Stablecoin Flows, Institutional Moves, and On-Chain Signals – Here’s What You Need to Know:

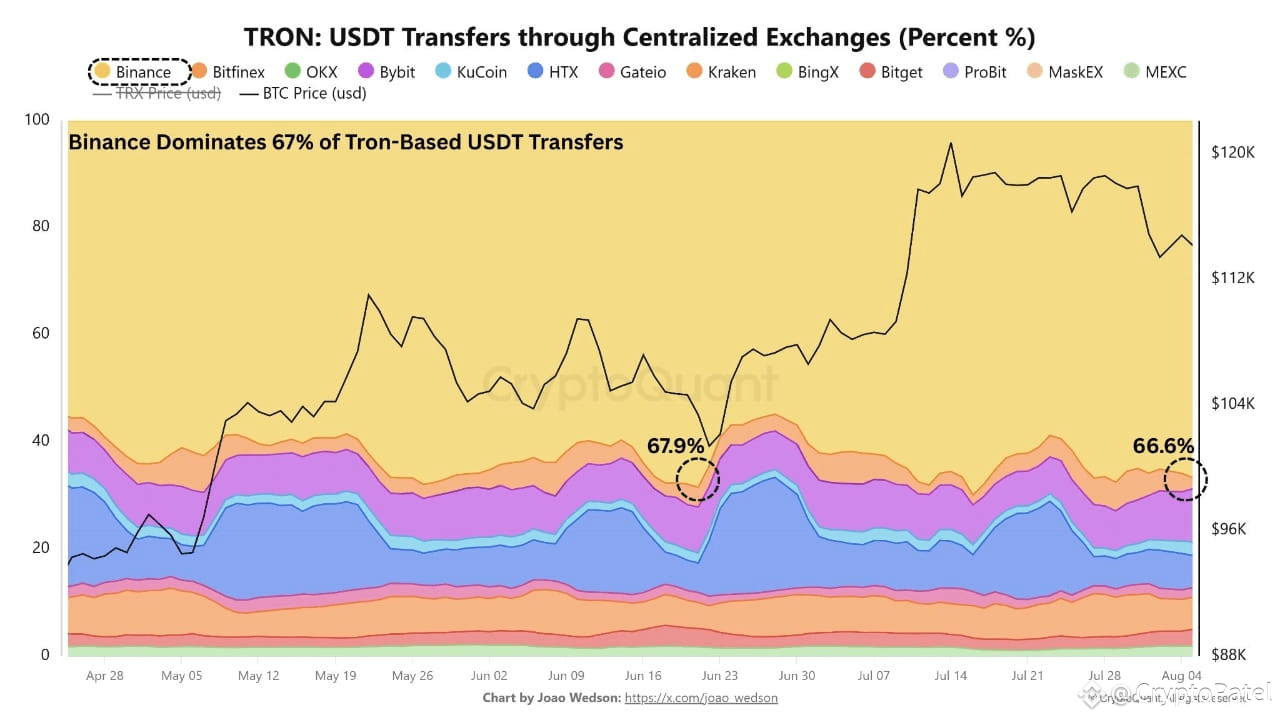

Binance + TRON = Stablecoin Powerhouse

🔹 #Binance now processes 67% of all USDT transfers via the #TRON (TRC20) network.

🔹 That’s over half of global spot USDT activity flowing through a single CEX on one chain.

🔹 TRON’s low fees + fast confirmations have made it the preferred route for institutional settlements and fund transfers.

🔹 This shows growing trust in TRON’s infrastructure and Binance’s deep stablecoin liquidity.

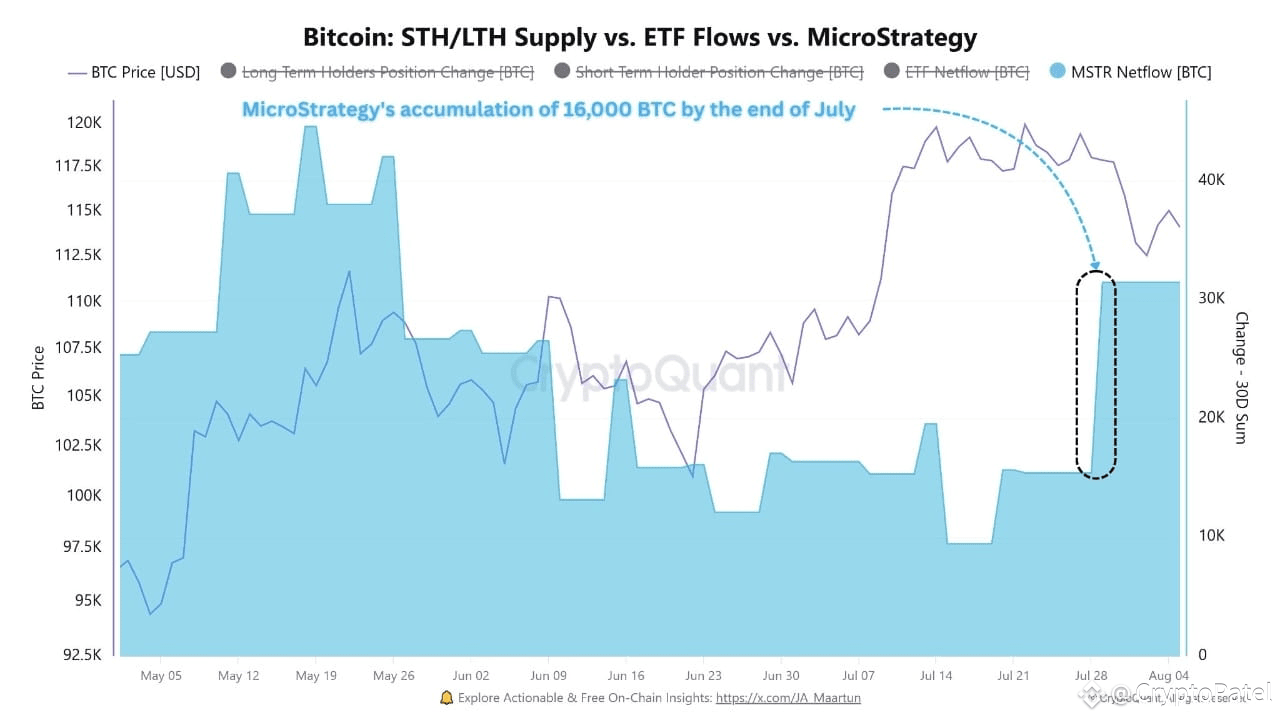

#MicroStrategy Buys Another 16,000+ BTC

🔹 Michael Saylor isn’t slowing down. His firm added 16,000+ BTC in late July.

🔹 Most of these were followed by exchange withdrawals — a classic on-chain sign of long-term accumulation.

🔹 Big players are not trading BTC — they’re moving it into cold storage.

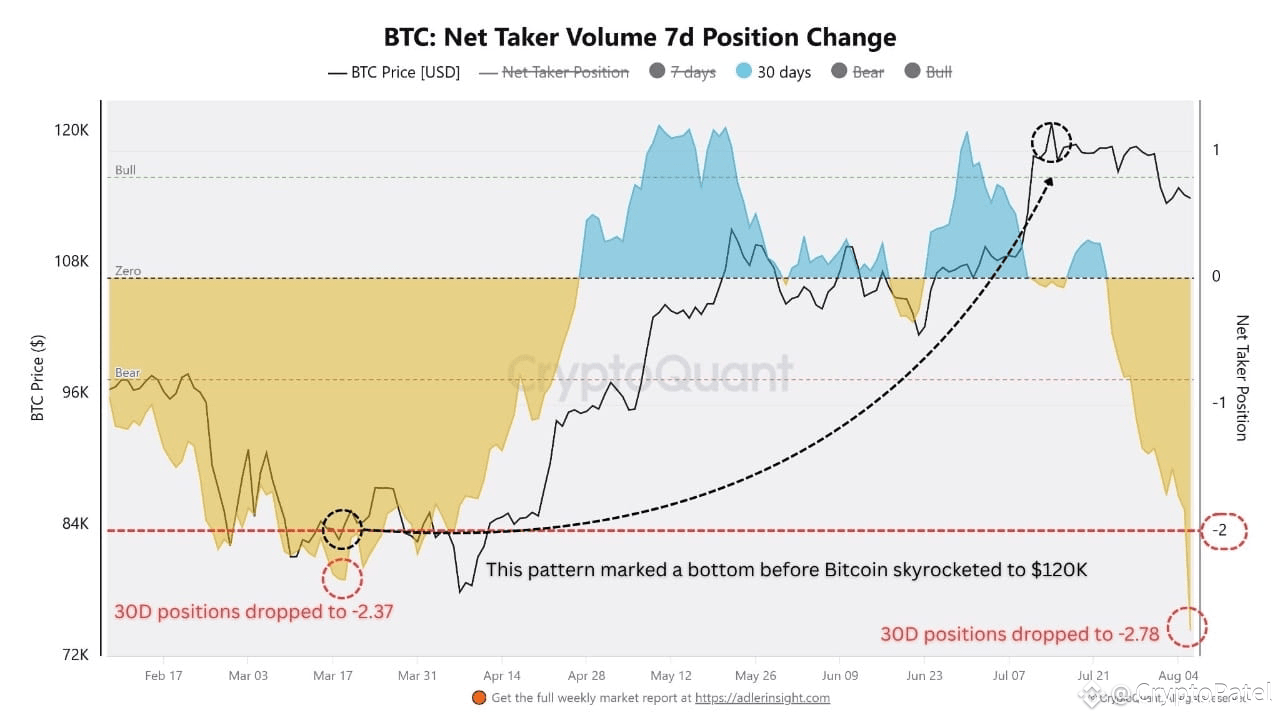

#Bitcoin Taker Volume Hits -2.78 (30D Avg)

🔹 The Net Taker Volume (30-day) for Bitcoin just dropped to -2.78, one of the lowest levels since March.

🔹 This metric tracks how aggressively market participants are selling.

🔹 Last time this happened? March 2025. $BTC reversed shortly after, rallying from $82K to $120K.

🔹 We could be nearing max pain = potential bottom.

What This Means:

🔹 TRON is dominating stablecoin flows.

🔹 Institutions are stacking BTC quietly.

🔹 Retail is panic selling again.

The data speaks, don’t fade the fundamentals.