1. Market Cap Math Kills the Idea

* ♦️SHIB (≈589 trillion supply): $1 * 589T = $589 trillion market cap. For context: global GDP is ~$110–$120T. There’s no realistic liquidity or capital base to support that.

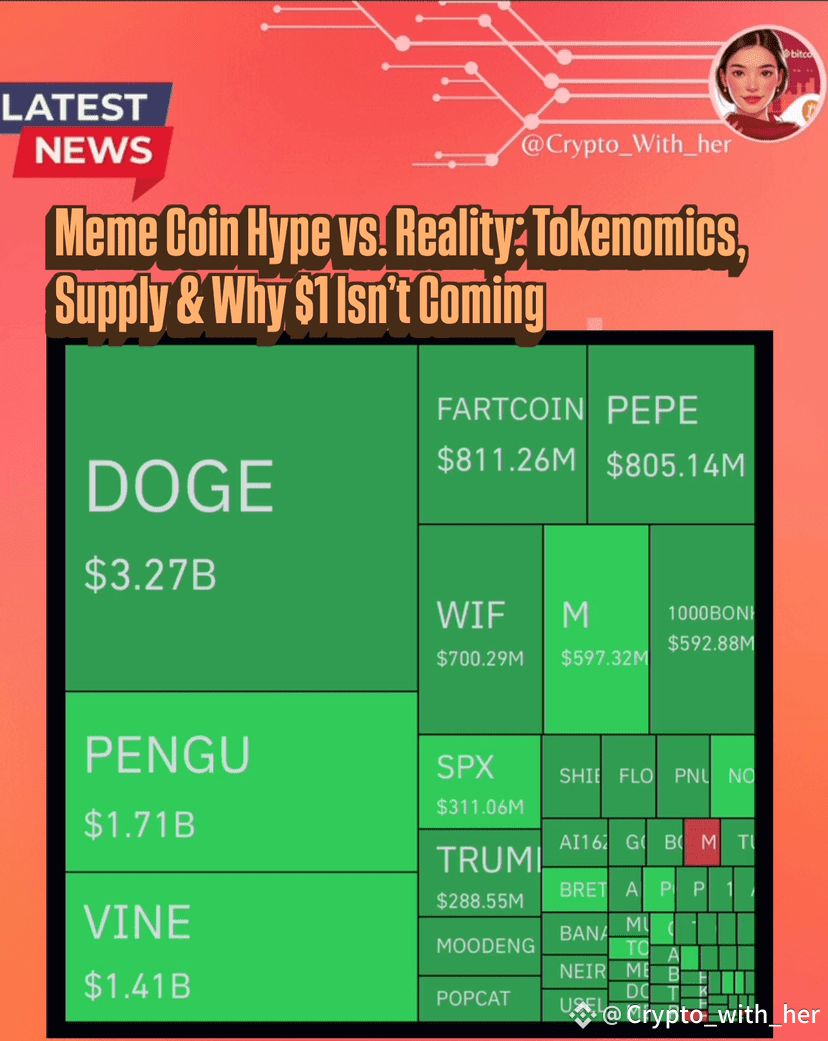

* ♦️PEPE (~420 trillion supply) and FLOKI have similar orders of magnitude; hitting $1 would imply absurd multi-hundred-trillion valuations.

* ♦️Even BOB or Neiro with smaller supplies would need massive, implausible capital inflows to justify such prices unless their circulating supply is tiny (and then dilution usually kills it).

2. Tokenomics & Dilution Risk

* 🔸Most of these meme coins have huge circulating plus potential inflationary supply (burn mechanics often weak or reversible).

* 🔸High supply + low real utility = price ceiling unless demand growth outpaces supply expansion by unreal levels.

*🔸 Even if a “$1” tweet drives a short squeeze, without fundamental demand it collapses fast (pump-and-dump dynamic).

3. Liquidity & Real Money Needed

* ⭕️To move price meaningfully toward even a fraction of $1 would require billions to trillions of dollars of real capital sitting in the book with buyers willing to hold through volatility.

* ⭕️Order book depth on decentralized exchanges for these coins is shallow; slippage would eat capital, making sustained pushes virtually impossible without centralized coordination (which is unsustainable or manipulative).

✅ What Does Make Sense for Investors

1. 🔺Relative Moves & Short-Term Plays

* Meme coins can squeeze, pump, and deliver short-term gains on virality, celebrity mentions, or speculative flows. Risk: extremely high, often with rapid drawdowns.

2. 🔺Risk-Adjusted Approach

* If you trade or hold these, size positions very small, treat them as lottery tickets, and use strict stop-losses.

* Ask: What’s the total supply? Who holds the large bags? What’s the active community / on-chain velocity?

3. ❇️Better “$1” Targets

* Look for low-supply, utility-driven projects where $1 implies a reasonable market cap (e.g., supply in the millions or low billions with clear use case).

* Evaluate token utility, real adoption, developer activity, and network effects—not just a viral hashtag.

MY TAKE ON IT:

“$1 soon!” for $SHIB, $PEPE, $FLOKI, etc. is mathematically unfeasible given current supply unless there’s a catastrophic change like massive burn plus sustained real demand (and even then, it’s far-fetched).

These coins can pump on sentiment, but that’s not sustainable investment—it’s speculation.

Smart money focuses on tokenomics, real utility, dilution control, and scalable demand, not viral price memes.

#ProjectCrypto #MemecoinReality #SHIB #PEPE #FLOKI #CryptoEducation #Tokenomics #RiskManagement #SmartCrypto #AltcoinAnalysis #DataDrivenCrypto