Only need one month! In February 2025, I used 5000 in a small account, and by this March, I made 100,000!

My cryptocurrency trading method is very simple! Let me share an executable plan. If you can carry it out, earning 1 million from 1000 is achievable.

Divided into two phases:

Phase One: Use 1000 to quickly accumulate and earn 100,000 through contract rolling! (It takes about 1 to 3 months)

In the crypto circle, 1000 is about 140 USD!

Optimal solution strategy recommendation: Contract

Each time use 30 USD, gamble on trending coins, ensure profit-taking and stop-loss +100 to 200, 200 to 400, 400 to 800. Remember to do this at most three times! Because in the crypto circle, a bit of luck is needed; each time you go all in like this, it's easy to win 9 times and lose once! If you pass three rounds with 100, then the principal will become 1100 USD!

It is recommended to use a triple strategy at this time

I do two types of orders a day, ultra-short orders and strategic orders. If the opportunity comes, I will buy trend orders. Ultra-short orders are used for quick attacks and quick attacks. The advantages of doing it at the 15-minute level are: high returns. Disadvantages: high risks. I only do it at the big cake concubine level.

The second type of order is the strategy order, which is to use a small position, such as 10 times 15u, to do a contract at the four-hour level, save the profit, and make a fixed investment every week.

The third type is mid- to long-term trend trading. When you see the trend, go directly to the advantage: make more money, find the right point and set a relatively cost-effective profit and loss ratio

This method is also one I have personally tested: from February to March 2025, in just one month, I made 100,000 yuan from 5,000 yuan! The profit ratio reached 2108.17%!

How did I turn 5,000 yuan into 1 million yuan by speculating in cryptocurrencies? Let me tell you something real! See how I made over 30 million yuan in 10 years! $BTC

The key is this: maximize your profits through futures trading! But don't rush into it. First, convert your 2,000 yuan into 300 U (approximately $300 USD). Let's do it in two steps:

Step 1: Snowball with a small amount of capital (300U 1100U)

Every time you take out 100U to play, pick the most popular coins. Remember two things:

① Run away when you double your profit (e.g. stop immediately when 100 becomes 200) ② Cut your losses when you lose 50U. If you are lucky, you can win 3 times in a row and get 800U

(100-200~400~800). But know when to quit! Play three rounds at most, and stop when you've earned around 1100U. This stage relies heavily on luck, so don't be greedy!

Step 2: When you have more money, you can start a combo (starting from 1100U)

At this time, use three different strategies to play the money:

1. Fast-in, fast-out type (100U)

I specialize in 15-minute fluctuations in stablecoins like Bitcoin and Ethereum. For example, if I see Bitcoin suddenly rise in the afternoon, I'll immediately follow the trend, make a profit of 3%-5%, and then run away, just like setting up a street stall, with small profits and high sales.

2. Buddhist fixed investment type (15U per week)

Use 15U a week to buy Bitcoin contracts (for example, if it's $50,000 now, and you think it can go up to $100,000 in the long run). Just use it as a piggy bank, so if it drops, don't panic. Wait for six months or a year. This is suitable for people who don't have time to watch the market.

3. The main trend order (all-in)

Expect a big market move and act aggressively! For example, if you notice the Federal Reserve is about to cut interest rates, Bitcoin could surge, so open a long position immediately. But be sure to plan ahead: how much profit you'll run with (like doubling your profits) and how much loss you'll accept (up to 20%). This strategy requires reading the news and understanding technical analysis; newbies shouldn't rush into it!

Important reminder:

① Deposit a maximum of 1/10 of your principal each time. Don’t go all in! ② Set a stop-loss for each order!

③ Play a maximum of three orders per day, and play games when you feel like it. ④ Withdraw cash when you reach your target profit, don't think about "making another wave"! Remember: those who use this method to make a comeback are ruthless people. They are ruthless to others and even more ruthless to themselves!

I made 60 million in five years of cryptocurrency trading, and every penny was a lesson learned through blood and tears!

Someone asked me, "Can you really make money trading cryptocurrencies?" I've spent five years proving the answer: Yes! But the prerequisite is that you understand the rules. Today, I'd like to share some valuable tips. These experiences are worth $60 million, and I hope they can help you.

Three iron laws of cryptocurrency trading, remember them!

1. Never chase high prices. Stay calm when the market is in FOMO.

When others are scrambling to buy, you should hold steady and quietly buy in when the market panics and falls. Smart people always ambush at low prices, not buy at high prices.

2. Be flexible in your operations and don’t let heavy positions tie you down

The cryptocurrency market is changing rapidly. Don't put all your bets on one opportunity. Leave yourself room for adjustment. There is always more than one opportunity.

3. A full warehouse is a sign of being a leek

Holding a full position blocks your retreat and carries enormous risks. There are countless opportunities in the market, so diversifying your positions is the only way to be responsible for your own funds.

A few key tips, if you do them well, you can make steady money!

•Don’t act rashly if the price of the currency remains sideways

Many people can't wait for the loneliness of sideways trading, and end up losing money as soon as they trade. Sideways trading is the most challenging period for patience, and only by staying calm can you hold on to your profits.

• Pay special attention to key areas

If the price of a currency is consolidating at a high or low level for a long time, it is often the prelude to a big market. Don't be anxious at this time, wait for the opportunity to come.

• Build positions steadily and steadily, like building a pyramid

Don't try to eat everything at once. Enter the market in batches and increase your investment layer by layer. This can not only spread the risk but also make your mentality more stable.

• Adjust strategies when the market goes up or down

Don't buy heavily when the market is high, and don't blindly copy when the market is low. The market is changing, you must follow the rhythm and don't let your emotions control you.

Where are the next opportunities?

When the next pullback comes, I'll lead everyone in bottom-fishing and seizing the opportunity to double their money. In this bull market, we're not just watching, we're acting!

If you want to make money, don’t be a lone wolf! Follow me, tell me your thoughts in the comments, and let’s seize the huge profit opportunities in the bull market together!

I've used 80% of the market's methods and techniques, and today I'll share with you the most practical one I've ever used: the Pinbar strategy, which works every time! It's a proven method that can generate 30% profit in a month.

Moving averages are one of the most popular technical indicators in the financial markets due to their simple calculations and their ability to guide trends. Besides identifying trends, can we use moving averages for other trading purposes?

The answer is yes! Joseph Granville, a renowned American expert in volume and price analysis, proposed the "Eight Rules" based on moving averages. Using principles such as divergence and moving average crossovers, he constructed a moving average trading system. These "Eight Rules" have become a highly regarded investment strategy in the field of technical analysis, and they fully demonstrate the core principles of Dow Theory.

Let's first get to know Granville. In addition to developing Granville's eight laws, he was also the originator of the moving average and the first person to propose the "volume-price theory." On January 6, 1981, Granville warned investors of an impending stock market crash and recommended selling all stocks. Sure enough, the Dow Jones Industrial Average fell 4.2% the next day, and over the following year, it continued to decline by 14%. This accurate prediction catapulted Granville to fame in the investment world.

Granville's Eight Laws posit that price fluctuations follow a pattern, with moving averages representing the direction of the trend. Therefore, when price fluctuations deviate from the trend—that is, when prices deviate from the moving average—then a correction in the direction of the trend is likely. Therefore, such deviations are significant buy and sell signals.

The deviation of price from its moving average is called the bias. Bias = Price - MA, where Price is the price and MA is the moving average. A larger bias indicates a higher likelihood of a price correction. However, if the trend is accelerating, the bias can be expected to widen. Therefore, bias is an important indicator to monitor.

Granville's Eight Rules use the relationship between price (stock price, futures price, or exchange rate) and moving averages as the basis for buy and sell signals. Key strategies include support, resistance, breakout, divergence, and false breakouts, providing investors with a reference for their trading strategies.

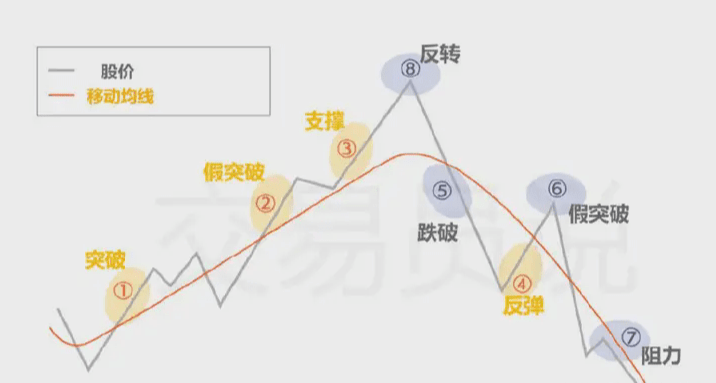

Granville believed that stock price fluctuations follow certain patterns, and that moving averages represent the direction of the trend. Granville's eight rules summarize eight different situations as the basis for entry and exit:

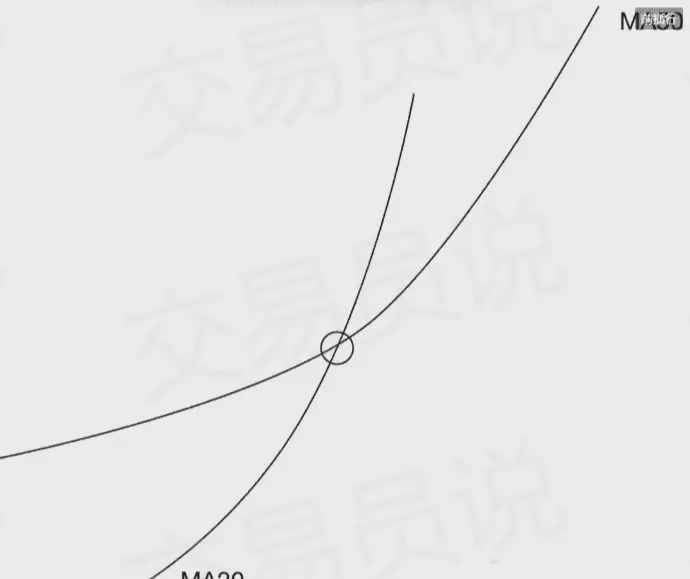

① Breakthrough: When the moving average gradually changes from a downward trend to horizontal consolidation or an upward trend, and the stock price breaks through the moving average from below the moving average, it can be regarded as a buy signal.

② False breakthrough: The stock price falls below the moving average, but then rebounds above the moving average, and the moving average is still showing an upward trend, which can be regarded as a buy signal.

③ Support: When the stock price trend is above the moving average, although the stock price corrects and falls but does not fall below the moving average and rebounds again, it can be regarded as a buy signal.

④ Rebound: When the stock price plummets, not only falling below the moving average, but even deviating far below the moving average, and the stock price begins to rebound and rise towards the moving average again, it can be regarded as a buy signal.

⑤ Breaking down: When the moving average changes from an upward trend to a horizontal line or shows a downward trend, and the stock price falls below the moving average from above the moving average, it can be regarded as a sell signal.

⑥ False breakthrough: When the stock price rebounds and breaks through the moving average, it immediately reverses and falls below the moving average, and the moving average still shows a downward trend at this time, which can be regarded as a sell signal.

⑦ Resistance (counter pressure): When the stock price continues to move below the moving average, even if the stock price rebounds, it cannot break through the moving average. At this time, the moving average becomes resistance to the stock price and can be regarded as a sell signal.

⑧ Reversal: When the stock price rises sharply and deviates far above the moving average, and then the stock price reverses and falls so that the stock price tends to the moving average, it can be regarded as a sell signal.

◔ The four core principles of Granville's eight principles

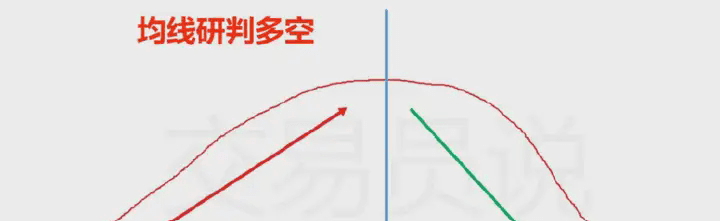

1. It is not advisable to short when the moving average is rising, and it is not advisable to go long when the moving average is falling.

2. The moving average itself has characteristics such as support and resistance, and boosting and depreciating prices, so it is conducive to long and short analysis.

3. The bullish and bearish price arrangements are a combination of price and moving average. Once the arrangement trend reverses, it is necessary to change the strategy and perform reverse operations.

4. The golden cross and death cross of the moving average are the intersection of previous price costs. Once the intersection occurs, it can often cause the price to form an upward or downward trend and bring opportunities for trend-following operations.

◔ Four major application flaws of Granville's eight rules

1. Since the Granville Principle relies heavily on moving averages, which are historical price trends, the occurrence of signals often lags behind prices, resulting in a time lag.

2. False signals usually occur when prices are in a sideways trend.

3. When choosing a moving average with a shorter period, such as 5 or 10 days, the time difference of the signal will be smaller, but there will be more false signals.

4. When choosing a moving average with a longer period, such as 120 days or 200 days, the signals obtained will be more significant and effective, but there will be a time gap. For example, the buy or sell signal will not appear until the price has risen or fallen for a short period of time.

◔ Granville's Eight Laws Parameter Settings

As mentioned earlier, shorter-period moving averages (such as the 10-day moving average) are more sensitive to change than longer-period moving averages. Conversely, longer-period moving averages tend to move more slowly and steadily. Therefore, when the stock price simultaneously breaks through both the long-term and short-term moving averages, it can be considered a short-term reversal buy signal, prompting a buy move. If the price falls below the shorter-period moving average, it can be considered a short-term reversal sell signal, allowing short-term traders to even take short positions.

Therefore, choosing the moving average period is extremely important. Some people will definitely ask: Which parameter is the best? This is a very good question, as it is also a question that every trader is looking for.

Here is a standard answer for you: there is no best and most accurate cycle parameter, only the cycle that suits you best.

Some traders may prefer short-term trading, in which case the moving average period may not be set too long to accommodate the rapid fluctuations required for short-term trading. Alternatively, for swing traders, the moving average period may not be set too short to simply identify the medium-term price trend.

Only by finding the moving average period that matches the commodity you are trading and combining it with your own operating logic and inertia can you ensure the reliability and stability of the buy and sell signals.

Before traders actually start using the eight rules to enter and exit the market based on buy and sell signals, they should first have a certain degree of confidence in the accuracy and winning rate of the results obtained for each commodity and each cycle, so that they can apply them more easily.

◔ Practical application of Granville's eight principles

I believe that after studying the above content, you have understood Granville's eight laws.

Granville's eight rules are highly dependent on moving averages. Therefore, they can be used not only in stocks, but also in futures, gold, crude oil, and foreign exchange markets.

Now let’s look at how Granville’s eight rules apply to trading.

Example 1: Timing to buy in an uptrend

The candlestick chart above shows the daily trend of the Canadian dollar/Japanese yen (CAD/JPY). The orange line represents the 200-day moving average. In the upward trend shown above, traders following Granville's eight rules would be looking for buying opportunities at points ①, ②, and ③, and selling opportunities at point ⑧.

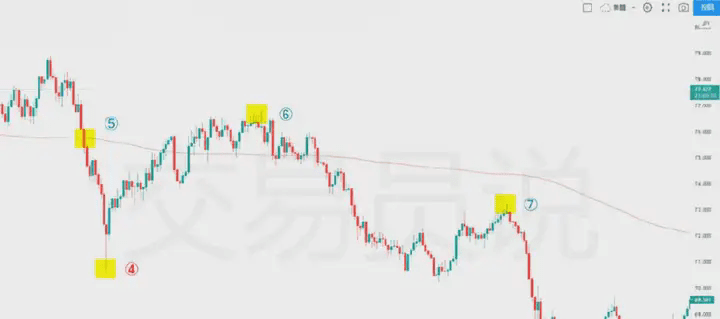

Example 2: Selling opportunity during a downtrend

The candlestick chart above shows the daily trend of the New Zealand Dollar/Japanese Yen (NZD/JPY). The orange line represents the 200-day moving average. In the downtrend shown above, traders following Granville's eight rules would be looking for selling opportunities at points 5, 6, and 7, and buying opportunities at point 4.

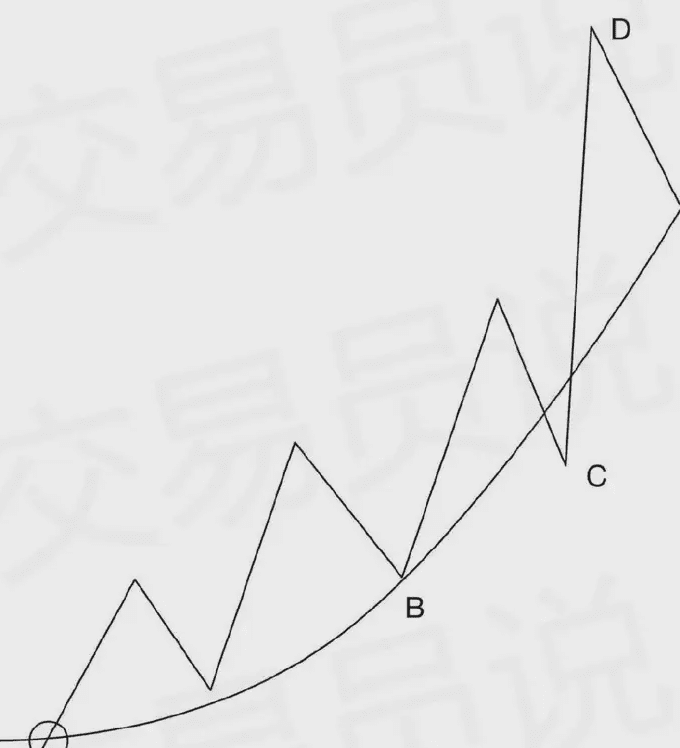

When it comes to moving average systems, it's fair to say that Graham's Eight Principles form the foundation for all subsequent moving average derivative applications. Next, let's take the Four Strategies for Entering a Market Based on a Rising Moving Average as an example. They provide an effective trading strategy for capturing entry opportunities when the market is trending upward.

Mode A: When the price breaks through the moving average, enter the market and go long

Moving averages act as both support and resistance. When prices break above a moving average, it signals a breakout of the previous resistance level, signaling an entry point. However, to mitigate market noise, traders can set conditions to filter out false breakout signals. For example, a long bullish candlestick breaking above a moving average, or two consecutive candlesticks closing above a moving average, can enhance trading accuracy.

There are many derivative trading strategies. For example, you can go long when the short-term moving average crosses above the long-term moving average, or when the price breaks through the outer Bollinger Bands. Alternatively, you can go long when the short-term moving average crosses above the medium-term moving average and the long-term moving average is also trending upward. These strategies all rely on a combination of moving averages and price indicators to identify potential buy signals.

When the moving average is flat and the market lacks a clear trend, the Class A opening mode is likely to lead to frequent entry and exit operations and large capital drawdowns, so it is not easy to be widely accepted by traders.

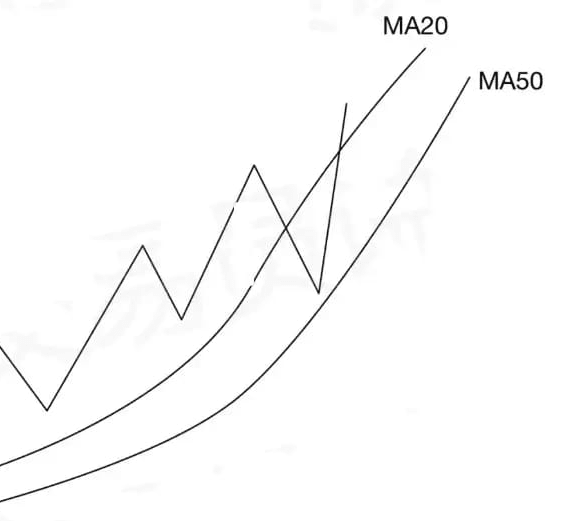

Mode B: After the price pulls back to the moving average and is supported, enter the market and go long

When the main trend is upward, taking advantage of market pullbacks to enter the market at key positions is a typical strategy and one of the more popular trading models in the market.

C mode: After the price falls below the moving average, it is supported. If the price is above the moving average, go long.

Essentially the same as Pattern B, this strategy uses pullbacks to enter the market at key positions based on the upward trend. It is also one of the more popular trading patterns today.

Derivative trading models include double and triple moving average strategies. In these strategies, prices can fall below the short-term moving average but not the long-term moving average.

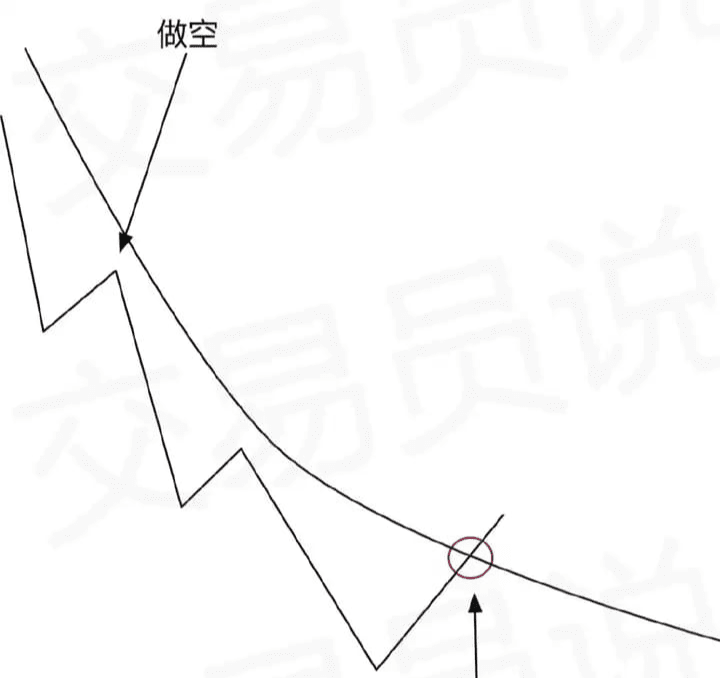

D mode: enter the market to short sell after the price moves away from the moving average quickly

This entry pattern is a counter-trend trade and is not recommended in isolation. Instead of trading directly on the pullback, we should capitalize on volatility within the pullback (such as in patterns B and C). This reduces risk and increases the success rate of your trades.

Trend judgment

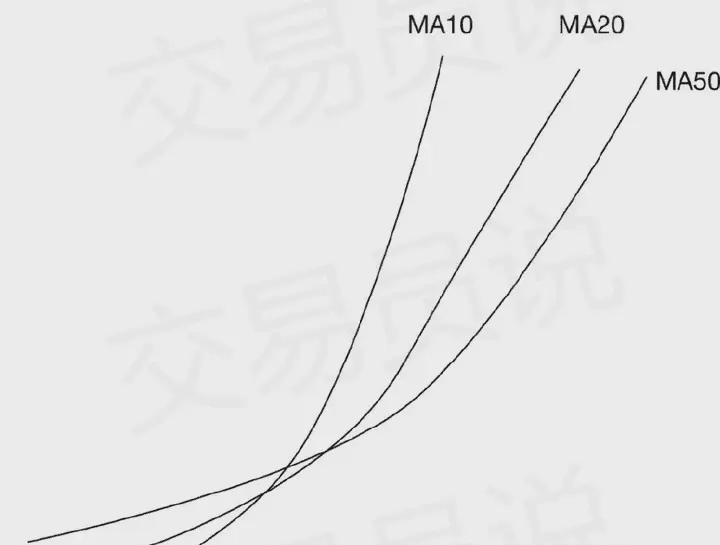

Besides using moving averages for entry in Patterns B and C, the most common use of moving averages is to identify market trends. Its advantages lie in its simplicity and effectiveness, making it applicable to a wide variety of instruments and timeframes. When the moving average is pointing upward, it indicates an upward trend; when it is pointing downward, it indicates a downward trend.

Derivative trading models include dual and triple moving average strategies. In the dual moving average model, if the short-term moving average crosses above the long-term moving average and points upward, it indicates an upward trend; if it does not, it indicates a downward trend. In the triple moving average model, if the short-term moving average is above the medium-term moving average, and the medium-term moving average is above the long-term moving average, and all three are pointing upward, it indicates an upward trend; if they do not, it indicates a downward trend.

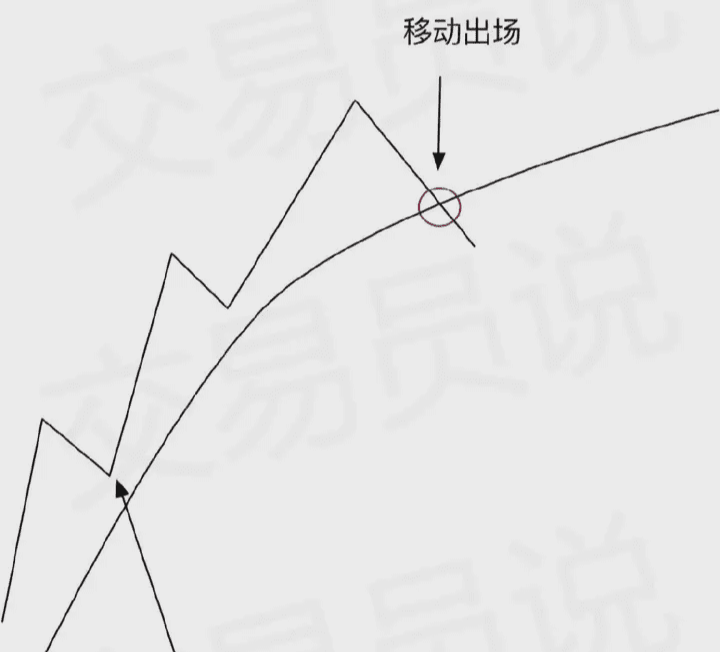

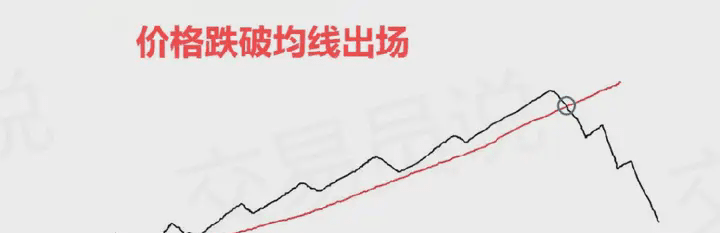

Use moving average to move the stop loss

In Granville's Eight Rules, moving averages can serve as both support and resistance, helping us identify entry points, and as a basis for trailing stop-loss orders. When prices break through a moving average, it usually signals an exit. This is especially true in long trend trades, where a break below a moving average is a clear exit signal.

In a short trend trade, we exit when the price breaks through the moving average.

In practice, we can incorporate other factors to filter out false breakouts. For example, we can require that a candlestick chart must break through a moving average with a long real body, or that the closing prices of two consecutive candlestick charts break through the moving average. Furthermore, the breakout candlestick chart must be accompanied by increased trading volume (applicable to both stocks and futures). We can even use multiple moving averages, setting the exit strategy to occur only after a candlestick chart breaks through multiple moving averages. These methods can effectively improve trading accuracy.

Moving average parameters need to be adjusted based on your individual trading system. In reality, all moving averages are essentially the same. Long-term moving averages are less sensitive to price fluctuations and can capture larger market trends, but this can also eat up significant unrealized profits. Short-term moving averages, on the other hand, are more sensitive and can capture more trends, but excessive trading frequency can affect the overall performance of the system. Therefore, it is crucial to properly set moving average parameters.

Starting from the moving average indicator, we can further explore other technical indicators, such as the outer track of the Bollinger Bands and the parabolic SAR. These indicators can also be used as exit points for moving stop-loss orders, helping us better manage risks and seize trading opportunities.

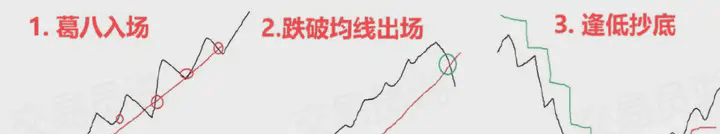

Three uses of moving averages: entering the market with the trend, exiting the market with profit, and bottom fishing against the trend

An advanced use of the moving average is to use it as a moving profit target. For example, if the moving average continues to rise, we can hold our position as long as the price doesn't break below it. Only when the price breaks below the moving average should we consider taking a profit target. This method can help us lock in profits during a trend.

Moving averages have three primary uses. First, enter the market according to Granville's Eight Rules: buy when the price approaches the moving average, or buy when the price rebounds after approaching the moving average. Second, the moving average can be used as a basis for moving profit targets. For example, when going long, exit if the price breaks below the moving average after a period of growth. Finally, the moving average can also be used as a contrarian entry condition. For example, after a period of decline, buy the dip when the price breaks through the moving average; or after a period of growth, short sell if the price breaks below the moving average. This means that the same moving average can have different effects depending on how you think about it in different market environments.

Summarize

Trading systems designed using moving averages as primary indicators typically have lower win rates and higher drawdowns. Therefore, it's recommended that you primarily use moving averages to predict market trends. You can use patterns B and C to determine entry points, but using pattern A and its derivatives is not recommended to avoid potential risks. Also, avoid using pattern D as much as possible. Moving averages can also be used as a trailing stop-loss exit method to help manage risk.

Gannbeck's eight rules have different definitions of moving average parameters. 10MA can be used as a parameter for short-term trading, and 22MA and 65MA can be used as parameters for medium and long-term trading. The moving average is actually the average cost of price holders. Gannbeck's eight rules are the relationship between price and the cost held by most people, and the changes in them are used as the basis for buying and selling.

In addition to freely setting the parameters of the moving average, you can also use the daily, weekly, and monthly moving average periods of the trading software to determine the timing of buying and selling. If you want to use it very accurately, you must choose the appropriate moving average period to apply and operate in conjunction with the wave theory. Only in this way can you accurately grasp price fluctuations.

Follow Aze's steps, believe first and then get, there is still room in the team, lead you out of confusion,

Again, follow the right people to make money, avatar → follow → is your code to get rich