@BounceBit The official website states:

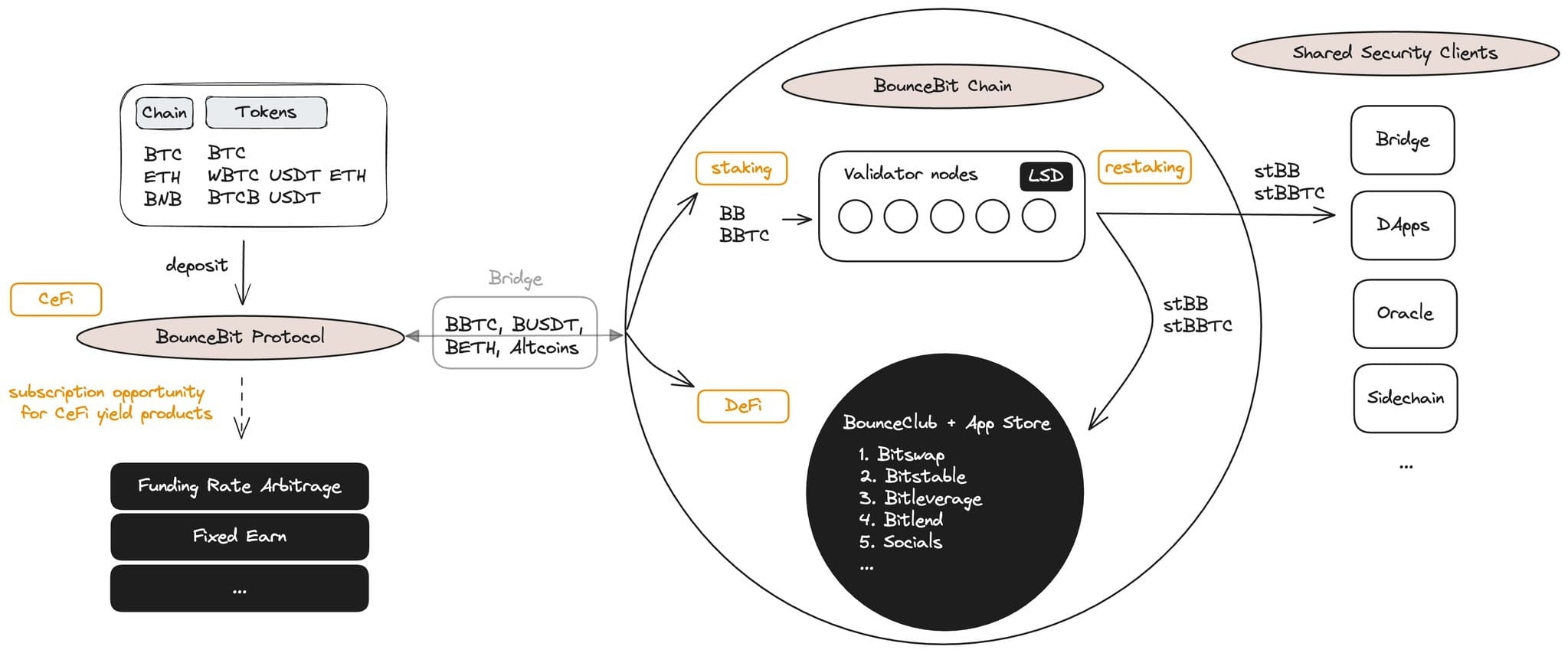

BounceBit has pioneered a new paradigm of CeDeFi infrastructure, providing institutional-grade yield products, Restaking application scenarios, RWA (Real World Assets) integration services, and packaging CeDeFi as a universal service, making high-yield opportunities accessible to all users.

The BounceBit chain is a dual-token PoS Layer1 secured by Bitcoin and the platform's native token $BB , combining the security of Bitcoin with full EVM compatibility.

By designing liquidity custody tokens (LCT) and collaborating with CEFFU, users can not only gain actual returns from CeFi but also use LCT to participate in Restaking and on-chain DeFi mining #BounceBitPrime

—————————————————————————————————————————————

CeDeFi literally means the combination of centralized finance and decentralized finance, and in fact, BounceBit has designed three yield modules.

Onchain CeFi Yield Centralized Custody Yield (On-chain Transparency)

General Process:

Stake BTC — hosted by regulated institutions — remain on-chain visible via MirrorX — participate in arbitrage, lending, and other yield strategies

Core Mechanism: Secure Custody + Mirror X+ Arbitrage

Sources of Yield: Cross-market arbitrage or BTC lending

Risk Level: Low

Official staking link: https://portal.bouncebit.io/cedefi

***About Mirror X: It is a product under Ceffu, and Ceffu is Binance's only institutional custody partner. MirrorX combines Binance's deep liquidity and advanced trading mechanisms, along with Ceffu's risk management and OTC settlement capabilities, to provide institutional investors with diversified, secure, and efficient digital asset access solutions.

Onchain Ecosystem DeFi Yield

General Process:

Participate in DeFi applications within the BB ecosystem — provide liquidity/staking mining/project issuance/governance participation, etc. — earn DeFi yields

Participation Method: On-chain protocol

Sources of Yield: Fee sharing, token incentives

Risk Level: Medium

Dapp link: https://portal.bouncebit.io/dapp/stake

Infrastructure Yield: Node staking and PoS mining

General Process:

Jointly stake BTC and $BB to become a validator/delegate node — participate in PoS — earn staking rewards

Participation Method: Staking or delegating nodes

Sources of Yield: On-chain transaction fees and BB tokens unlocked from PoS

Risk Level: Medium-Low

BounceBit Blockchain: https://bbvision.io/

Official introduction to self-owned chain PoS staking: https://docs.bouncebit.io/infrastructure/bouncebit-pos-chain/dual-token-staking-consensus#dual-token-pos-structure