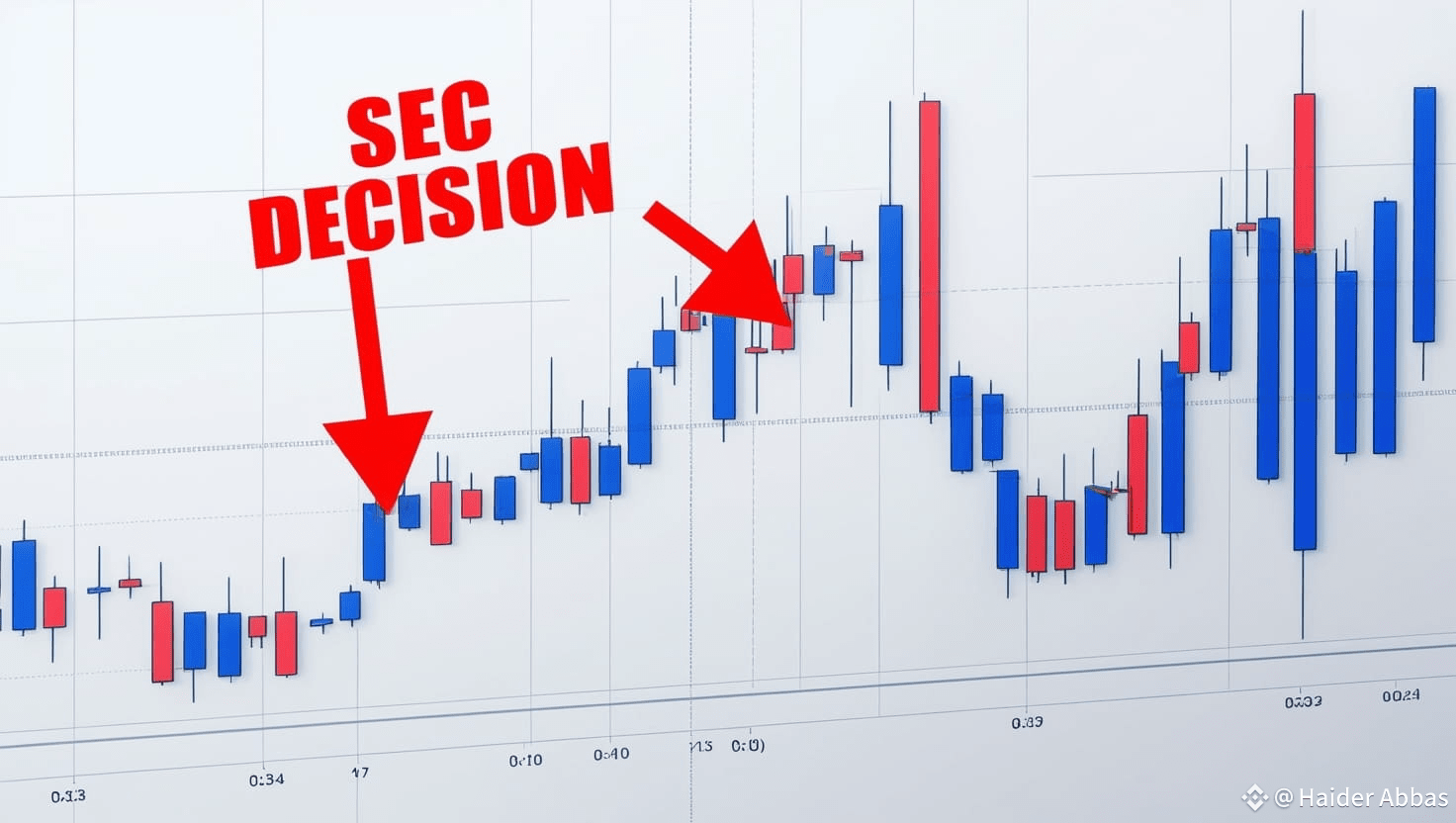

With the SEC’s Ethereum ETF decision imminent, spot traders have a rare chance to capitalize on volatility. Below are strategic ideas—always do your own research and manage risk!

Ethereum (ETH/USDT)

Why? Direct exposure to the ETF verdict. Approval = institutional FOMO. Rejection = potential dip (buy-the-rumor, sell-the-news risk).

Entry Zones:

Bullish Scenario: Buy dips near 3,500–3,500–3,600 (key support).

Bearish Scenario: Wait for a rejection sell-off below $3,400 before accumulating.

Targets: 3,800(pre−ETFhype)→3,800(pre−ETFhype)→4,200+ (if approved).

Stop-Loss: Below $3,300 (risk management is key!).

#SpotTrading #EthereumETF #AltcoinGems #CryptoVolatility #TradeSmart