The crypto market is on high alert after a long-dormant Bitcoin whale suddenly transferred $9.6 billion in BTC—originally mined in 2011—raising fears of a major sell-off. The move comes just as the U.S. Senate passed three landmark crypto bills, including the GENIUS Act, sparking mixed reactions across the industry.

Whale Activity Sparks Market Jitters

A Bitcoin address inactive for 14 years abruptly moved thousands of BTC this week, triggering speculation about an impending market dump. The coins were acquired when Bitcoin traded below $30, meaning the whale is sitting on a 2.4 million percent gain. Analysts are divided on whether this signals a major correction:

- Bearish Take: Some, like WhaleWire CEO Jacob King, argue that the GENIUS Act’s audit requirements could expose weaknesses in the crypto market, leading to a crash.

- Bullish Take: Others, like Sygnum’s Katalin Tischhauser, believe the new regulations provide legal clarity, strengthening stablecoins and institutional adoption.

The GENIUS Act: Threat or Opportunity?

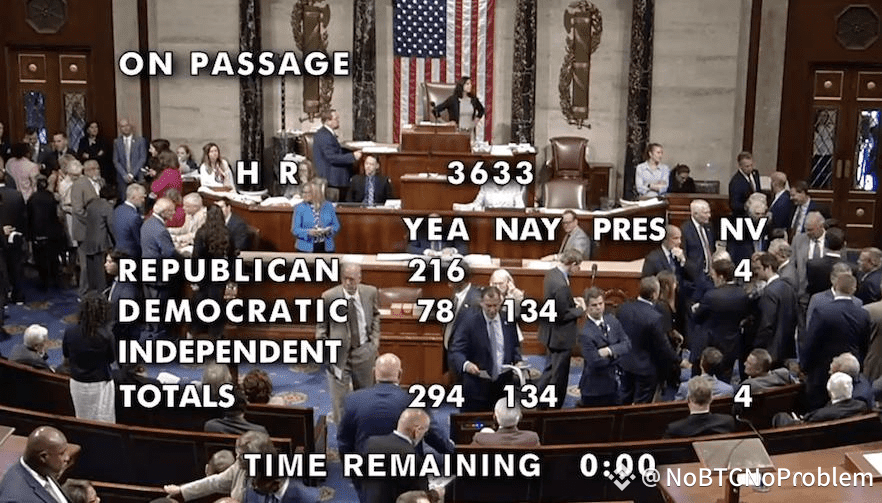

The newly passed GENIUS Act aims to establish clear rules for stablecoins, including:

- Mandatory audits for issuers

- Legal recognition of stablecoins as settlement instruments

- Stronger compliance with anti-money laundering laws

While some fear stricter rules could destabilize the market, others see it as a step toward long-term legitimacy. Nansen analyst Nicolai Sondergaard notes that Satoshi-era whales may not care much about regulations—they’re simply cashing out after years of holding.

Market Sentiment: Greed vs. Caution

Despite the whale’s movements, Bitcoin’s price remains resilient, supported by:

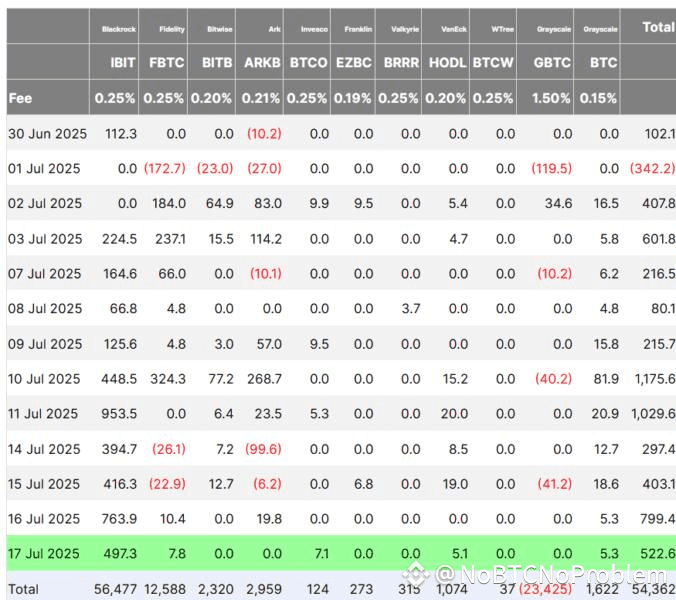

- 11 straight days of ETF inflows ($522M added Thursday alone)

- Mildly bullish options data (traders hedging both ways)

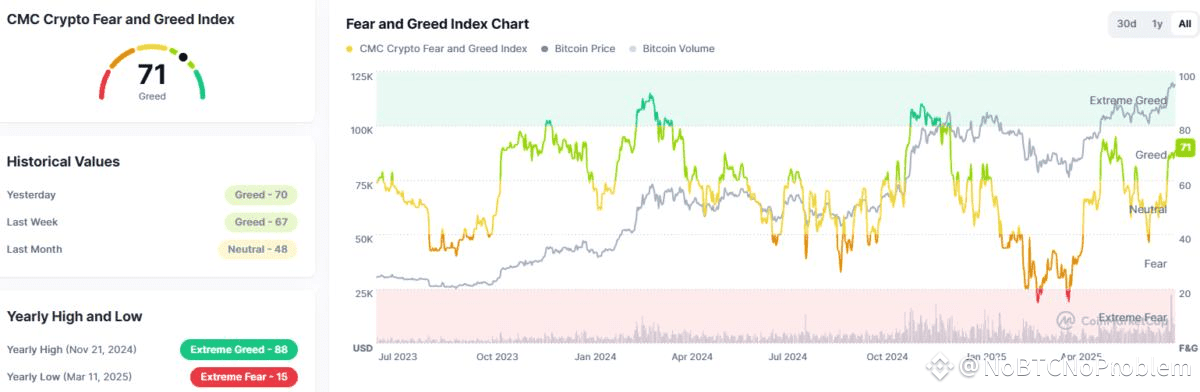

- Fear & Greed Index at 73 (showing greed but not extreme euphoria)

However, with such a massive whale potentially selling, traders are bracing for short-term volatility. Historically, large BTC dumps have led to 10-20% dips before recovery.

What’s Next for Bitcoin?

- If the whale dumps: Expect a sharp correction, possibly to $60K-$65K before rebound.

- If ETFs keep buying: Institutional demand could absorb selling pressure, keeping prices stable.

- GENIUS Act impact: Long-term, regulation may reduce fraud and attract more big investors.

Final Takeaway: While the whale’s move is concerning, Bitcoin has weathered bigger storms. The real test is whether retail and institutional buyers can counterbalance any major sell-off. One thing is clear—the market is at a critical inflection point.

#BTC #Whale.Alert #Whalestrap #fundamentalanalysis #Follow