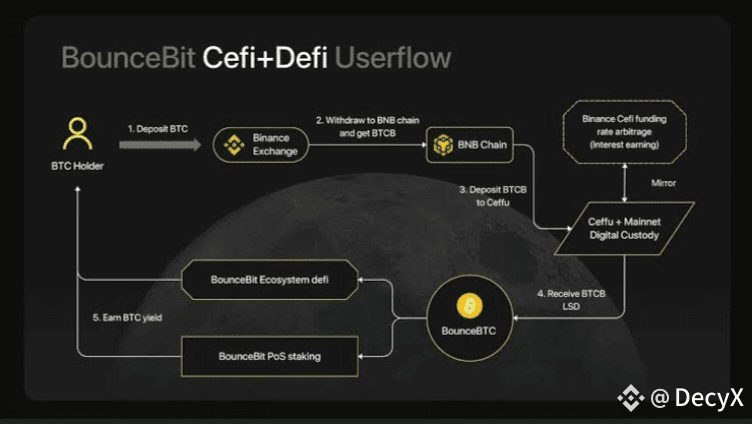

DeFi long enough to spot the next big infrastructure pivot-not just hype. BounceBit ($BB ) is exactly that: a smart, dual-token PoS Layer-1 that makes Bitcoin productive again. It blends a CeFi+DeFi yield approach with restaking mechanics, full EVM compatibility, and regulated custody, turning idle Bitcoin into dynamic yield-generating collateral.

What BounceBit Does

BounceBit is pioneering Bitcoin restaking, which means BTC holders can now stake their coins in a Proof-of-Stake network while retaining asset utility. It uses a dual-token system-native token BB and BBTC (staked BTC)-to secure validators and provide liquidity. Stake, earn, restake across dApps, bridges, real-world assets-all while keeping trophies in custody.

Why This Is Important

Bitcoin has long been a passive store of value-safe, stable, but idle. BounceBit changes that by making it DeFi-ready. With both CeFi-grade yield (via regulated partners like Ceffu and Mainnet Digital) and DeFi features (like LST restaking and EVM dApps), it unlocks layers of income potential without sacrificing security. That’s a breakthrough for BTC utility.

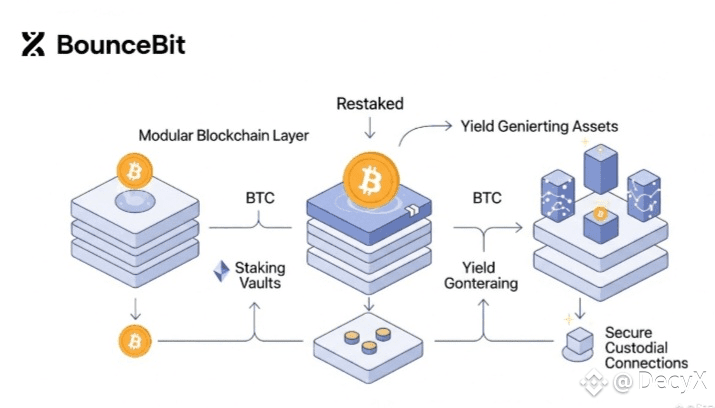

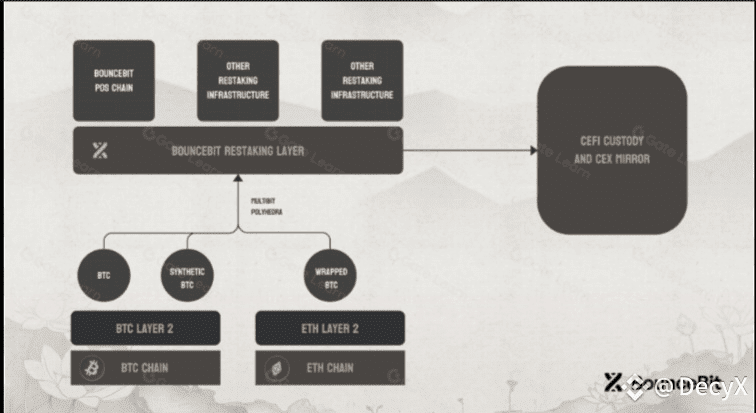

Core Architecture

EVM-Compatible PoS Chain: Developers can use Solidity tools while BTC backs consensus.

Dual-Token Security: Validators stake both BB and BBTC, separating staking from management.

Liquid Staking Tokens (LSTs): Users receive stBB or stBBTC, letting them restake or provide liquidity.

Shared Security Clients (SSCs): This infrastructure enables new sidechains, oracle networks, and modular modules secured by staked BTC.

Tokenomics & Ecosystem Signals

Max Supply: 2.1 billion BB (a nod to Bitcoin's 21M cap).

Circulating Supply: Roughly 19–20% at launch; includes a Binance Megadrop (~8% of total supply).

Funding: Raised $8M in seed rounds; strong backers include major VCs.

These indicate a well-structured launch and potential for scalable adoption if demand for Bitcoin restaking grows.

Recent Developments

Mainnet Launched: Official launch on May 13, 2024, accompanied by an airdrop for early participants and TVL breaking $550M.

CeDeFi Milestones: The first BTC restaking chain with a mix of yield sstrategie-staking, arbitrage, and traditional DeFi.

Utility Momentum: Users can engage via CeFi yield programs or DeFi restaking and liquidity methods-making Bitcoin deeper than just a “digital gold.”

Risks to Watch

Security of bridges and restaking logic-only secure if protocols and custody are bulletproof.

Validator centralization could undermine trust.

Token inflation or unlock events may pressure price.

Long-term adoption depends on usage, not novelty.

Conclusion

Bitcoin has long been trapped in “store of value” mode. BounceBit gives it restaking-powered utility, blending DeFi and CeFi features in a thoughtful, infrastructure-first way. It's part of the next modular, multi-chain finance frontier and deserves a place in any serious crypto developer or investor’s roadmap.

@BounceBit #BounceBitPrime #creatorpad $BB