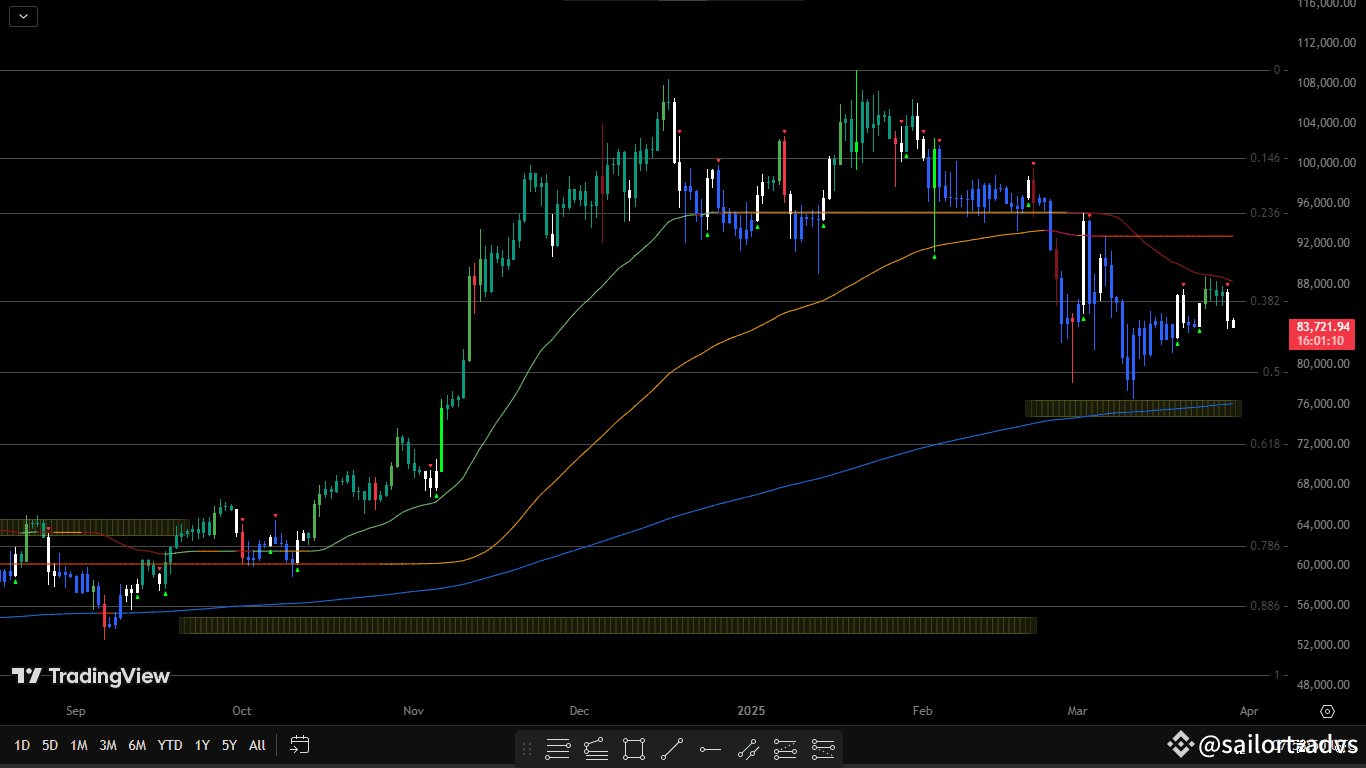

📊 #BTC is at a CRITICAL turning point. Forget the noise—here’s the only game plan that matters based on high-probability confluences:

🟢 Scenario 1: The Bullish Rebound (Smart Money Plays This) 👀

✅ #Bitcoin❗ respects key #Fibonacci levels (0.5-0.618) & fills the Fair Value Gap (FVG) before reversing.

✅ Buyers step in at the channel’s lower boundary, signaling a potential leg up.

✅ My Indicator shows strength → higher lows, bullish momentum shift.

🎯 Trade Plan (Long Entry):

🔹 Entry: Near FVG & Fibonacci confluence after bullish confirmation.

🔹 Stop-Loss: Below FVG & 0.618 Fib level (invalidate bulls).

🔹 Targets: Mid-channel 🎯 Upper boundary 🚀 Breakout → Major Liquidity Pool!

🔺 🚀 Extreme Bullish Case: A breakout above the channel could ignite a major rally—be prepared!

🔴 Scenario 2: The Breakdown (Trap or Trend Reversal?) ⚠️

⚠️ Bitcoin fails to hold the Fibonacci zones and breaks lower = Bearish signal.

⚠️ No strong reaction at FVG = Weak buying pressure = Potential dump.

⚠️ My Indicator confirms weakness = Selling pressure incoming.

📉 Trade Plan (Short Entry):

🔻 Entry: Retest rejection of broken support (FVG, Fib, Channel).

🔻 Stop-Loss: Above 0.618 Fib & structure highs.

🔻 Targets: Swing lows 🎯 Major liquidity pools 🔥

🔻 🚨 Extreme Bearish Case: A clean break of major swing lows could trigger a liquidation cascade. Watch closely!

🟡 Scenario 3: The Fakeout Zone (Stay Sharp) 🔄

➖ If price stays stuck between key levels, expect choppy conditions.

➖ Breakout traders might get trapped, and liquidity hunts are likely.

➖ Best play? Scalp range extremes OR wait for confirmation—don’t get baited!

🎯 The Ultimate Move? Let the Market Show Its Hand First!

🧠 The key is reacting, not predicting.

🔥 Use liquidity, FVGs & Fibonacci to stay ahead of the game.

🎯 One move can change everything—are you positioned correctly?

👇 Drop your thoughts in the comments. Where are we headed? 🚀📉