#BinanceSquare In the world of Japanese candlesticks, there are some signals that do not appear often… But when they do, they are like a manual alarm bell in the trader's ear. One of these signals is the Hanging Man candle.

🔍 What is the Hanging Man Candle?

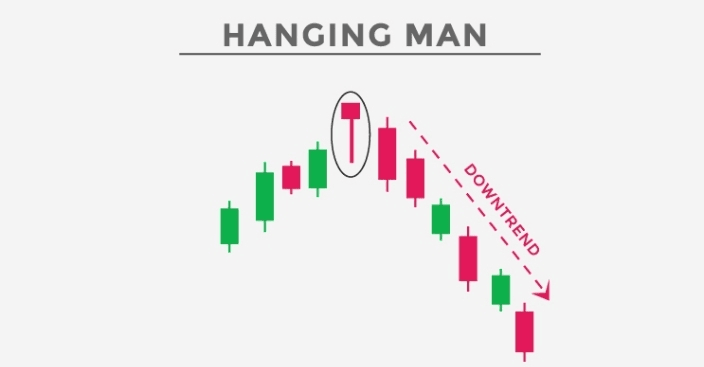

The Hanging Man candle is a bearish reversal pattern that often appears after a strong upward trend.

Characterized by:

A small body (bullish or bearish) at the top.

A long lower shadow at least twice the length of the body.

A short or nonexistent upper shadow.

Its shape suggests that the price tried to drop significantly during the session but closed near the top… However, this failed attempt leaves a clear warning: buyers are starting to weaken.

💡 The Difference Between Hanging Man and Inverted Hammer

The shape may sometimes look similar, but the position in the trend changes the meaning entirely.

Inverted Hammer: Appears after a downtrend and serves as a signal of a potential upward reversal. (We previously explained this in one of our past lessons).

Hanging Man: Appears after an upward trend and serves as a warning of a potential downward reversal.

Element Inverted Hammer Hanging Man

Location After a Downtrend After an Uptrend

Signal Probability of Rise Probability of Fall

Significance Buyers Entering After Fall Sellers Entering After Rise

📈 Live Example from the Market

Imagine a coin like $BTC or $PEPE rising for several consecutive hours, then a candle appears with a small body at the top and a long lower shadow… After that, a strong red candle confirms the reversal.

This scenario often repeats at temporary peaks, especially in smaller time frames (15m, 1h) and also in larger time frames (daily).

🛡️ How to Handle It Professionally?

1. Do not rely on it alone: Wait for confirmation with a bearish candle afterward or a break of a nearby support level.

2. Watch for trading volume: If the trading volume is high when the Hanging Man appears, it is a stronger signal.

3. Combine it with indicators like RSI or MACD to see if the market is in an overbought zone.

⚠️ Common Mistake

Some sell as soon as they see the Hanging Man, and that’s a mistake… It could be just a stop before continuing to rise. Confirmation is key.

🎯 Summary

The Hanging Man candle is not just a pretty shape on the chart… It is a warning from the market that the rise is losing momentum.

As for the inverted hammer, despite its similar shape, its reverse context makes it a message of hope for traders at the end of a downtrend.

The secret to understanding candles is reading the story told by the previous trend.

5. #BinanceFeed