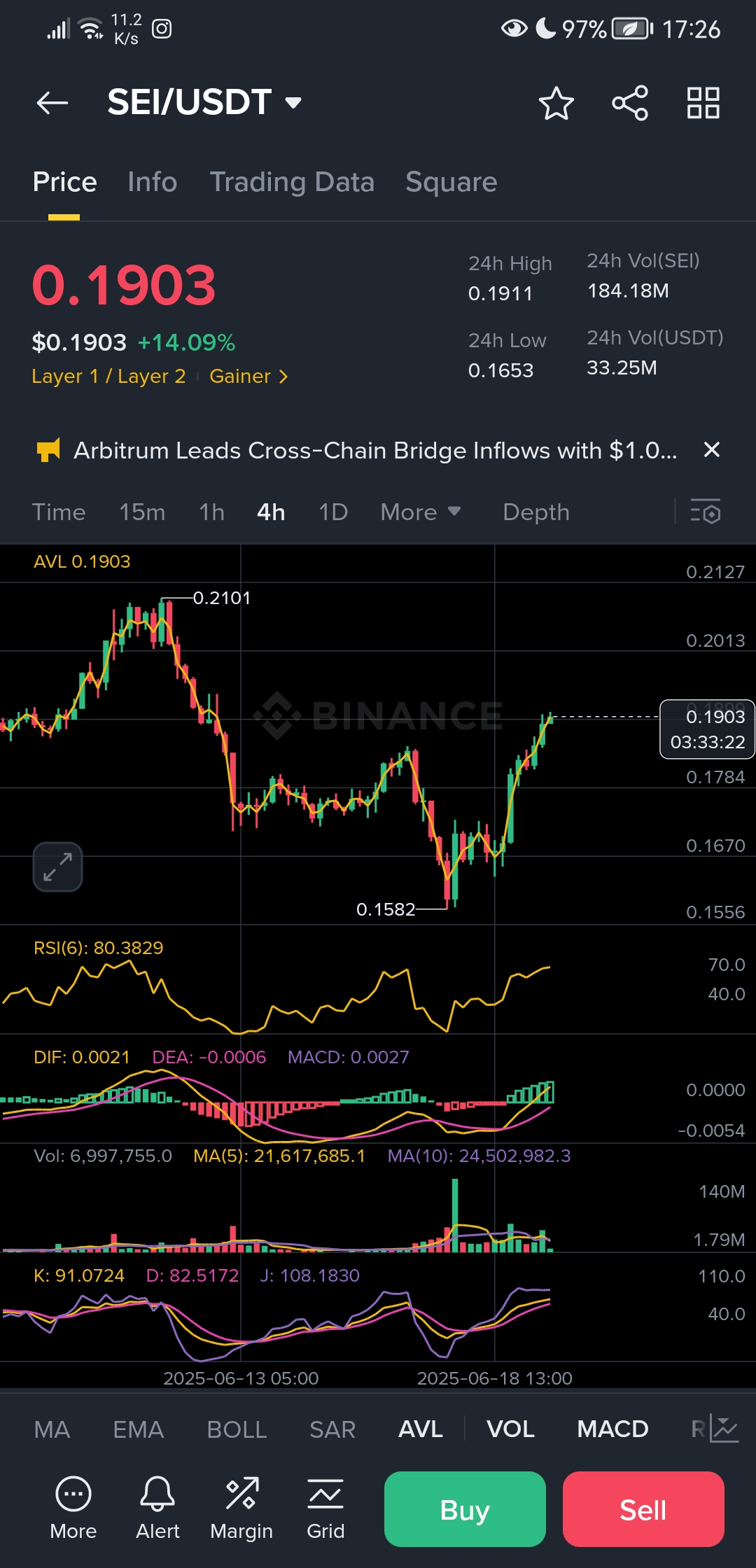

The currency $SEI is currently trading at 0.1903 with a strong increase of +14.09% over the last 24 hours, reaching a daily high of 0.1911 after a sharp rebound from the low of 0.1582.

So, are we witnessing the beginning of a new upward wave? Or is this just a trap for buyers? Let's analyze together. 👇

---

📊 Technical indicators say:

🔸 RSI at 80.38 – indicates clear overbought conditions, suggesting that the currency may be close to a temporary correction or a pause.

🔸 MACD shows a positive crossover, but the difference between DIF and DEA is still narrow, which means momentum has not yet exploded strongly.

🔸 Stochastic K/D is also in overbought areas (K at 91, D at 82), supporting the idea of a potential correction or temporary cooling.

🔸 Volume recorded a clear jump in the last candles, indicating strong liquidity entering – a very important signal in cases of breakout or the beginning of a trend.

---

⚖️ Is buying now a smart decision?

✅ Opportunity if:

Masters quick entry and quick exit (Scalping).

I placed a stop loss below 0.1780.

Targeted an initial profit at 0.2010 then 0.2100 as a main resistance.

$SEI

❌ Risk if:

I just entered hoping for continued rise without waiting for a correction.

Ignored high overbought indicators.

The general market for currencies is in a state of fluctuation or liquidity weakness.

---

🧠 The final word:

The currency $SEI showed remarkable strength and a clear breakout, but indicators warn of overbought conditions. The current movement could be a "first surge" before a temporary correction, or the beginning of a completely new trend.

Watch the level of 0.1910–0.2010 closely, as it is a crossroads.

What do you think? Should we wait for a breakout confirmation? Or was the rise just a false bounce? Share your opinion 👇