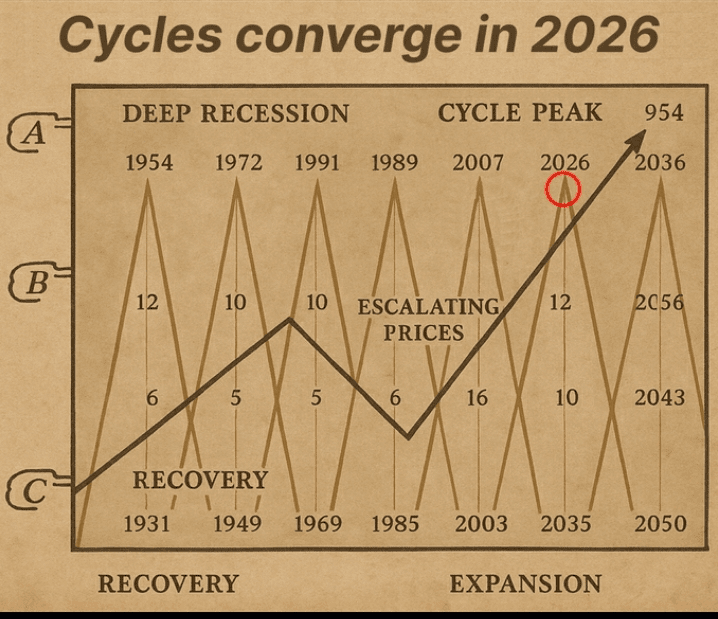

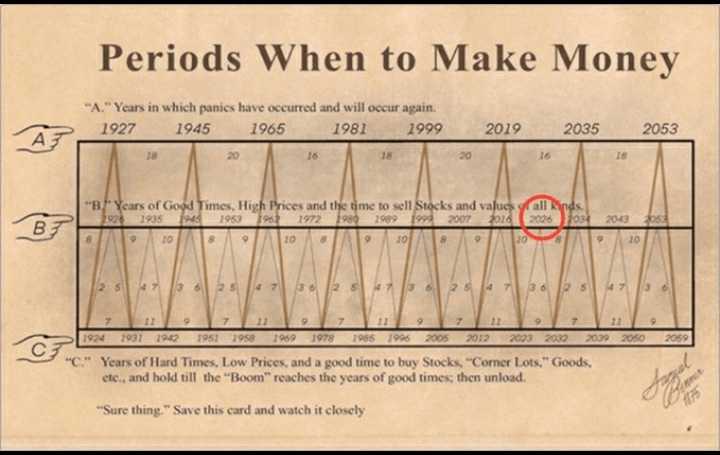

🚨 The peak of the 200-year farmers' chart arrives in 2026

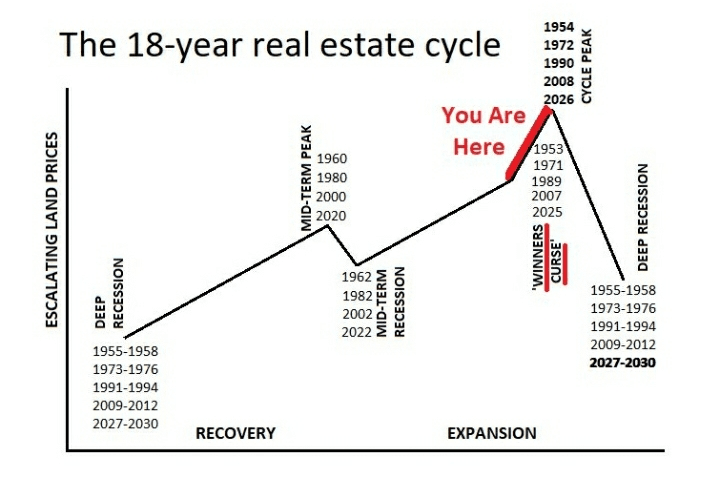

The 18-year real estate cycle shows the same pattern

2026 will be the largest economic cycle in history

Here's what's coming and the list of alternatives I'm buying 👇🧵

1/

Every 18 years, the real estate sector completes a full economic cycle

Peaks are followed by crashes - like clockwork since the 19th century

2007 was the last peak - 2026 is the next peak

And the cycle has never been wrong

2/

Separately, the 200-year 'farmer wealth cycle' also calls 2026 the peak of profits.

This cycle charts productivity and speculation and the rotation of wealth

And historically aligns with generational peaks

2026 aligns with both - a rare and powerful overlap

3/

This convergence indicates a once-in-a-lifetime setup

Everything inflates to a peak of euphoria - real estate, stocks, and cryptocurrencies

Liquidity is everywhere, and retail fear of missing out is at its peak

The system rewards momentum hunters - before it breaks

4/ In 2007, the same thing happened - credit peaked, and assets inflated

By 2008, the crash wiped out the gains made over months.

The signs were there, but greed obscured clarity; 2026 could be the next 2007 - but on steroids

5/ This does not mean avoiding the market

This means understanding that 2026 could be your final race

Riding the wave and extracting the positive side - but preparing for the exit

Because 2027 may bring the deepest correction of our era

6/ Double peak signals, excess liquidity, real estate peaks, macroeconomic alignment

Few will choose the right timing, and even fewer will exit

But if you know the cycle, you can avoid the crash

That's why I prepared a list of alternatives with greater potential for 2026 👇

7/ $HYPE |

Market cap: $13.6 billion

Hyperliquid is a decentralized perpetual exchange offering high-speed trading with no gas fees directly on-chain.

Built using its dedicated layer one, aiming to compete with centralized exchanges in terms of speed and user experience.

8/ $ENA |

Market cap: $4.3 billion

Ethena is a synthetic dollar protocol supporting the USDe stablecoin, designed to provide yield and stability without relying on traditional banking services.

The US dollar uses neutral strategies like perpetual swap contracts to maintain its exchange rate and generate yields.

9/ $PENDLE |

Market cap: $900 million

Pendle is a DeFi protocol that allows users to trade and earn yield on future yield streams by splitting yield-bearing tokens into principal and yield components.

It supports yield tokens, interest rate speculation, and efficient yield farming across multiple chains.

10/ $LINK |

Market cap: $13.2B

Chainlink is a decentralized oracle network that connects smart contracts with real-world data, APIs, and off-chain computing.

It enables secure and reliable data feeds for DeFi, NFTs, gaming, and enterprise applications across multiple blockchains.

I hope you enjoyed this topic...

Follow me for more content