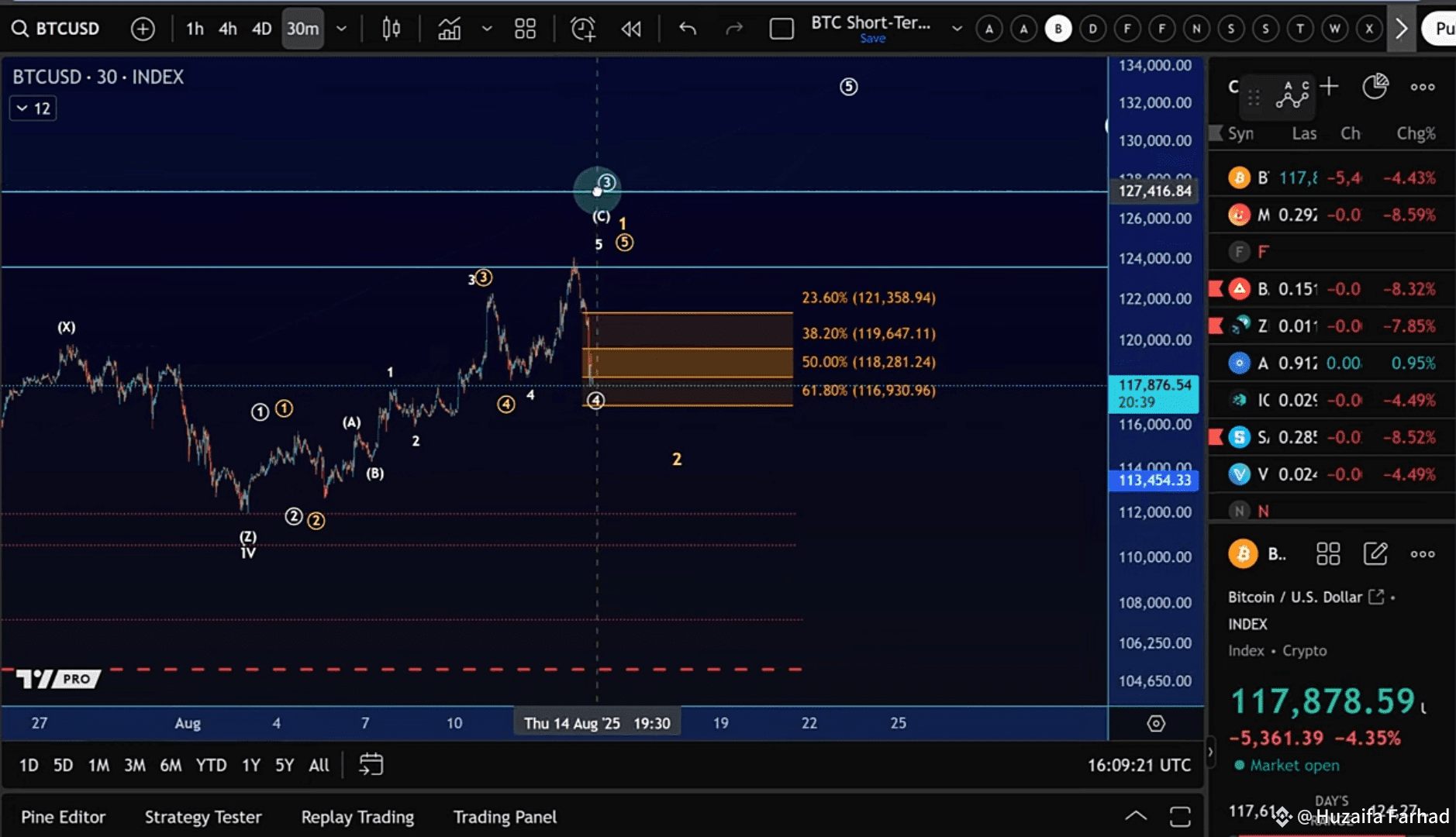

📌 Bullish Scenario 1 – Yellow Count:

Valid as long as $112,000 (Aug 2 low) holds.

Below $112K = invalidation → deeper retrace possible.

📌 Bullish Scenario 2 – White Count:

Key level: $112,670 (Aug 5 low).

Break under this = shift to alternate Elliott count.

📏 Key Price Levels:

$123,600 – Fibonacci resistance; capped recent high.

$119,000 – $117,400 – CME gap zone; likely short-term magnet.

$116,290 – Intermediate futures support.

$112,670 – White count invalidation.

$112,000 – Yellow count invalidation.

⚠ Technical Notes:

Current pullback may be a Wave 4 flat or Wave 2 correction.

No major bearish confirmation until $112,000 breaks.

Gap closure remains probable before any extended drop.

📈 Outlook:

While above $112K, bias remains for another leg up.

Short-term traders watching $117.4K gap fill.

Macro-driven volatility expected this week.

#BTC #Bitcoin #Crypto #MarketUpdate #CMEGap #TechnicalAnalysis