Snapshot (for reference):

⸻

1) Quick snapshot — what the market says right now

• Price (live): ≈ $808.7 per $BNB .

• Market cap & rank: BNB sits in the top 5 by market cap (≈ $112–113B range).

• Context: BNB recently cleared the $800 zone — a level last seen near earlier 2021 resistance — and is drawing renewed analyst attention.

Sources used for live-price & market context: Binance live price page and CoinMarketCap.

⸻

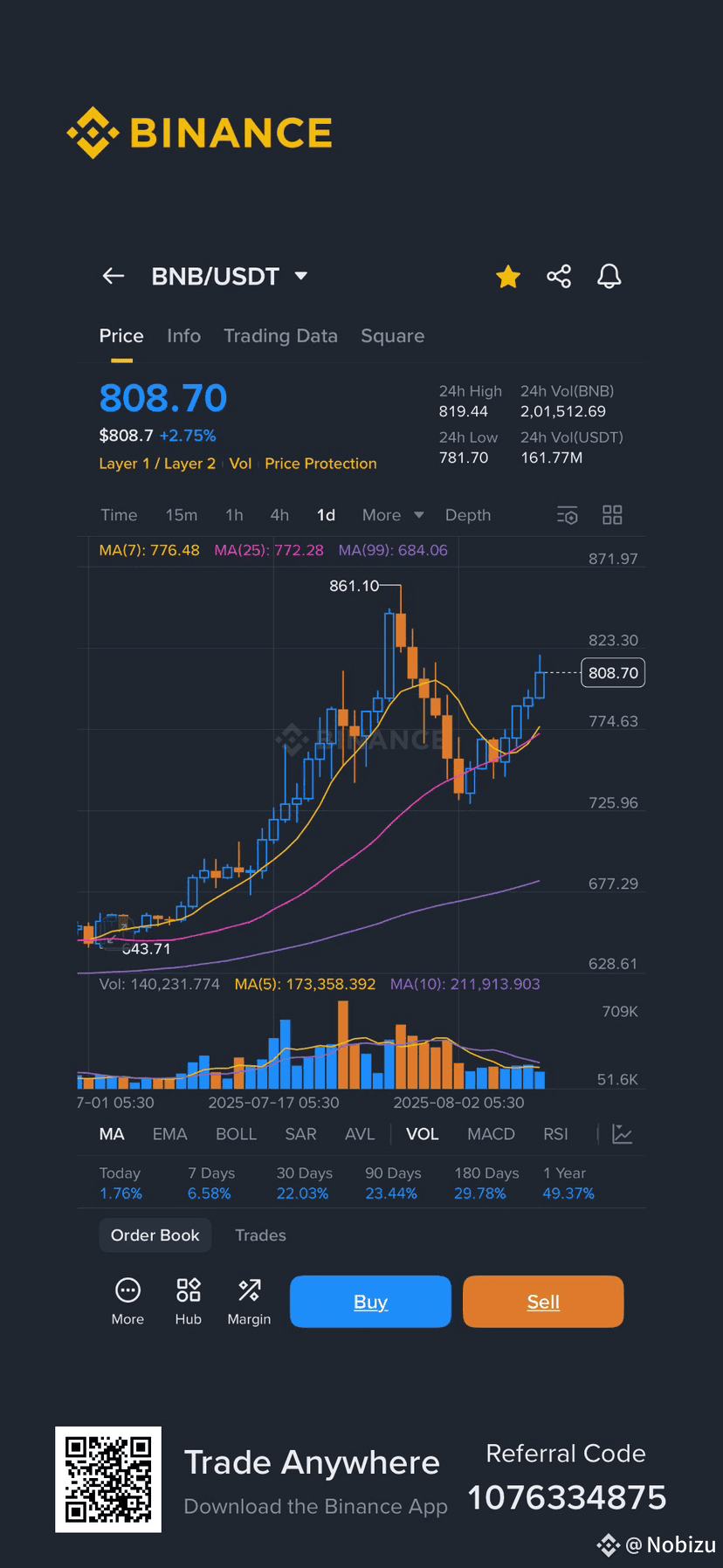

2) What the attached chart (your snapshot) shows — read like a human, not a robot 📊👀

Key visible levels (from the snapshot):

• Recent high printed on the chart: $861.10 (local peak).

• Current trading area: ~$808–810 (price is back above the short-term MAs).

• Moving Averages visible on your screenshot: MA(7) ≈ 776.48, MA(25) ≈ 772.28, MA(99) ≈ 684.06 — price is above MA7 & MA25 and well above MA99, a constructive sign.

• Volume: there are clear volume spikes earlier (the run-up), and recent bars show healthy buy-side volume but lower than the peak—classic consolidation after a run.

Interpretation: $BNB pulled back from a local top (~$861) and found support around the mid-$700s, then staged a recovery above the short-term moving averages. That’s textbook pullback → higher-low → continuation structure if buyers keep stepping in. The MA alignment (shorter MAs above longer ones) looks bullish overall on the daily frame. 📈

⸻

3) Technical read: levels, patterns & likely scenarios 🔧

Bull case (what momentum traders want to see):

• Reclaim and hold $820–830 convincingly (with rising daily volume) → likely run to $900–$950 (next structural supply) and potentially test prior highs if macro stays friendly.

• Continued series of higher daily closes above MA(7)/MA(25) confirms strength.

Neutral / consolidation case:

• Range trade between $740–$830 while BNB digests the July/Aug gains. This is the low-volatility accumulation zone — good for scalpers or layering entries.

Bear case (risk management zone):

• Failure to hold $740–$760 and a daily close below MA99 (~$684) could signal deeper retracement toward $620–$680. Use a tactical stop if you’re trading the swing.

• Note: large market-wide sell pressure (BTC shock, regulatory headlines) can accelerate flash drops — always size positions prudently.

⸻

4) On-chain & ecosystem catalysts — why BNB might keep its tailwind 🧭

• BNB Chain continues to onboard projects and the token benefits from exchange + chain demand (fees, burns, staking & ecosystem activity). This dual-utility is a structural advantage vs pure altcoins. (Binance research highlights macro tailwinds for L1 / Layer-2 ecosystems this month.)

• Institutional / custody moves and improving exchange trust can funnel more capital into top exchange tokens — recent mainstream partnerships and custody-related news are positive for investor confidence. Notably, Binance’s industry-facing moves (and broader market regulation clarity) are being tracked closely by traders.

Two big headlines traders are watching: (1) sustained DeFi / tokenized-assets growth flagged in Binance Research, and (2) major custody / bank partnership news that could reduce counterparty risk and attract capital.

⸻

5) Short-term & medium-term price roadmap (practical targets) 🎯

Immediate (days → 2 weeks):

• Bull trigger: Daily close > $820 with rising volume → target $900 then $950–1,000.

• Danger zone: Daily close < $740–760 → watch for larger pullback to $680–720.

Medium-term (1–3 months):

• Base case: Slow march higher as adoption & fee-burning dynamics continue → $1,000–1,200 possible if macro momentum persists and institutional flows continue. Several analysts are eyeing higher targets if demand stays robust.

Risk Management (must-read):

• Keep position size appropriate (BNB is volatile). Use stop-loss levels (example: stop below $740 for swing trades) and scale into positions — don’t buy the top. Always account for portfolio allocation limits.

⸻

6) Why this moment matters (macro overlay) 🌎

• The broader market is in a risk-on phase led by BTC strength and L1 interest — this bounces up many large-cap alt tokens. Binance research shows a healthier market cap expansion this month, which supports BNB’s bid.

• Meanwhile, traditional banking custody moves (reported by FT/Reuters) are slowly removing a trust barrier — if custodians expand access, large capital could re-enter centralized exchanges and top tokens. This is a potentially quiet but powerful bullish tailwind.

⸻

7) Trade plan examples (not financial advice — DYOR) 🔖

Conservative swing:

• Entry: layer in $760–790

• Target: $950 (partial) / $1,100 (add)

• Stop: $720 (tighten if above $800)

Aggressive dip-buy:

• Entry: $700–740 (if market pulls back)

• Target: $900+, scale out on way up

• Stop: $660

⸻

8) Final verdict — crisp & human summary ✅

$BNB is showing healthy post-run consolidation and the chart on your snapshot suggests buyers are in control above the short-term moving averages. The coin benefits from real utility (exchange + chain) and positive macro headlines (research + custody news). If BTC and risk appetite hold, BNB has a solid shot at re-testing the upper $800s–$1,000 area this cycle — but always respect stops and manage size. 🎯🔥

Remember: this is a market with fast moves — set stops, size positions carefully, and don’t let FOMO overturn risk rules.

Not financial advice. DYOR. 🧠💡

⸻

Sources (most important ones used)

• Live price & market data (Binance live price page).

• Market cap & broader price data (CoinMarketCap).

• Recent analyst write-ups / bullish outlooks on BNB’s next targets.

• Binance Research: market trends & ecosystem context.

• FT / Reuters coverage (custody / bank partnership signals that affect exchange trust).