#TrumpTariffs $BTC #WhiteHouseDigitalAssetReport #SECProjectCrypto #FOMCMeeting

🔍 What's the News?

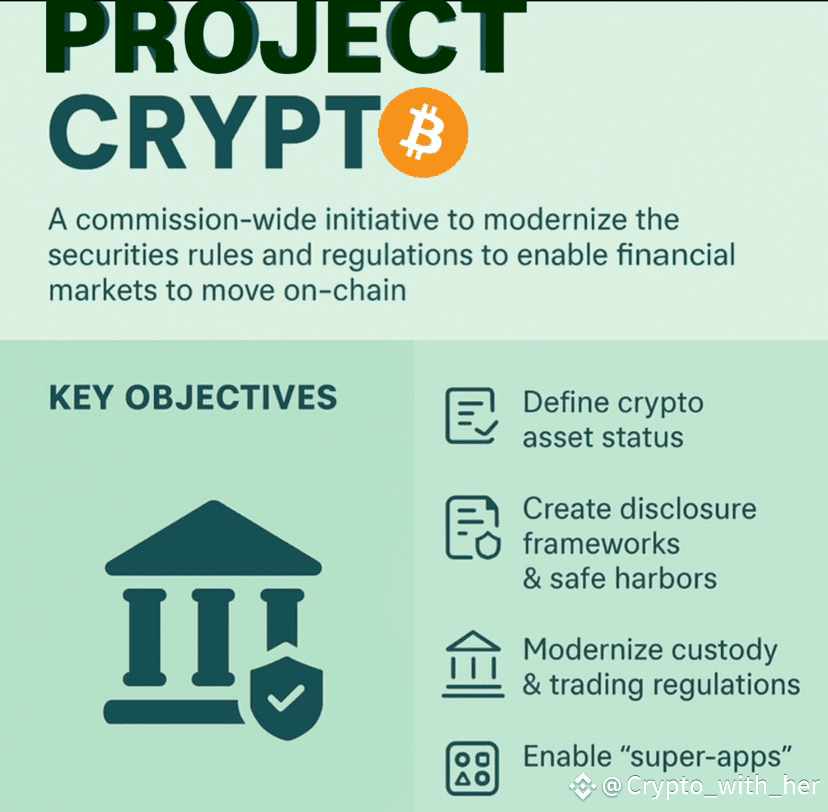

SEC Chair Paul Atkins announced the launch of Project Crypto — a commission-wide initiative to reshape U.S. securities regulation and enable financial markets to operate on-chain, using blockchain technology

🧭 Key Objectives

1. ❇️Define Crypto Asset Status Clear guidelines to classify tokens—security, commodity, or stablecoin—to replace Howey Test ambiguity

2. ❇️Create Disclosure Frameworks & Safe Harbors New rules for ICOs, airdrops, staking rewards, token offerings, aiming to support U.S.-based capital raising 🇺🇸

3. ❇️Modernize Custody & Trading Regulations Rules updated to protect self-custody rights and expand custodial and intermediary involvement under U.S. regulatory standards

4. ❇️Enable “Super‑Apps” Allow platforms under one license to offer trading, staking, lending, and both security and non-security crypto services

5. ❇️Tokenization of Traditional Assets Support tokenized securities, on-chain trading, integration of DeFi into capital markets infrastructure

6. ❇️Regulatory Relief & Innovation Exemptions Use SEC’s interpretation and exemptive powers to loosen outdated rules and encourage U.S. innovation at scale

🌐 Context & Strategic Direction

* 🔷Project Crypto aligns with a 160-page White House report (President’s Working Group) recommending sweeping crypto reforms in the U.S. financial system.

* 🔷It signals a major regulatory pivot from the enforcement-heavy era under Gary Gensler, who treated most crypto assets as securities. Under Atkins, the SEC emphasizes clarity and tailored policy over broad litigation campaigns.

📌 Why It’s Important

* 🔸Regulatory Clarity: Firms will now know where they stand—whether the SEC considers their token a security or not.

* 🔸Reshoring Innovation: Startups are encouraged to launch from the U.S. rather than offshore to avoid regulatory uncertainty.

* 🔸Supports Institutional Growth: Encourages tokenization trends and integration of blockchain tools into traditional asset markets for faster settlement and liquidity expansion.

* 🔸Investor Empowerment: Protects self-custody while allowing regulated intermediaries to service investors—offering more choice and improved access.

⚠️ Risks to Monitor

* 🔺Draft regulations: Time-consuming rulemaking and public comment periods could delay implementation by up to 6+ months

* 🔺Regulatory polarization: With SEC now dominated by Republican commissioners, critics warn of reduced bipartisan oversight and future volatility

#ProjectCrypto #SEC #CryptoRegulation #Blockchain #CryptoNews #Web3 #DeFi #Tokenization #DigitalAssets #CryptoMarkets