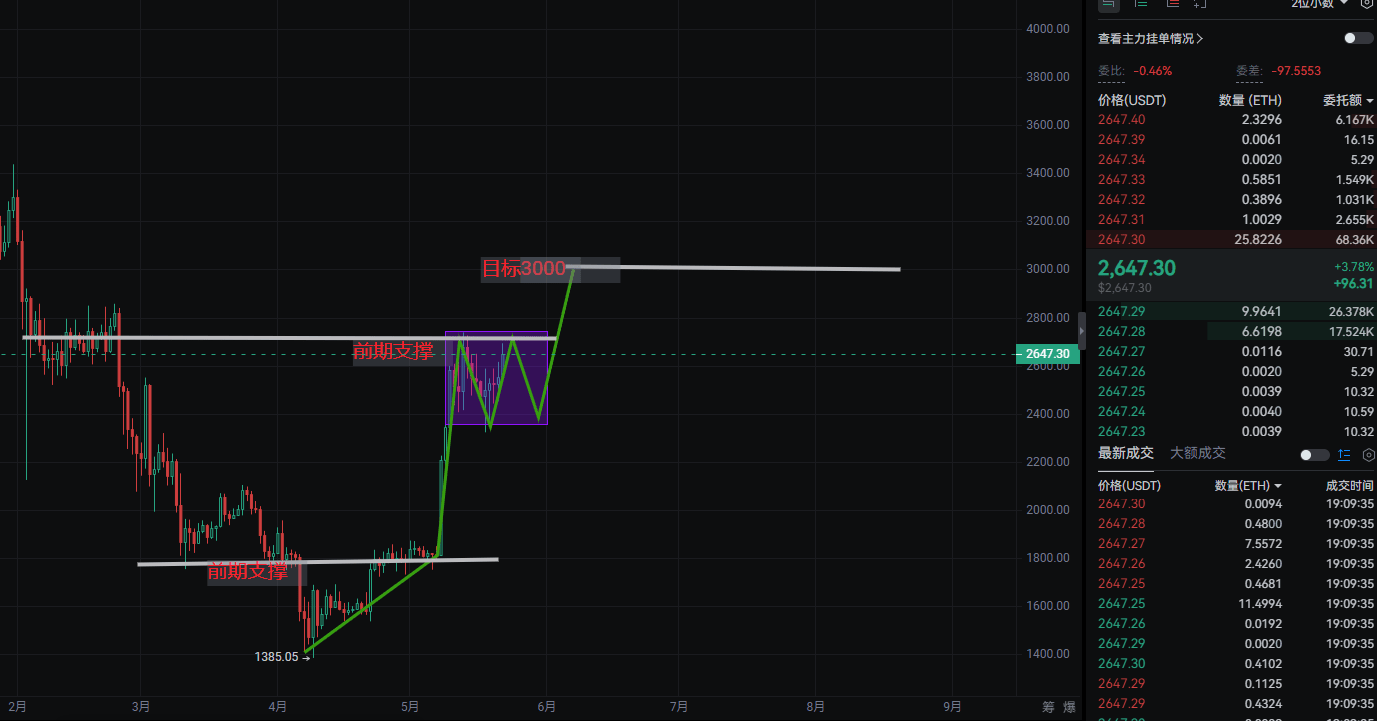

I. Current price structure and key resistance levels.

Technical triple verification:

Weekly trend line breakthrough: ETH has broken the descending trend line since November 2022 after forming a double bottom structure at $2,150 (now turned support).

Fibonacci cluster pressure: The 2,800−2,900 range accumulates the 1.618 extension point (2,834) and historical trading volume node ($2,877).

Implied volatility anomaly:

Deribit options market shows a 320% surge in open interest for call options with a strike price of $2,800 over 7 days.

Long-short battle zone monitoring:

CME Ethereum futures form a $120 million short position at $2,750.

Binance perpetual contract funding rate remains at 0.03%-0.05% (neutral to bullish).

II. Fundamental accelerators and delays.

Bullish catalysts:

Countdown to Cancun upgrade (expected to land in Q1 2024).

Proto-danksharding technology reduces Layer 2 gas fees by 80%.

Post-upgrade network annual burn amount estimated to increase to 2.6 million ETH (current circulating supply 1.2%).

Institutional positioning undercurrents.

Daily trading volume of US Ethereum futures ETF exceeds $800 million (Bitwise data).

Coinbase custody account ETH staking amount increased by 37% month-on-month (breaking 9.2 million).

Potential risk points:

SEC's determination of ETH as a security remains undecided (final resolution expected in May 2024).

Liquid staking derivatives like Lido face regulatory scrutiny (accounting for 34% of total staking).

III. On-chain data perspective.

Whale behavior decoding:

Addresses holding >10,000 ETH have increased their holdings by 960,000 over 30 days (Glassnode).

Exchange ETH balance drops to 14.3% (lowest since 2020).

Miner/staker dynamics:

After the merger, miners' selling pressure disappears, and the new supply decreases by 98% year-on-year.

After the Shanghai upgrade, the net withdrawal amount is -216,000 ETH (continuing deflation).

IV. Multi-dimensional time prediction model.

Scenario simulation:

Probability expectation time window for driving factor combinations: Cancun upgrade + interest rate cut expectation 65% in 2024.

In March-April of the year, only technical breakthroughs reach 45%, with a 12% regulatory black swan outbreak projected for Q2 2024 and 2025.

Post.

On-chain cycle indicators:

Current MVRV-Z Score is 1.8, with 45% room to the overbought threshold (3.2).

Exchange net flow indicators show a main force accumulation period lasting 17 weeks (historical median 21).

Weekly)

$ETH #比特币突破11万美元 #币安Alpha上新 #我的EOS交易