Recent Market Overview

After BTC fell from the 123300 high, it oscillated around the 117500–118300 area, testing the short-term EMA support multiple times without breaking, in a relatively standard high-level box accumulation structure; stronger than BTC's main upward rhythm.

The two are currently clearly differentiated: BTC is stagnating at high levels, while ETH is breaking out strongly.

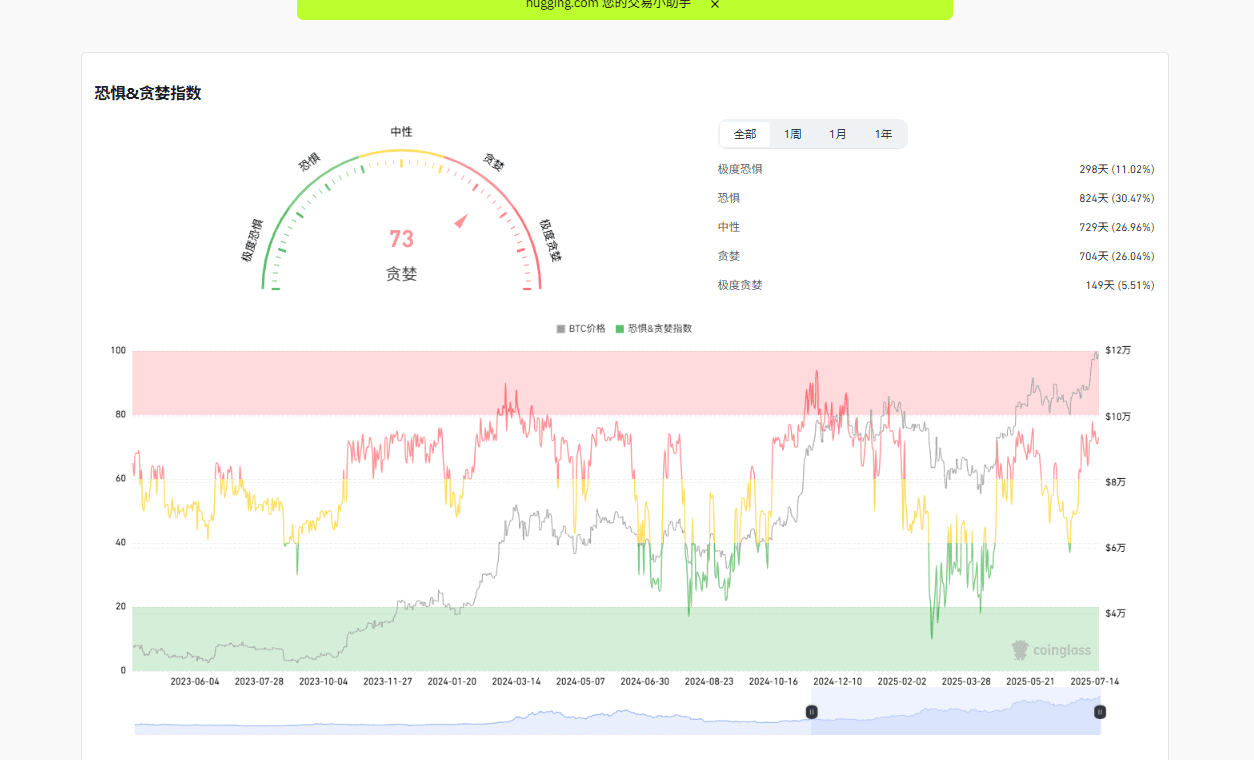

Market Sentiment:

The multi-platform greed/fear index has risen to 73, indicating that market sentiment is still in a clearly 'greedy' range. I personally judge that the current risk preference is relatively high, but short-term chasing is not cost-effective.

At the same time, ETH's rise has not yet driven the entire market to synchronize volume, and market leaders still have a wait-and-see attitude.

Review of the overall market:

After BTC led the entire market to break out, due to the lack of new positive macro factors (such as no substantial progress on ETF), combined with technical overbought conditions, the price has oscillated and retraced at high levels. Meanwhile, ETH has strengthened against the trend due to L2 ecology, protocol upgrades, and capital inflow narratives.

It is worth noting: Recently, both Circle (the parent company of USDC) and Tether (the parent company of USDT) have released plans to restart large-scale issuance on the Solana chain and ERC20 chain, regarded by the market as a 'liquidity injection signal.'

This increase may become a turning point for pushing the next phase of the market, especially potentially benefiting the altcoin sector, and a supplementary rally may soon unfold.

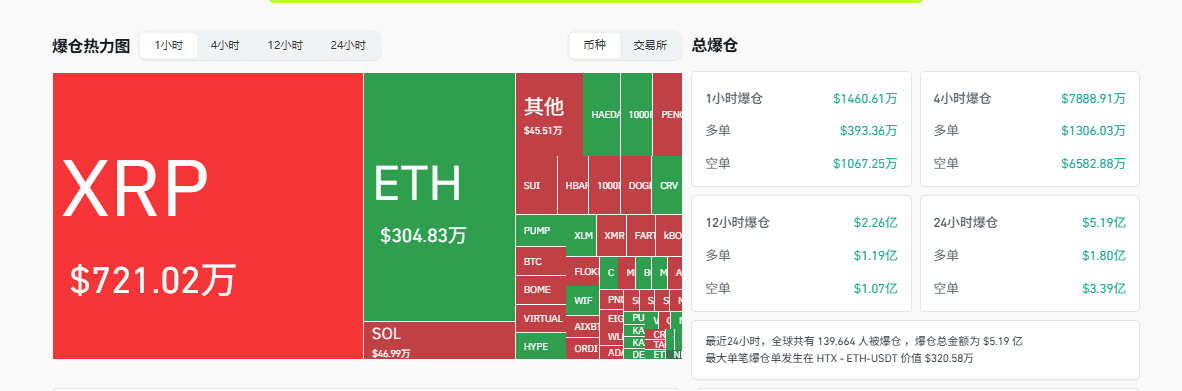

Market Sentiment & Liquidation Data:

Multi-platform Greed/Fear Index: 73, up 2 points from yesterday, sentiment is hot

Recent 24-hour liquidation data: 138975 people, total liquidation amount reached 506 million dollars

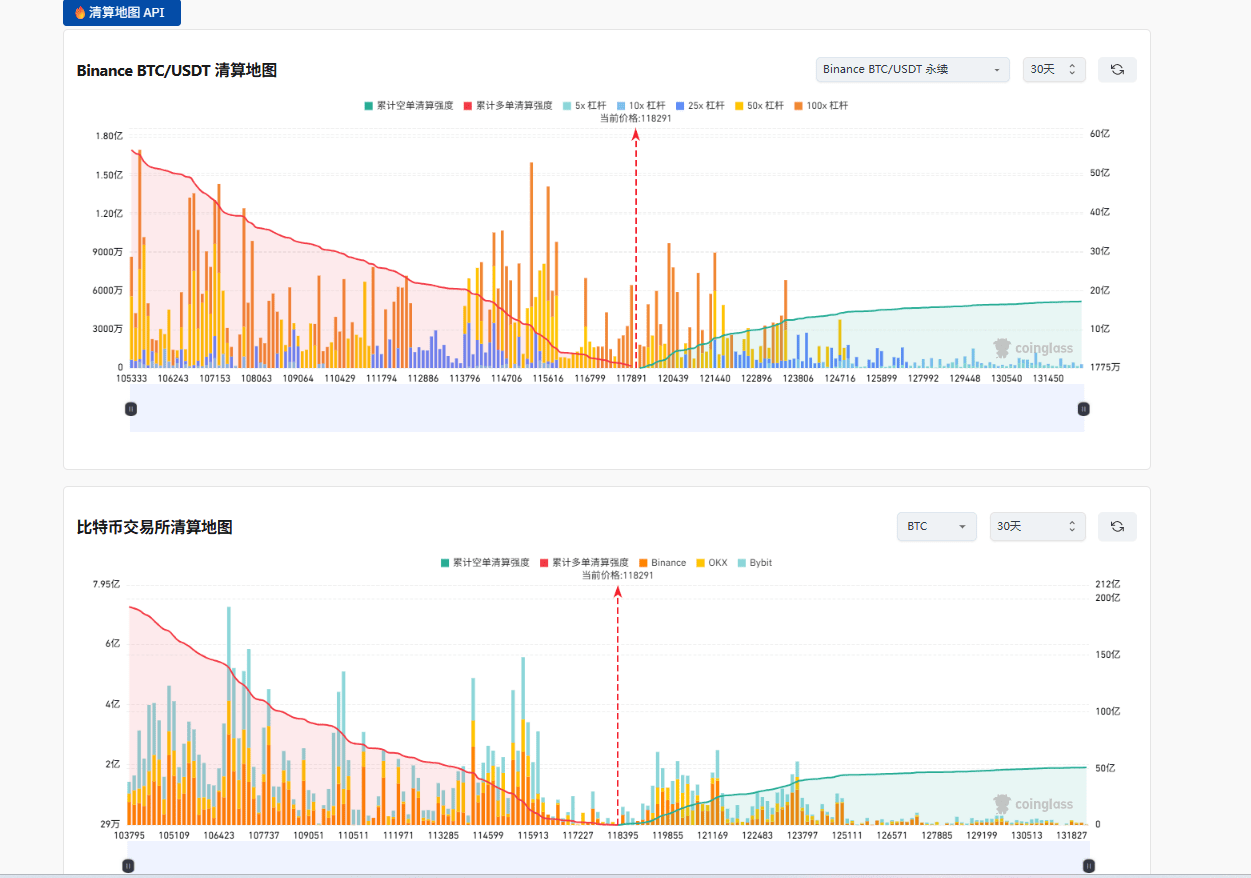

Liquidation structure: In the past 30 days, the long liquidation intensity was 19.264 billion dollars, with short cumulative liquidations at 5.124 billion dollars, indicating that there is a bias towards chasing high positions during the rise, and pullback pressure may intensify at any time.

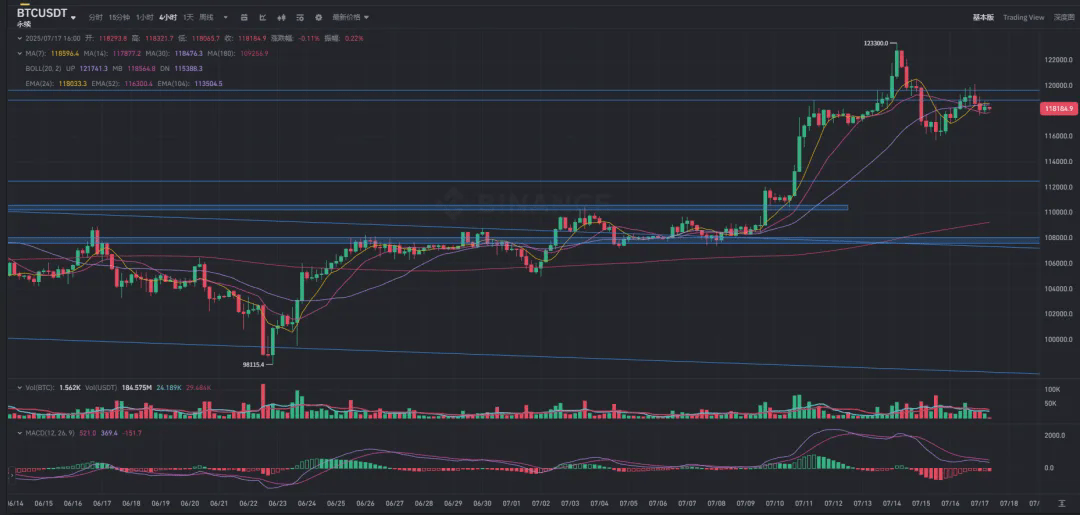

BTC Trend Breakdown (4-hour chart)

Support Level:

First Support: 116700–117000 (BOL bottom divergence recovery structure)

Second Support: 114300–114000 (last pullback low + BOLL channel bottom), if this level is broken, it will test the lower edge of the phase channel

Resistance Level:

First Resistance: 118800–119200 (box top + previous high), short-term bullish touchstone

The (starting point of the last major decline), a volume breakthrough may lead to a trend attack

Operation Suggestion (BTC):

Maintain 'oscillation biased down' operation rhythm:

If the rebound reaches the 118800–119200 area without breaking, consider light shorting, with a stop-loss suggested above 121000

If it stabilizes around 116700 on the pullback, observe whether it forms a low absorption structure; if it breaks down, wait for confirmation around 114000 for low absorption

Under high-level oscillation stagnation structure, it is not advisable to blindly chase long positions

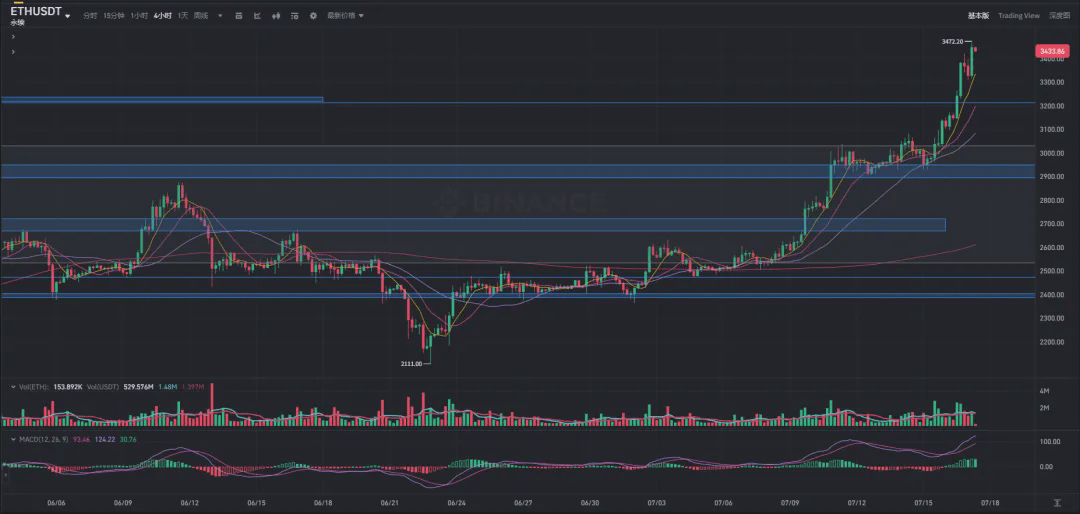

ETH Trend Structure (4-hour chart)

Support Level:

First Support: 3320–3270 (box top + pullback confirmation area), I will pay close attention to whether it forms a pullback confirmation

Second Support: 3210–3170 (previous platform high + EMA52 support), if it holds without breaking, the expectation of continued major rise will be strengthened

Resistance Level:

First Resistance: 3520 (previous high of the phase), a key threshold for further volume

Second Resistance: 3570–3730 (early 2024 sideways dense area + congested), be cautious of a pullback after reaching this level

Operation Suggestion (ETH):

ETH is currently in a major upward rhythm, I suggest maintaining a 'wait and see' operation strategy:

If the price stabilizes at the 3270–3210 range on the pullback, the target will be set first at this level

If the price lingers near 3520, consider small shorting to bet on a short-term pullback, with a stop-loss placed above 3570

Focus on the altcoin sector

Focus more on several sectors in the altcoin direction

AI + L2 integration track (such as FET, GRT, AR)

AI remains the most active narrative, especially with clear signs of capital inflow in the ETH ecology, market expectations for the next main line will revolve around 'AI × Ethereum'

Modular track (TIA, DYM, etc.)

With Celestia stably building a bottom, if DYM pulls back without breaking, modular projects are starting to construct a phased bottom structure, I will pay attention to whether they will first break through with volume

SOL ecology + stablecoin expectation sector (JUP, WIF, PYTH)

Affected by U

Hot rotation projects (POL, OP, ARB, LINK, INJ)

Community consensus and narrative continuity are strong, suitable for timing games combined with TOTAL3 strong breakout

Pay more attention to the MEME sector

DOGE WIF BONK FLOKI

Summary and Operation Suggestions:

BTC maintains box oscillation structure, leaning towards oscillation high short + bottom games

ETH continues the strong rhythm, I maintain a bullish strategy

USDC/USDT

Focus on SOL ecology, AI concepts, and modular sectors in the altcoin space, participating in batches in conjunction with rotation rhythm

Overall strategy remains: light positions to control risk, waiting for key structural breakthroughs before heavy involvement