Crypto Market Overview – Dec 30, 2025 ‼️

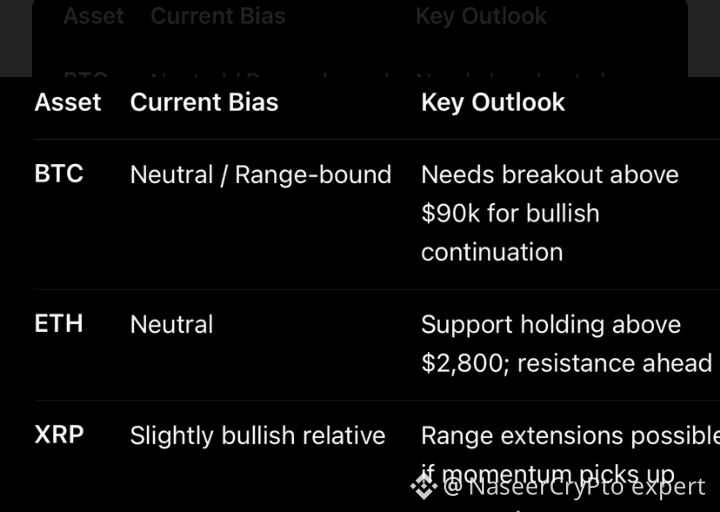

The broader crypto market is trading with thin liquidity and muted volumes, typical for year-end sessions. While Bitcoin and major altcoins briefly saw strength earlier this week, price action has since reverted lower amid subdued trading and profit-taking, leaving markets range-bound and sentiment mixed. Recent data shows total market capitalization around $3.04 Tn, with Bitcoin dominance near 57% and strong participation from other large caps like XRP ledgers.

Mixed macro drivers — including holiday liquidity drying up and cross-asset volatility continue to cap directional conviction across the board.

📉 BTC – Range-Bound with Macro Headwinds

BTCUSDT

Perp

87,012.2

-2.32%

• Price action: Bitcoin has struggled to hold above the psychological $90,000 area and currently trades closer to the $87k zone, with intraday volatility evident as buyers/sellers battle over support and resistance.

• Drivers: Thin liquidity, profit-taking, and year-end tax positioning are contributing to sideways movement. There’s ongoing institutional interest in BTC accumulation, which has historically underpinned resilience even amid declines.

• Technical: Short-term momentum is modestly bearish, but BTC remains above key structural support — a break below could increase range expansion toward lower levels.

• Outlook: Neutral-to-cautious — consolidation likely continues ahead of 2026 catalysts (regulatory clarity, macro shifts).

Key Levels to Watch:

📍 Support: ~$85,000 – $87,000

📍 Resistance: ~$90,000 – $92,000

⚙️ ETH – Stabilizing but Facing Resistance

ETHUSDT

Perp

2,928.11

-2.39%

• Current behavior: Ethereum is trading around $2,900–$3,000 amid mixed sentiment. While recovering above $3,000 has been constructive, ETH still faces resistance in that zone short-term.

• Positive catalysts: Recent validator metrics are signaling strong staking interest and a potential return of structural upside, fueling bullish forecasts that see ETH revisiting higher price bands longer term.

• Technical sentiment: A close above $3,100–$3,200 could be a springboard for broader recovery; failing to reclaim that may see ETH drift sideways.

Key Levels to Watch:

📍 Support: ~$2,800 – $2,900

📍 Resistance: ~$3,100 – $3,300

🔁 XRP – Outperforming Relative to BTC/ETH

XRPUSDT

Perp

1.8471

-2.28%

• Performance snapshot: XRP continues to show relative strength compared to the broader market, trading near $1.85–$1.90 — outperforming BTC and ETH in percentage terms on low volumes.

• Technical outlook: Price forecasts for late December suggest tight trading ranges near current levels, with the possibility of a slightly higher average price if buyer support persists.

• Market interest: XRP’s lower beta compared to BTC during sideways conditions has attracted attention from traders seeking alternatives when BTC dominance climbs.

Key Levels to Watch:

📍 Support: ~$1.75 – $1.80

📍 Resistance: ~$1.90 – $1.95

📌 Sentiment & What’s Next

Short-term:

• The market is in consolidation mode, with holiday liquidity thin and traders reluctant to take big directional bets.

• Bitcoin’s lack of a clear breakout leaves major altcoins tethered to Bitcoin’s price action.

Medium-term catalysts to monitor:

• Macro sentiment shifts and liquidity conditions as we enter 2026.

• Potential institutional flows and ETF dynamics rebounding after year-end.

• Ethereum staking dynamics and validator behavior.

• Broader adoption or regulatory clarity across major jurisdictions.

🧠 Summary